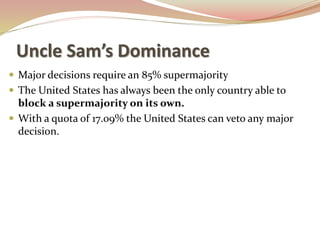

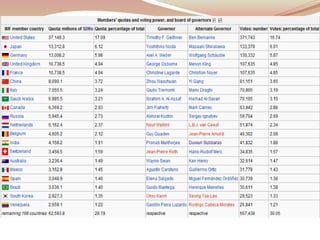

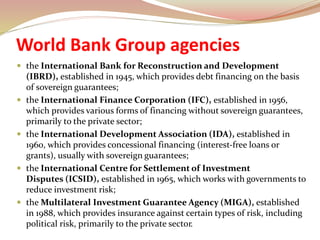

The document outlines the roles and functions of the International Monetary Fund (IMF) and the World Bank, emphasizing their goals of fostering global monetary cooperation, reducing poverty, and providing financial assistance to developing countries. It discusses the historical context, criticisms, and examples, such as Argentina's economic crisis, where IMF policies had significant adverse effects. Both institutions have faced scrutiny for their influence over the economic policies of developing countries, often described as a form of modern imperialism.