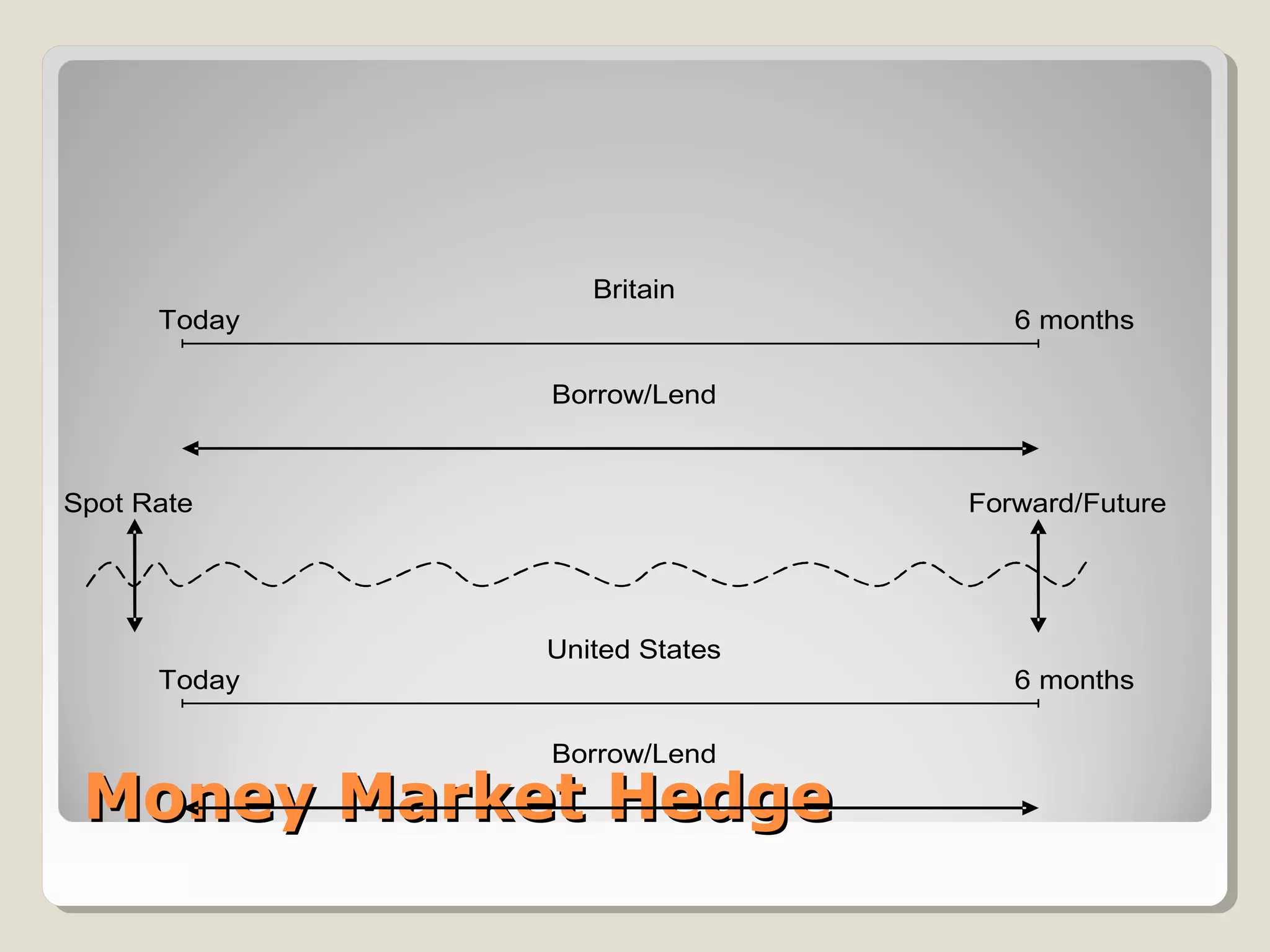

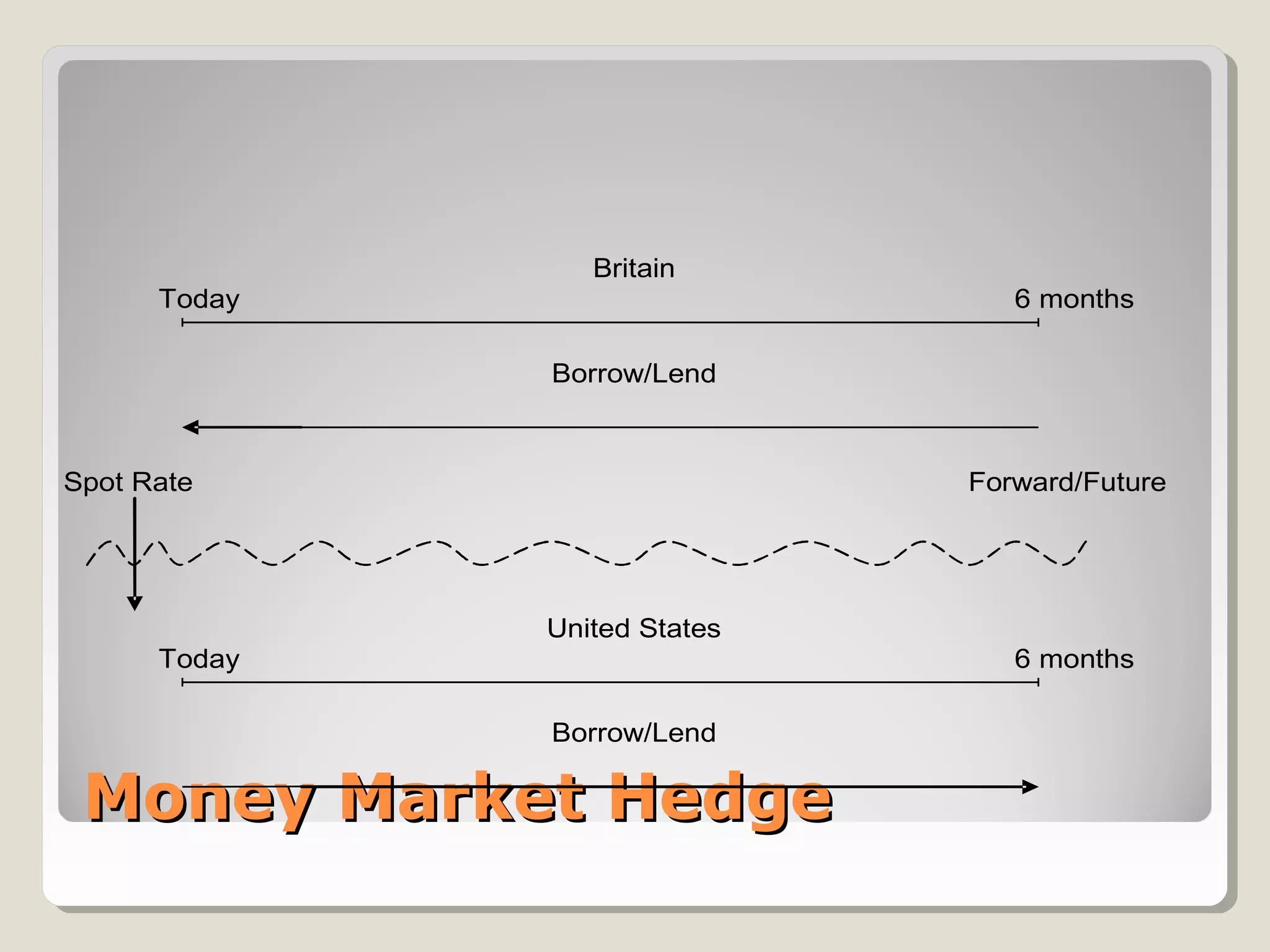

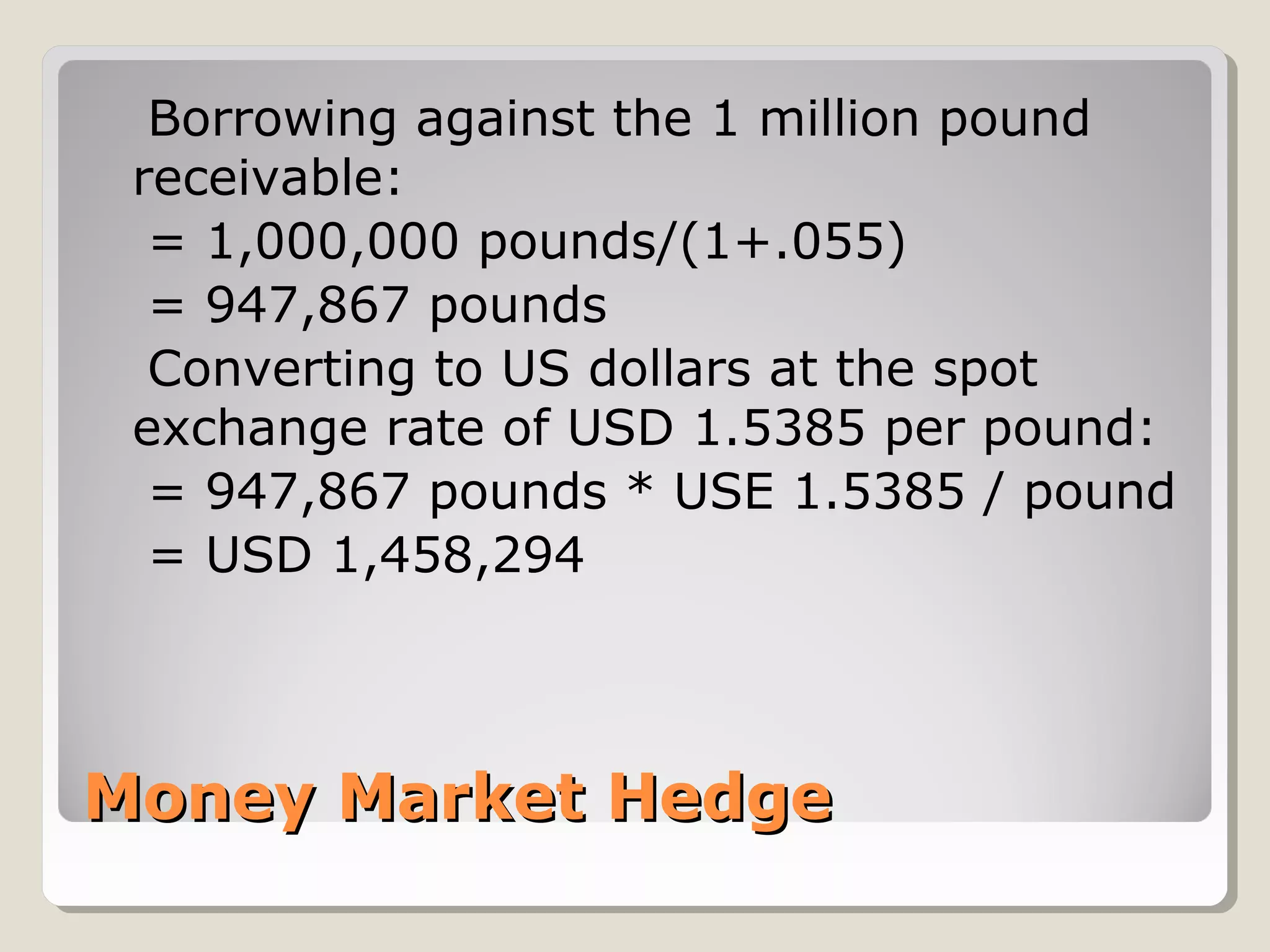

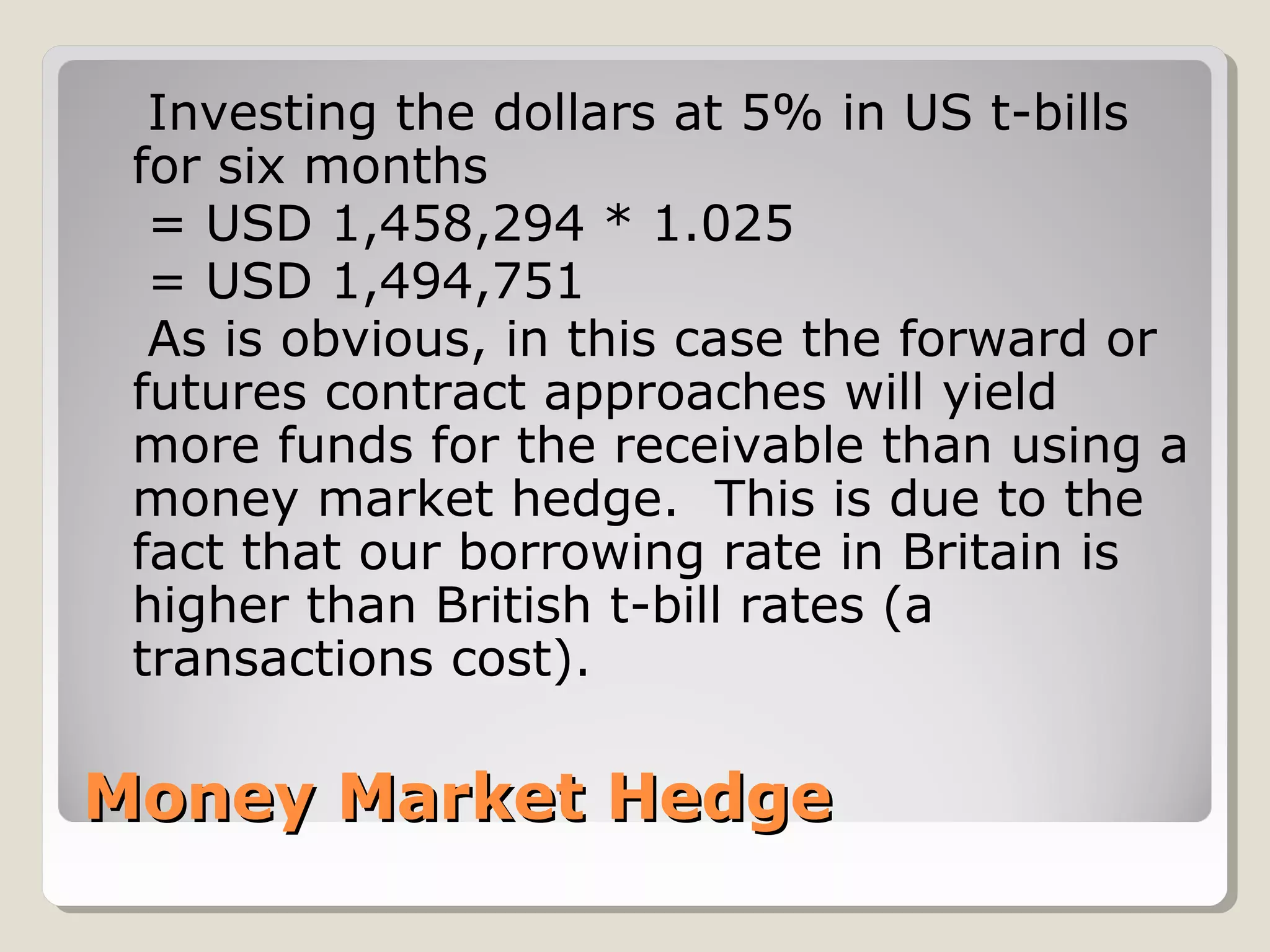

1) The document discusses various hedging strategies using derivatives and money markets to hedge against foreign exchange risk when receiving a payment of 1 million British pounds in 6 months.

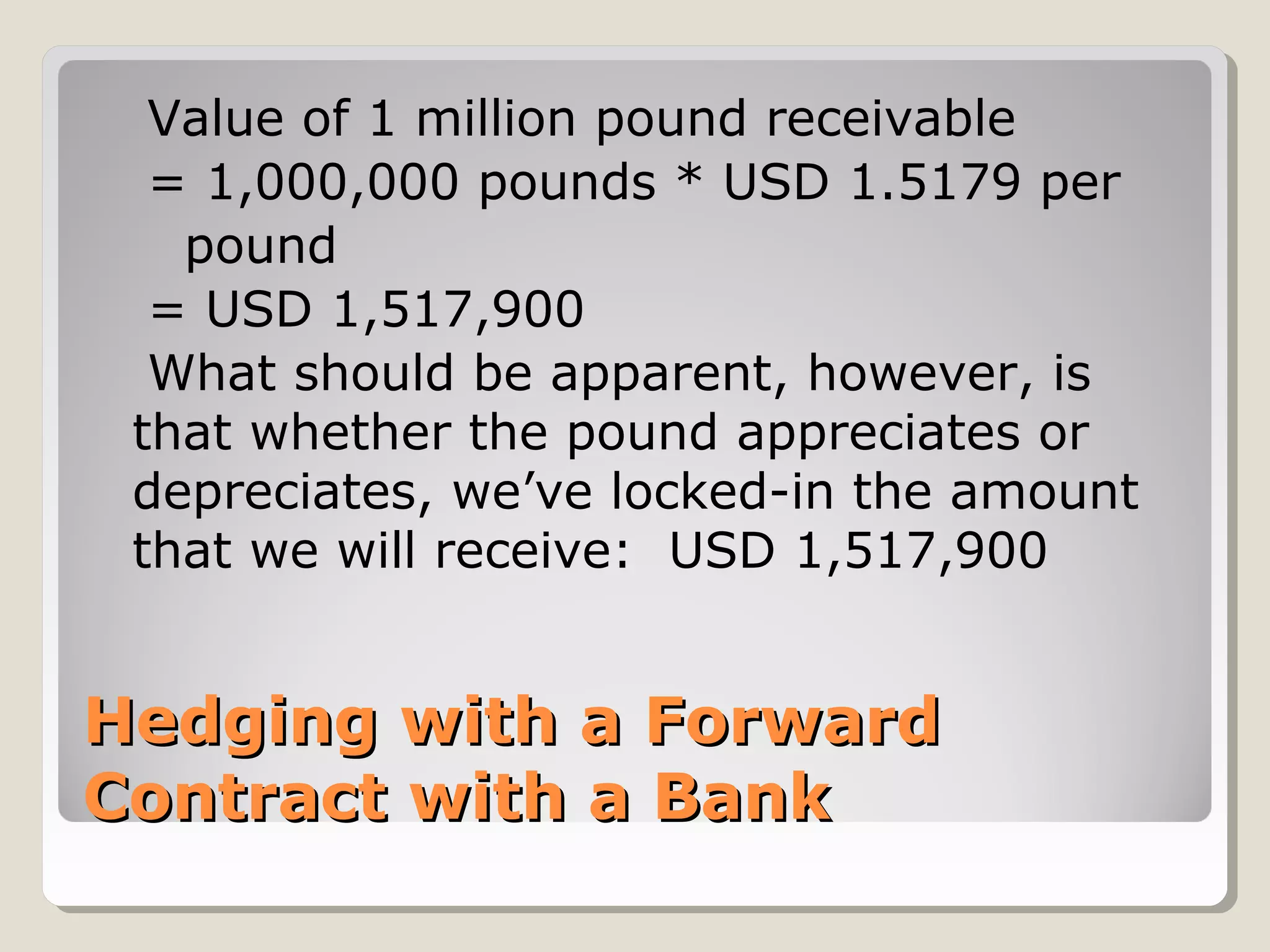

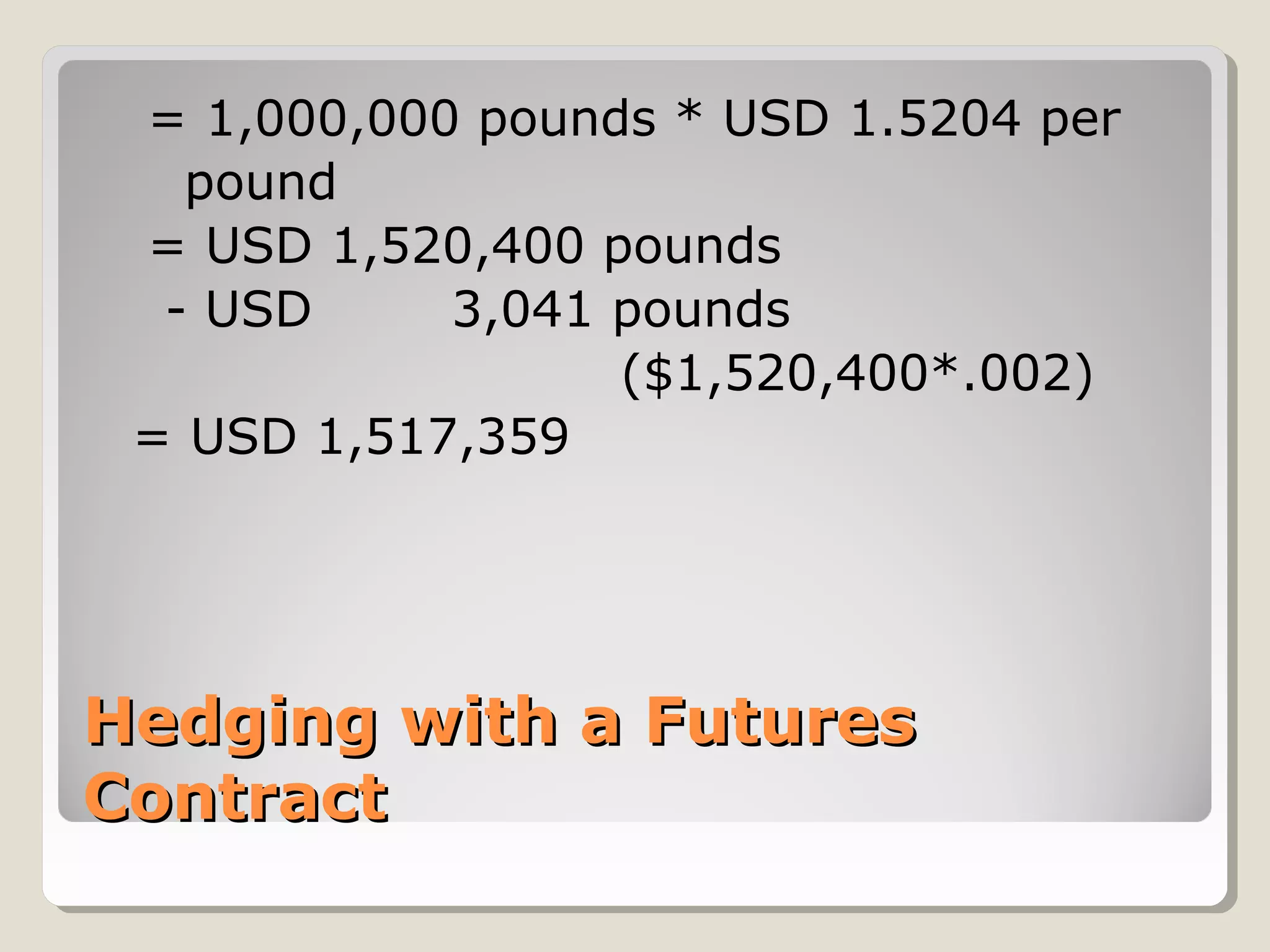

2) It analyzes using a forward contract with a bank, futures contract, and money market hedge to lock in the US dollar value that will be received in 6 months.

3) It also discusses using a put option hedge, where a put is purchased and call is sold to perfectly hedge the position and allow for upside potential if the pound appreciates against the dollar.