The document discusses several methods for hedging against currency risk when receiving 1 million British pounds in 6 months, including:

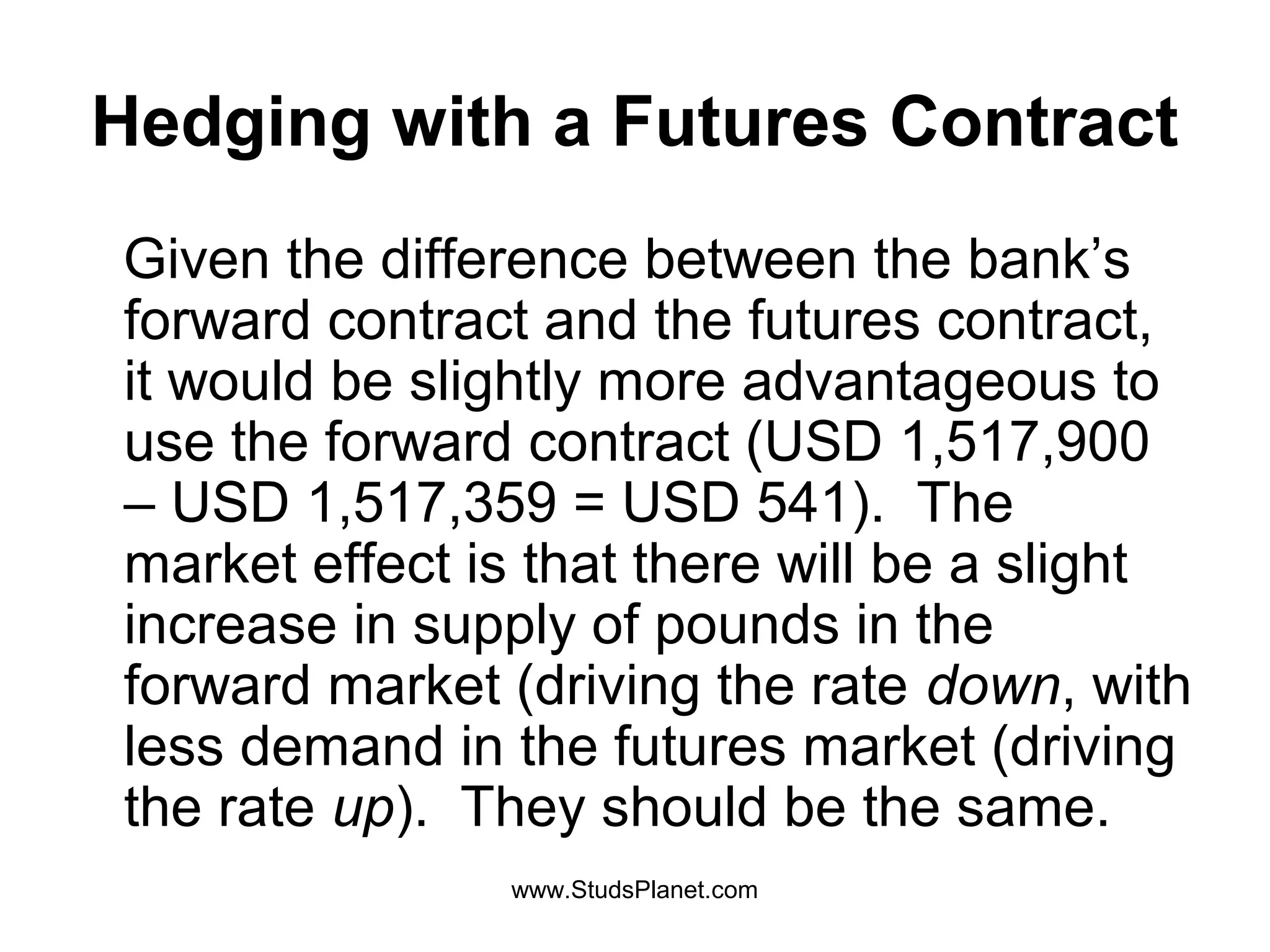

1) Entering a forward contract with a bank at 1.5179 USD/GBP, guaranteeing receipt of USD 1,517,900.

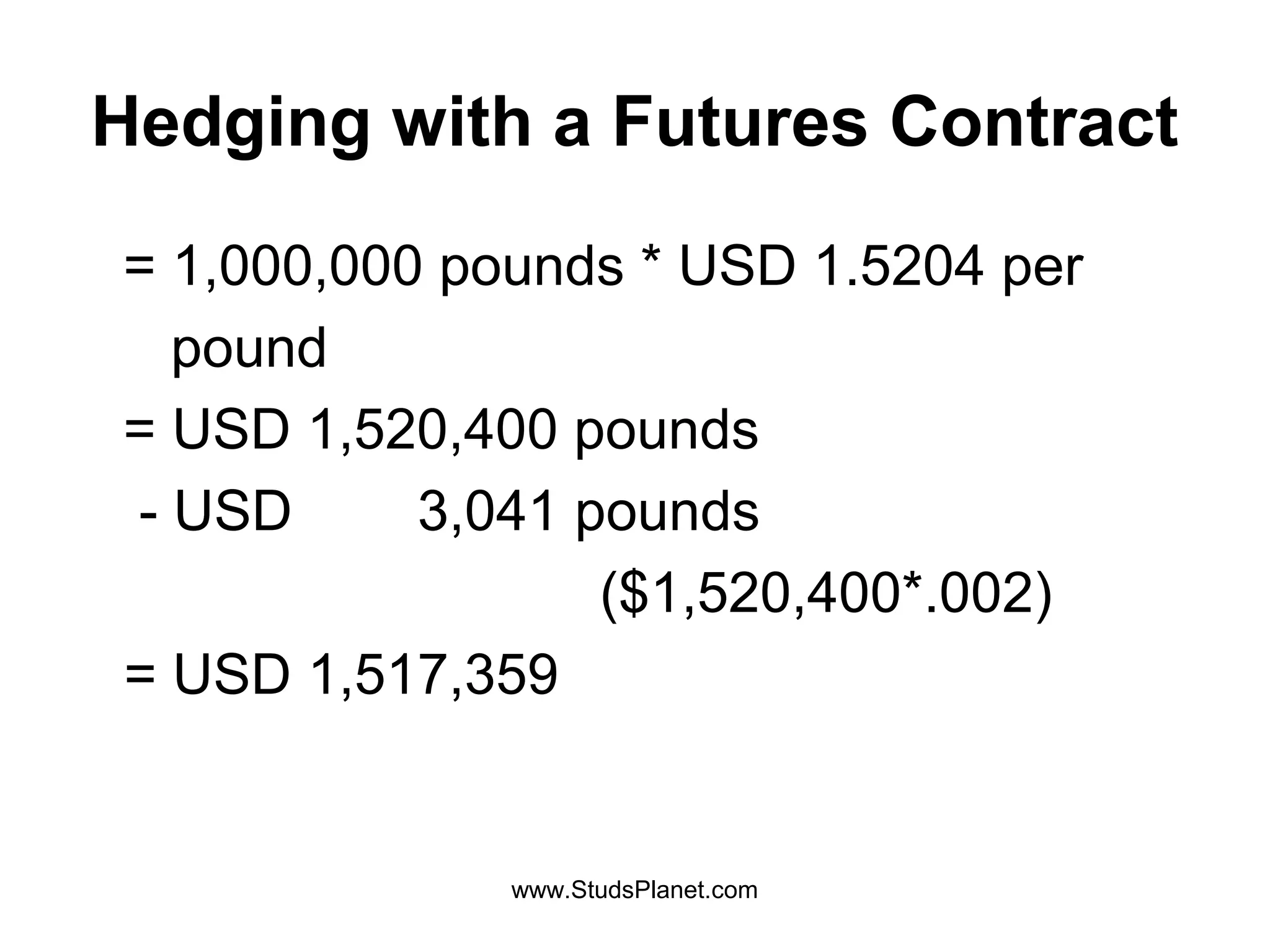

2) Using futures contracts at 1.5204 USD/GBP, netting USD 1,517,359 after commissions.

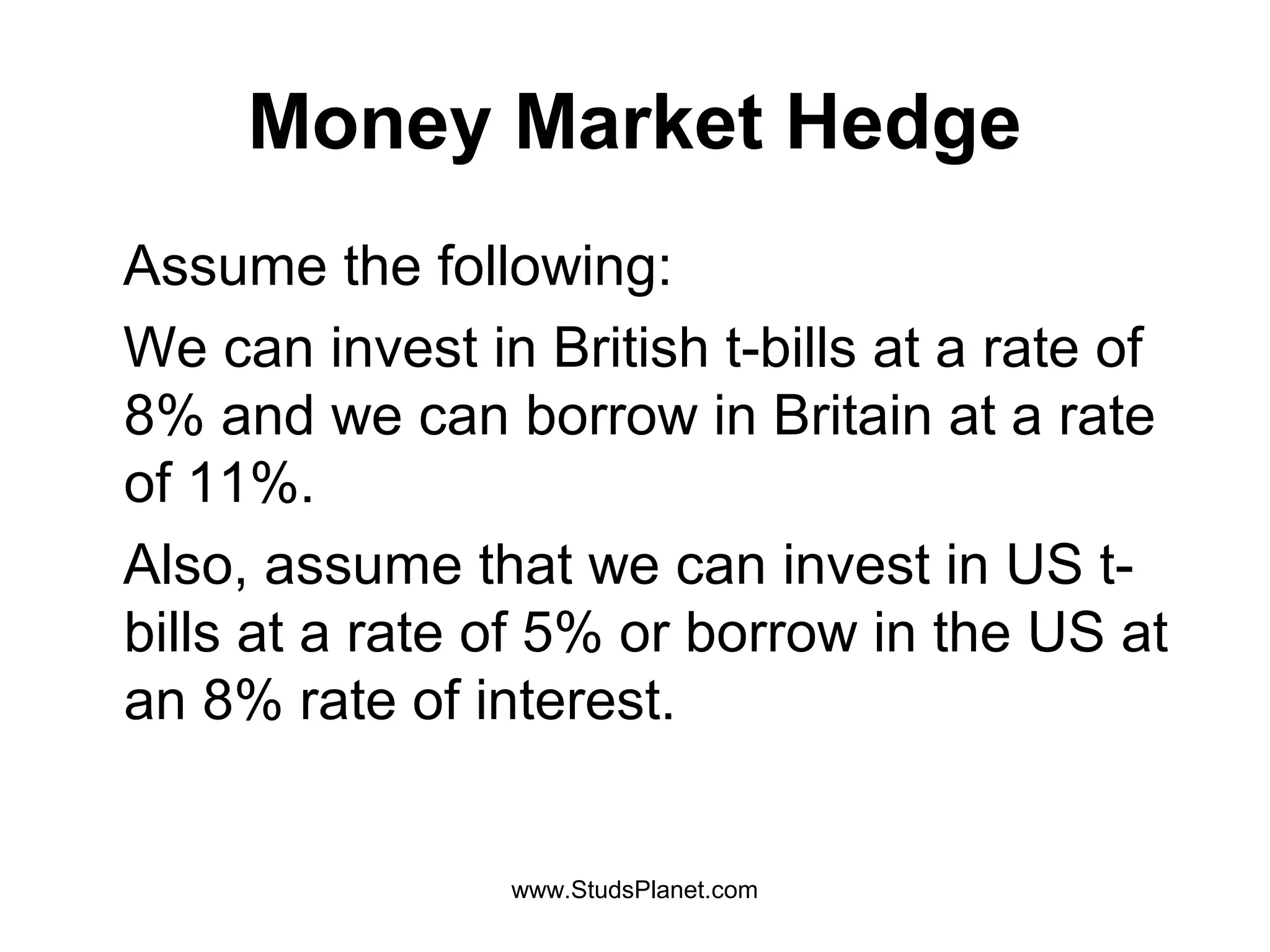

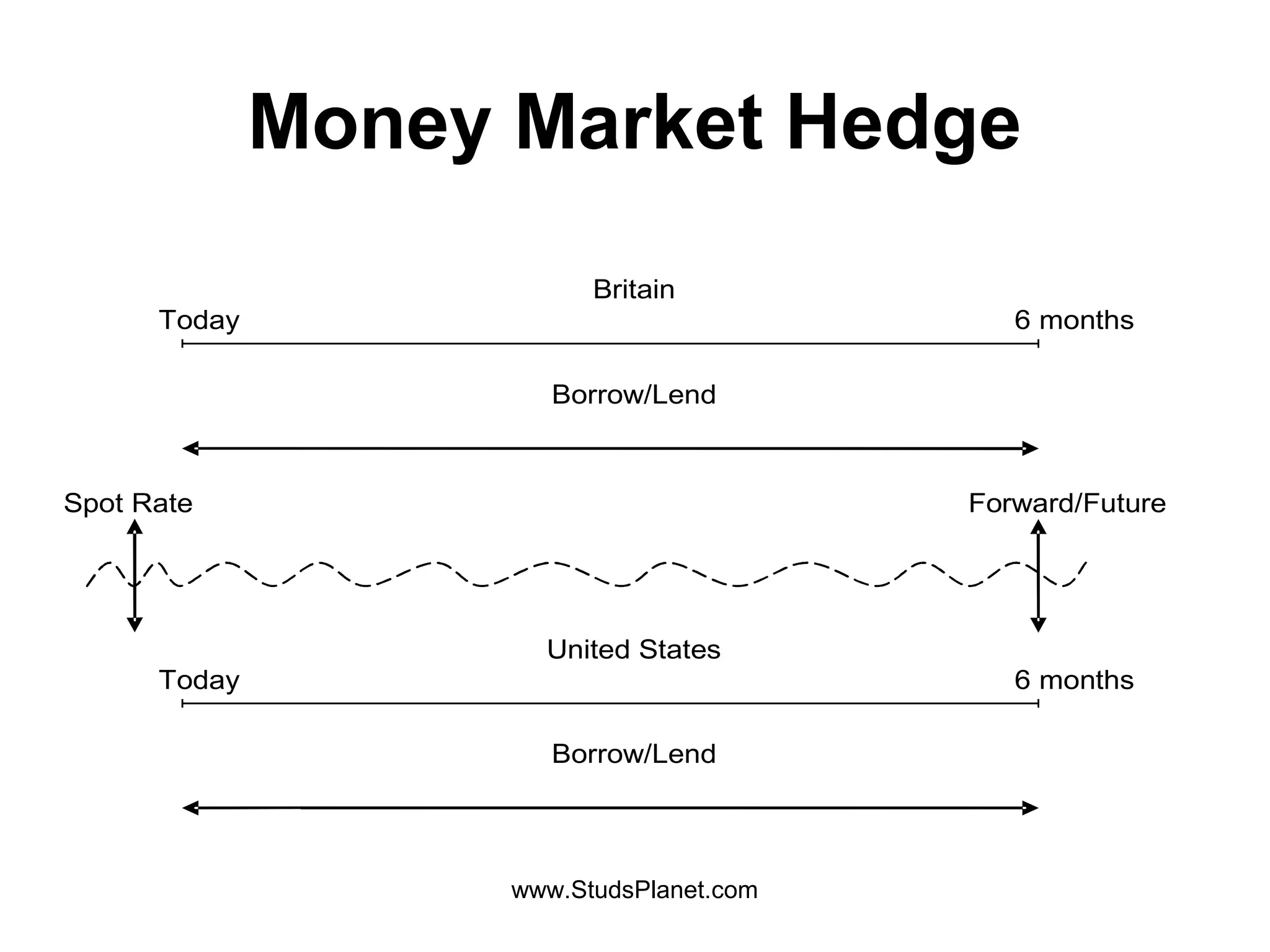

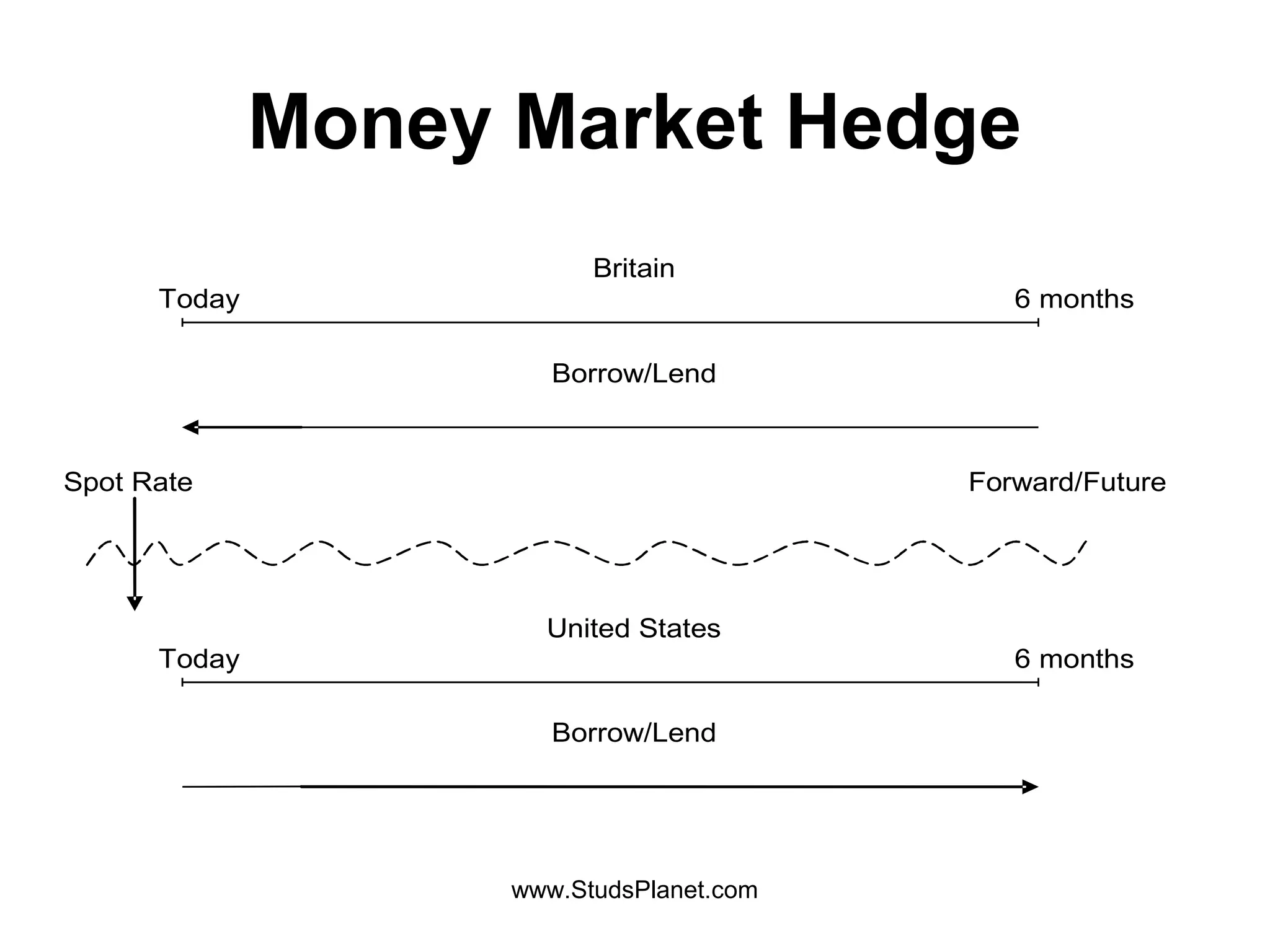

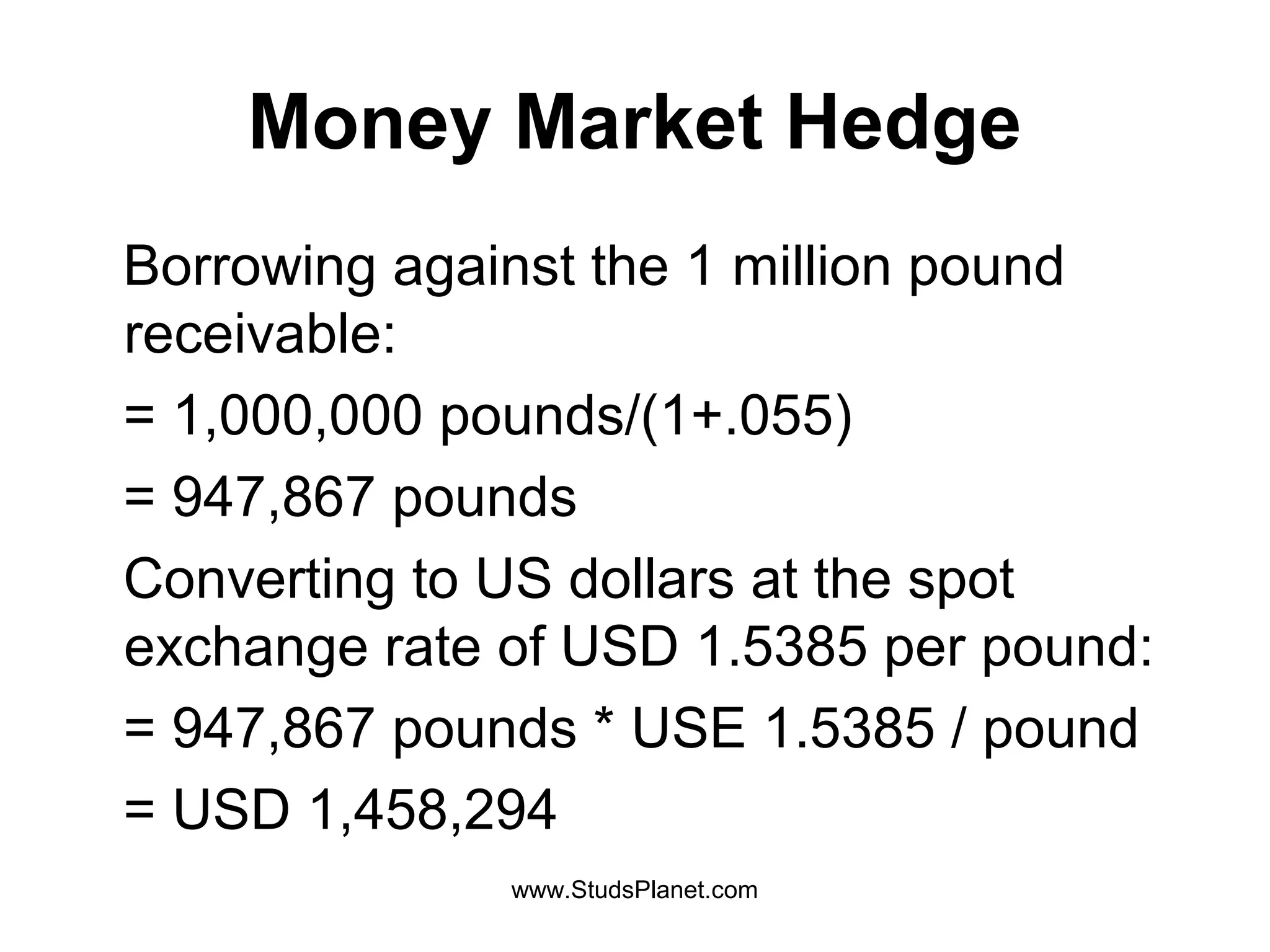

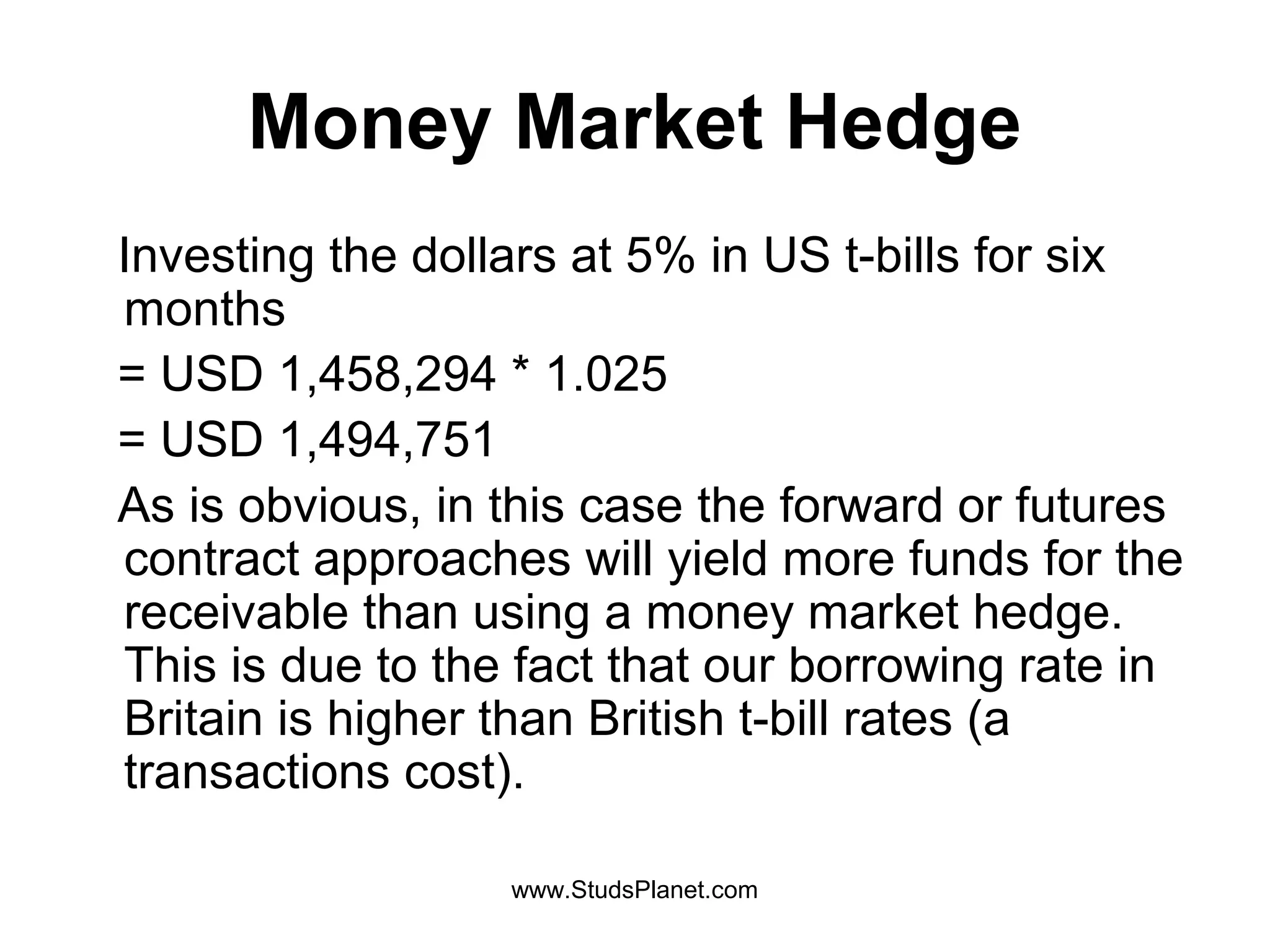

3) Borrowing pounds at 11% interest and converting/investing dollars at a 5% rate, receiving less than the forward methods.

4) Buying a put option at 1.53 USD/GBP for a net of USD 1,515,000, but retaining upside potential if