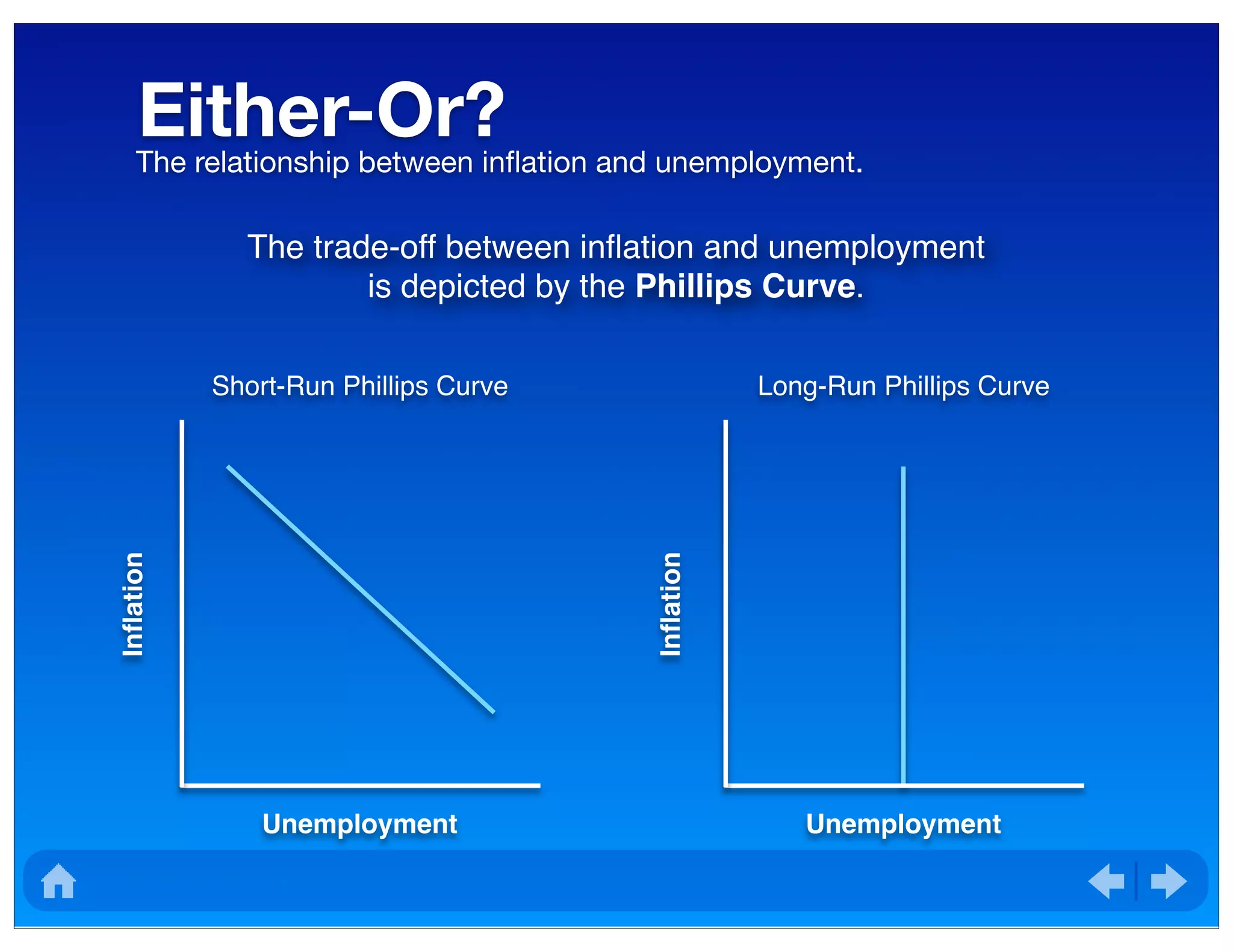

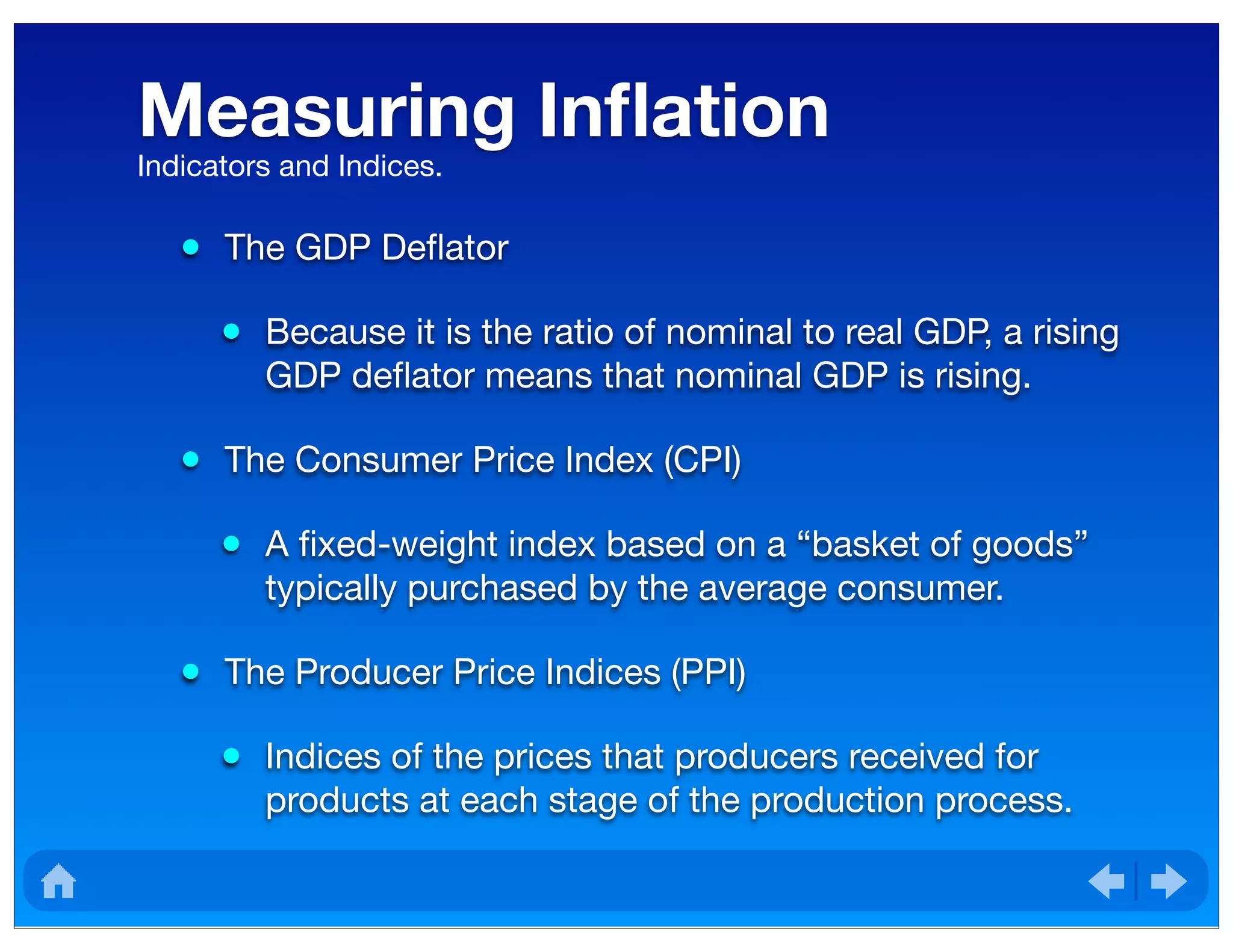

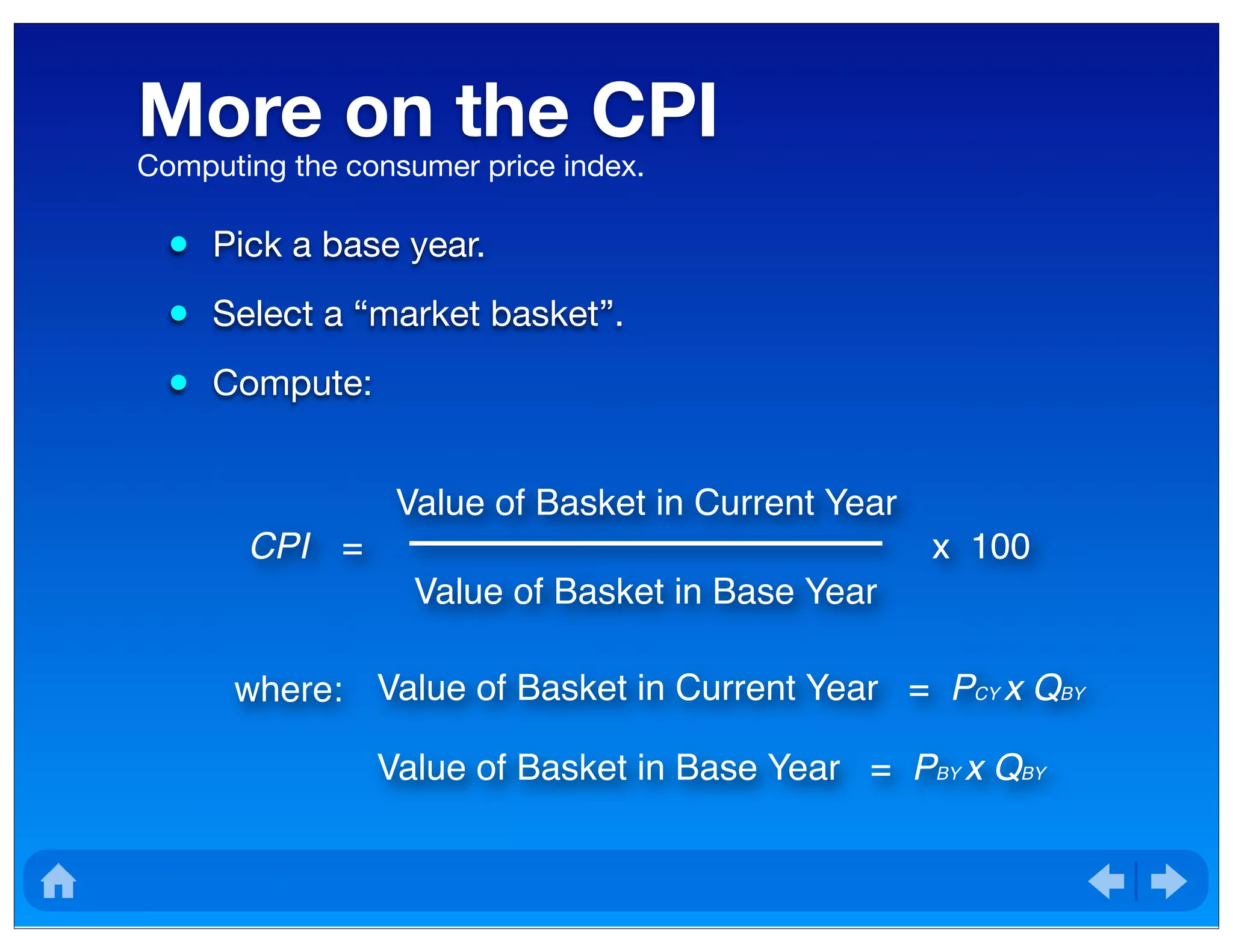

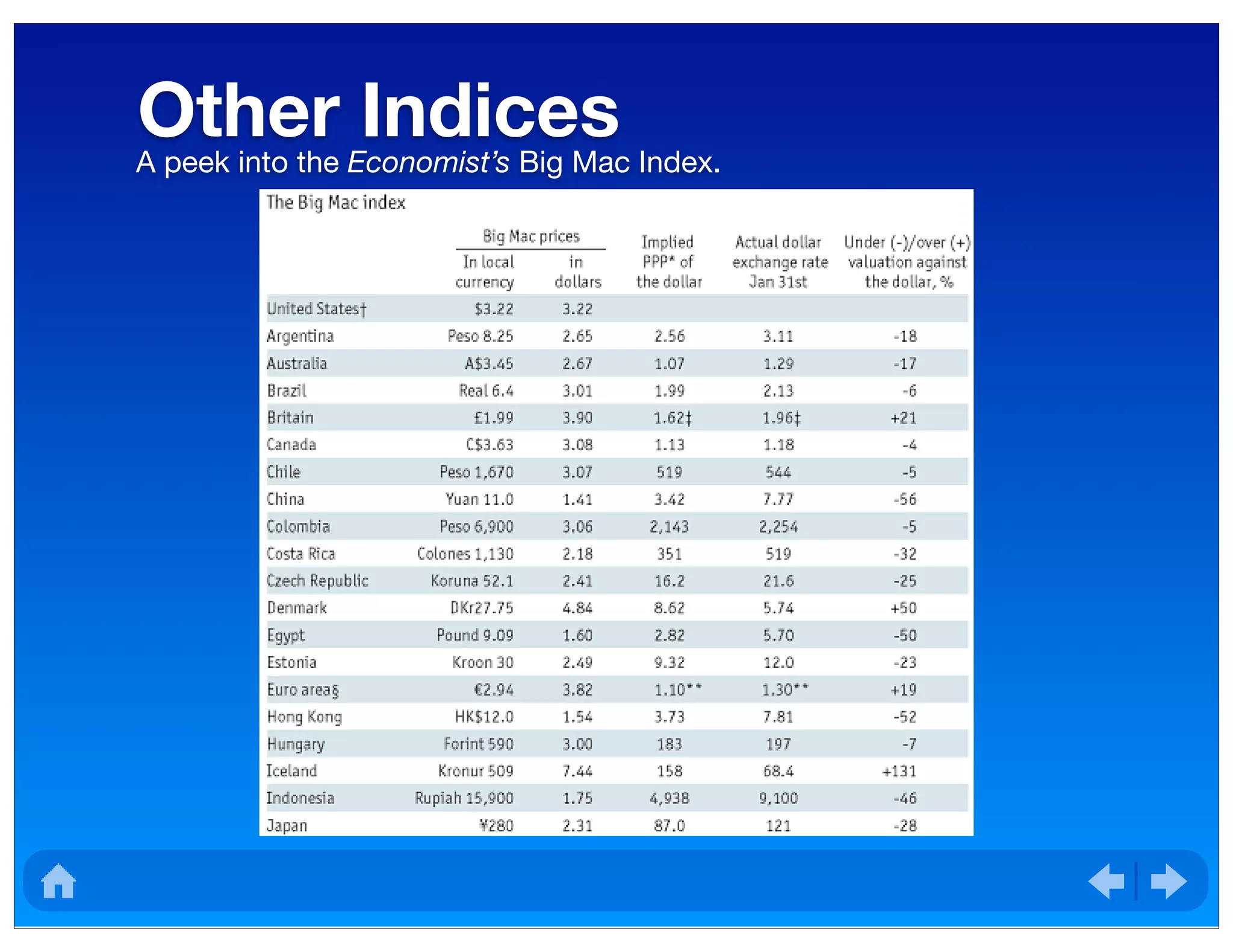

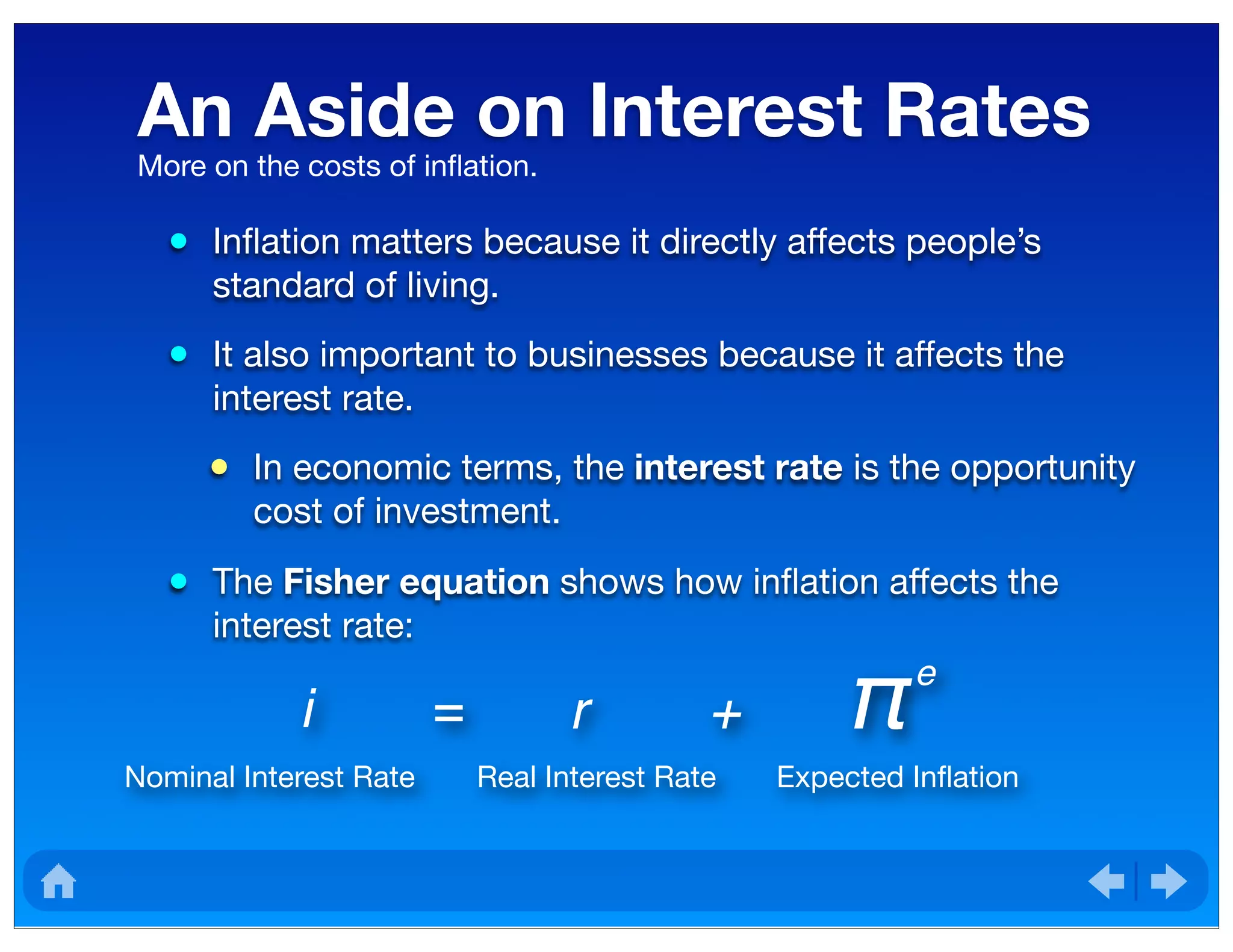

This document discusses the concept of inflation, defining it as the overall increase in price levels across the economy. It explains the causes of inflation, such as demand-driven and supply-driven factors, and how it is measured using various indices like the GDP deflator, consumer price index (CPI), and producer price indices (PPI). Additionally, the document touches on the implications of inflation on interest rates, prices' stickiness, and the trade-off between inflation and unemployment as illustrated by the Phillips curve.

![P

Q

D

1

P

MC

0

P

A

C

B

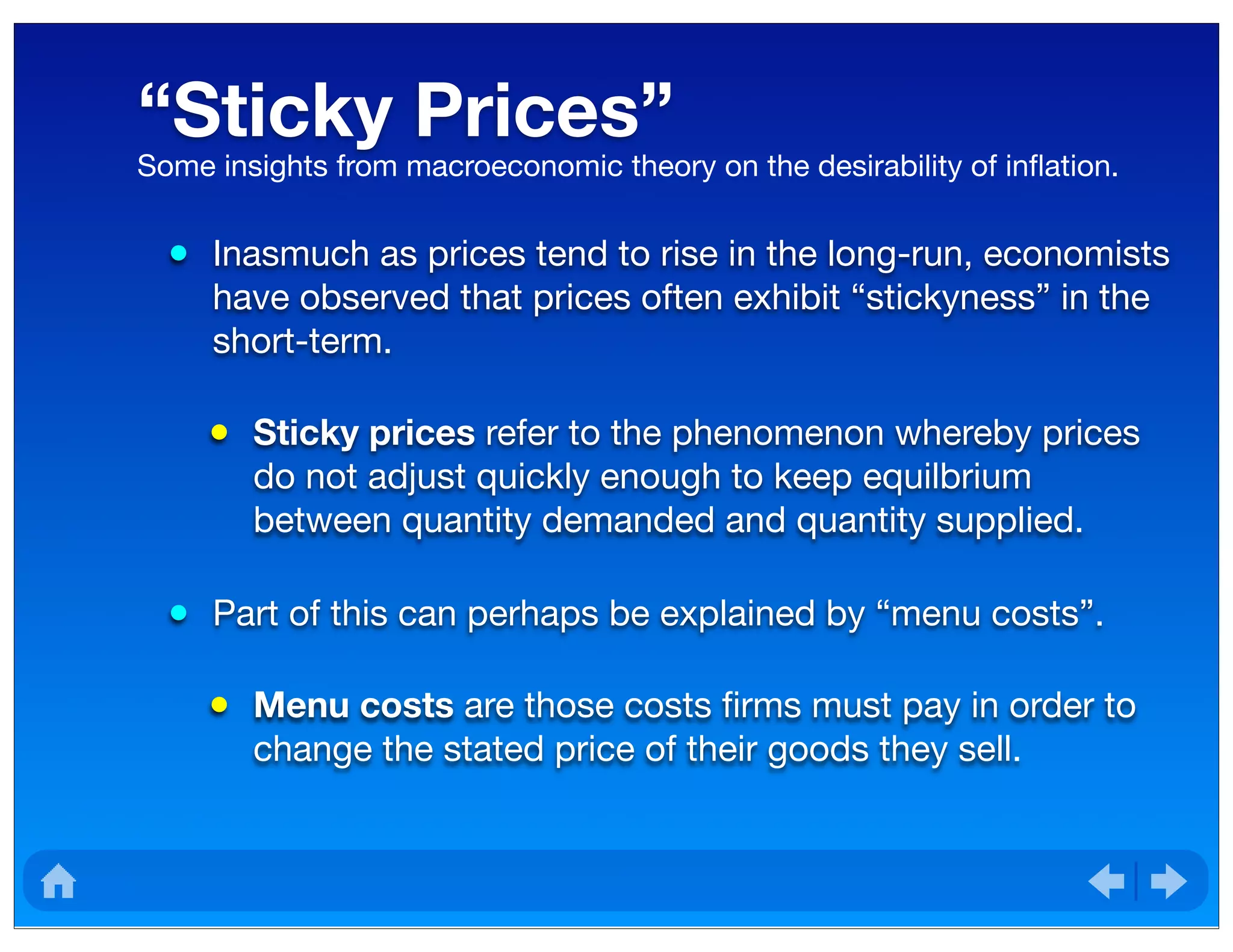

By holding prices fixed, firms lose potential

profit in the amount of [C – A].

If prices are held fixed, consumers lose

potential consumer surplus in the amount of

[A + B].

As such, the total social loss is [C + B].

*If [C + B] > Z > [C – A],

firms will not pay the menu

cost even if society will be

better off if they do.

The unanticipated deflation unambiguously decreases social welfare.

0

Q 1

Q](https://image.slidesharecdn.com/lecture8inflation-151125141244-lva1-app6892/75/Macroeconomics-Inflation-10-2048.jpg)

![P

Q

D

1

P

MC

0

P

D

F

E

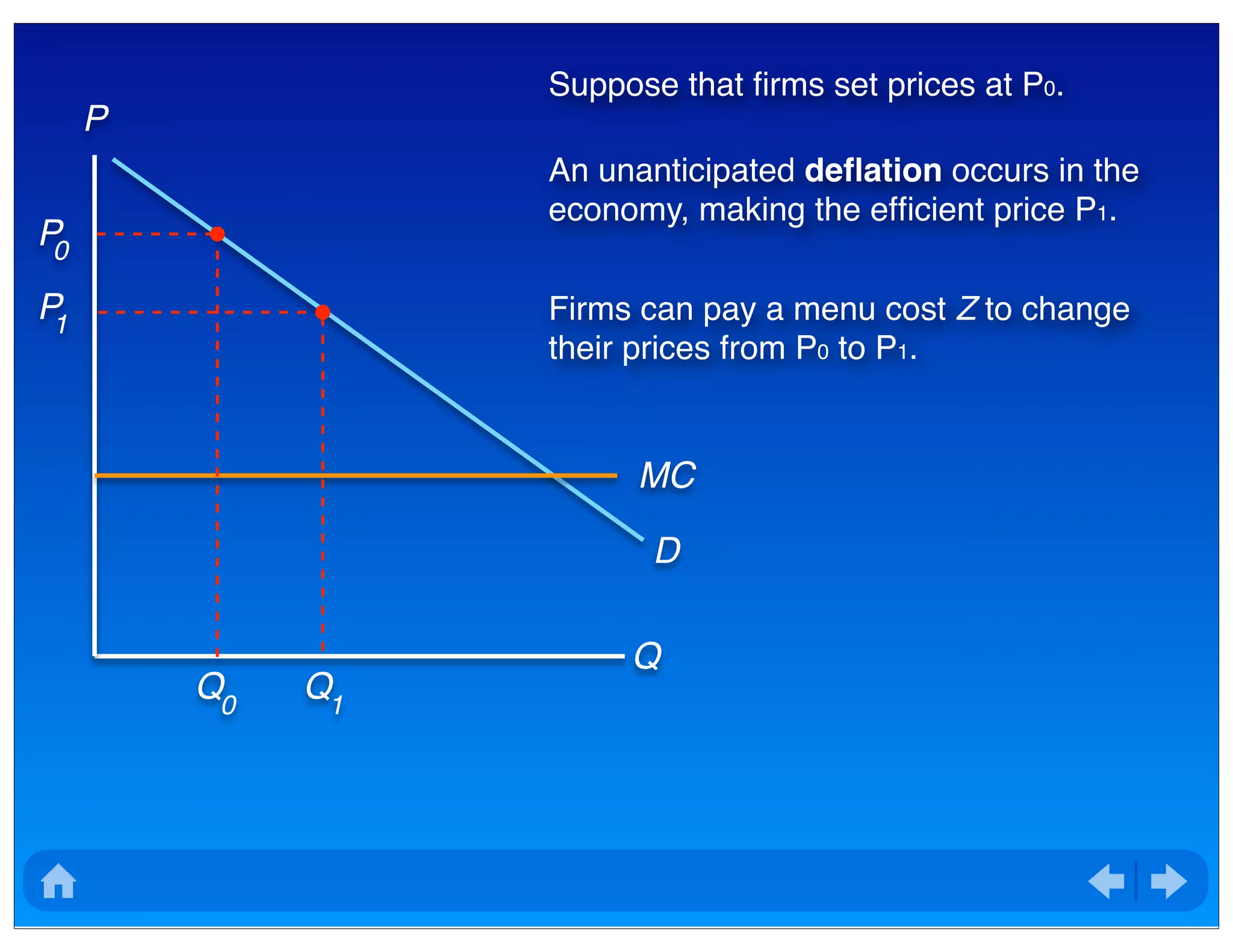

By holding prices fixed, firms gain profit in

the amount of [F – D].

If prices are held fixed, consumers gain

consumer surplus in the amount of [D + E].

As such, the total social gain is [F + E].

*If – Z < [F – D] firms will

not pay the menu cost and

hold prices fixed.

The unanticipated inflation has increased social welfare.

0

Q1

Q](https://image.slidesharecdn.com/lecture8inflation-151125141244-lva1-app6892/75/Macroeconomics-Inflation-11-2048.jpg)