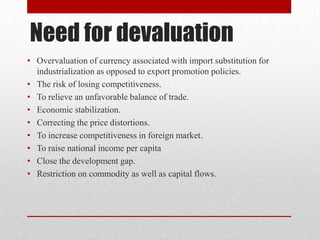

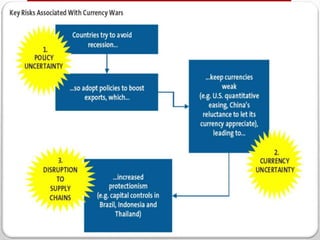

The document discusses the concept of currency wars, where countries compete to lower the value of their currencies to boost exports. It provides background on past currency wars and reasons they occur, such as trade disputes and volatility. Specific examples discussed include China selling US treasuries, Brazil launching an offensive to suppress gains in its currency, and the introduction of the Euro challenging the US dollar's dominance. The effects of currency devaluation like improving trade balances are also summarized.