Embed presentation

Download as PDF, PPTX

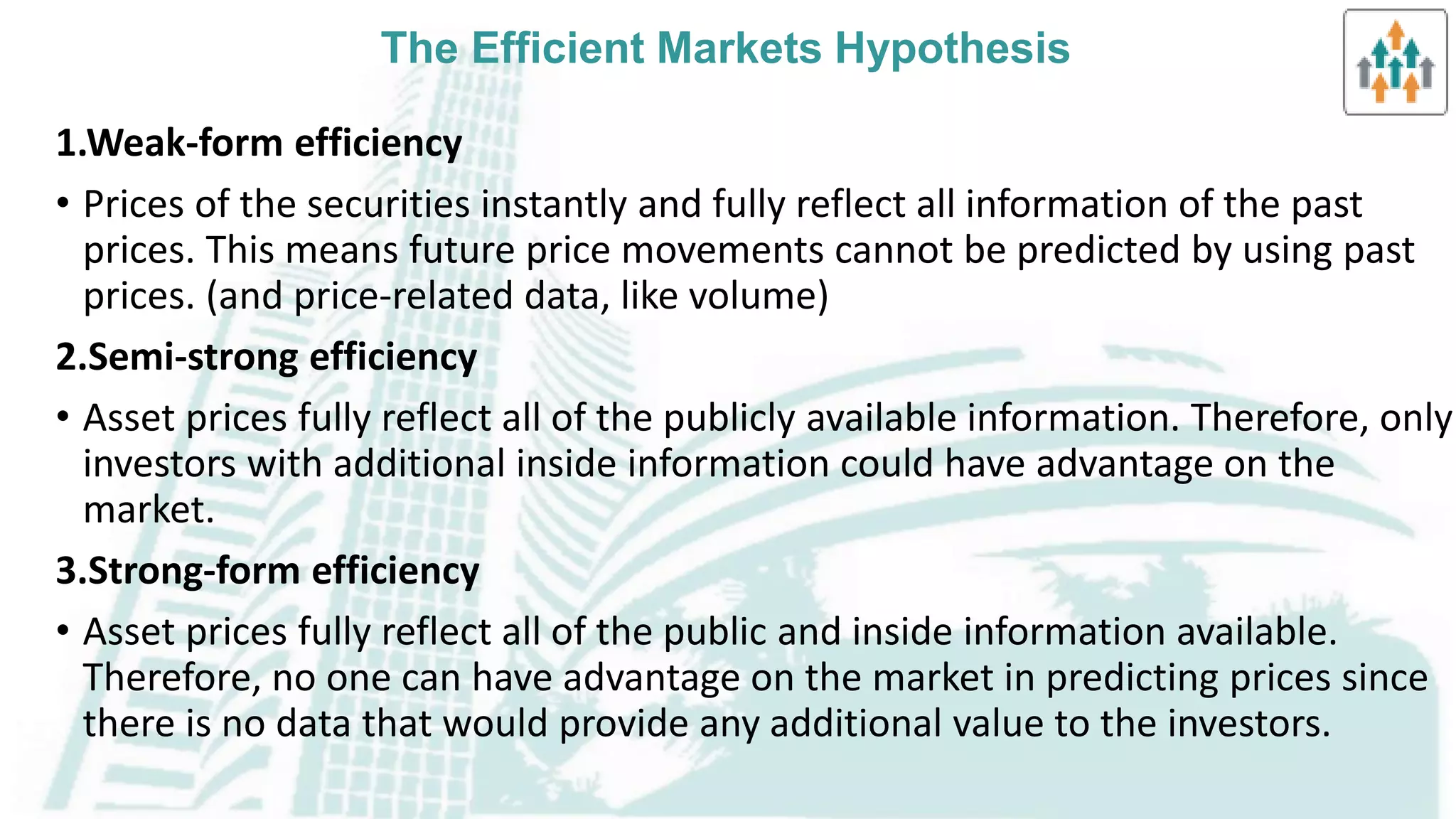

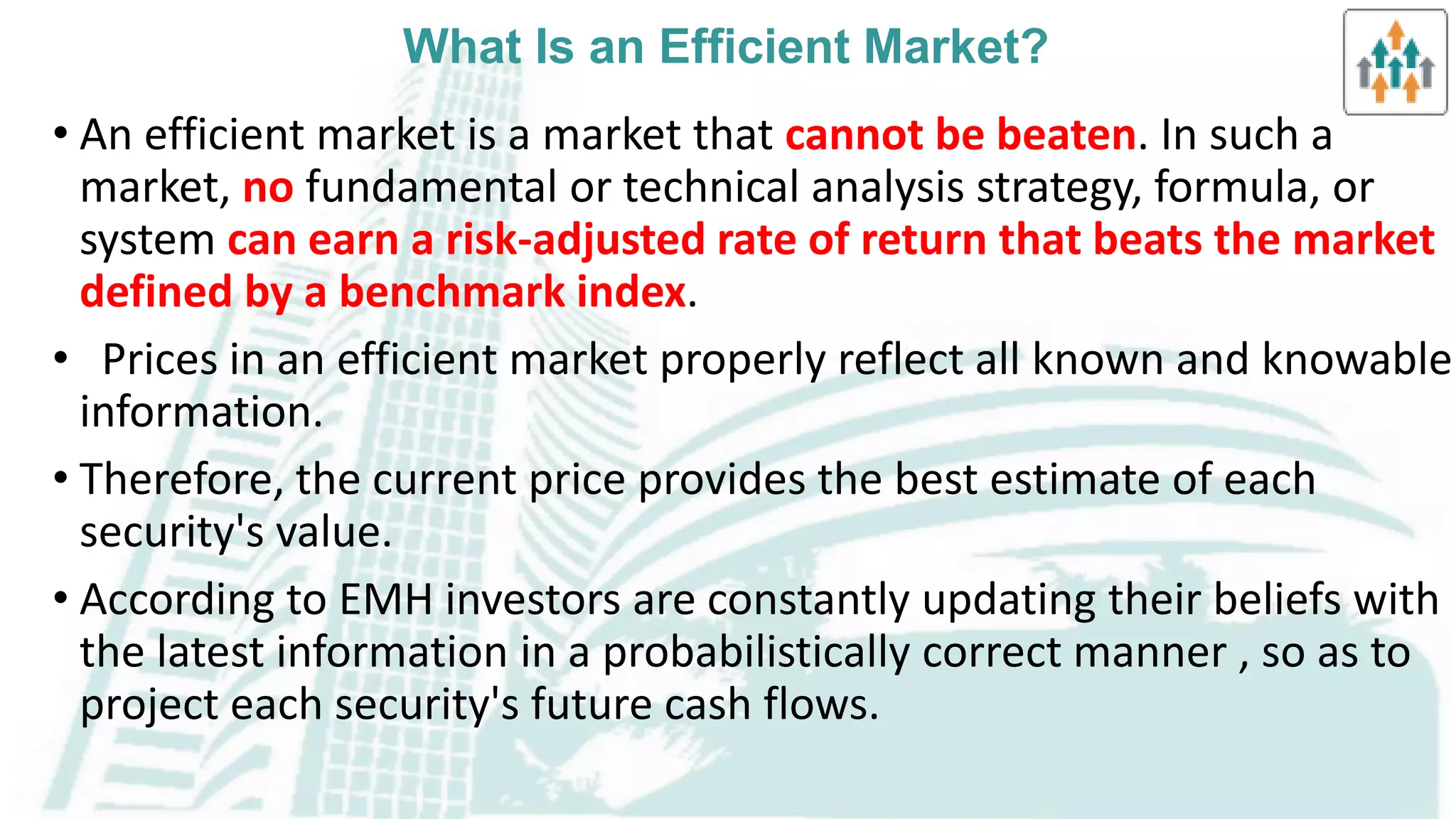

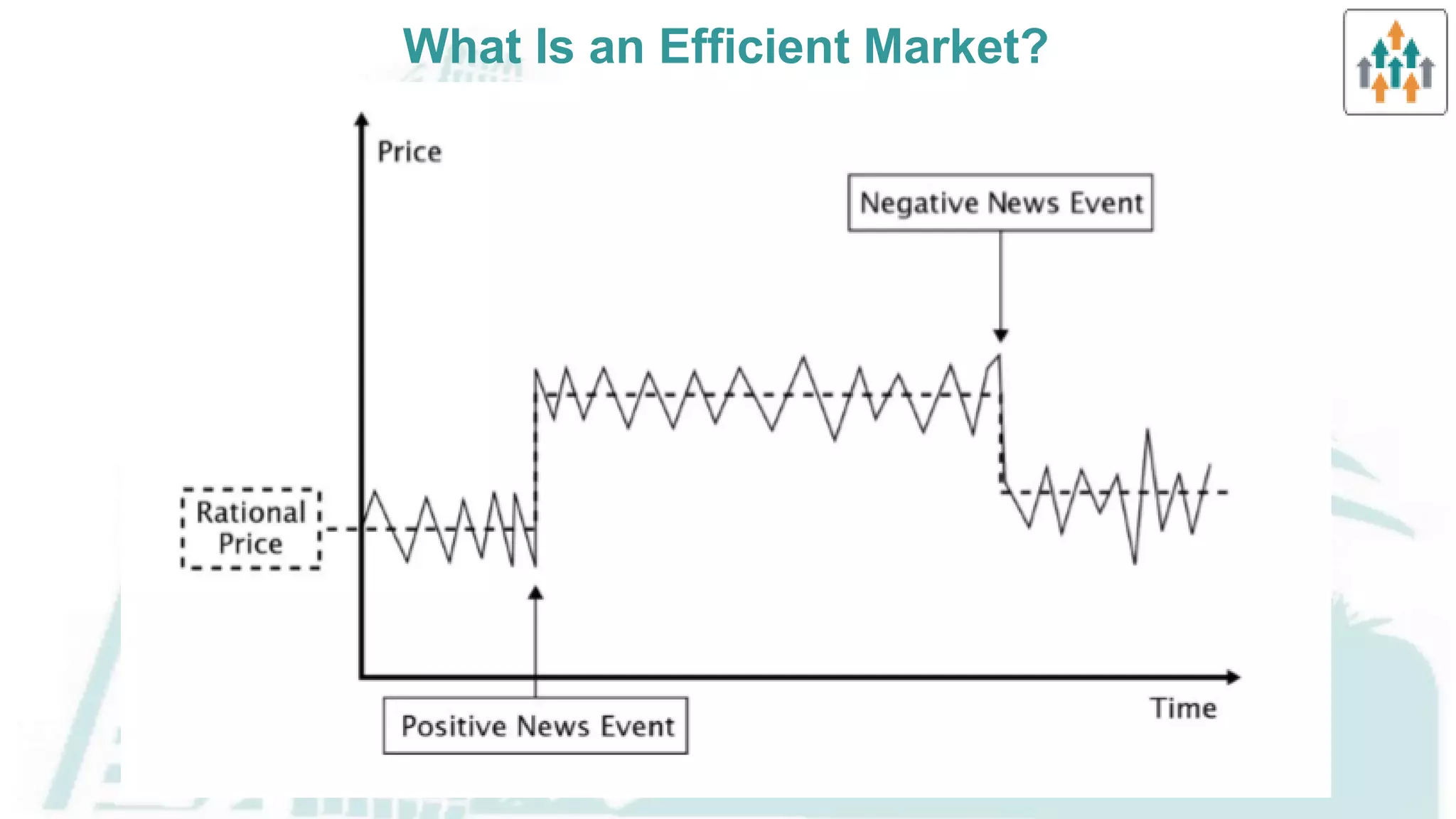

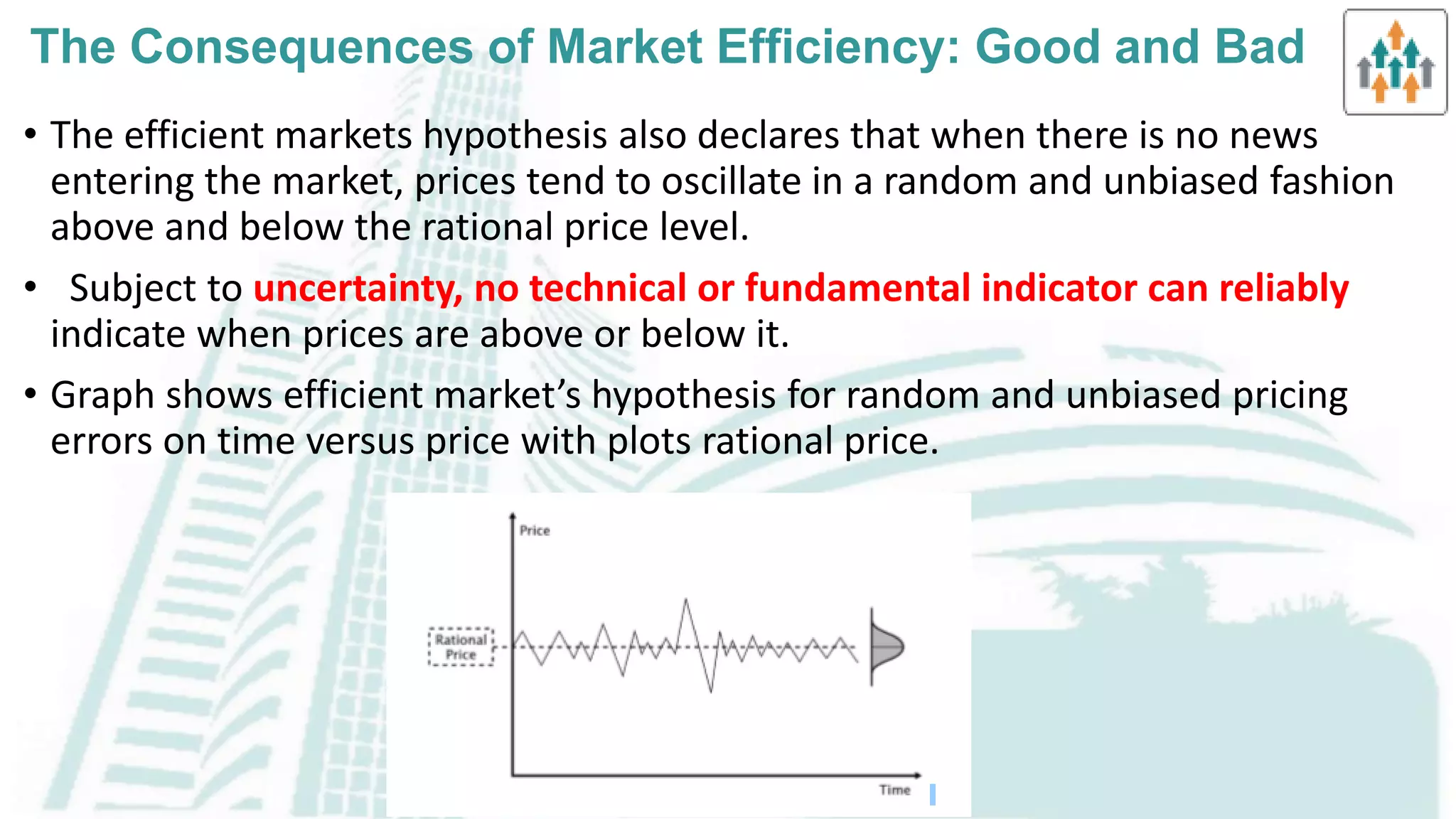

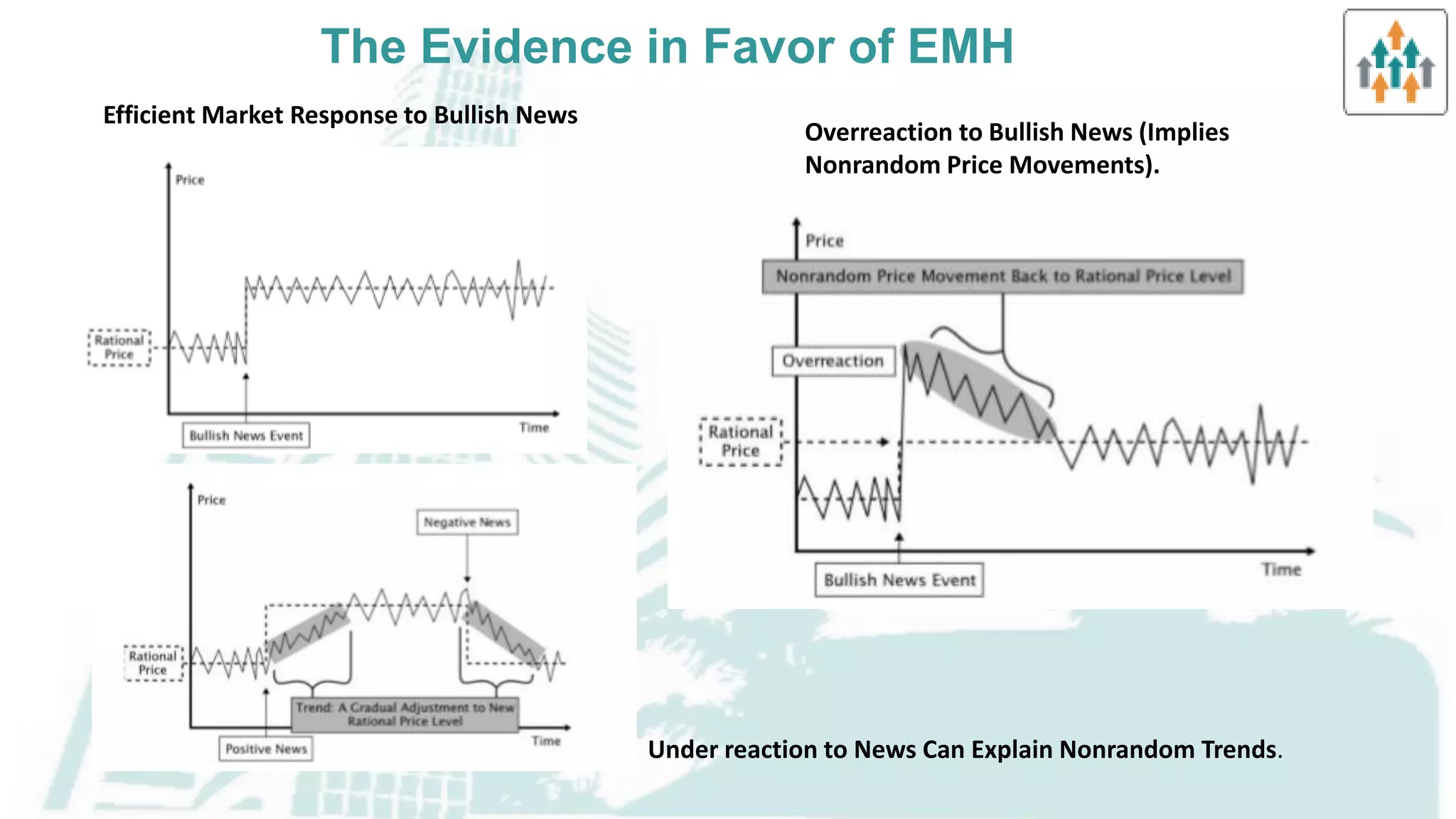

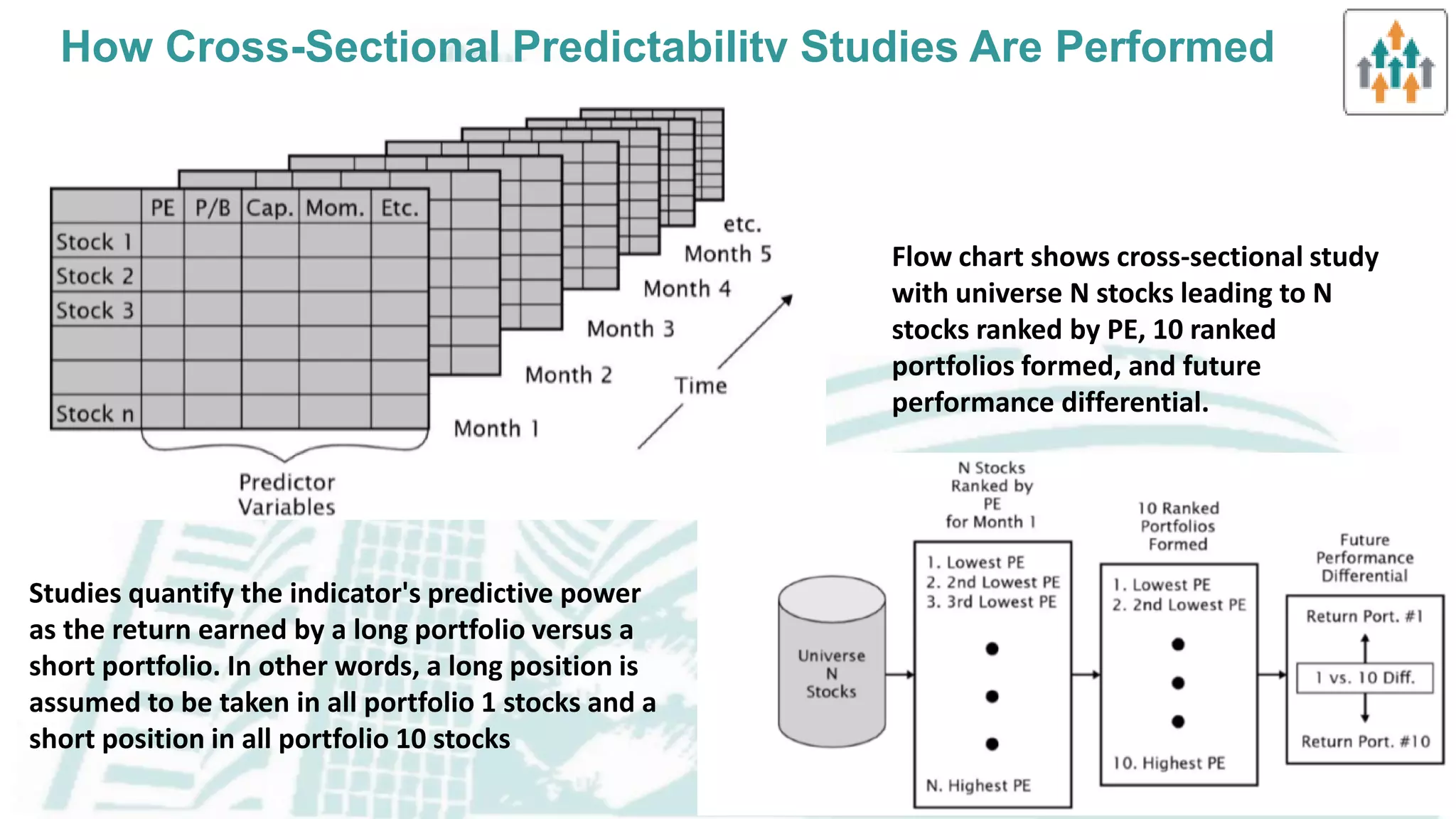

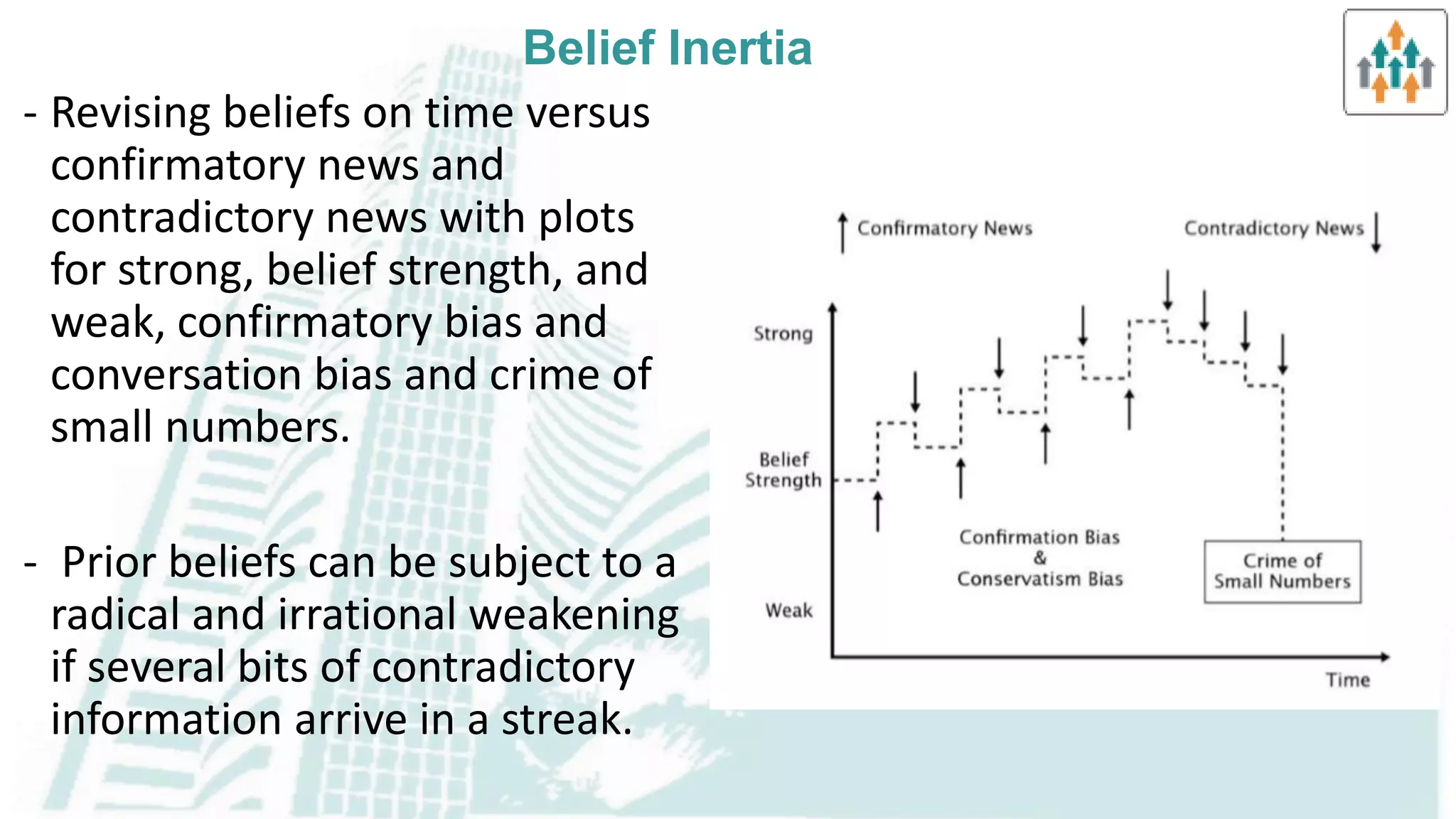

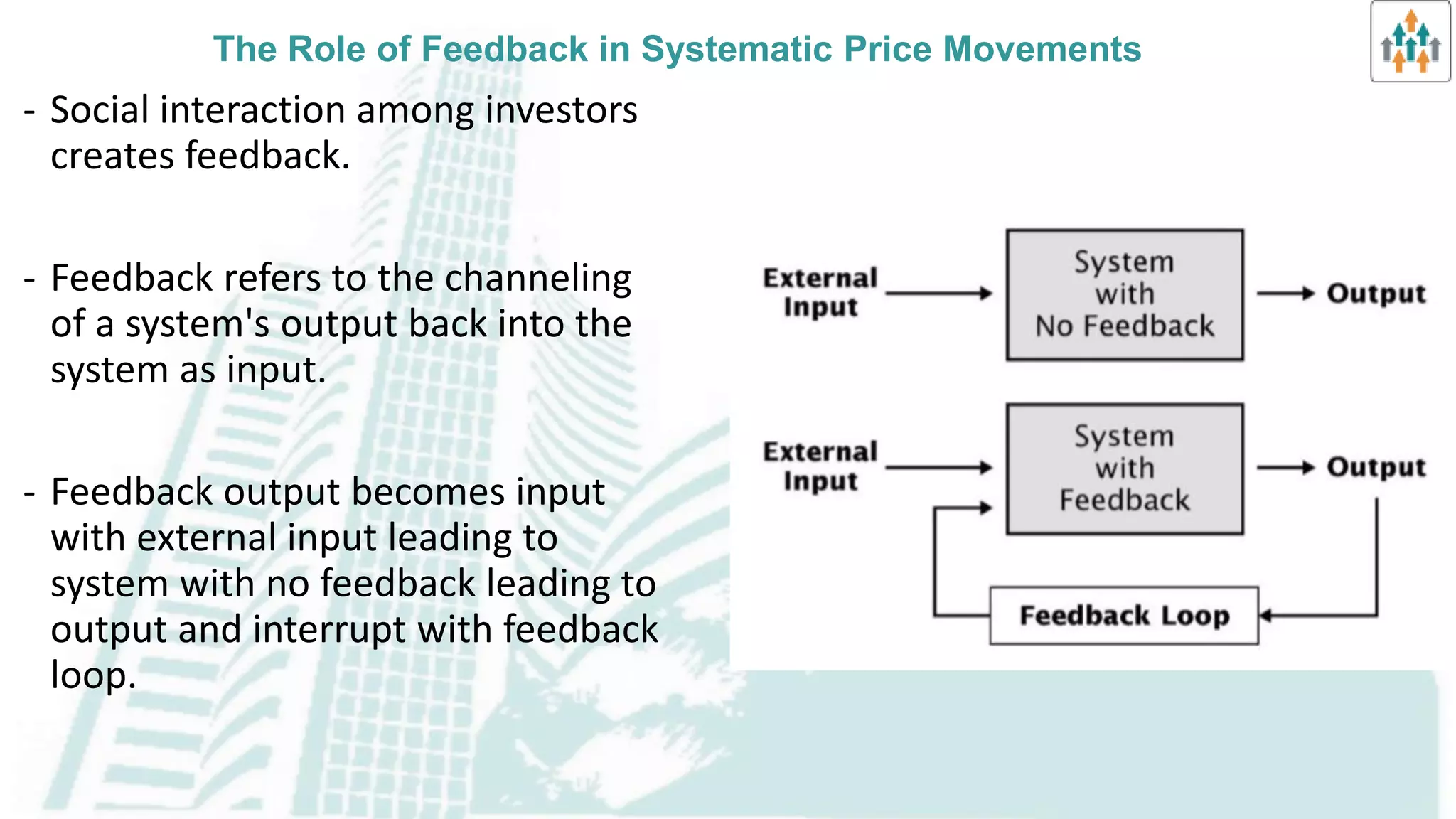

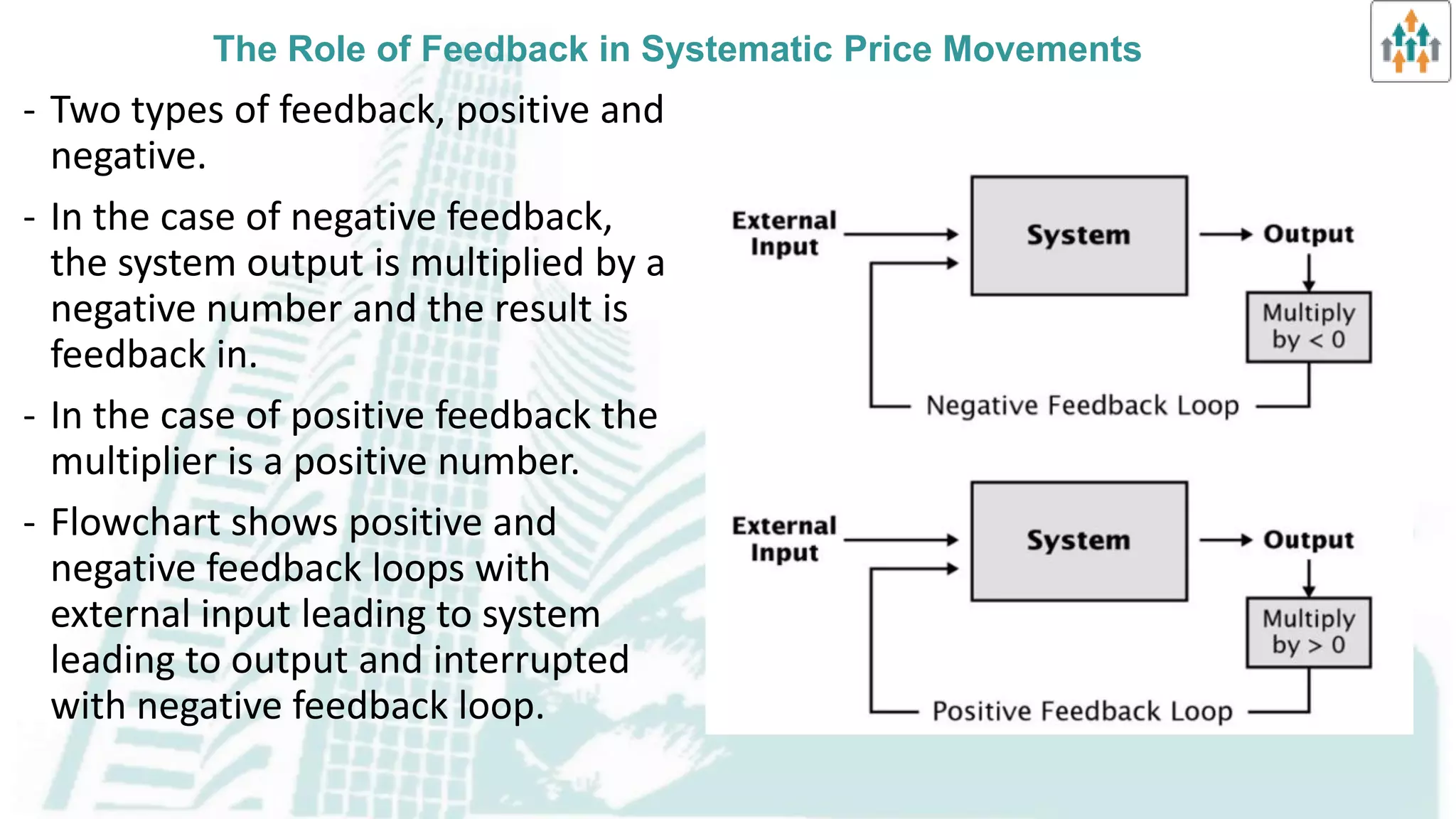

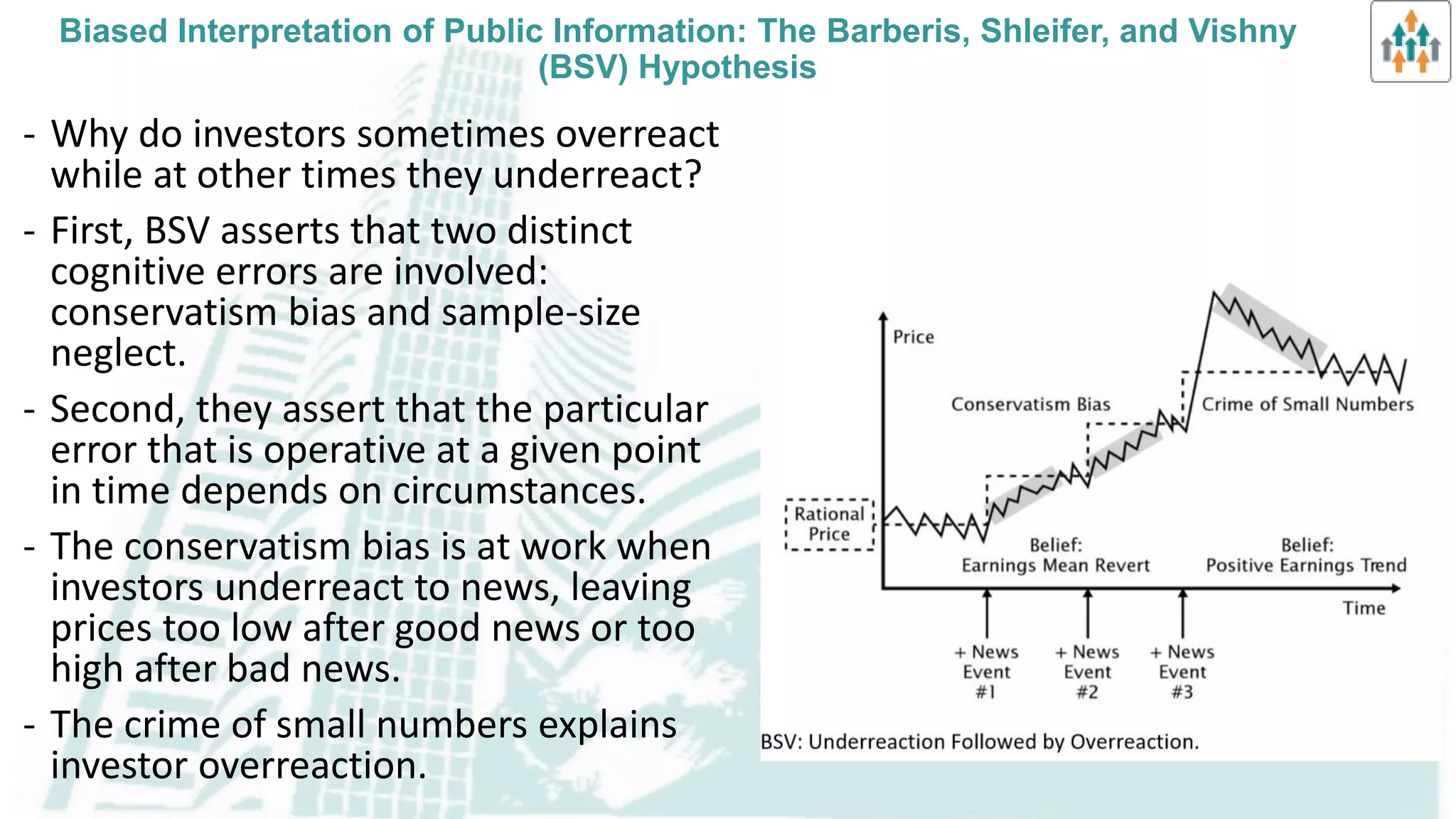

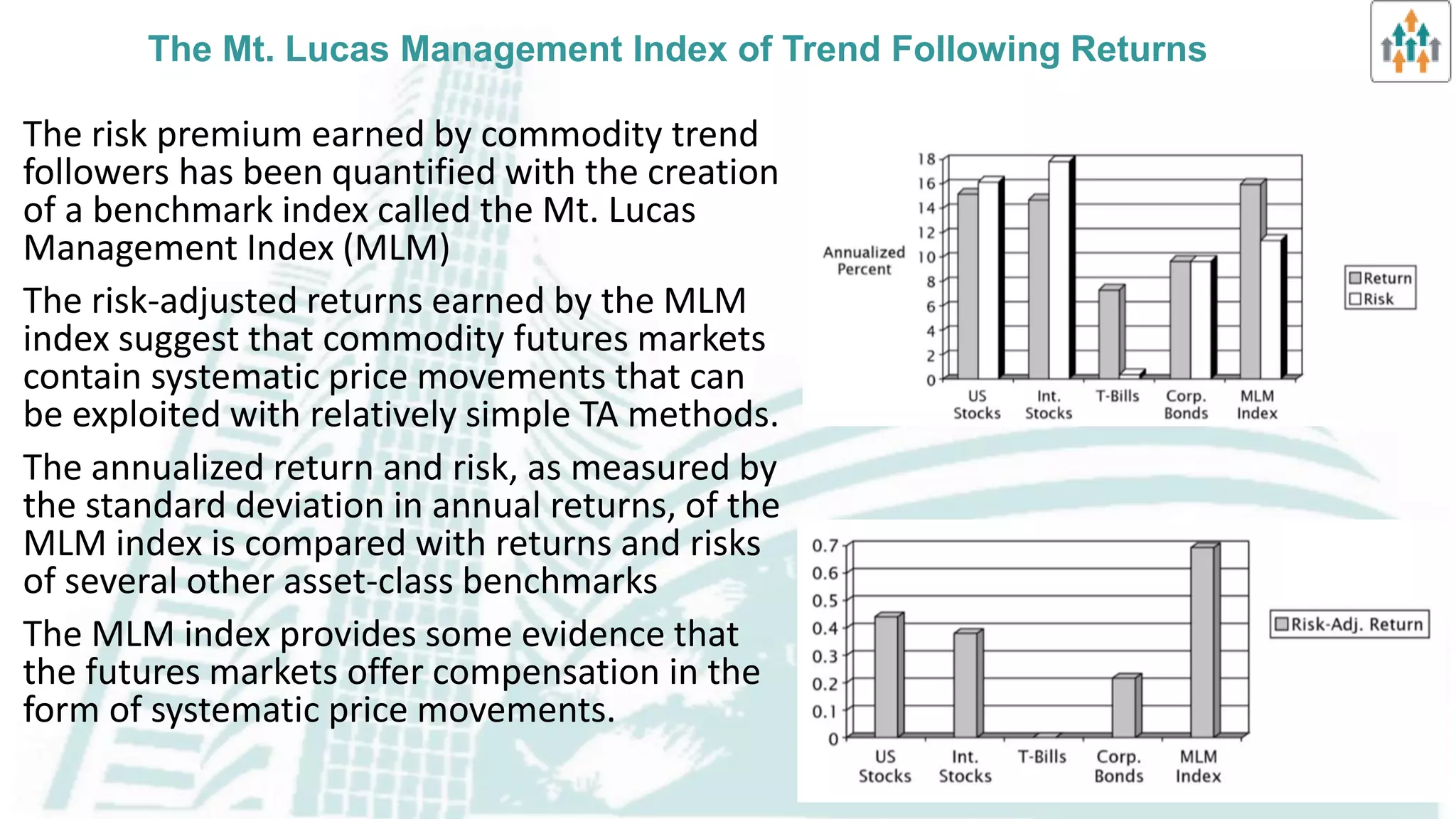

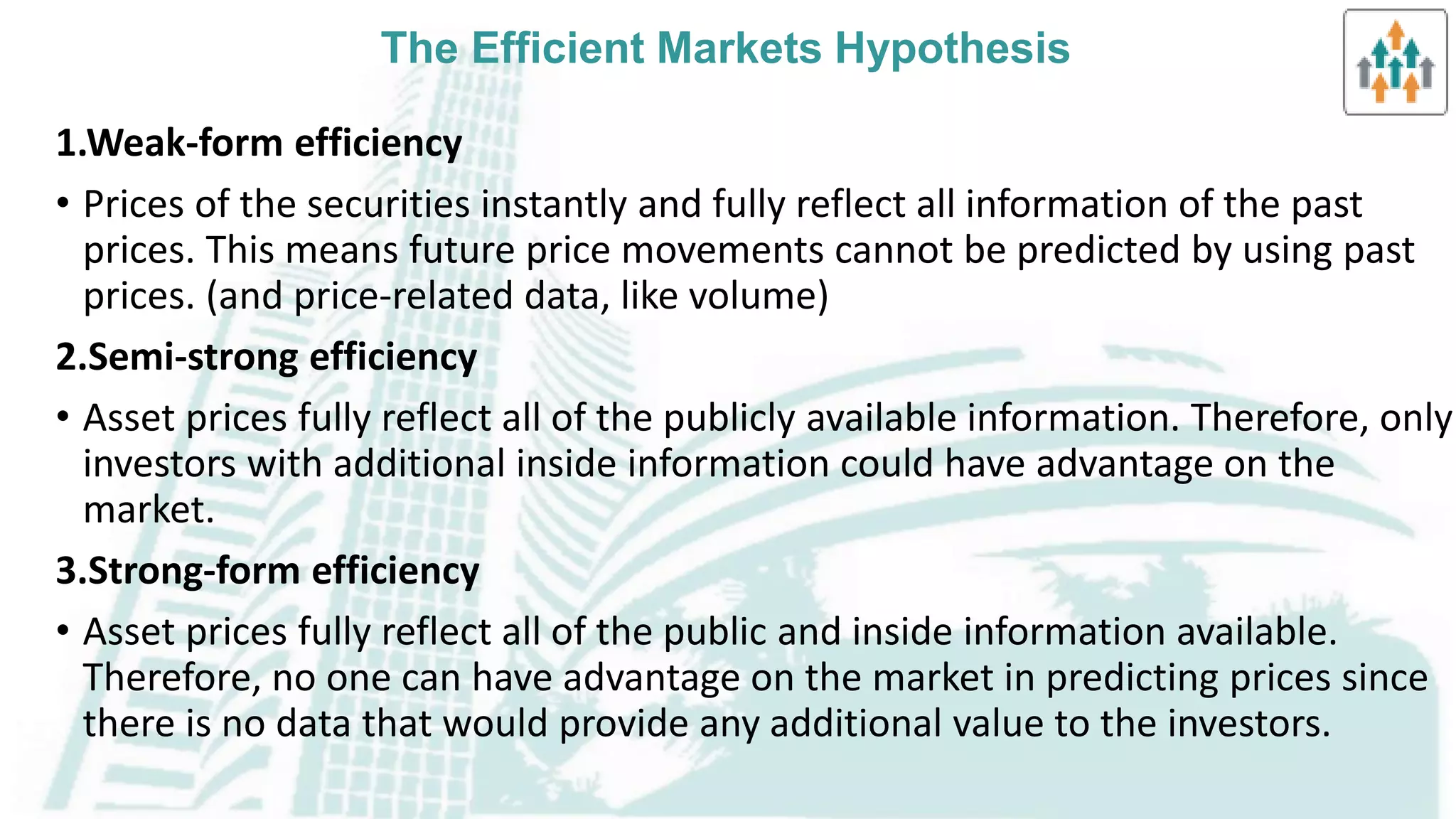

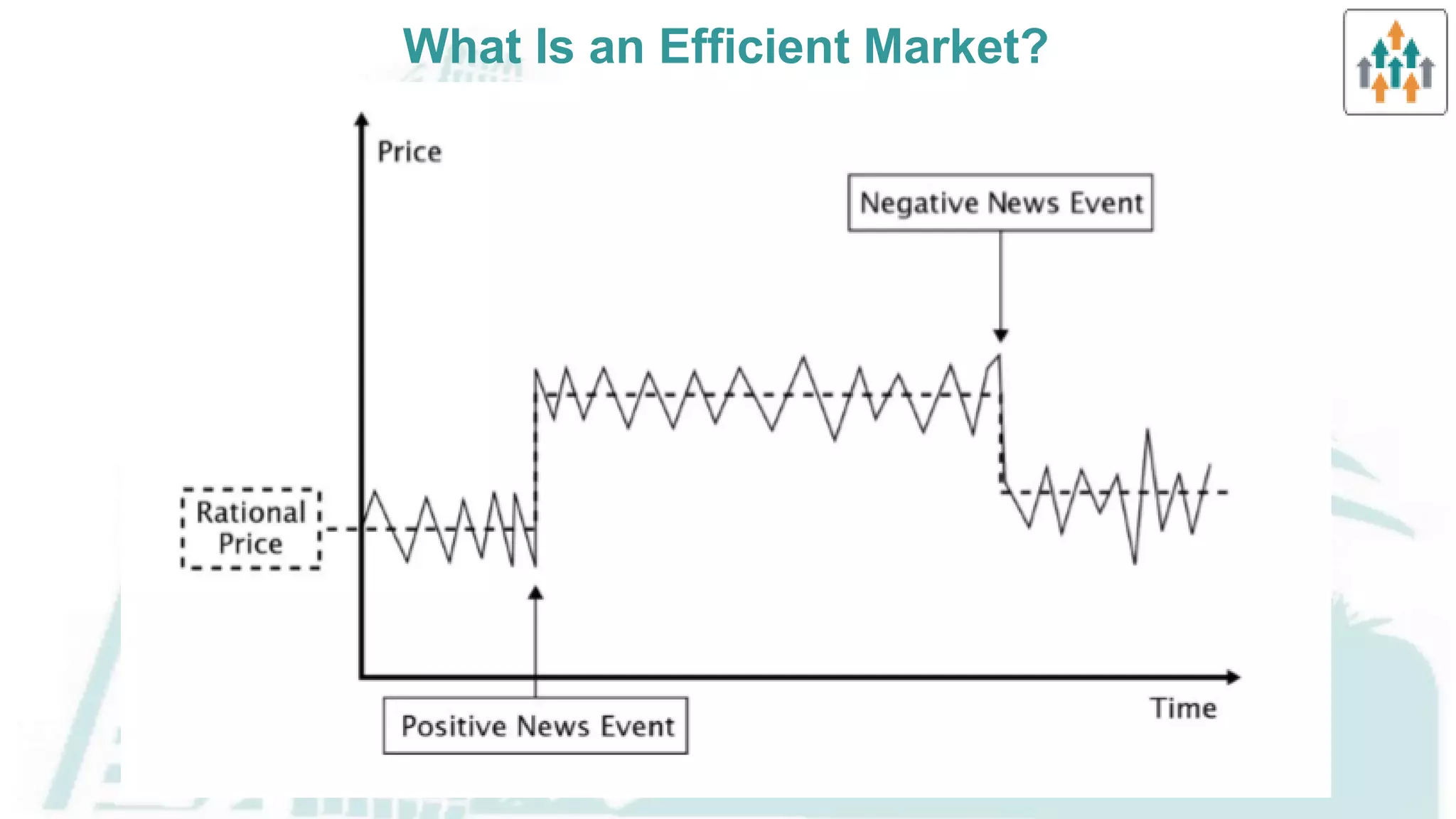

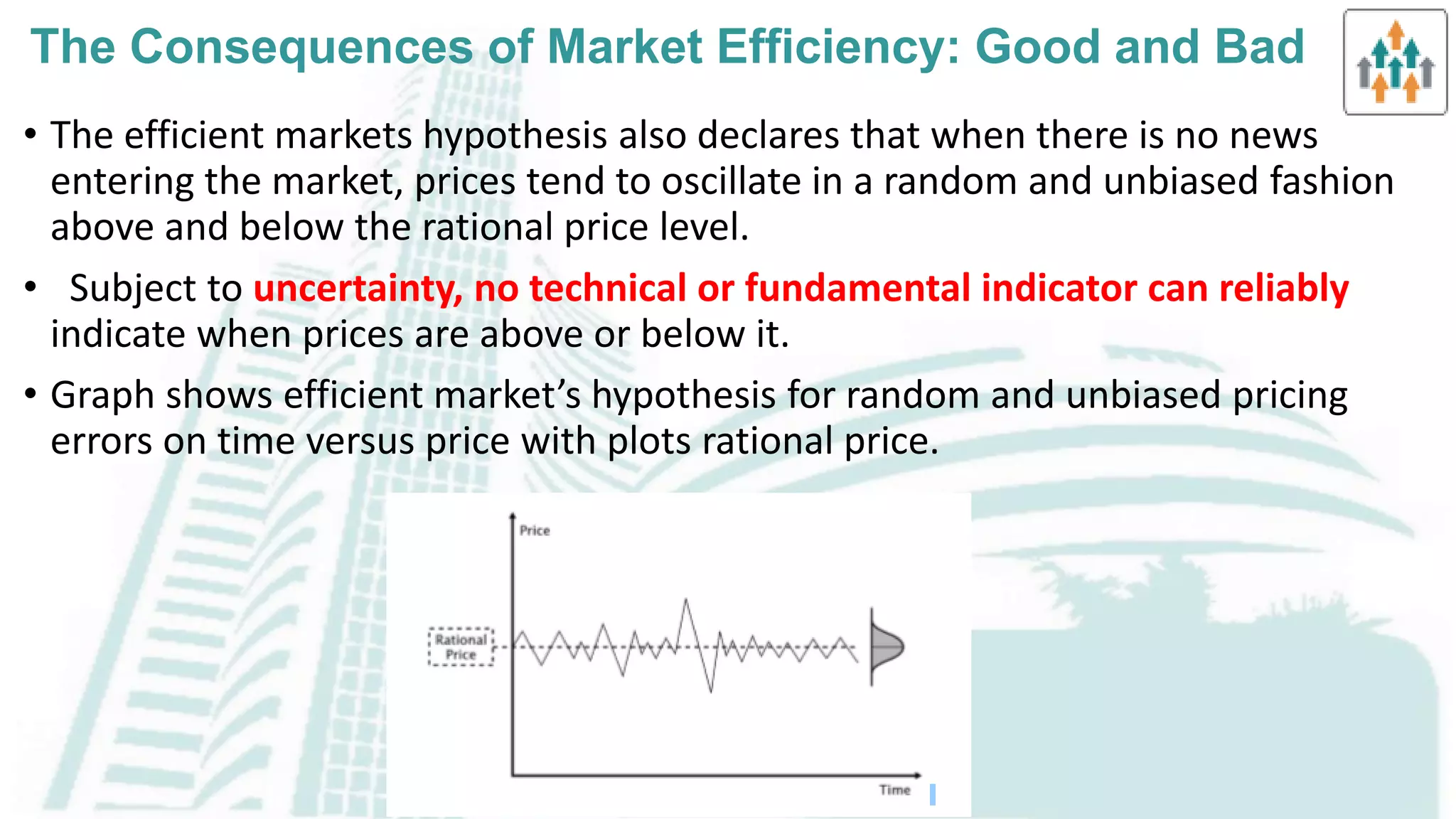

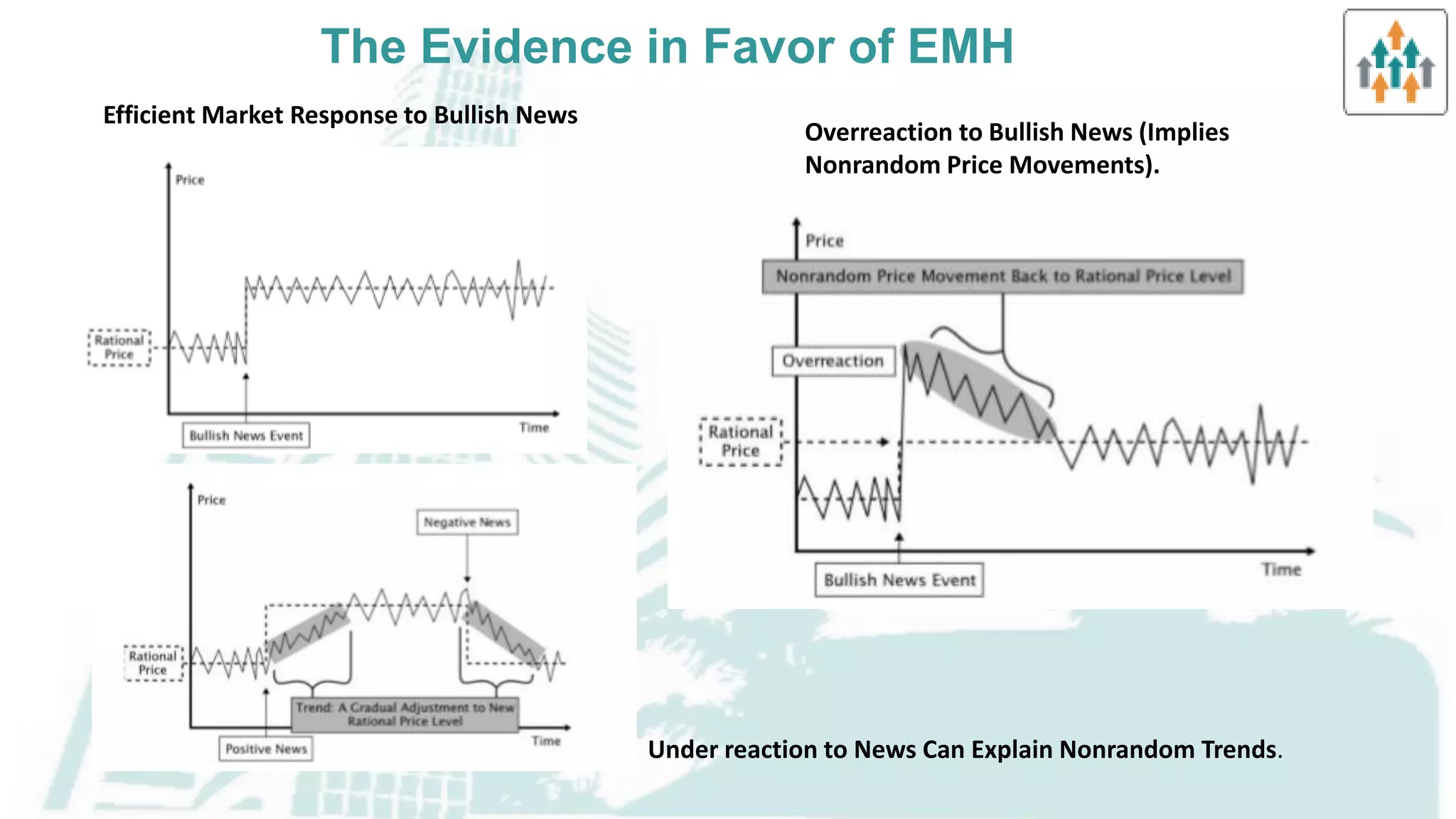

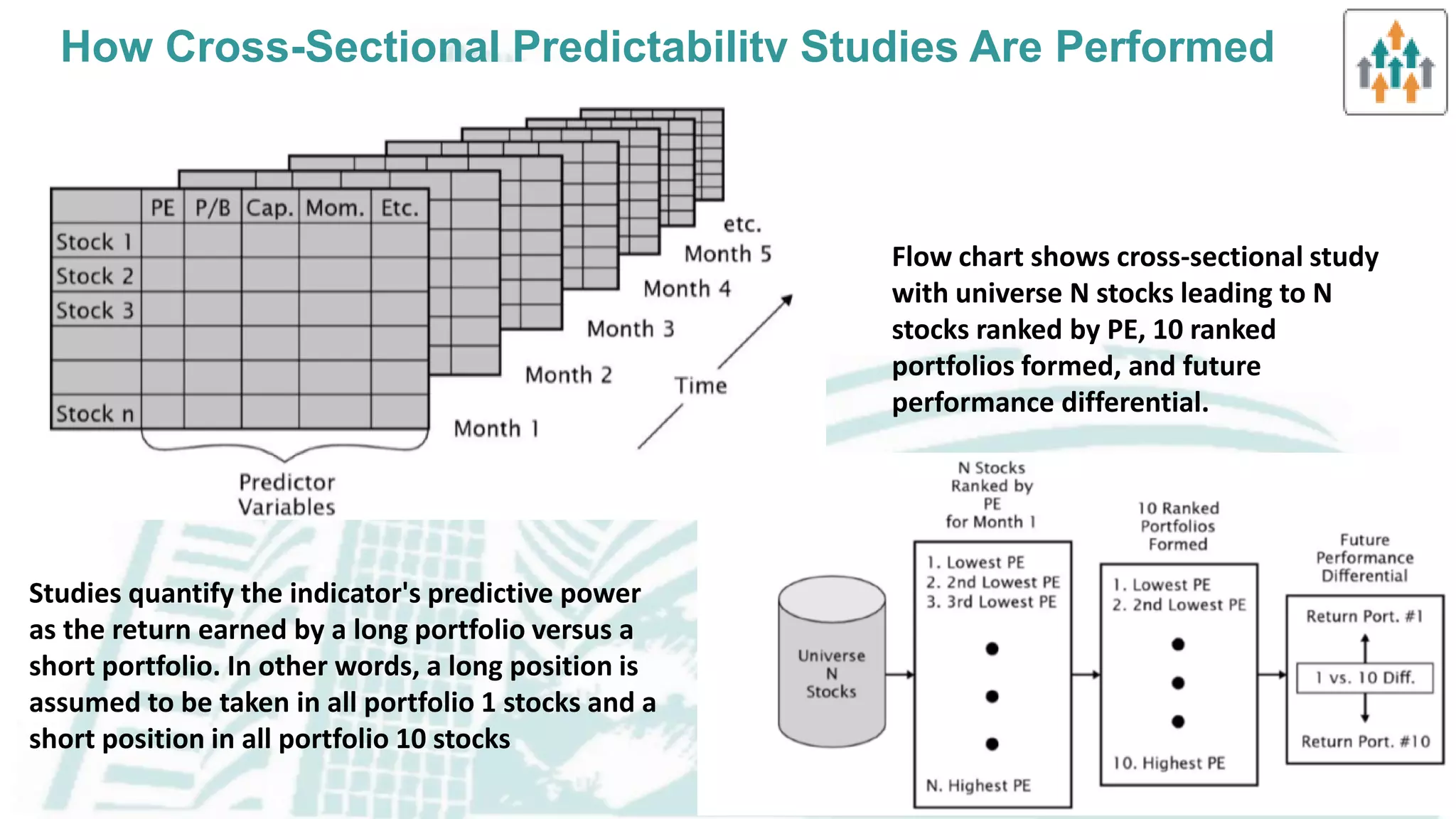

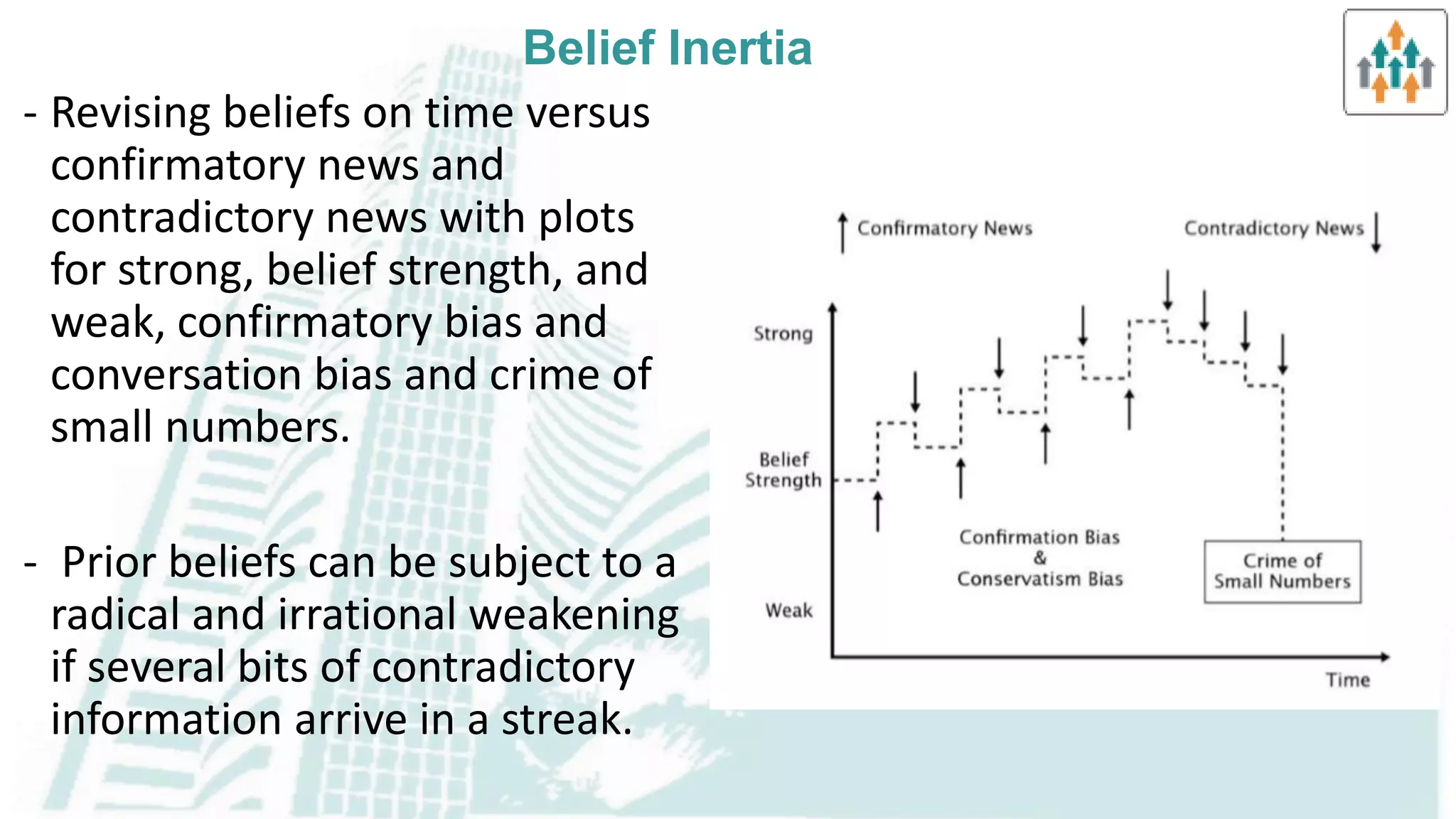

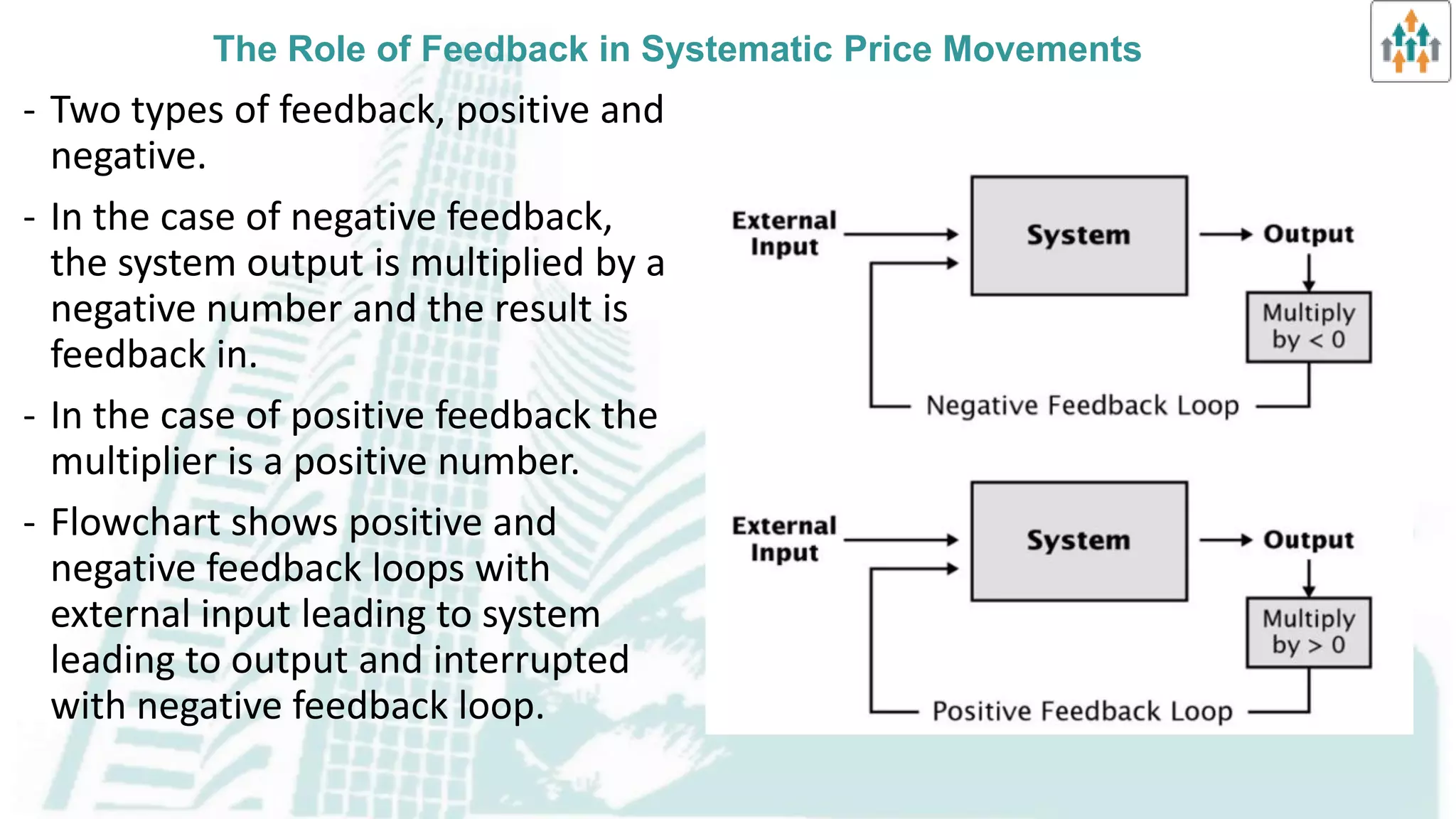

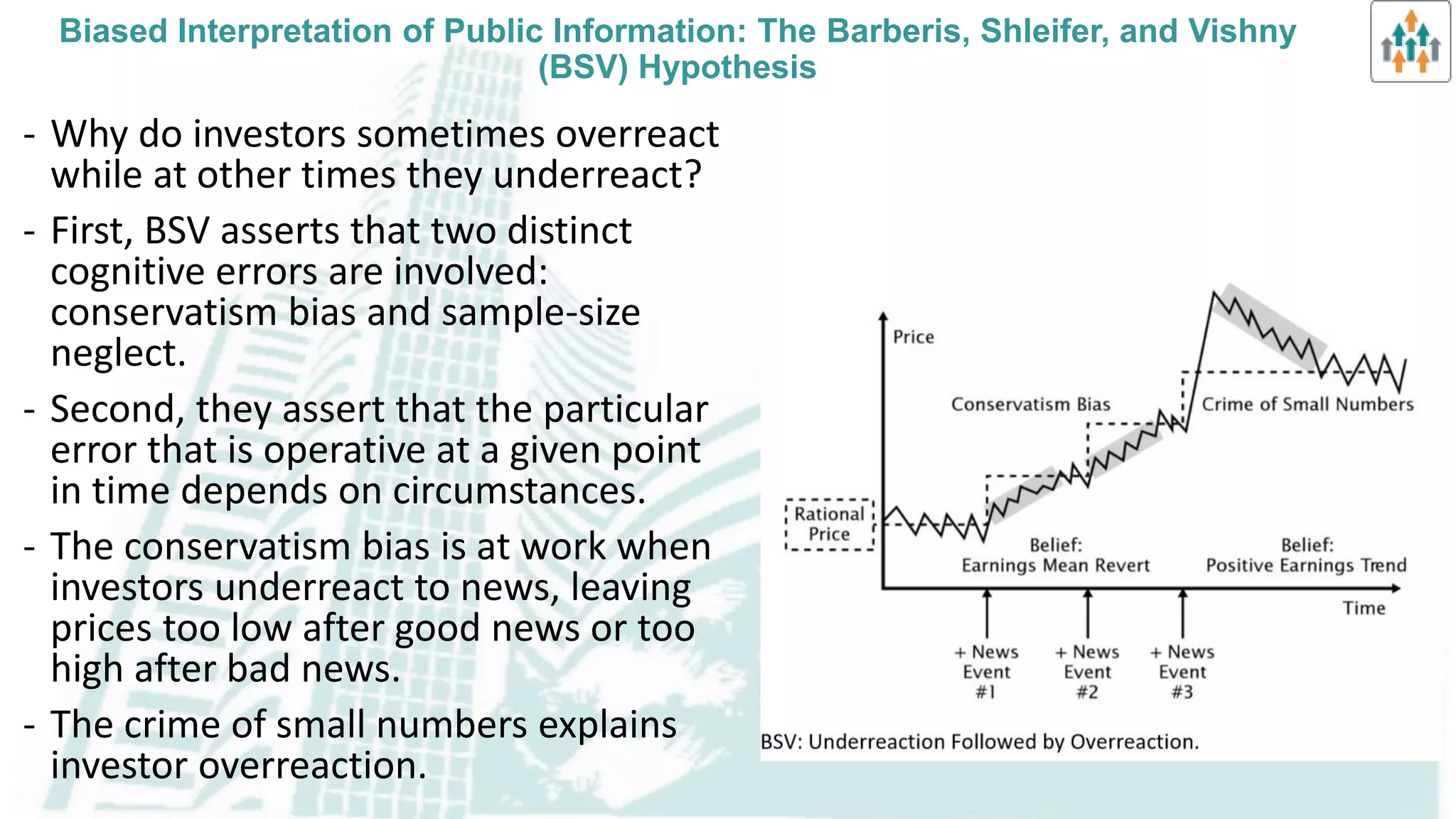

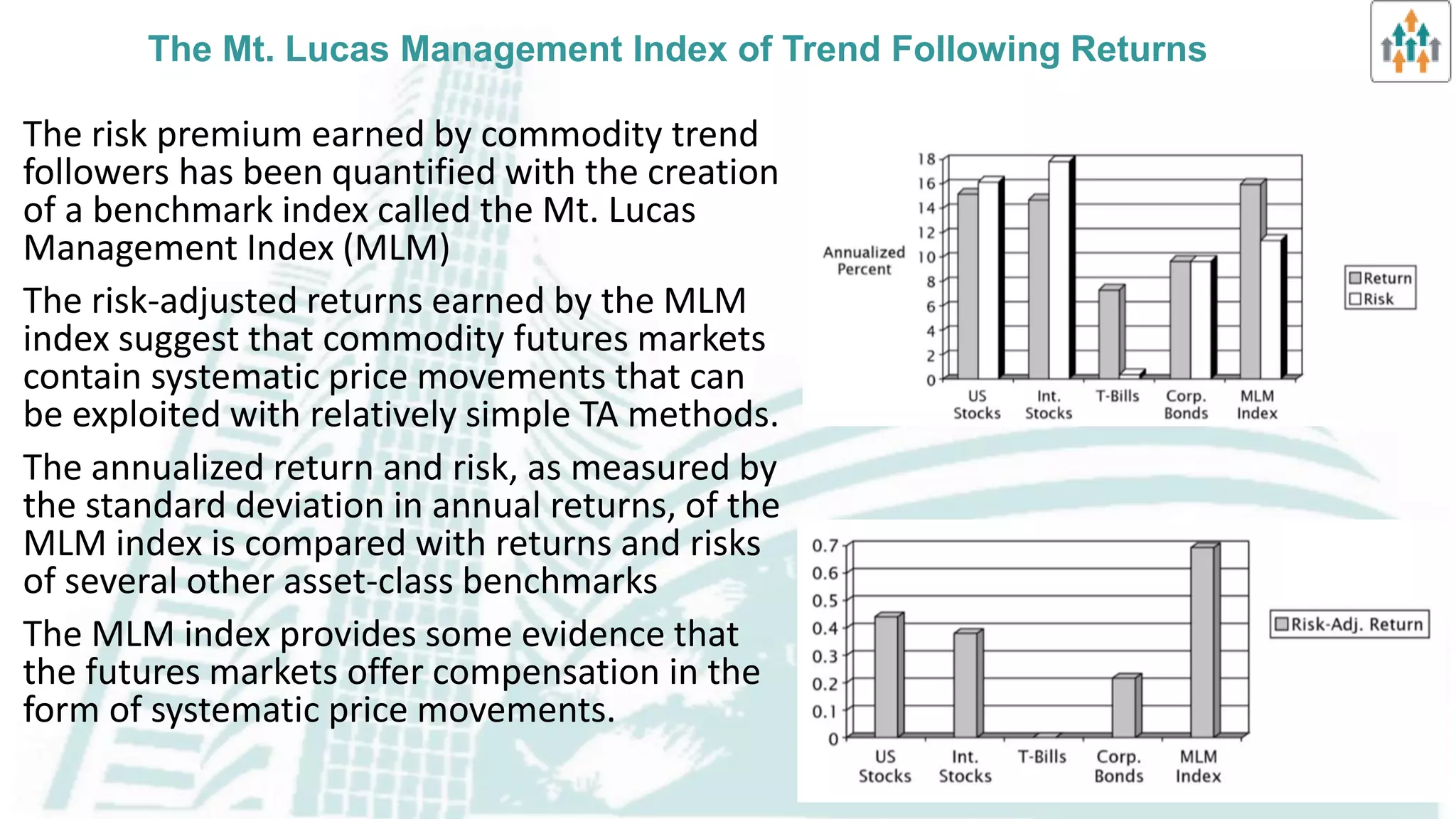

The document discusses the efficient market hypothesis (EMH) and theories of nonrandom price motion. It covers the three forms of EMH - weak, semi-strong, and strong - and defines what constitutes an efficient market. It also discusses criticisms of EMH, such as flaws in its assumptions that investors are rational and pricing errors are random. Behavioral finance theories are presented as alternatives that incorporate human irrationality and cognitive biases. Predictability studies showing prices can be predicted with public information are discussed as contradicting EMH.