Embed presentation

Downloaded 38 times

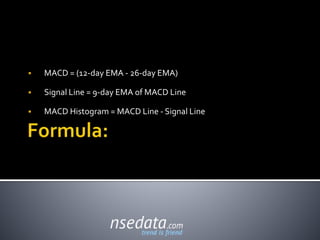

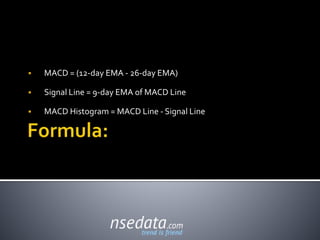

The MACD (Moving Average Convergence Divergence) is a momentum indicator developed by Gerald Appel in the late 1970s that shows the relationship between two moving averages of prices. It is calculated by subtracting the 26-day EMA from the 12-day EMA, with a nine-day EMA of the MACD serving as the signal line to generate buy and sell signals. The MACD histogram is derived by subtracting the signal line from the MACD line, helping traders identify market opportunities.