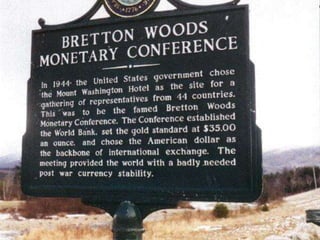

The Bretton Woods Agreement established a system for monetary and exchange rate management among 44 countries in 1944, creating fixed exchange rates with the U.S. dollar convertible to gold. Its design included obligations for member countries to declare par values, avoid competitive devaluations, and maintain adequate monetary reserves, supported by the International Monetary Fund (IMF). However, internal inconsistencies and fluctuations of the dollar led to its collapse in 1971, when the U.S. abandoned fixed exchange rates and gold convertibility.