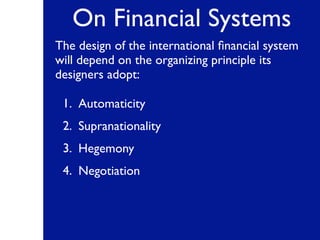

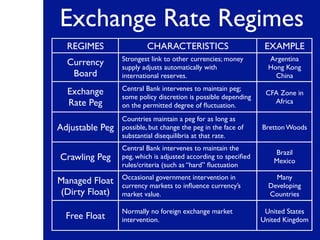

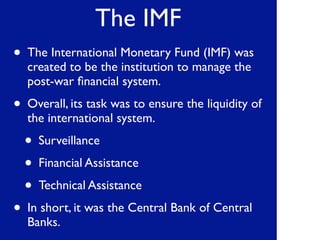

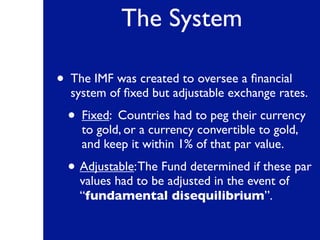

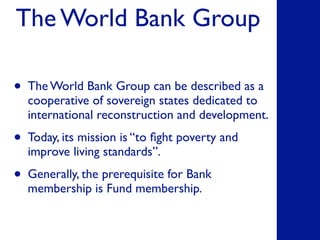

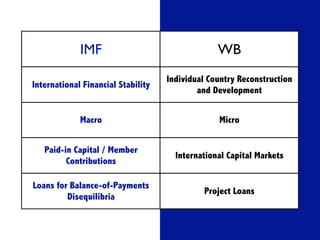

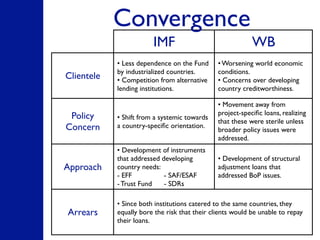

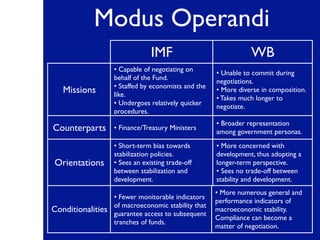

The document discusses the creation and roles of the Bretton Woods institutions, namely the IMF and World Bank, in managing the post-World War II financial system, focusing on international economic reconstruction and development. It outlines different exchange rate regimes and the functions of both institutions, highlighting their cooperation and challenges over time. Despite criticisms, it notes the institutions' essential roles and the need for adaptations to effectively address global economic issues.