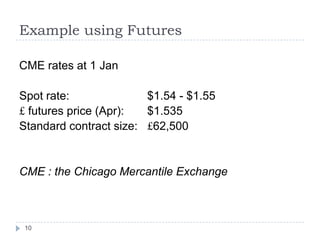

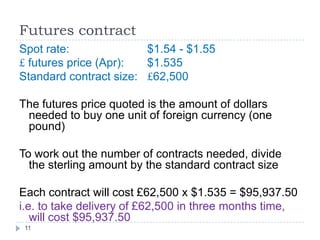

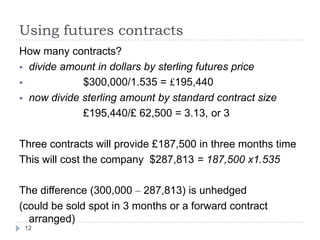

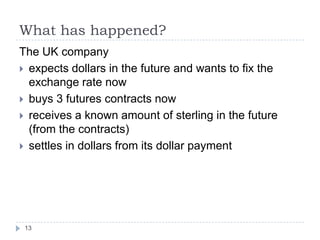

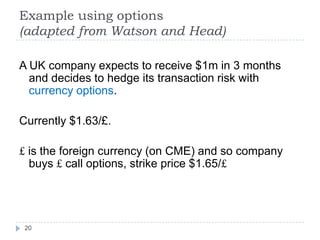

1) A UK company expects to receive $300,000 in 3 months and wants to hedge against the risk of pound appreciation. It can use currency futures contracts traded on an exchange to lock in today's exchange rate for delivery of currency in the future.

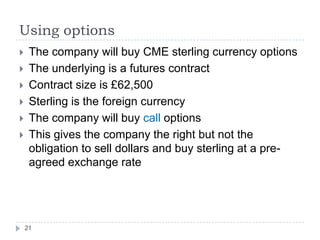

2) The company would buy 3 futures contracts today, each contract providing £62,500 in 3 months. This would give the company £187,500 to match its expected $300,000 receipt at today's locked-in exchange rate.

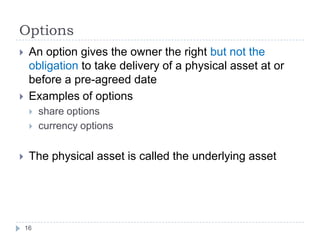

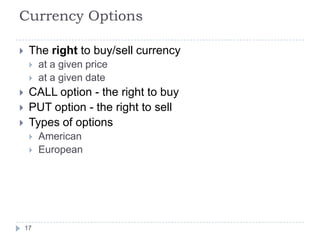

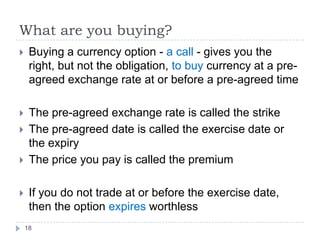

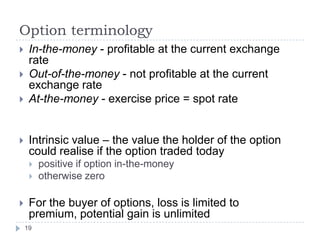

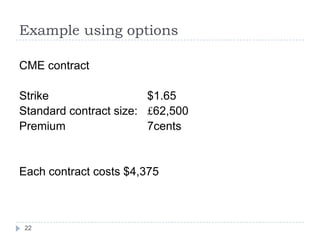

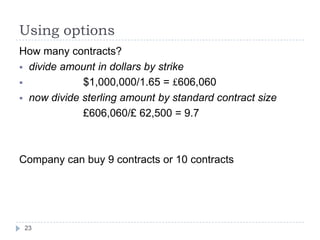

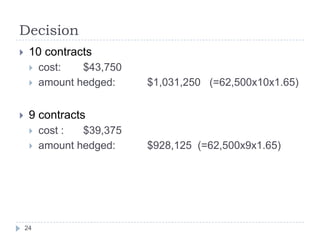

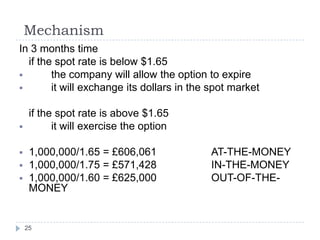

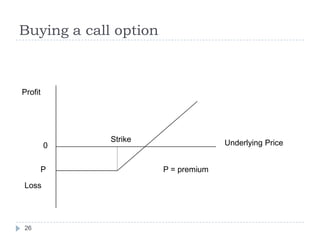

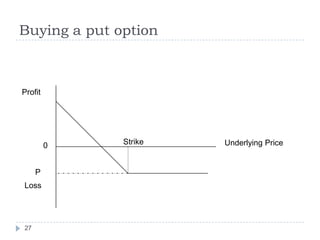

3) Currency options provide an alternative to futures by giving the right but not obligation to exchange currency at a preset strike price. The company could buy call options on £62,500 contracts with a $1.