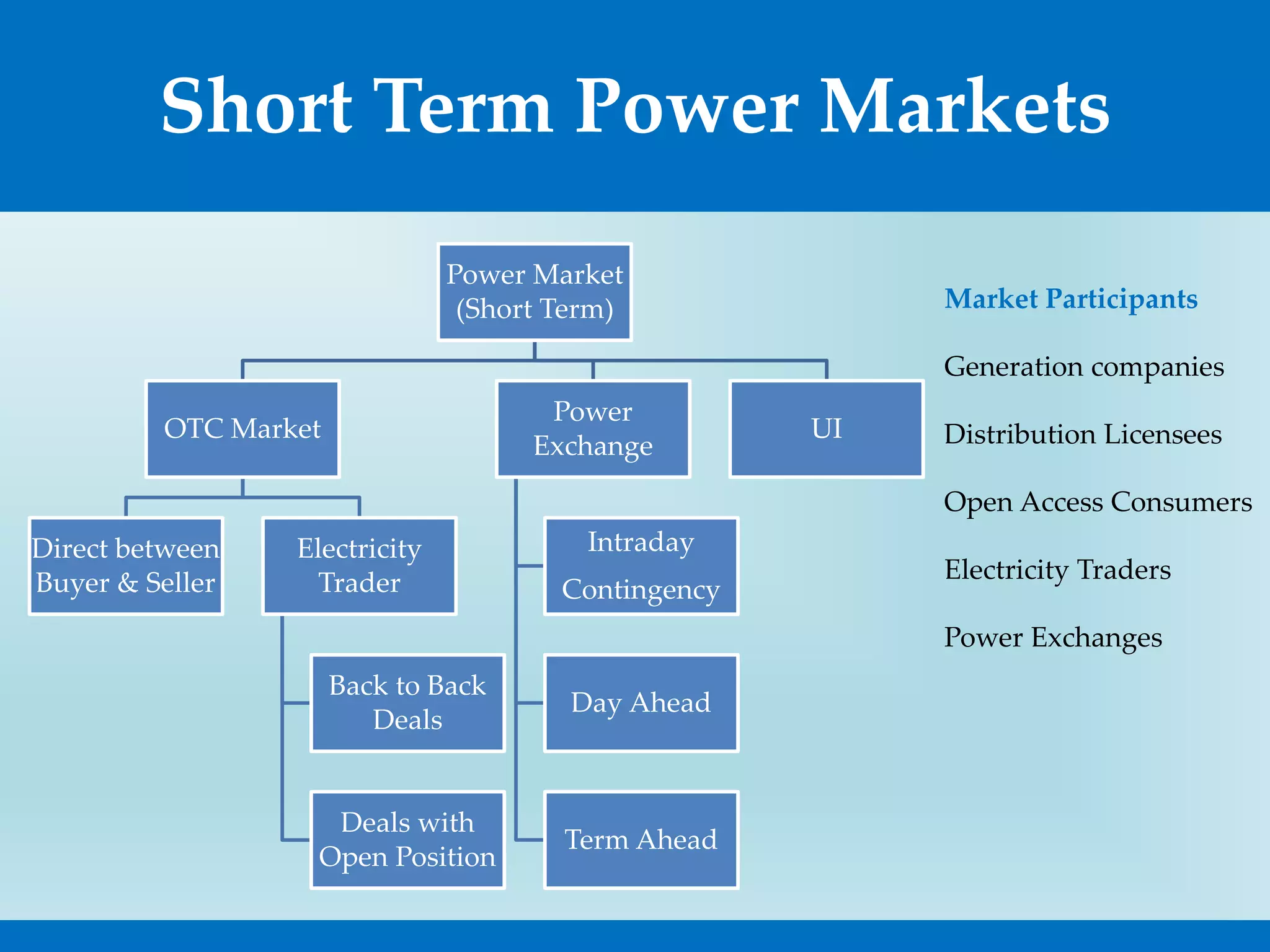

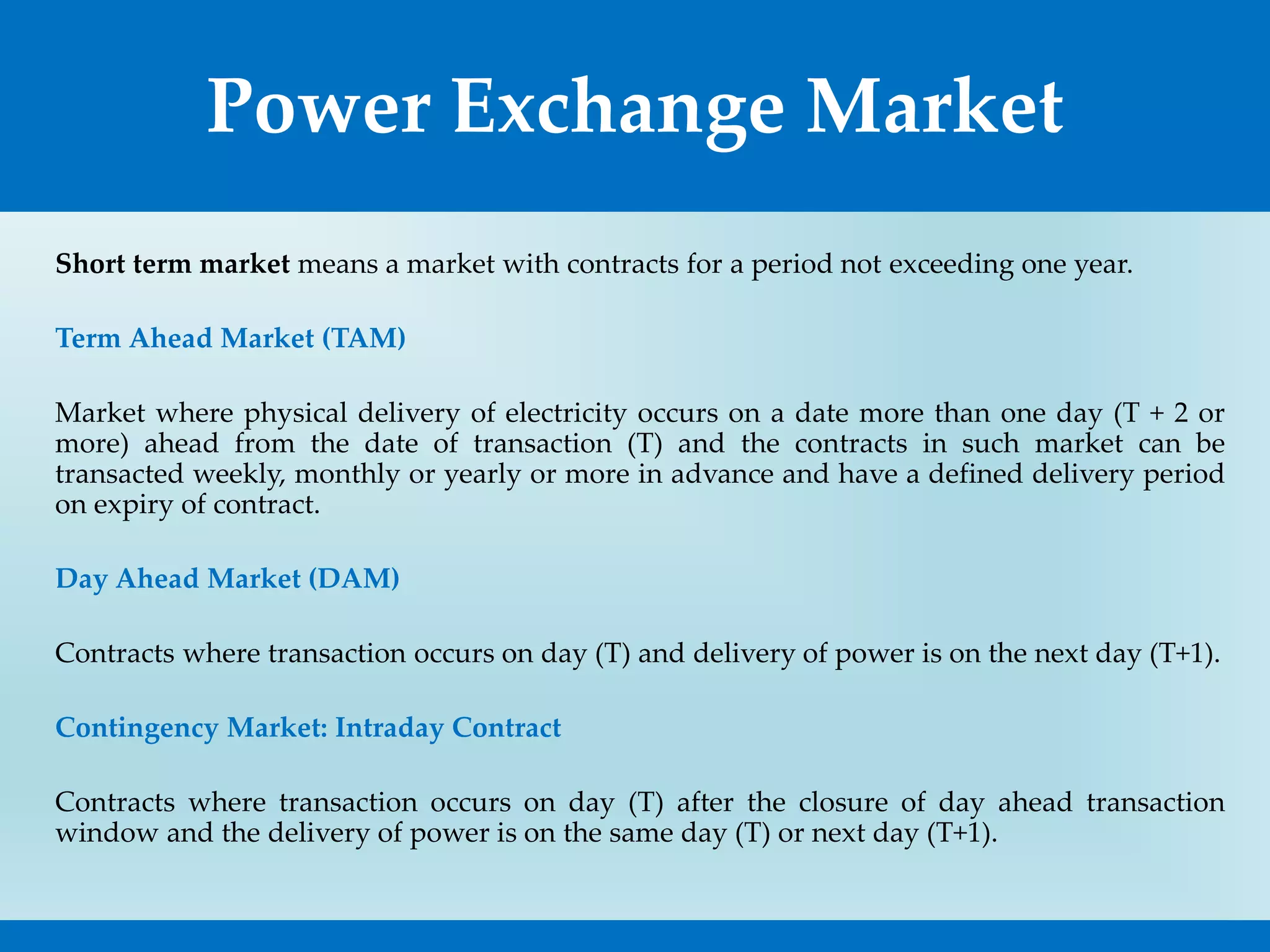

The document provides a comprehensive overview of the power market and trading industry in India, highlighting the shift towards short-term trades amidst a backdrop of power shortages. It details various trading structures, including the over-the-counter (OTC) and power exchange markets, along with transaction trends and associated risks such as credit, operational, and price risks. The growth in power trading and the regulatory framework around trading margins are also discussed, indicating significant interest from diverse market participants.