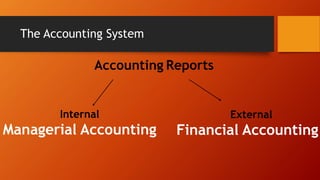

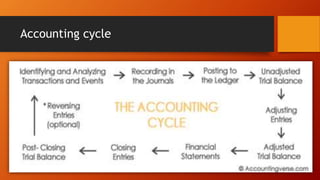

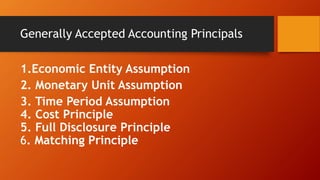

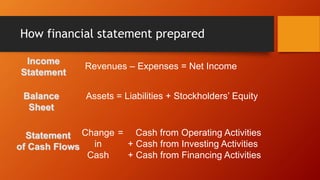

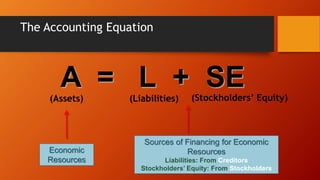

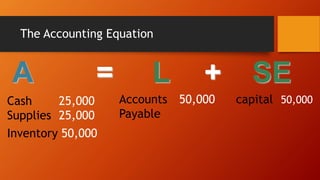

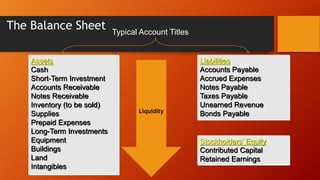

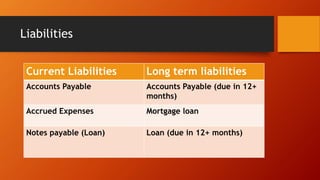

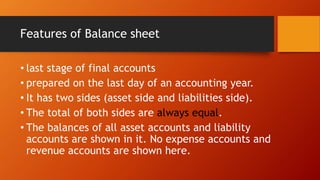

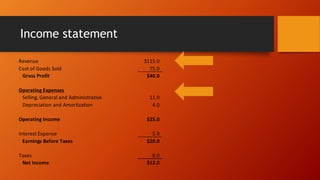

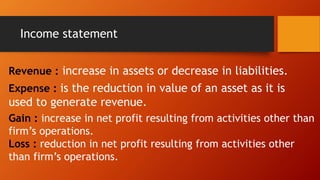

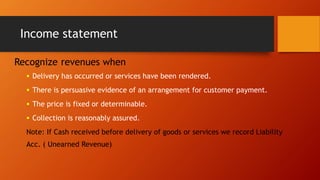

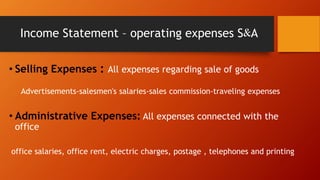

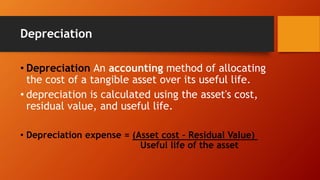

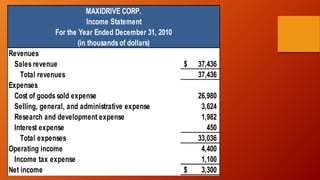

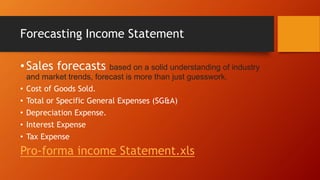

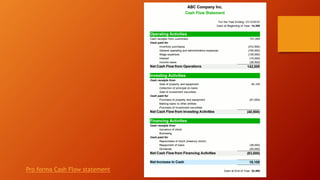

This document provides an overview of key financial statements and accounting concepts. It discusses financial statements including the balance sheet, income statement, and statement of cash flows. It explains how these statements are prepared and what key components they include such as assets, liabilities, revenues, expenses, net income, and cash flows. It also covers accounting principles, the accounting cycle, and tools for financial analysis like breakeven analysis.