Embed presentation

Downloaded 13 times

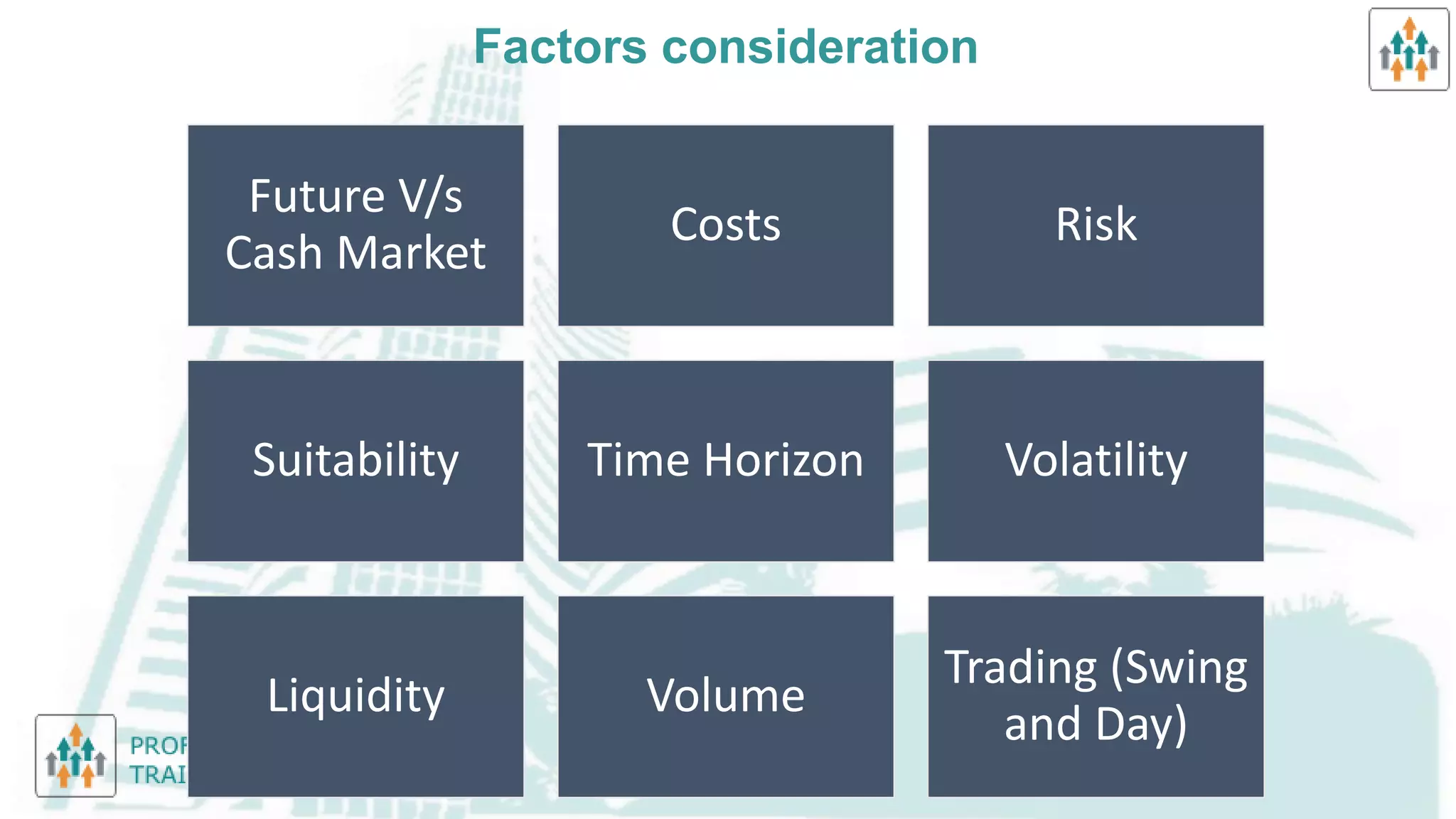

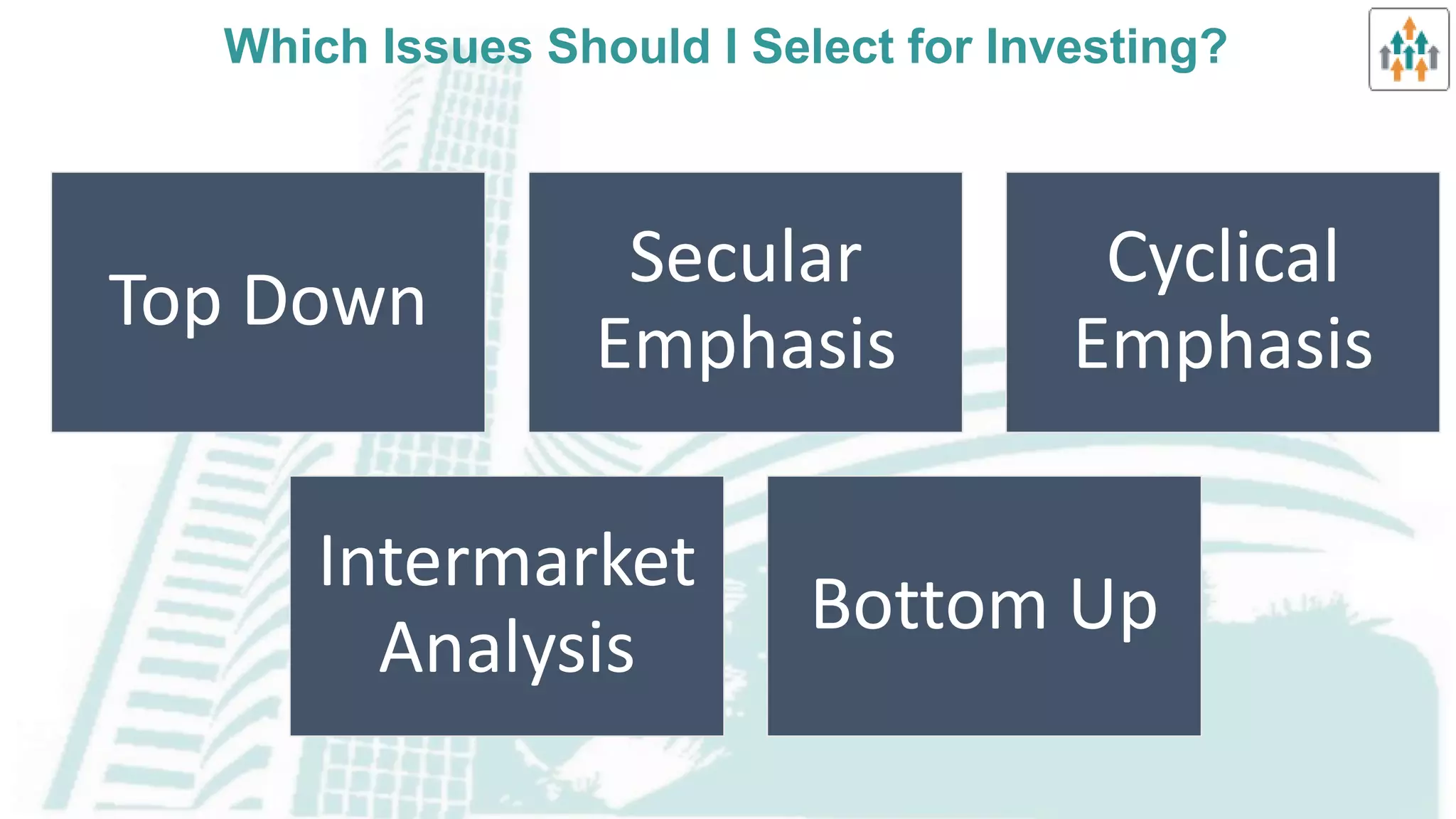

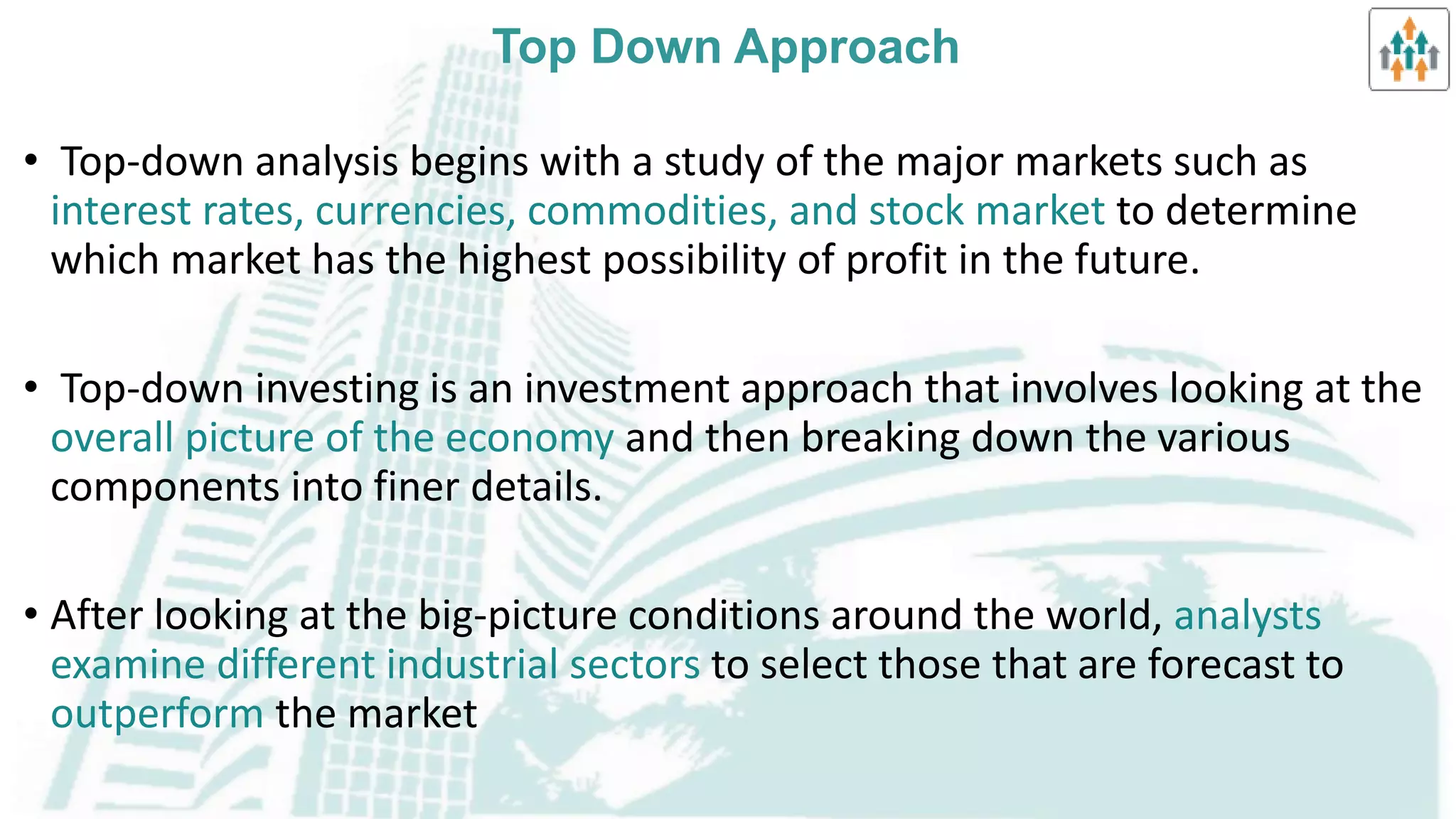

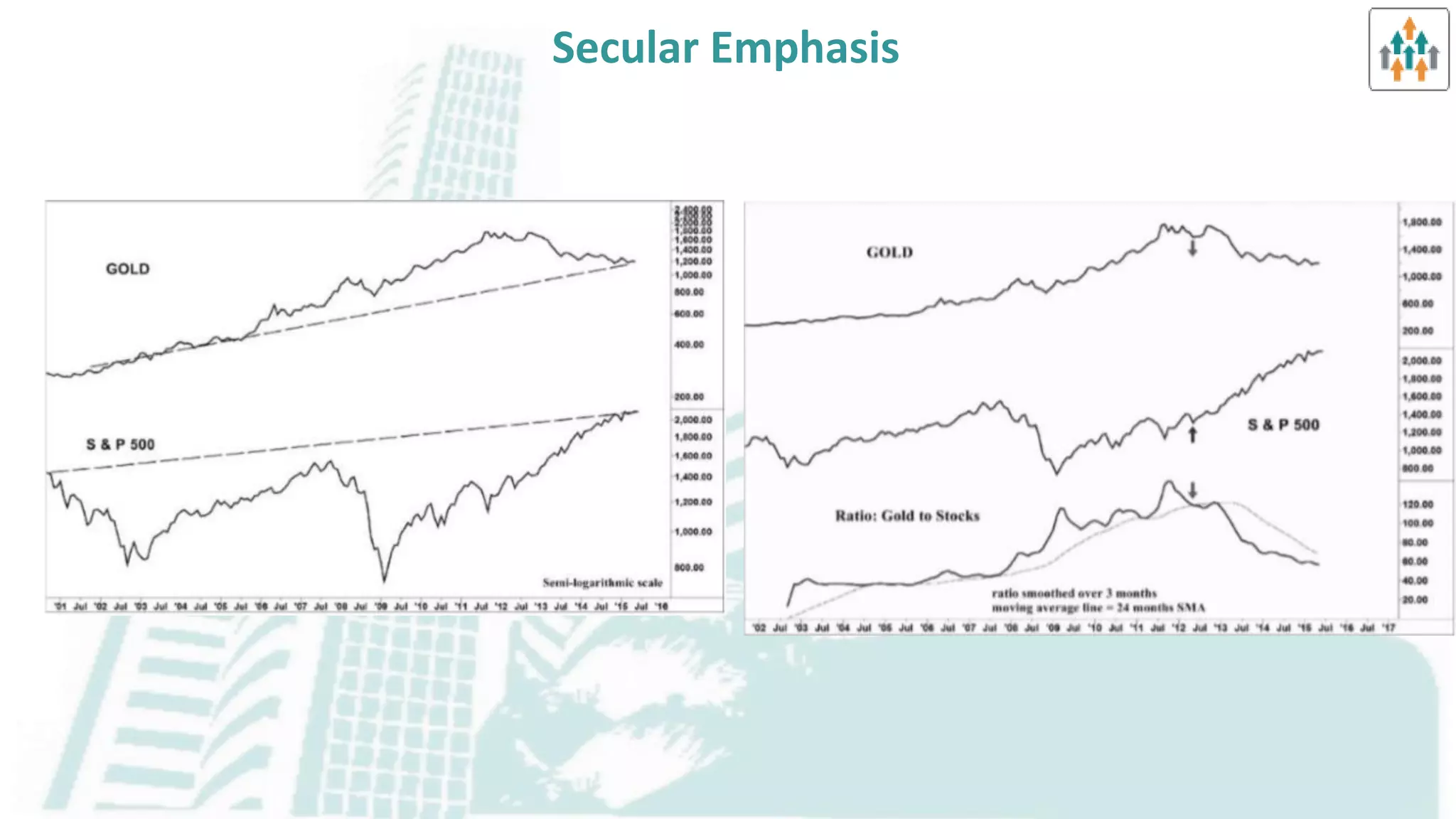

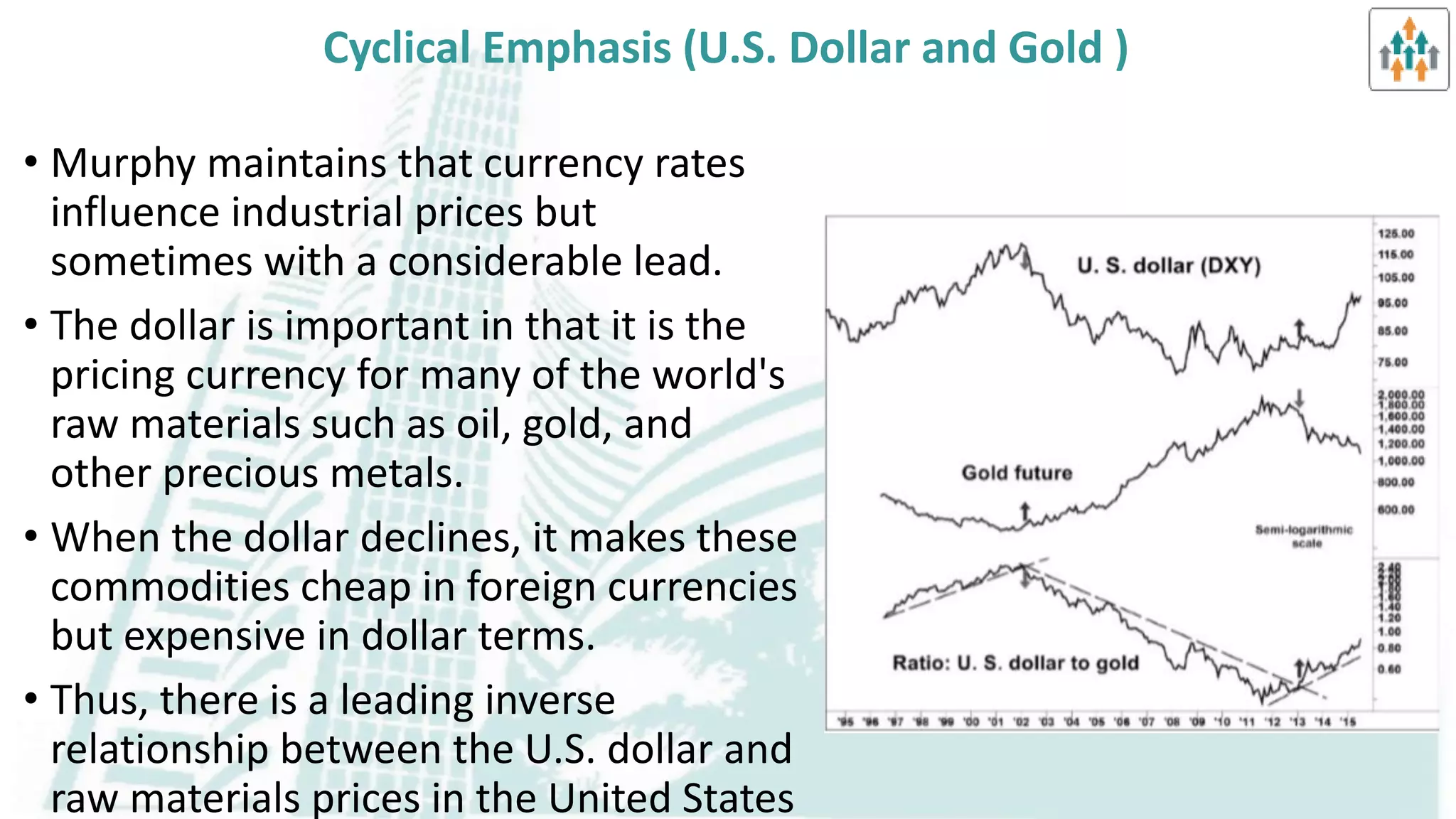

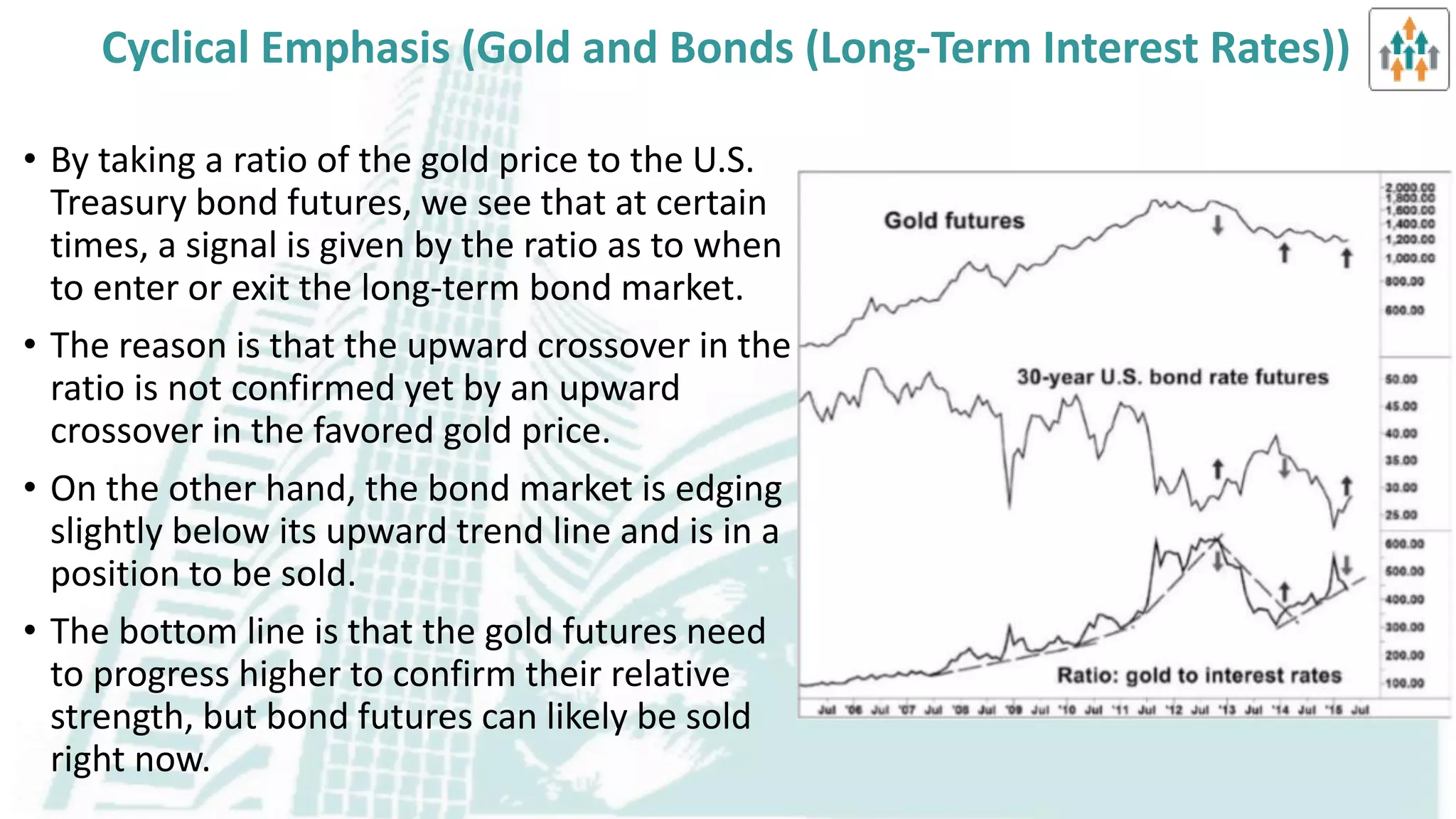

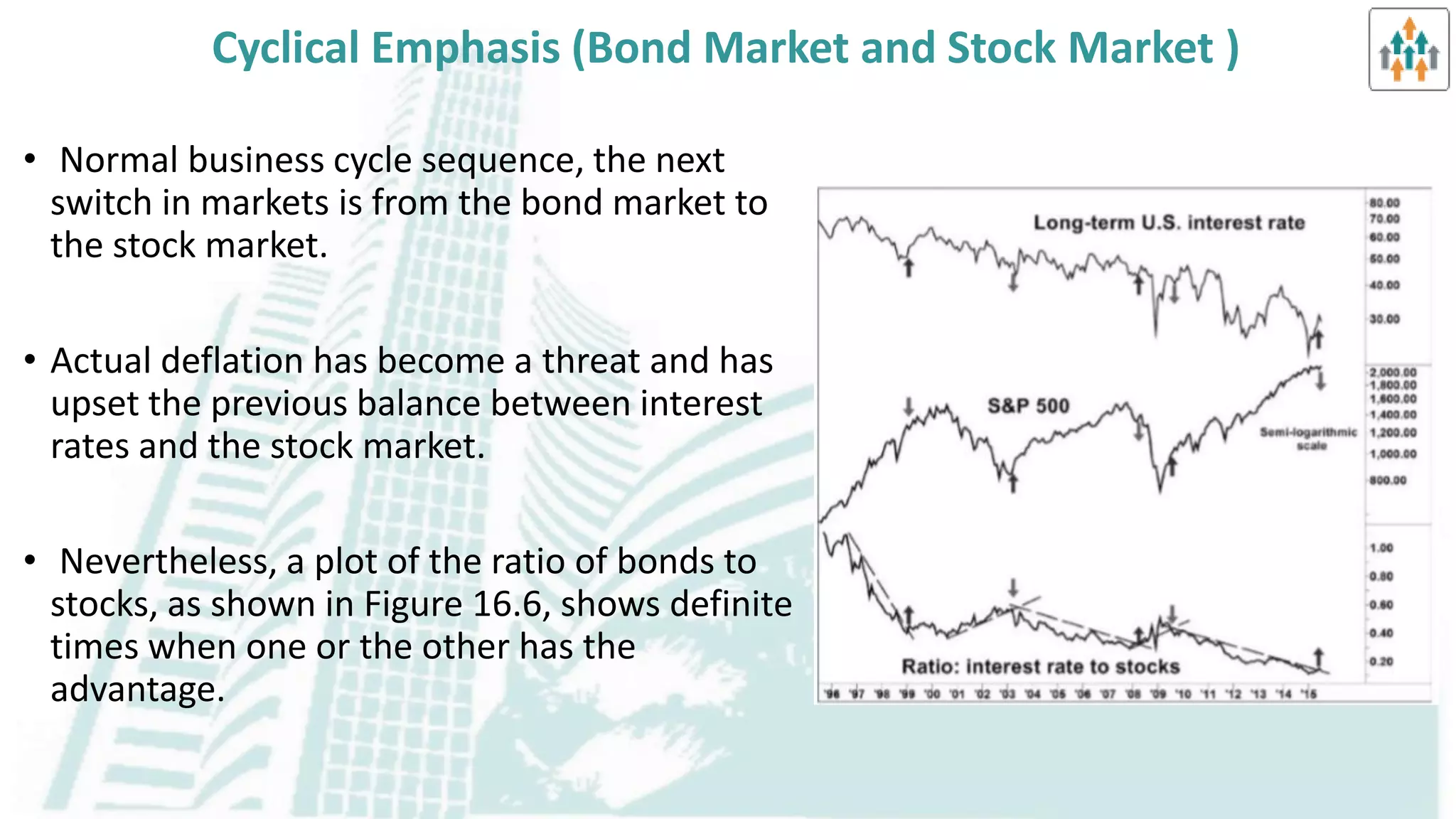

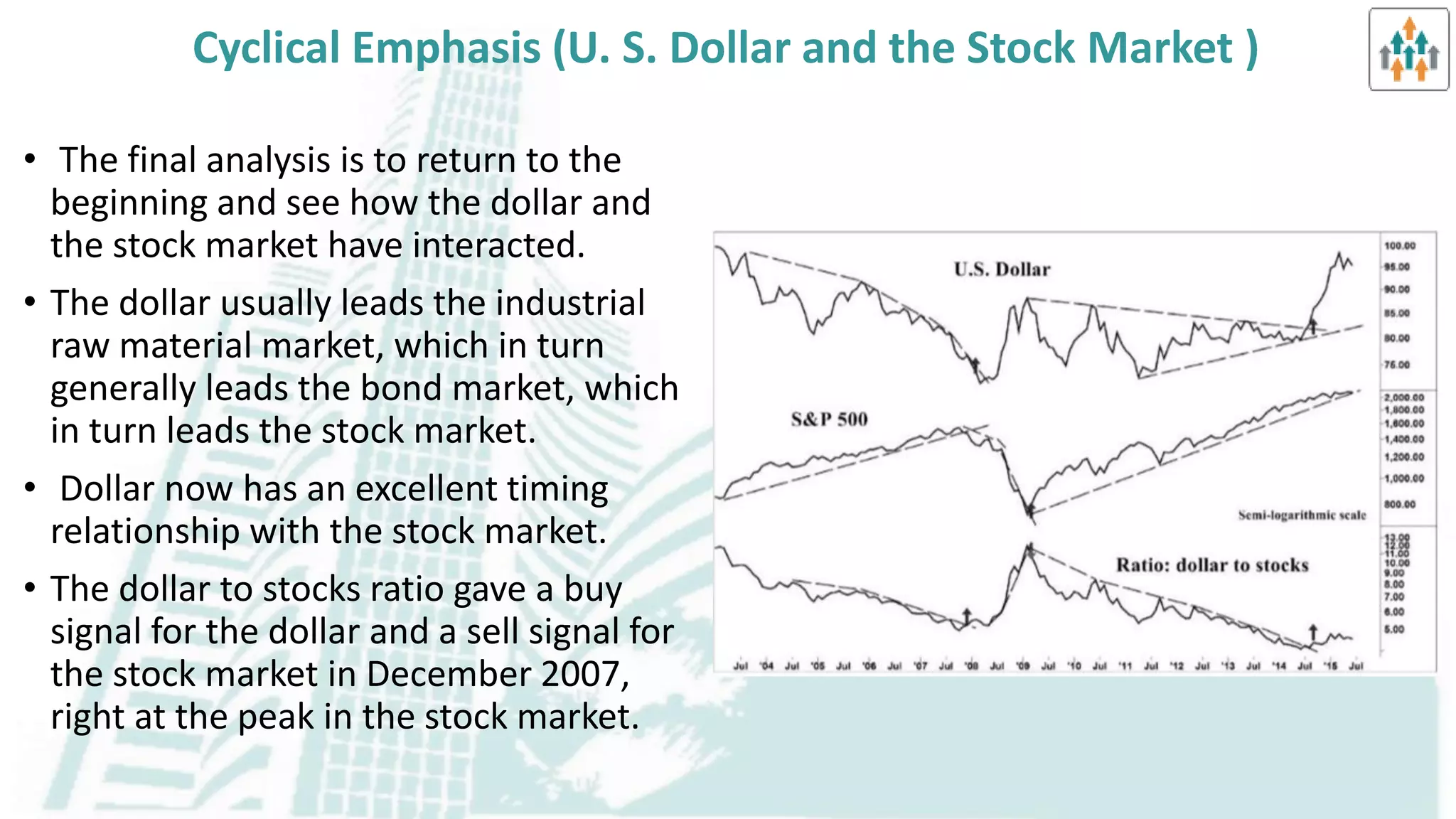

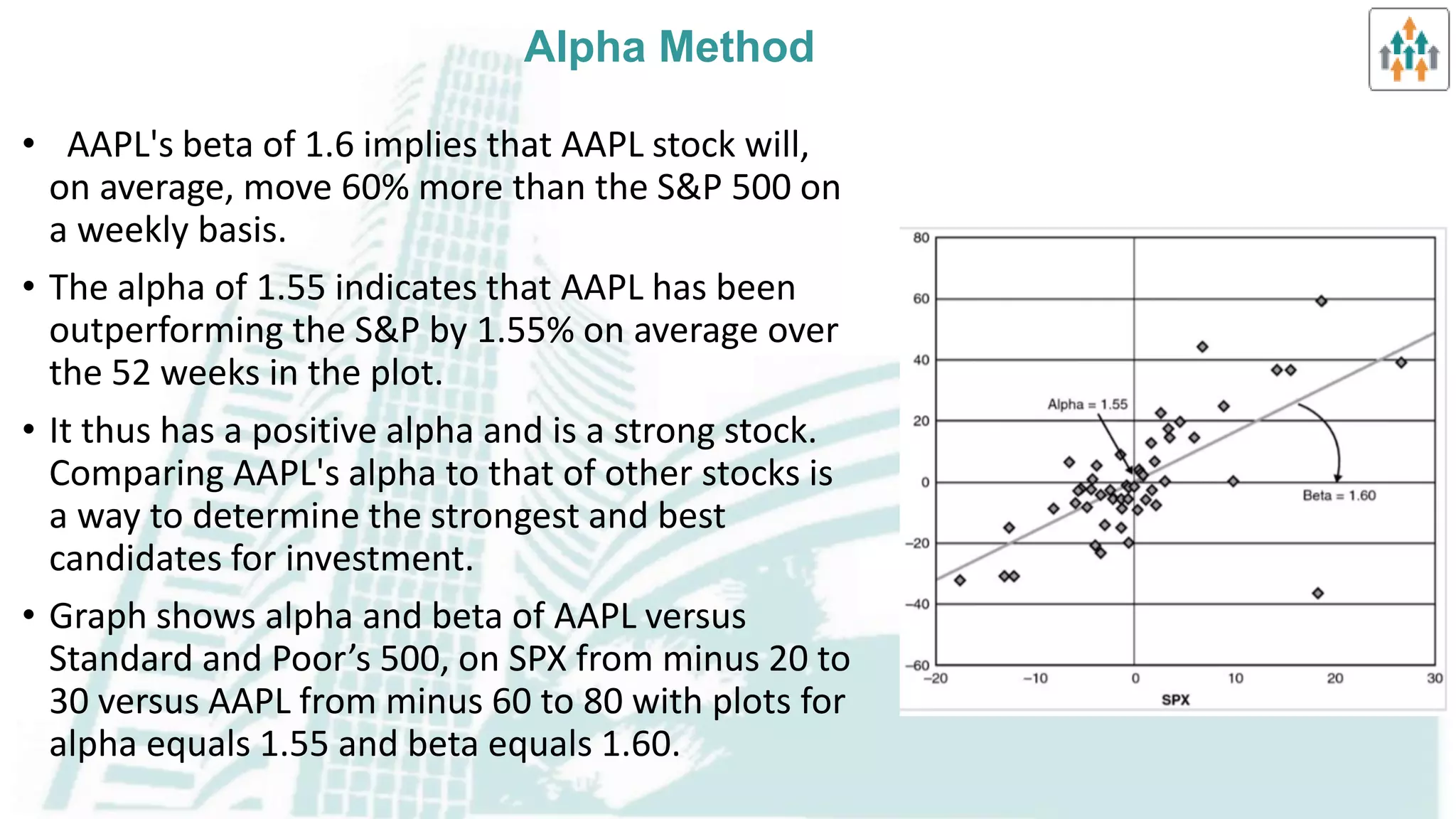

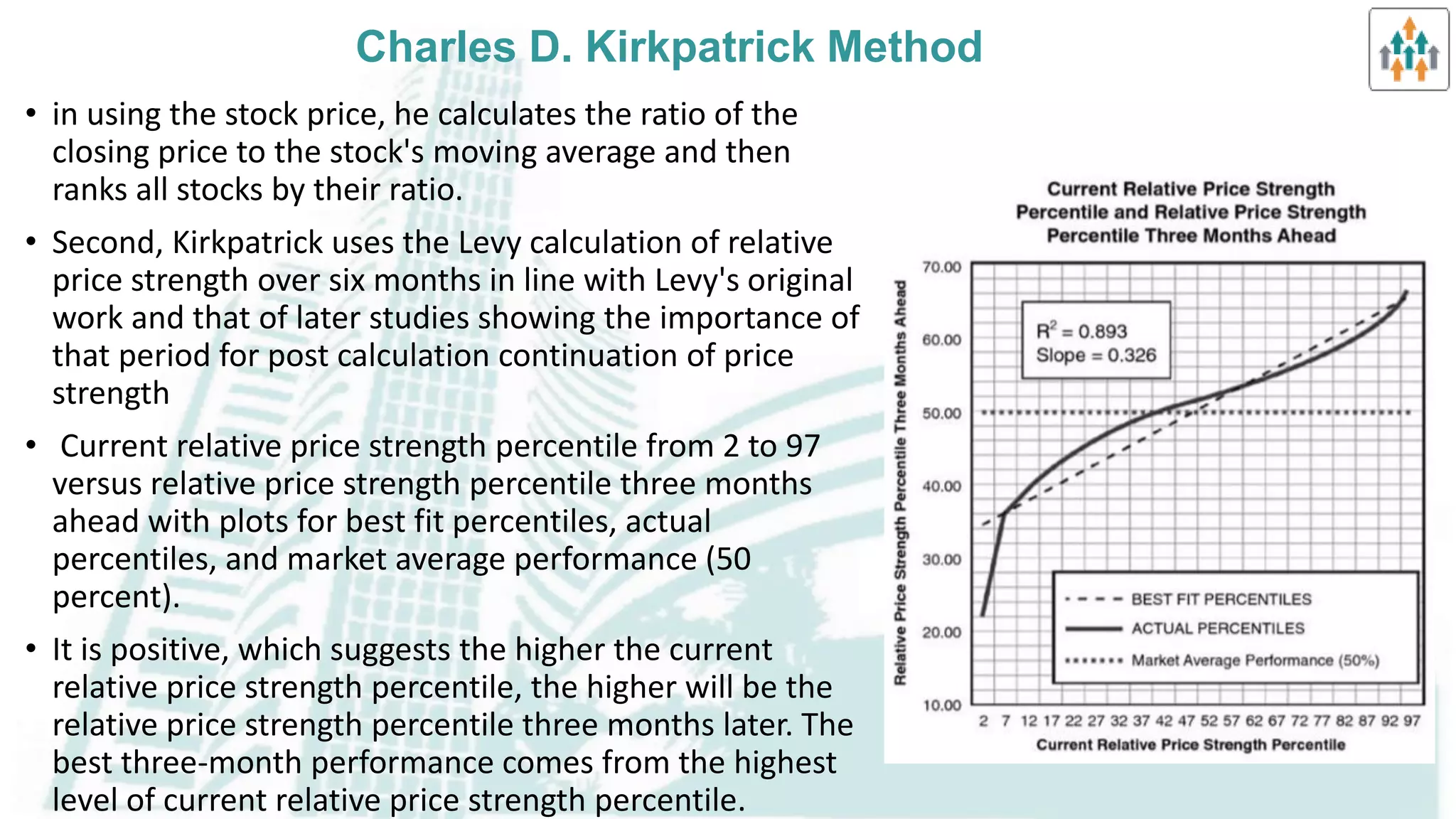

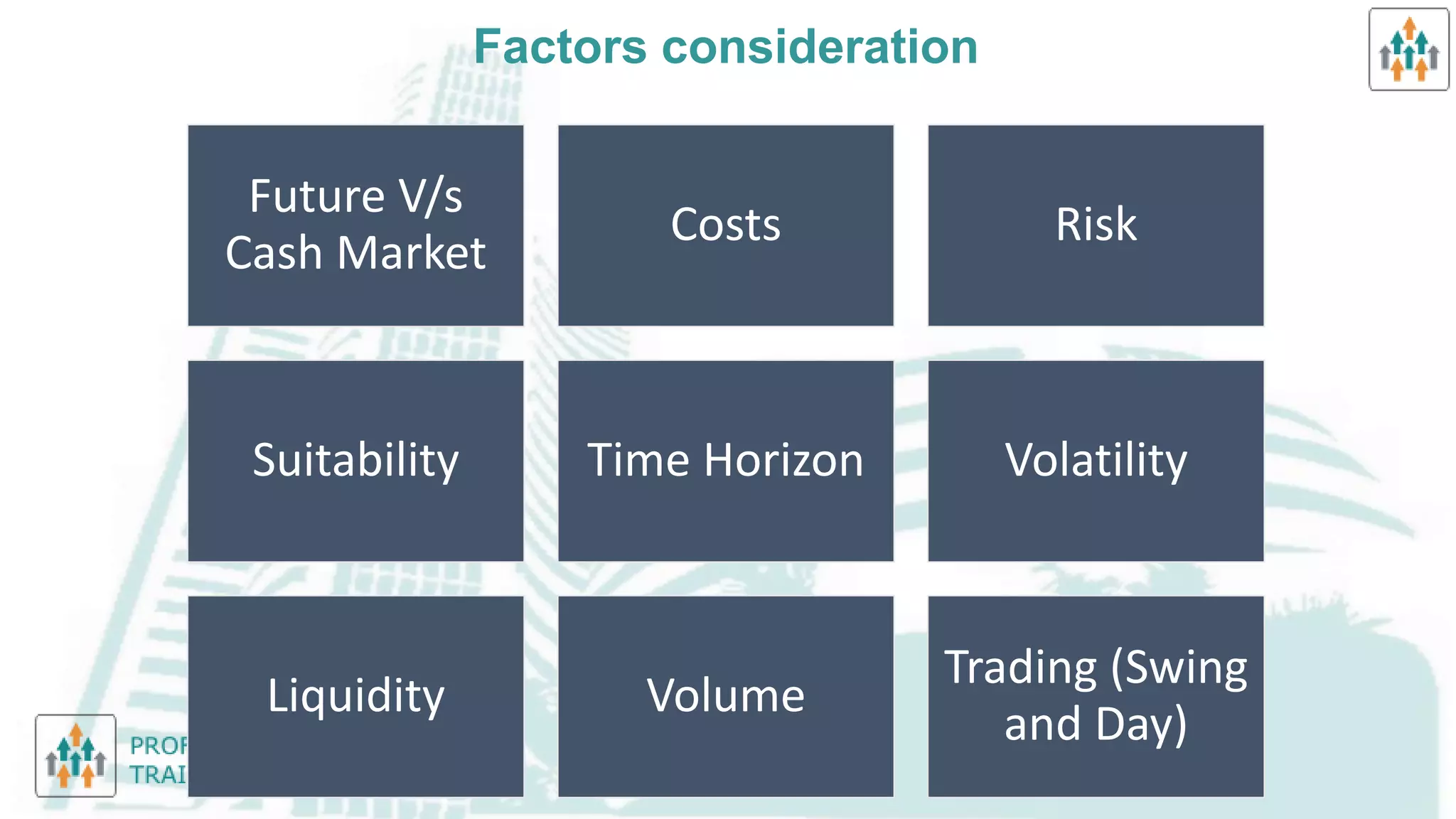

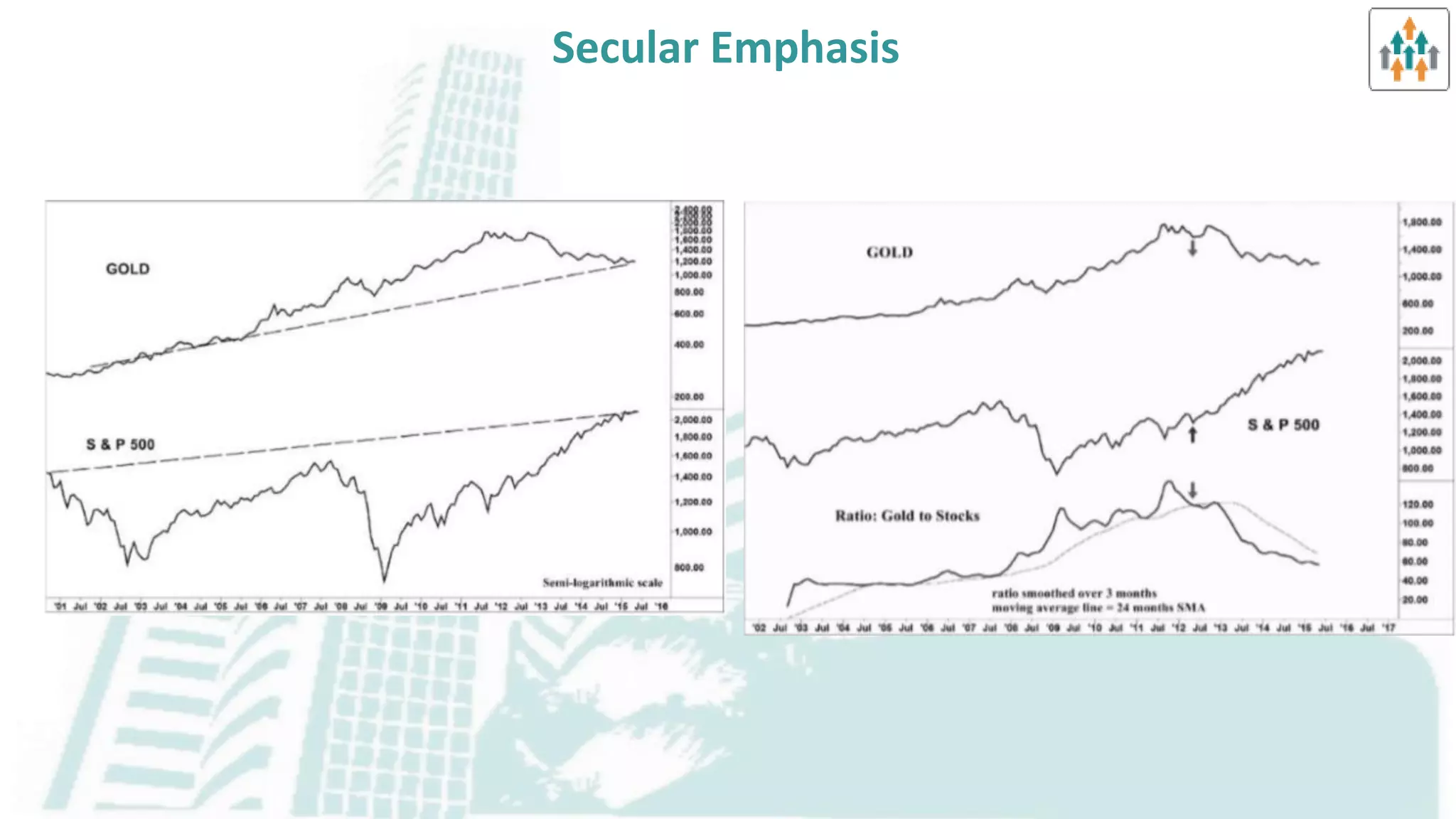

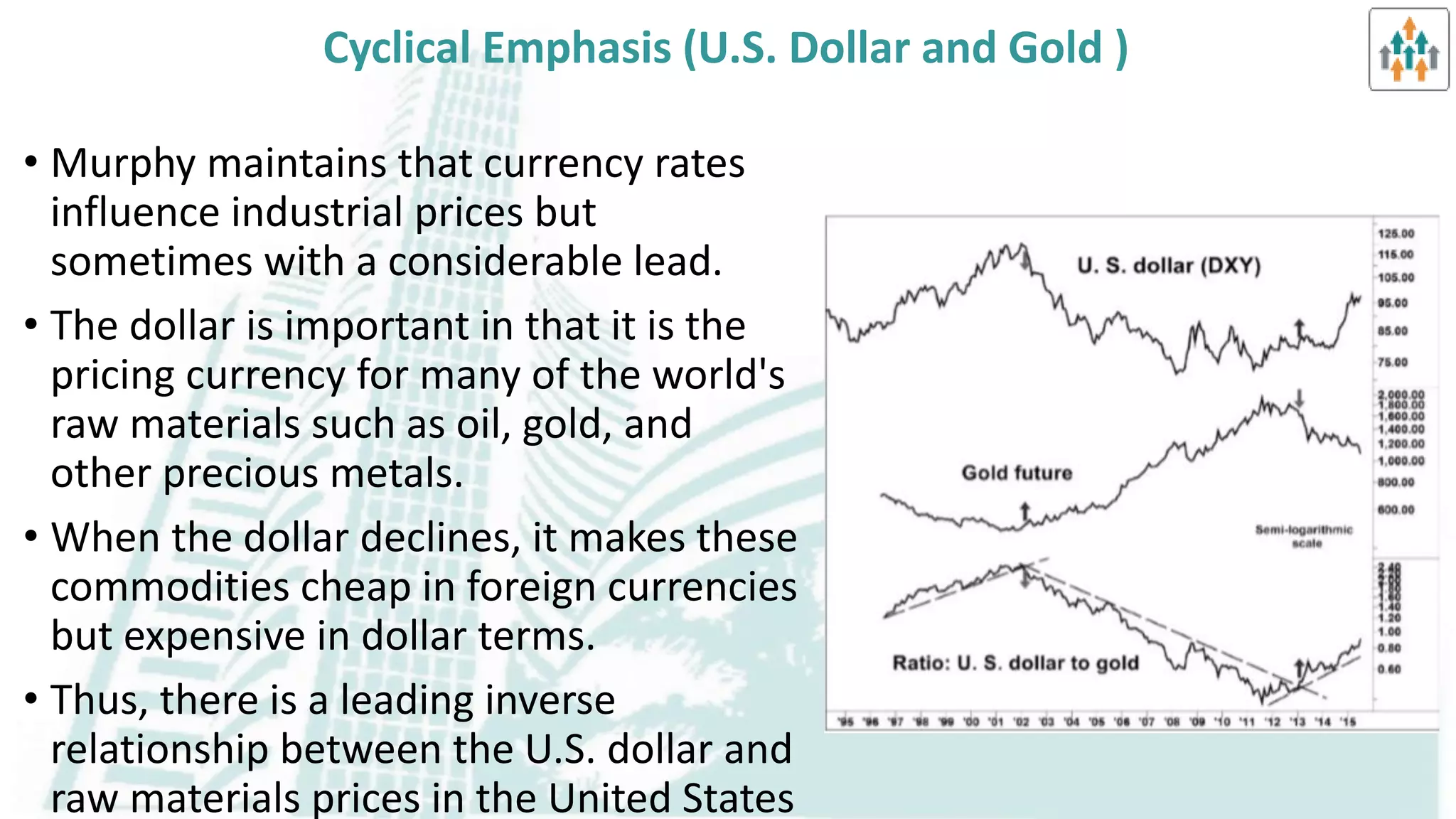

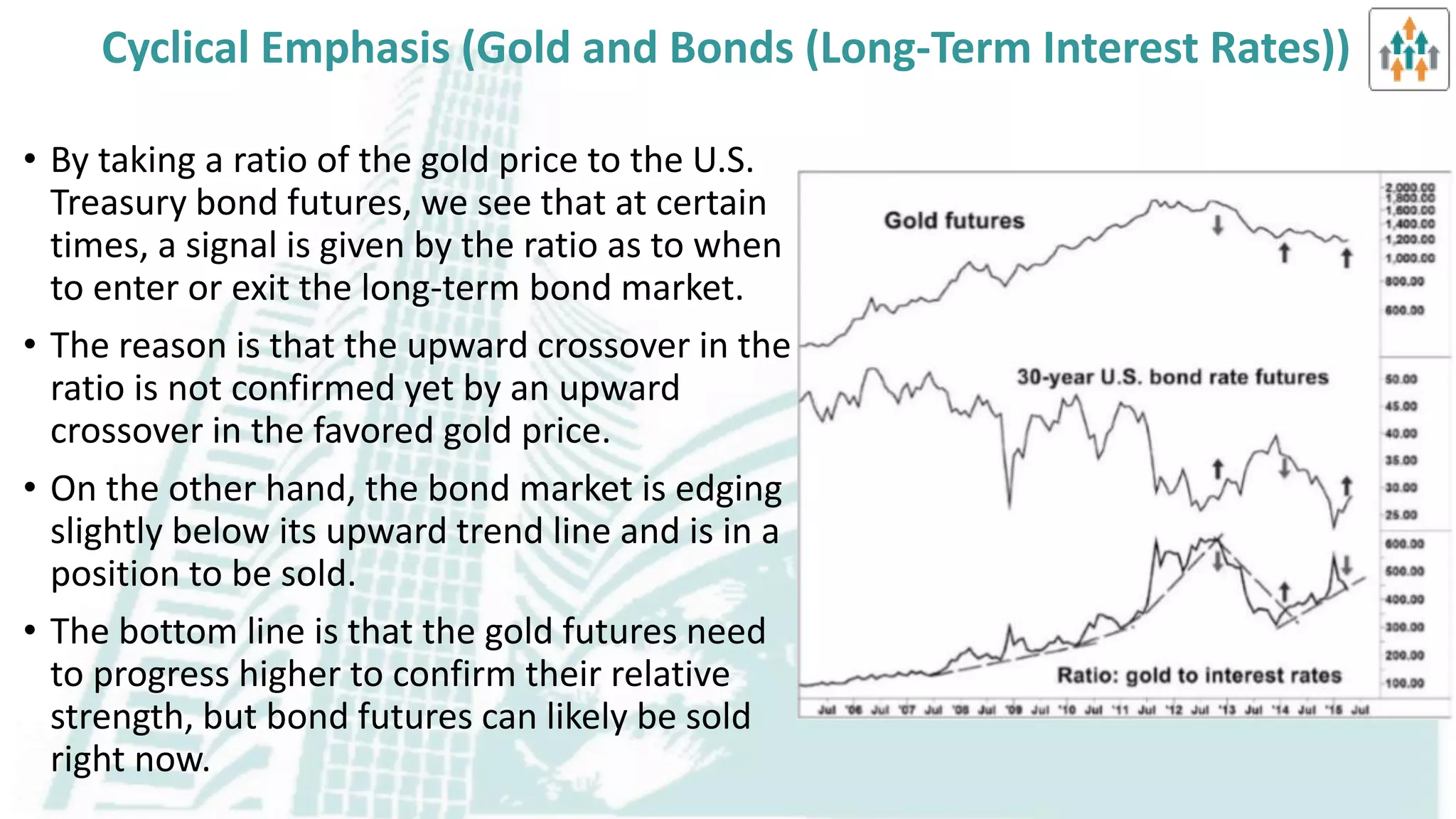

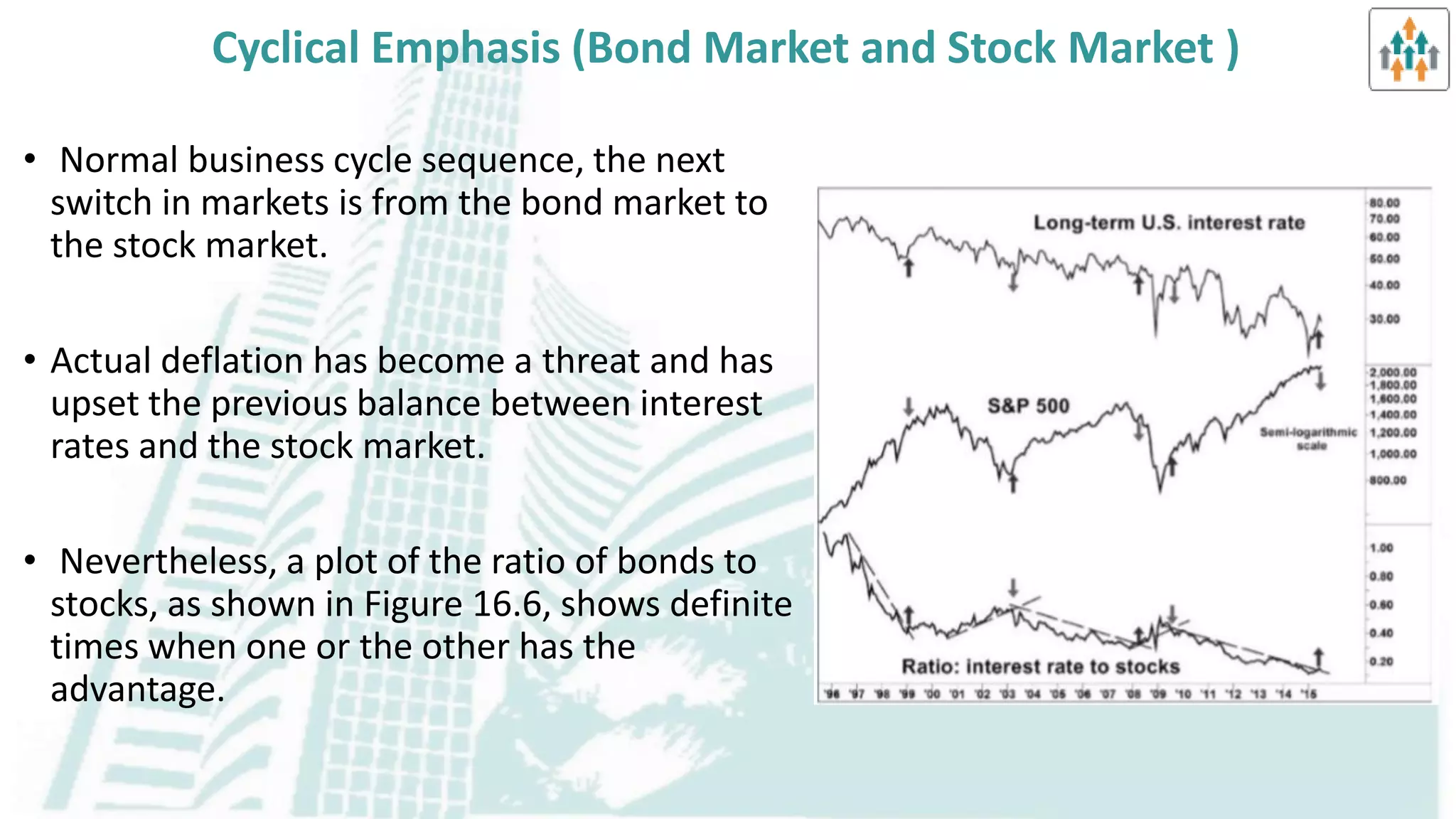

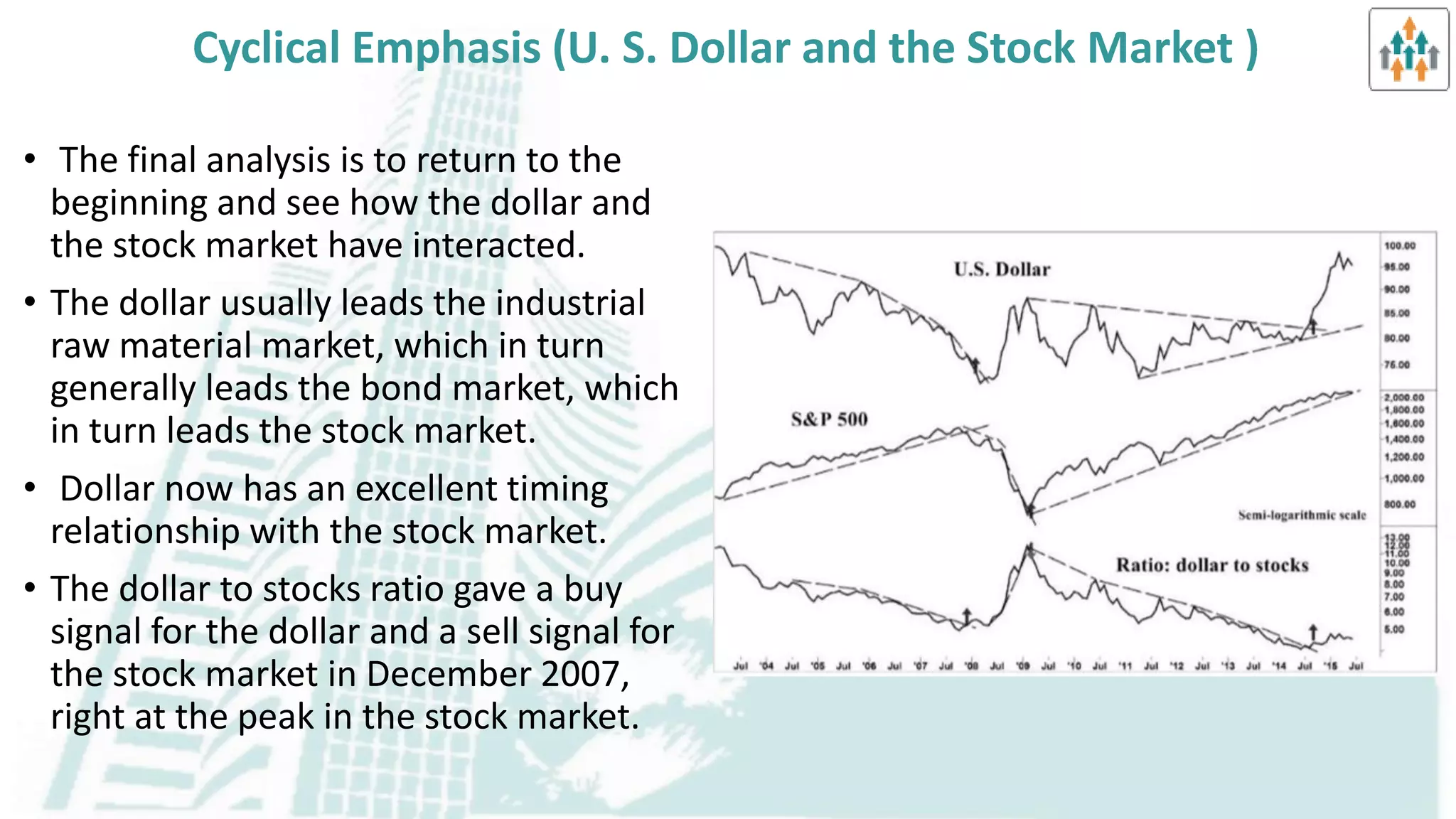

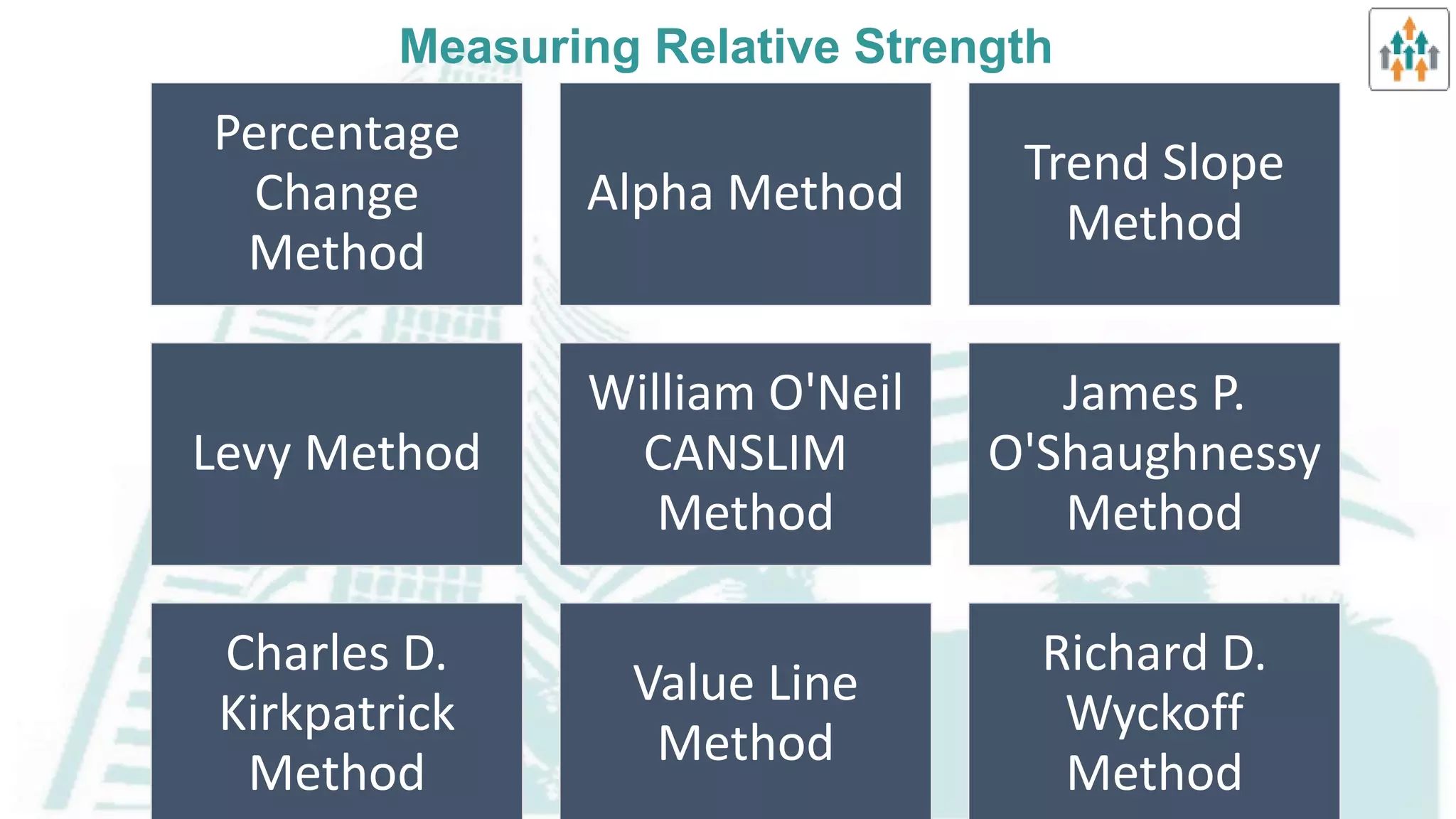

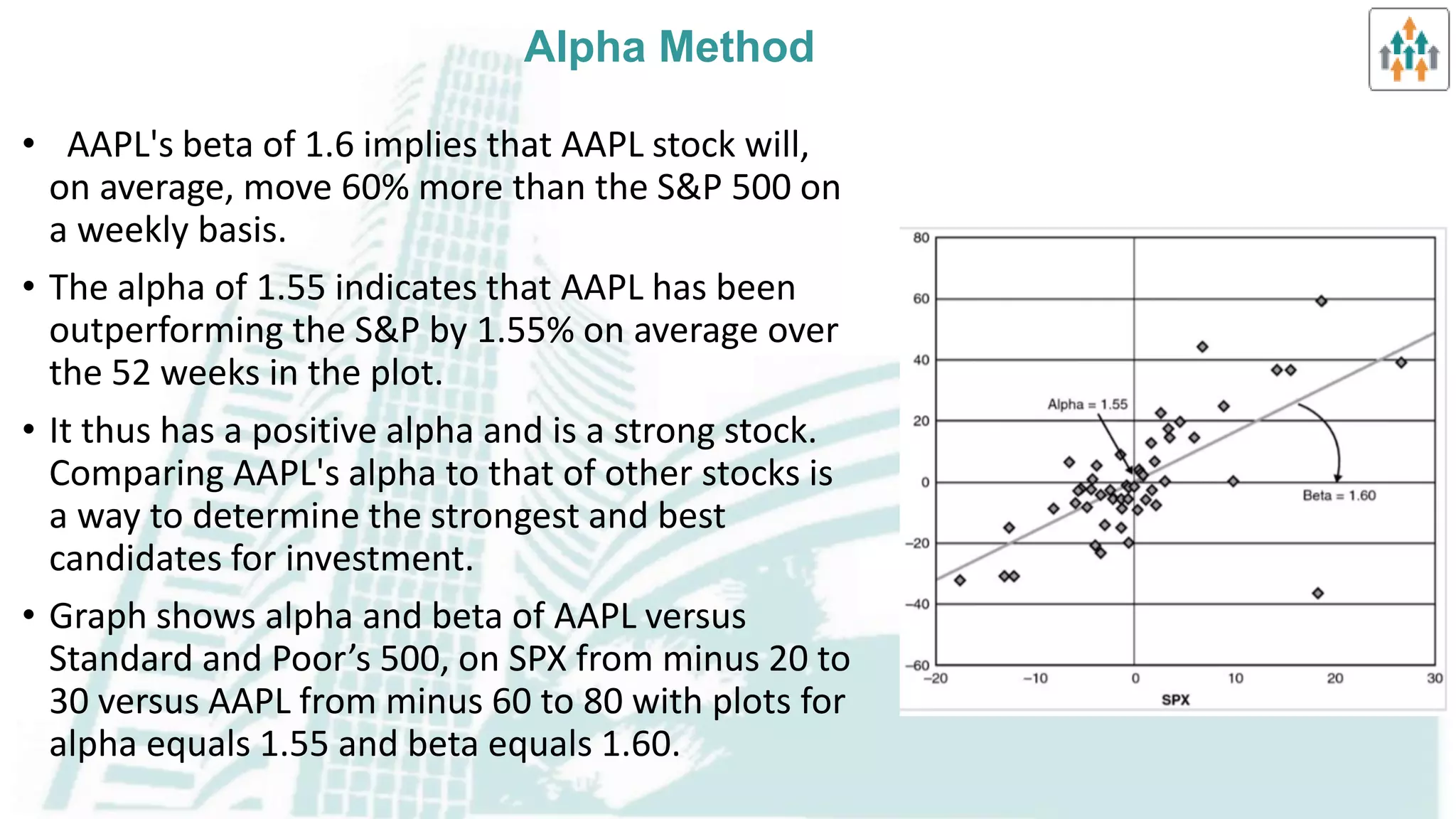

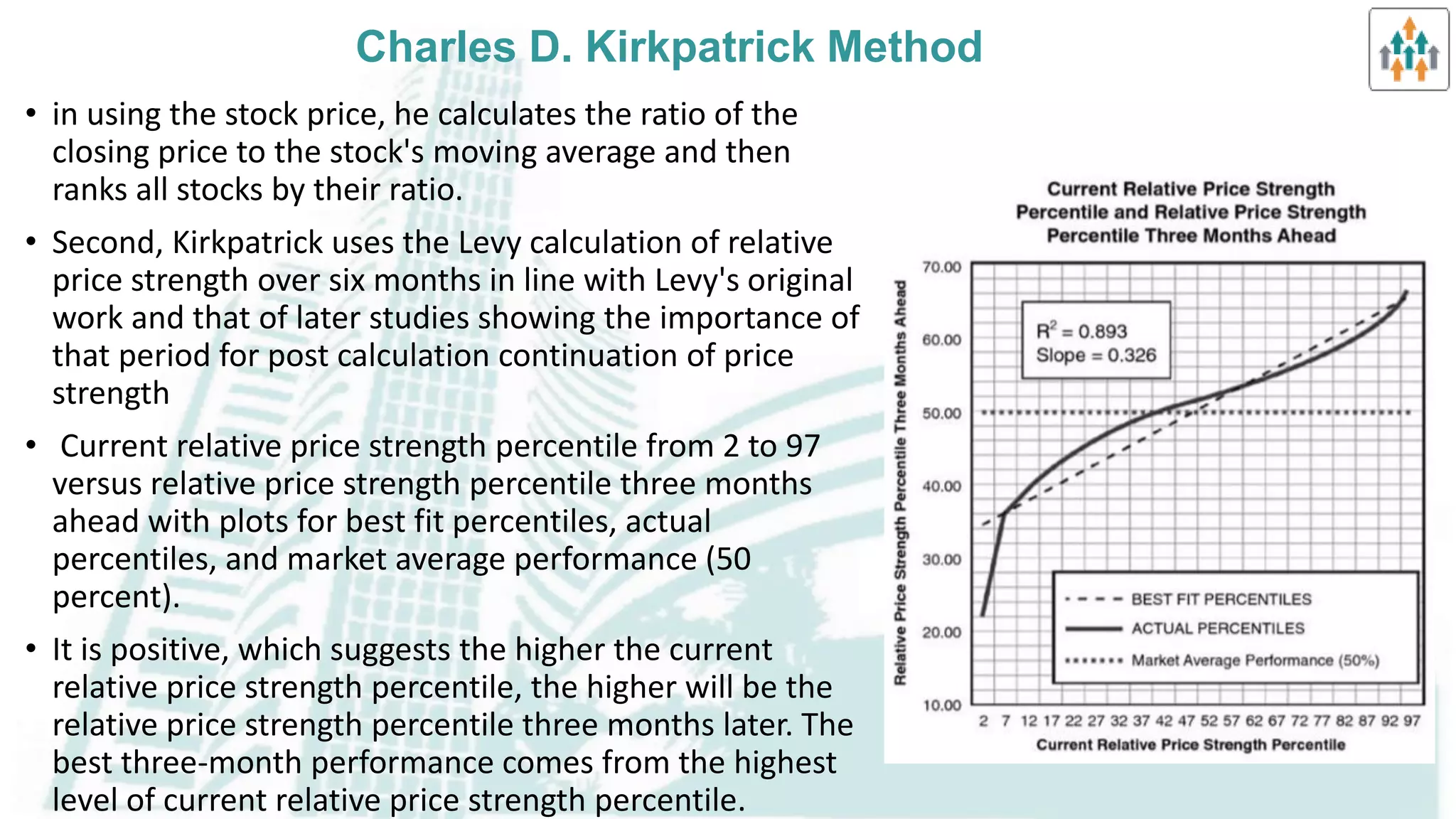

This document discusses various approaches to selecting markets and issues for trading and investing. It covers factors to consider when choosing between futures and stock markets. It also describes top-down and bottom-up analysis approaches, with top-down starting at a macro level and drilling down, while bottom-up starts by analyzing individual companies. Additionally, it outlines methods for analyzing secular trends, business cycles, and relative strength, including the percentage change, alpha, trend slope, Levy, CANSLIM, and other models.