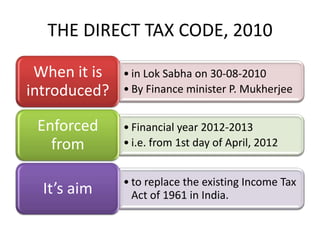

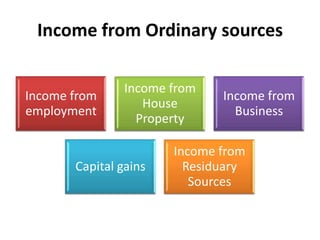

The document summarizes key aspects of the Direct Tax Code (DTC) 2010 introduced in India. Some key points:

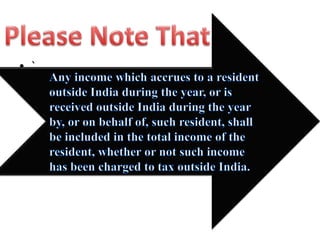

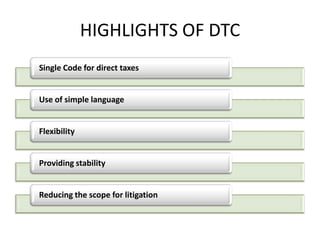

1. The DTC 2010 aims to replace the existing Income Tax Act 1961 and simplify direct tax laws using simple language. It consolidates various direct tax laws into a single code.

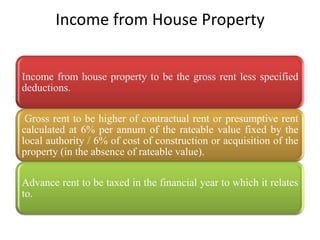

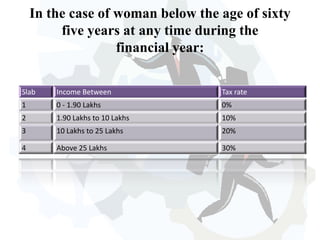

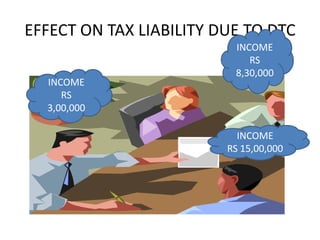

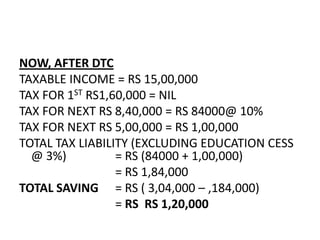

2. Major changes include a single slab for all individuals (0-30% tax), corporate tax rate reduced to 30%, wealth tax rate cut to 0.25%, capital gains tax treated separately.

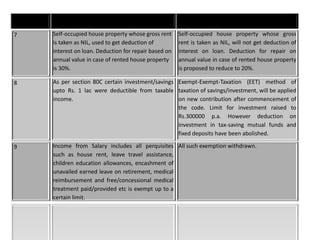

3. The DTC proposes the EET model for taxing investments and aims to promote long-term investments. Key dates for tax filing also changed to 30th June and 31st August.