Embed presentation

Download as PDF, PPTX

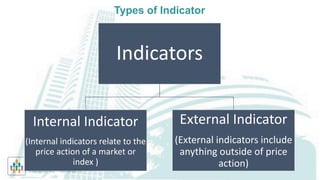

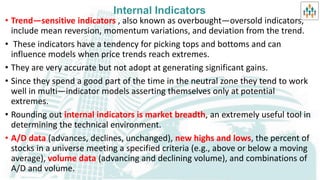

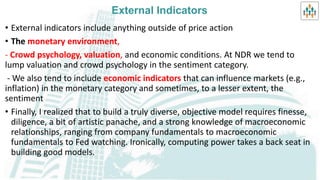

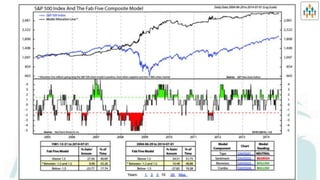

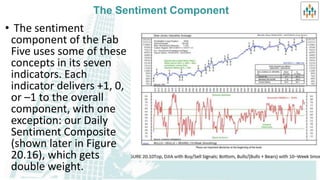

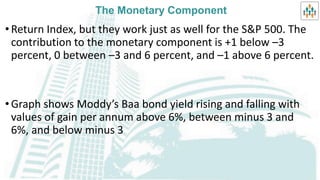

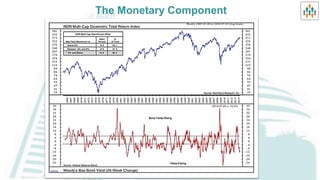

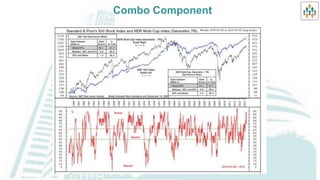

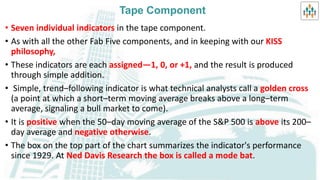

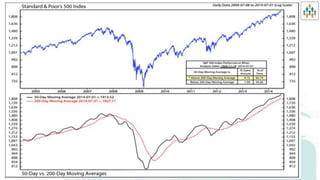

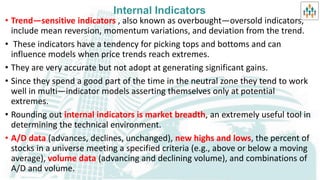

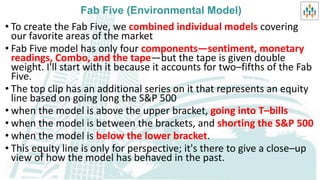

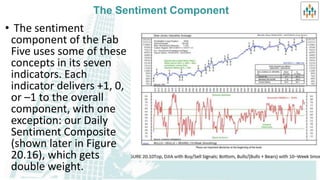

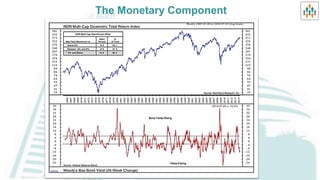

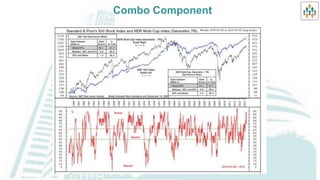

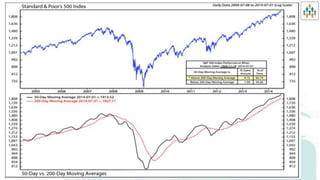

The document describes a stock market model called the "Fab Five" environmental model. The Fab Five model uses four main components - sentiment, monetary readings, combo, and tape (given double weight). Each component is made up of multiple indicators that are assigned values of +1, 0, or -1. The values are combined for each component and across components to assess overall market risk and determine whether conditions are bearish, neutral, or bullish. Examples of indicators include interest rates, market breadth, sentiment polls/surveys, and moving average crosses.