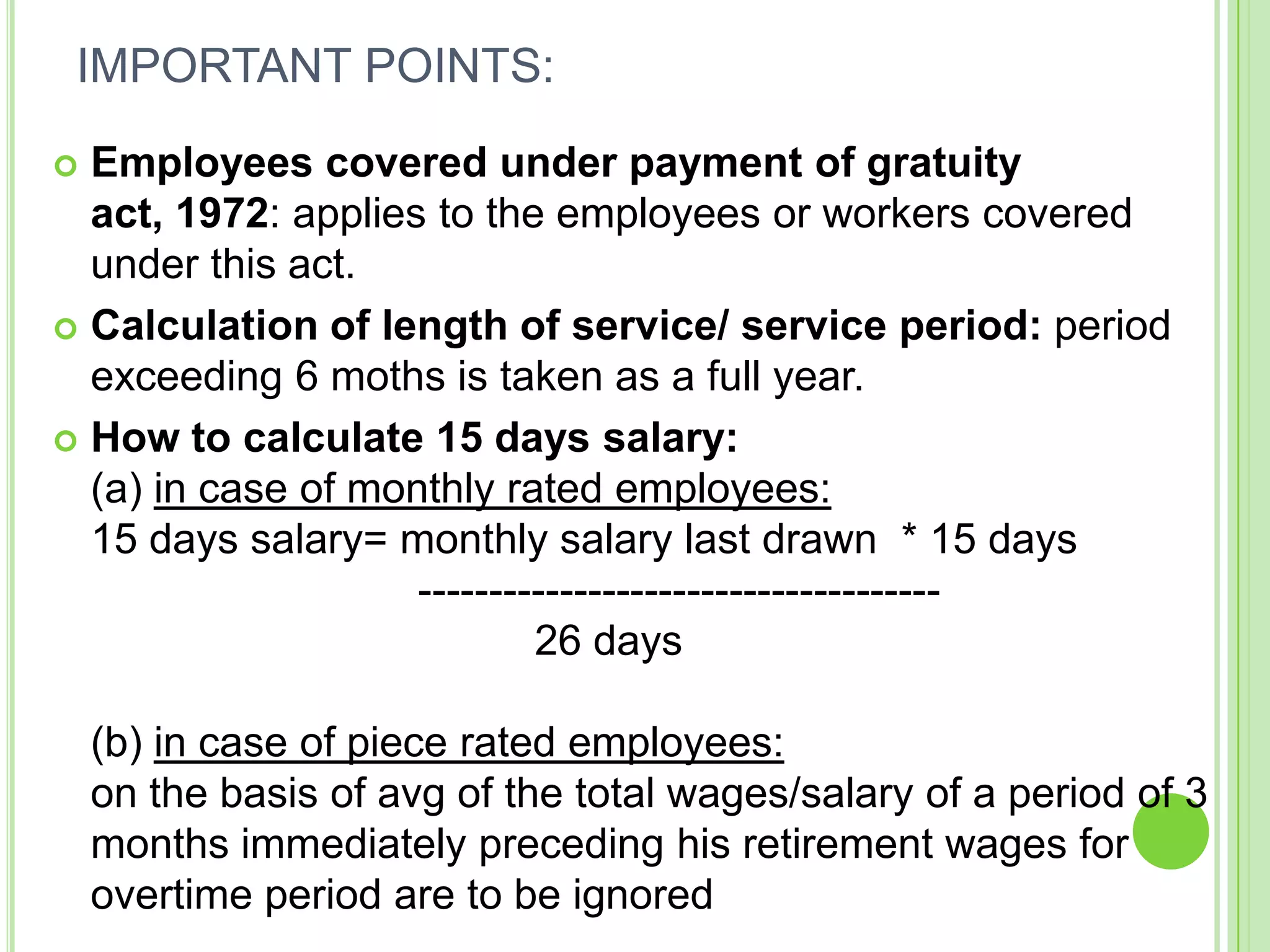

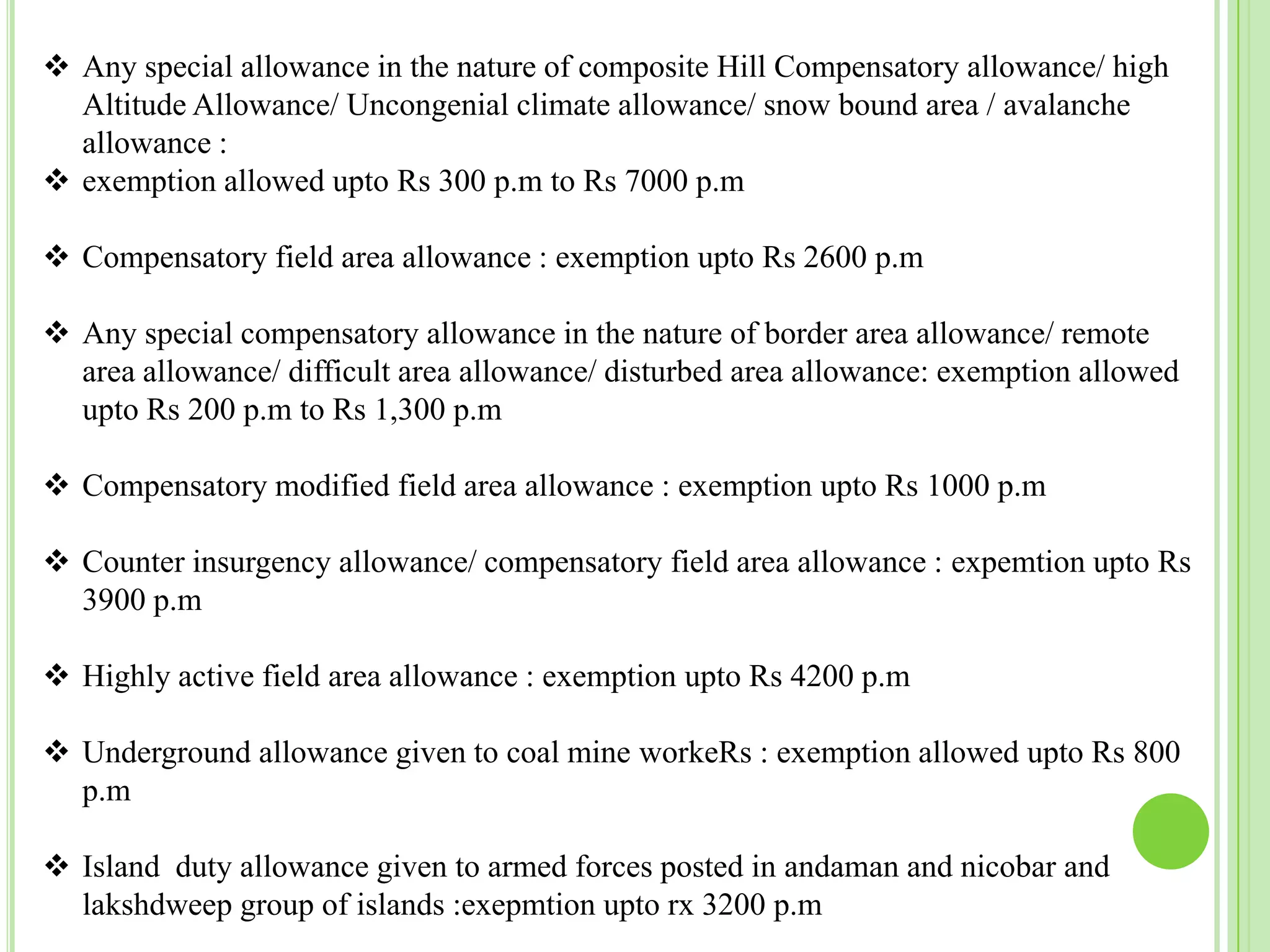

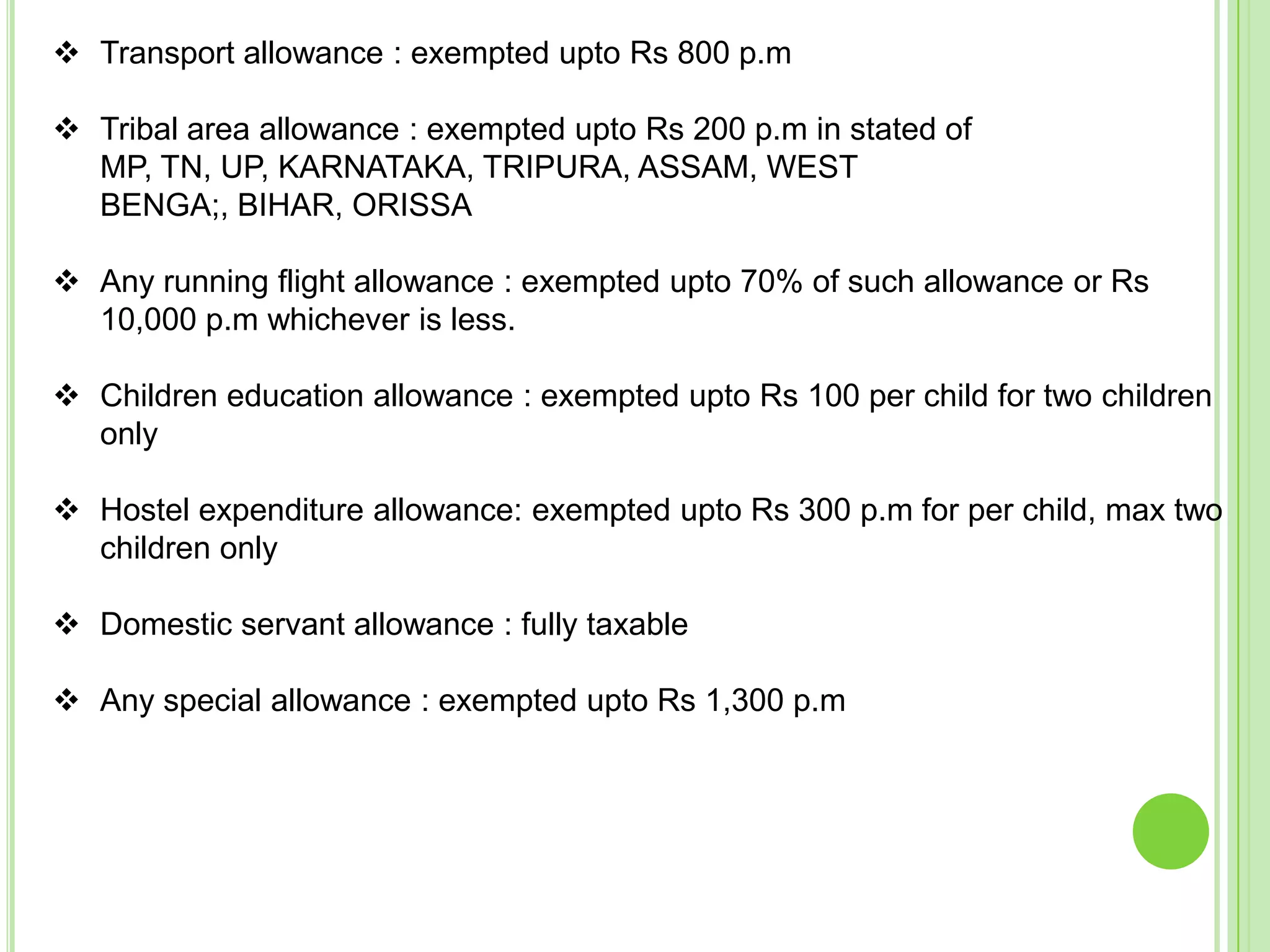

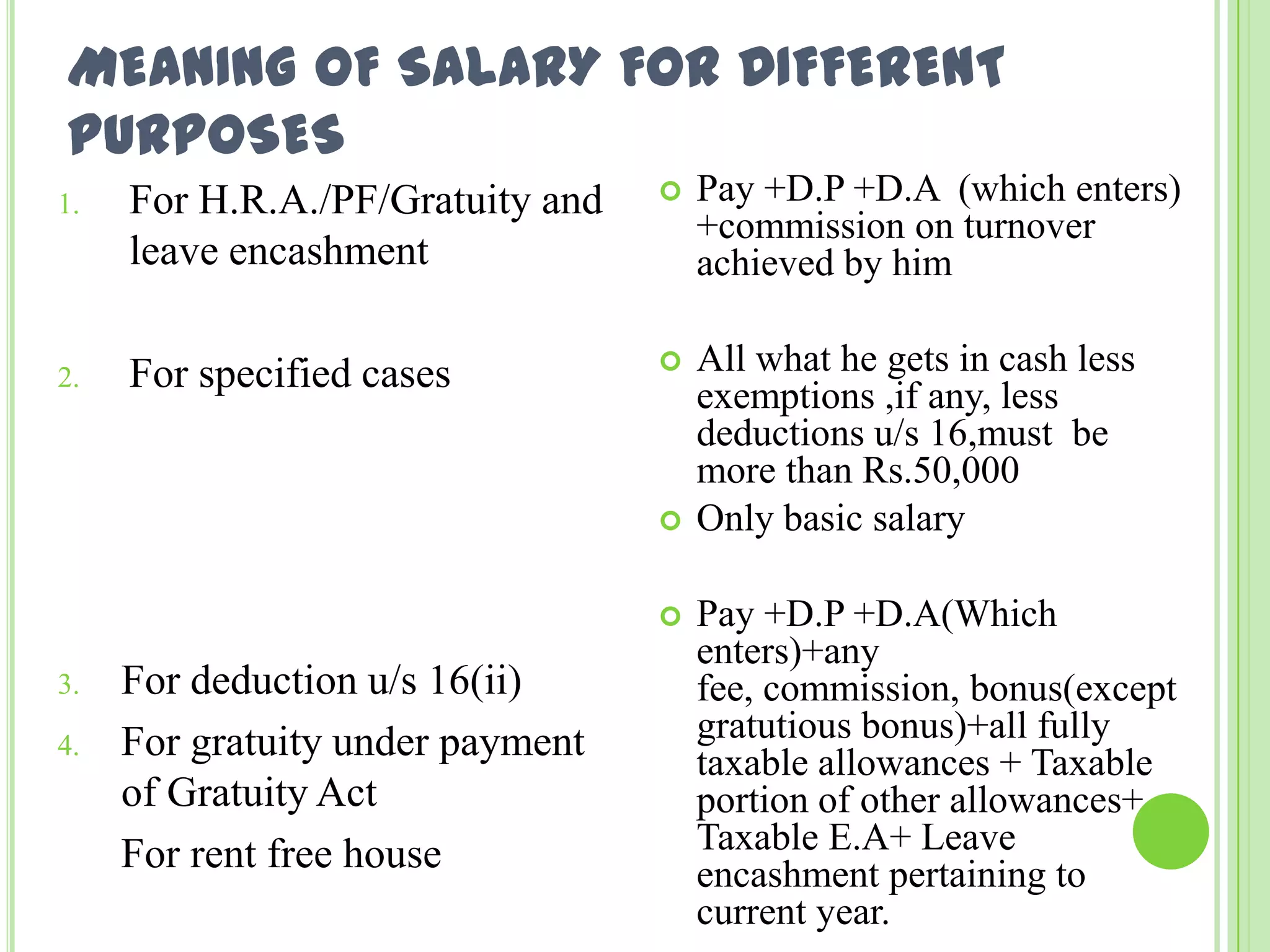

1. Allowances can be fully exempted, fully taxable, or partially taxable depending on the type of allowance. House Rent Allowance is partially taxable with an exempted amount based on rent paid, salary, and location.

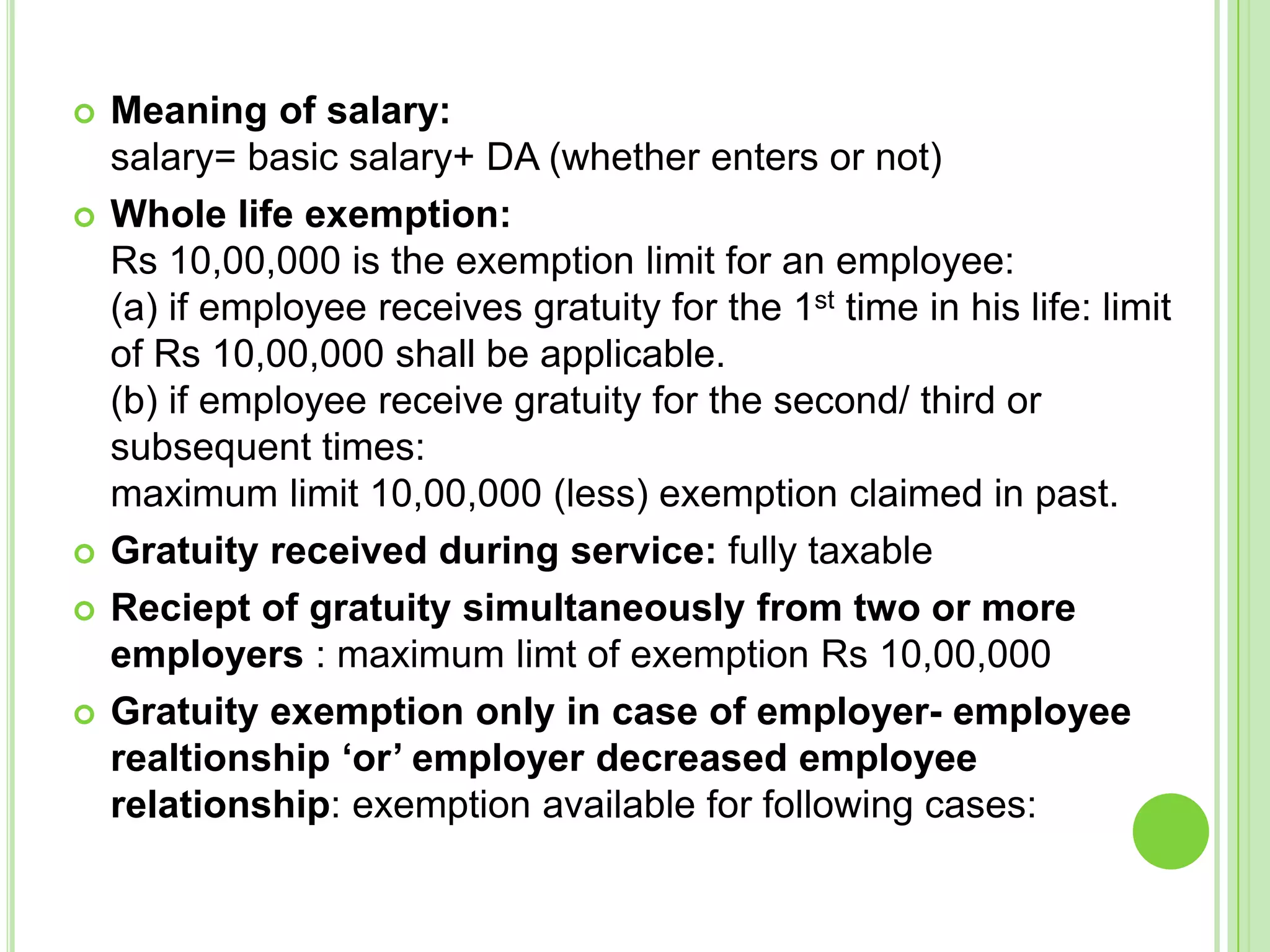

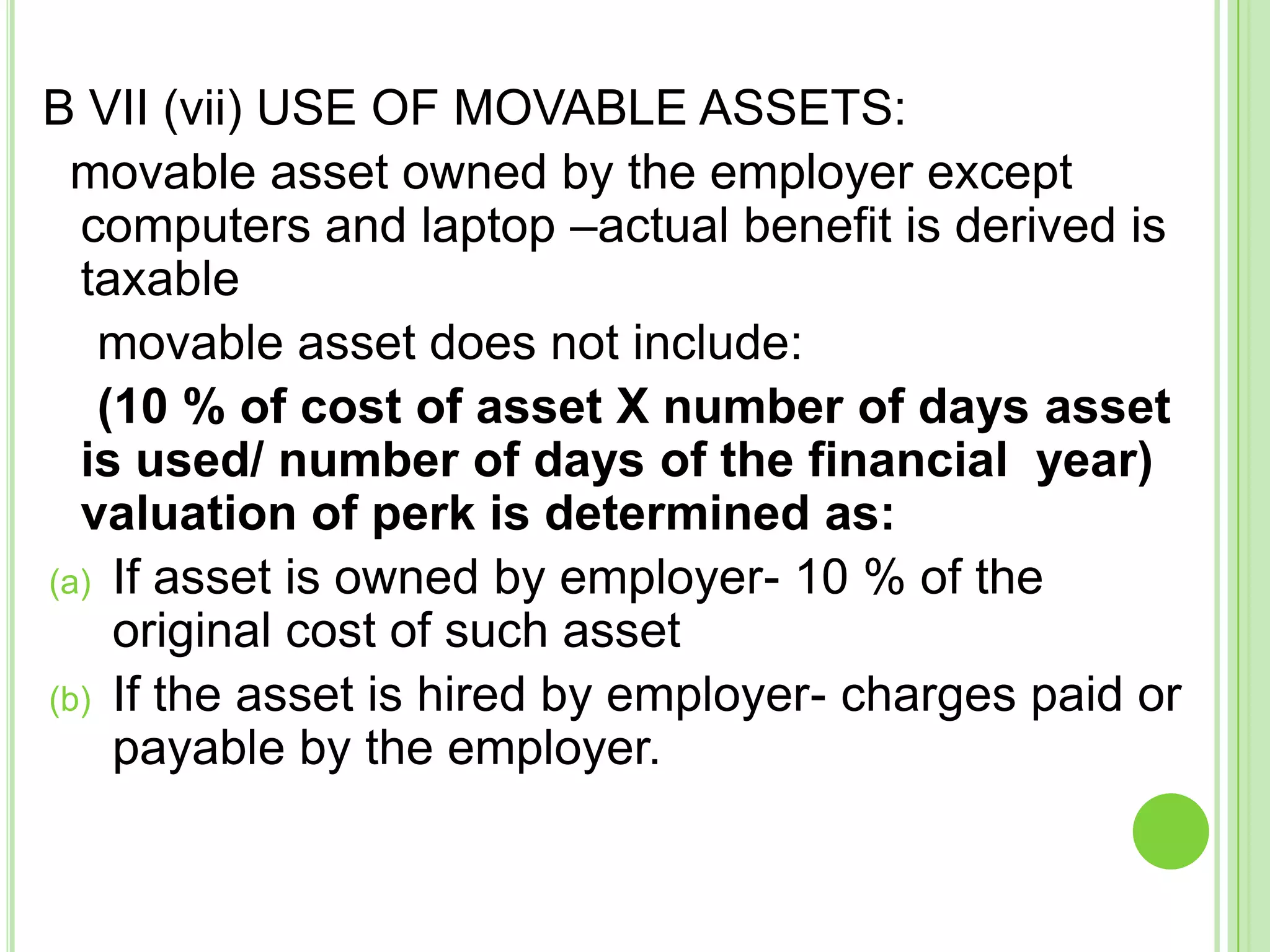

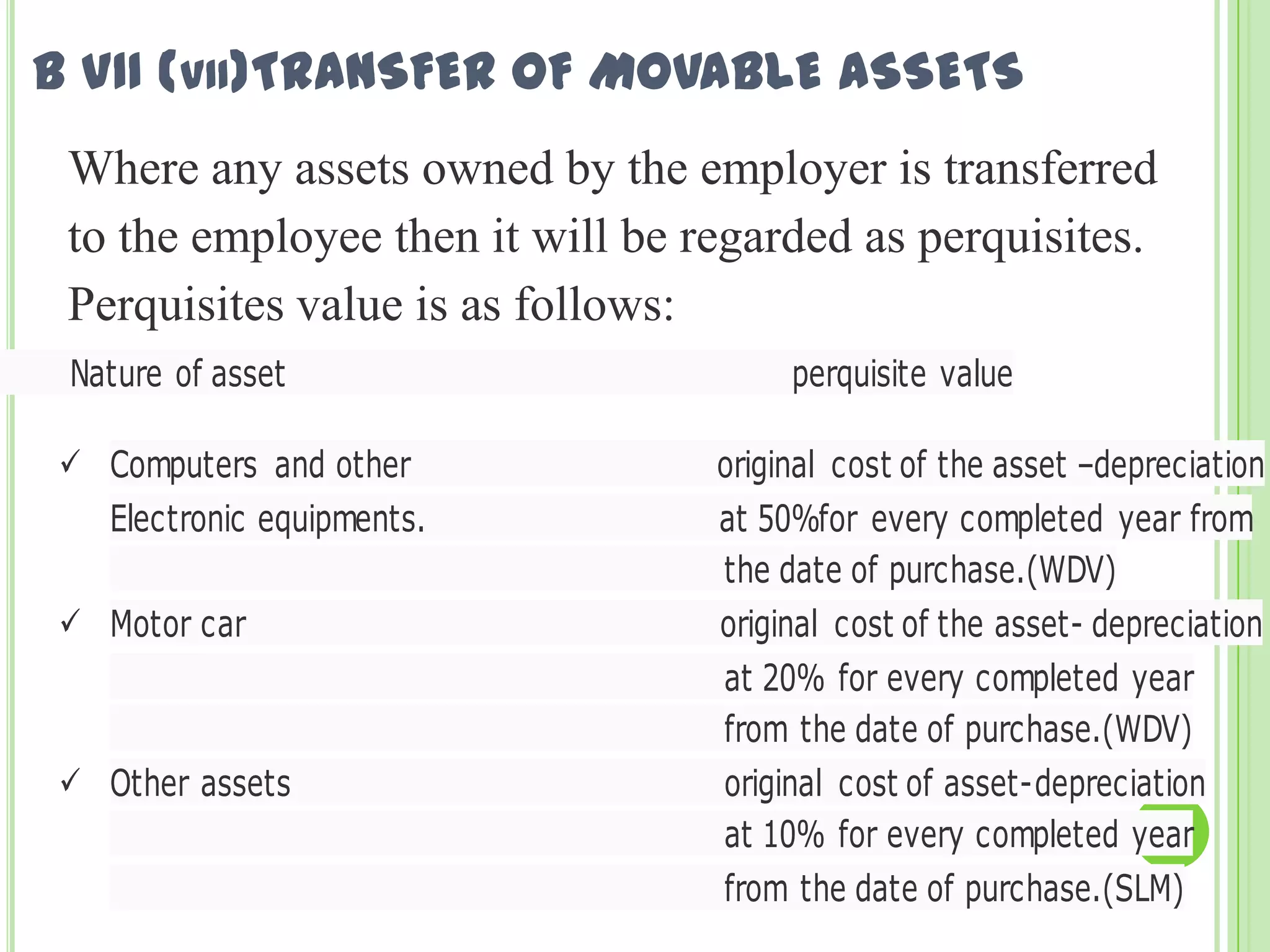

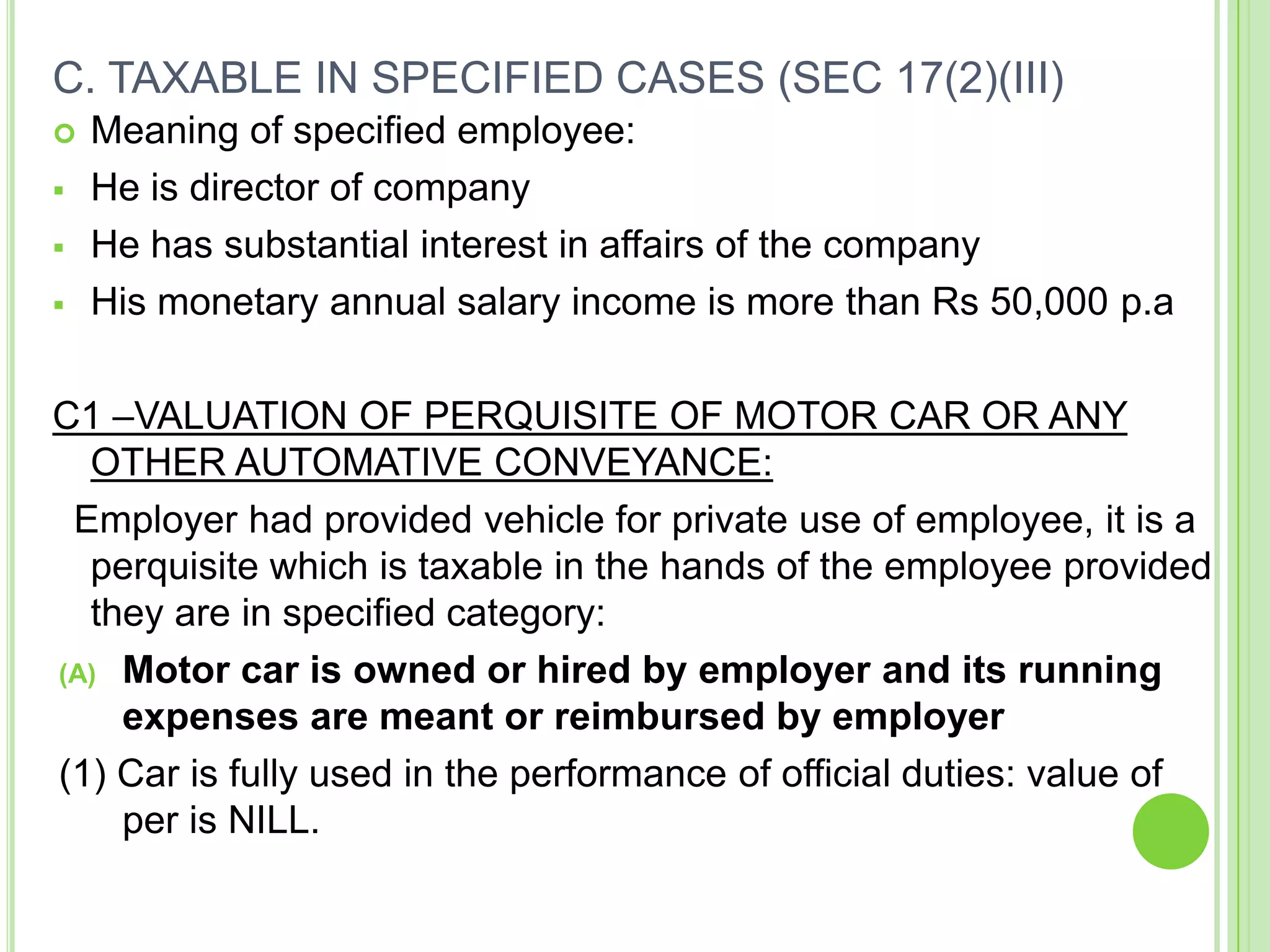

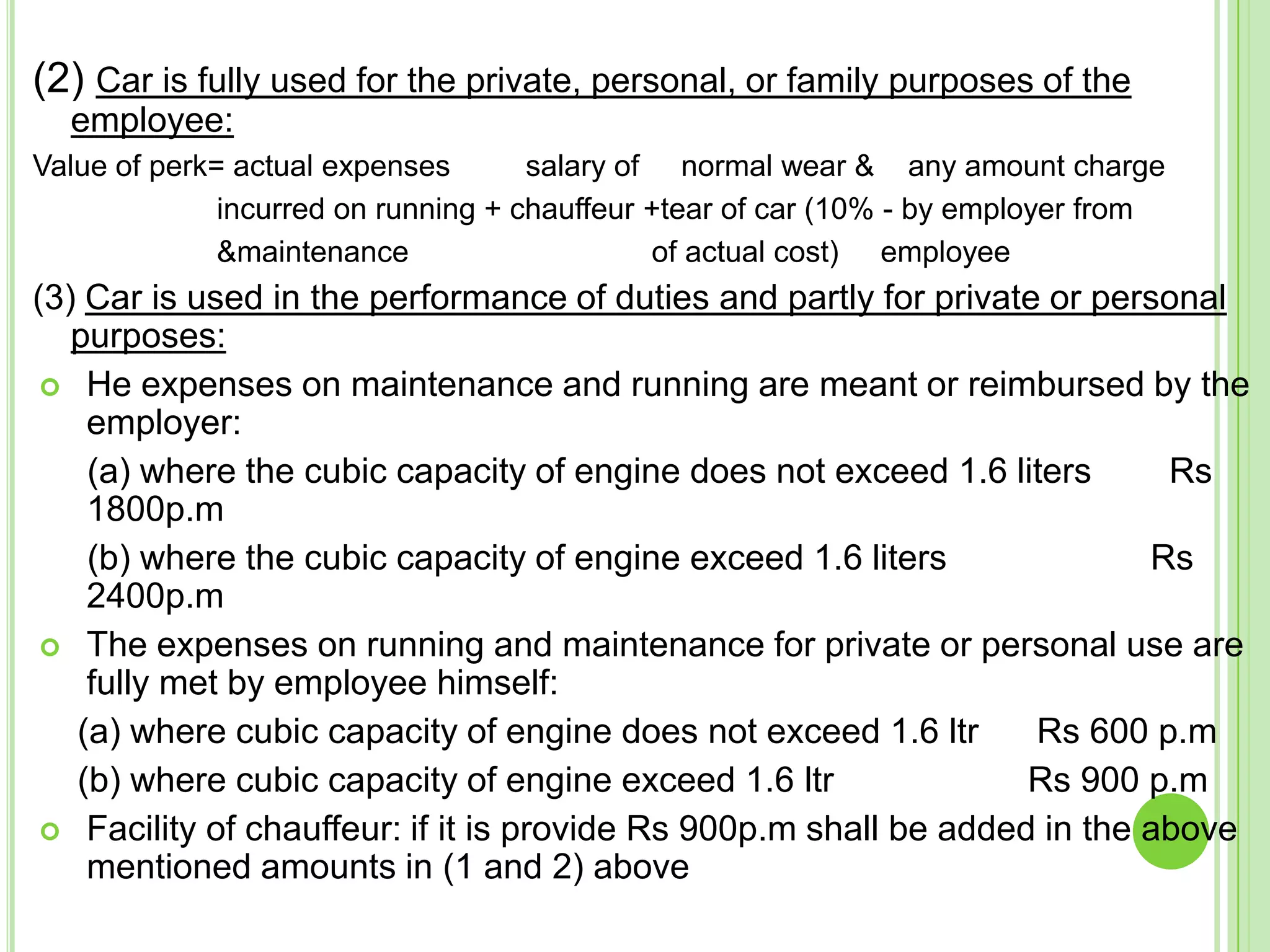

2. Perquisites include non-monetary benefits provided by employers like rent-free housing, cars, food, gifts, etc. Some perquisites are fully exempted from tax while others are fully or partially taxable depending on employee type and conditions.

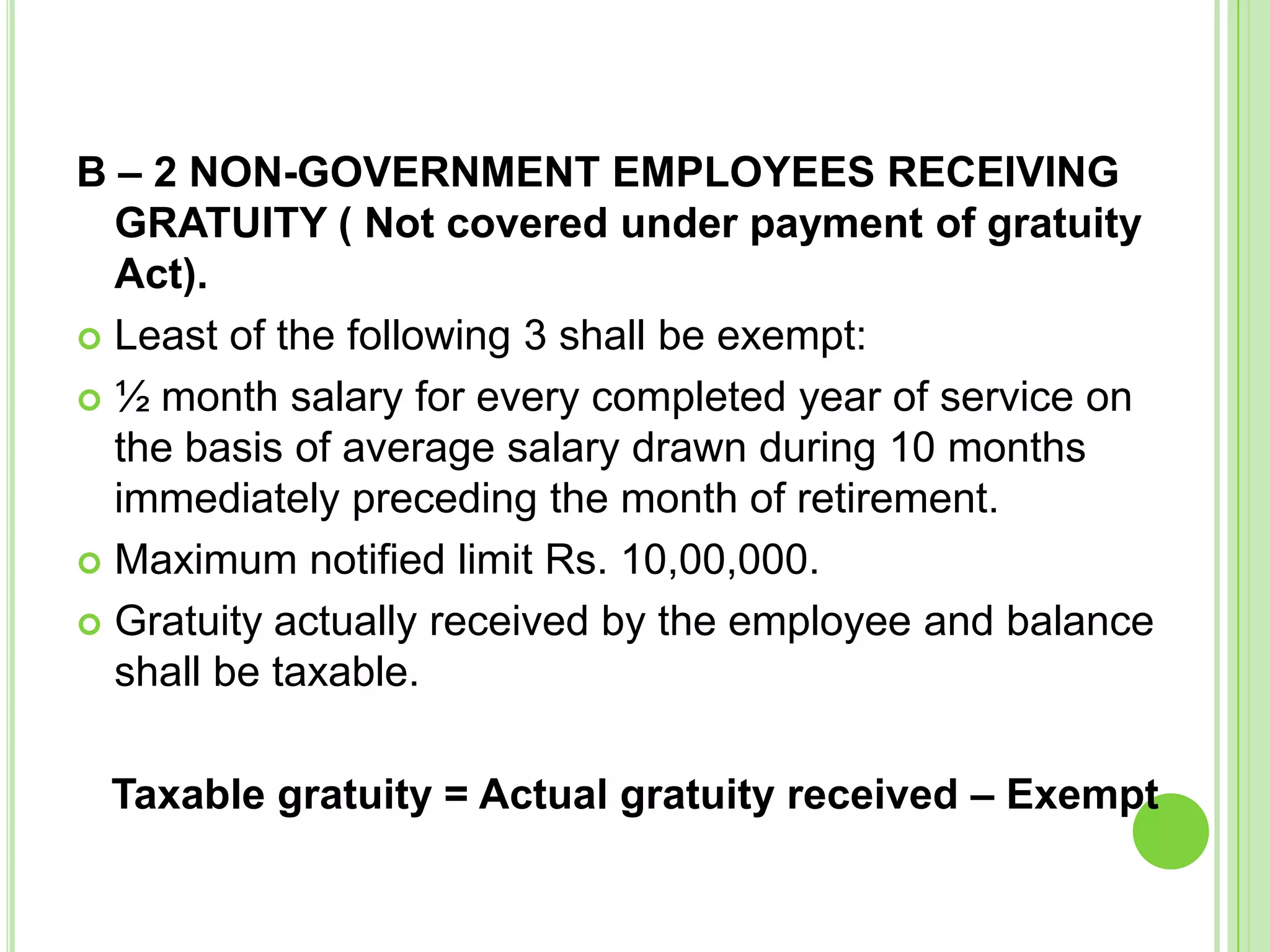

3. For specified employees like directors, perquisites related to rent-free housing, cars, domestic servants are fully taxable based on prescribed valuation methods even if used for official purposes. Perquisites are valued

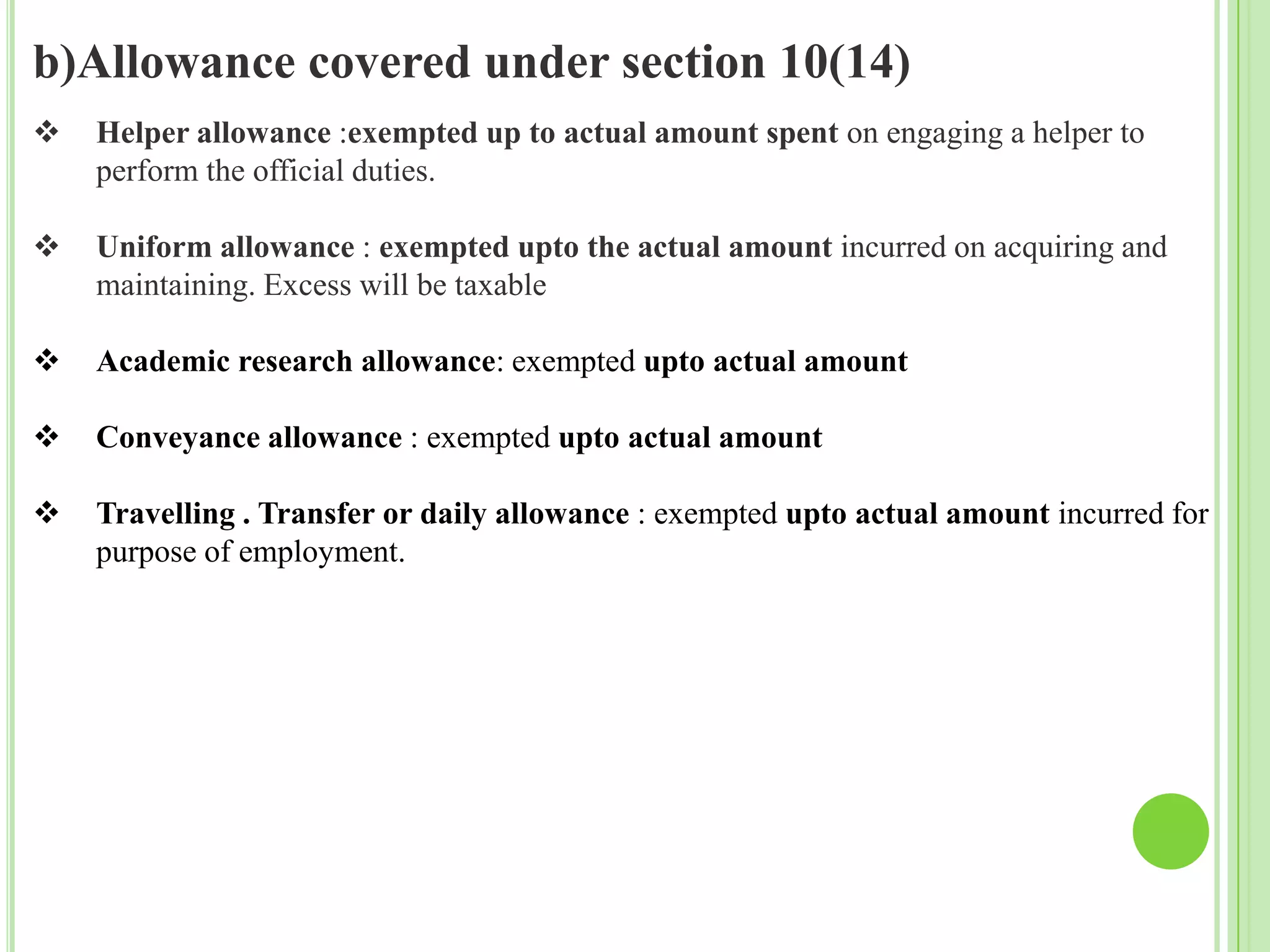

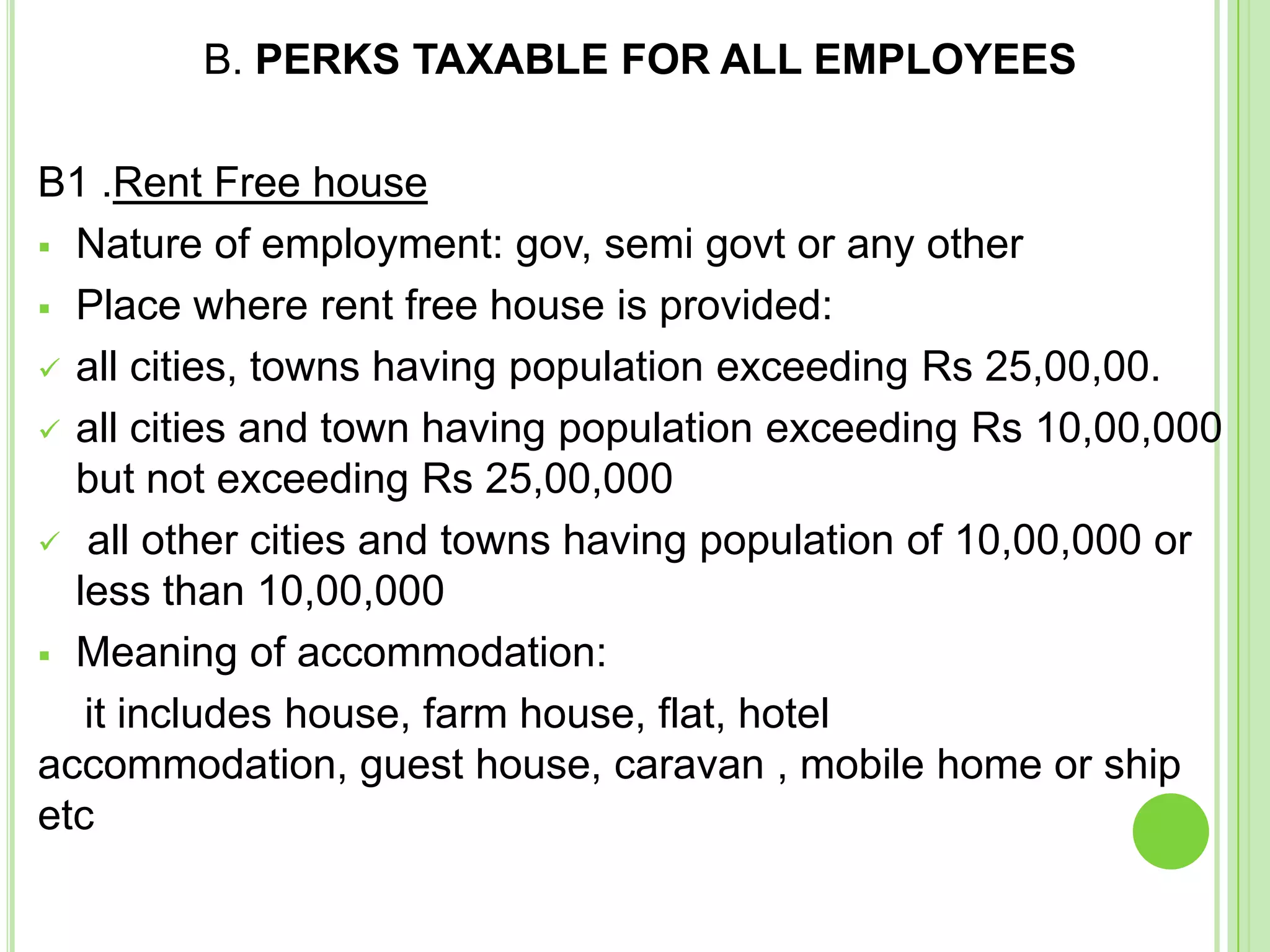

![PAYMENT EXEMPTED U/S 10

1.Leave travel concession/Assistance[section 10(5)]

1.If journey is performed by air

(i)

Economy class air fare of the national carrier by the shortest

route

(ii) Actual amount spent by the employee on journey by air travel

2. If journey is performed by rail

(i)

Air-conditioned first class rail fare by the shortest route

(ii) Actual amount spent by the employee on journey by rail

3. I f place of origin of journey and place of destination is

connected by rail.

(i)

Air conditioned first class rail fare by the shortest route

(ii)

Actual amount spent by the employee on that journey](https://image.slidesharecdn.com/perquisitesallowance-140123223327-phpapp01/75/Perquisites-allowance-31-2048.jpg)