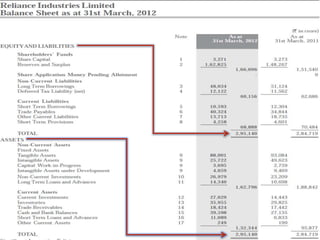

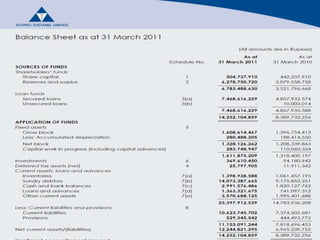

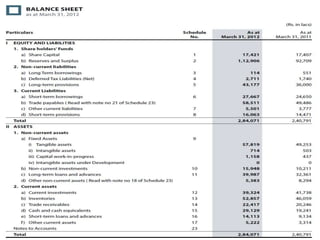

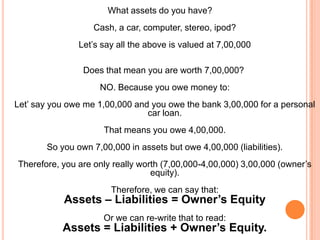

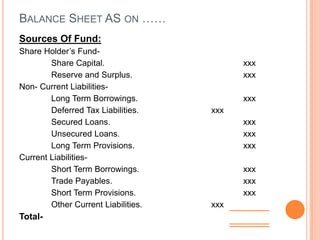

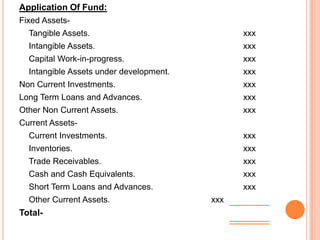

This document provides an overview of accounting concepts related to balance sheets, including definitions and explanations of key items that appear on a balance sheet. It begins with an introduction to balance sheets and how they show a business's assets and liabilities at a point in time. It then defines and explains common items that make up sources of funds (equity and liabilities), applications of funds (assets), as well as other accounting concepts like provisions, receivables, payables, and work-in-progress. The document aims to help readers understand the key components of a balance sheet and their meanings.