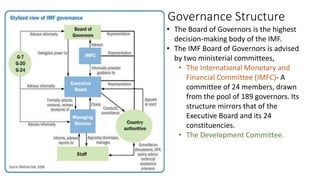

The International Monetary Fund (IMF) was established in 1944 to promote global economic stability and reduce poverty by providing financial assistance and policy advice to its member countries. It currently has 189 members and focuses on macroeconomic issues, balancing international trade, and supporting countries facing economic difficulties, while also facing criticism for its intrusive policies and their impacts on sovereignty. The IMF has played a crucial role in the economic development of countries like Bangladesh but its recommendations should be critically examined due to past controversies.