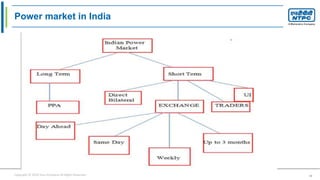

This document discusses Indian electricity markets and power exchanges. It provides information on how electricity is traded as a commodity for both power and energy. An electricity market enables purchases through bids to buy and sales through offers to sell using supply and demand principles. Power exchanges facilitate transparent and efficient trading of electricity in India on a day-ahead basis through a double-sided closed auction. The two main power exchanges in India are the Indian Energy Exchange and Power Exchange India, which allow generators and distribution companies to trade electricity.