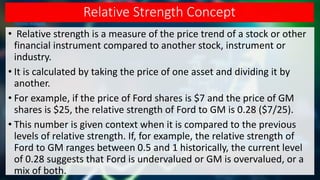

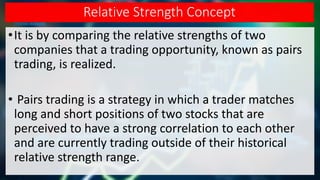

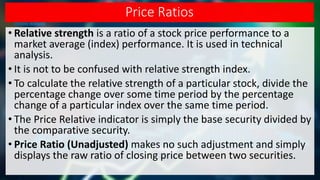

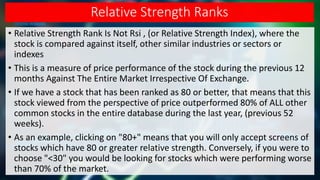

Relative strength compares the performance of one asset to another over a period of time by taking the price of one and dividing it by the other. It provides context on whether an asset is undervalued or overvalued relative to its historical trading range compared to the other. Pairs trading strategies look for opportunities when two historically correlated assets diverge in their relative strength. Tools for analyzing relative strength include price ratios, relative strength ranks based on market performance, volatility ranks, and identifying bullish or bearish divergences in the price relative.