The document discusses various hedging strategies for a company that is owed 1 million British pounds in 6 months, including:

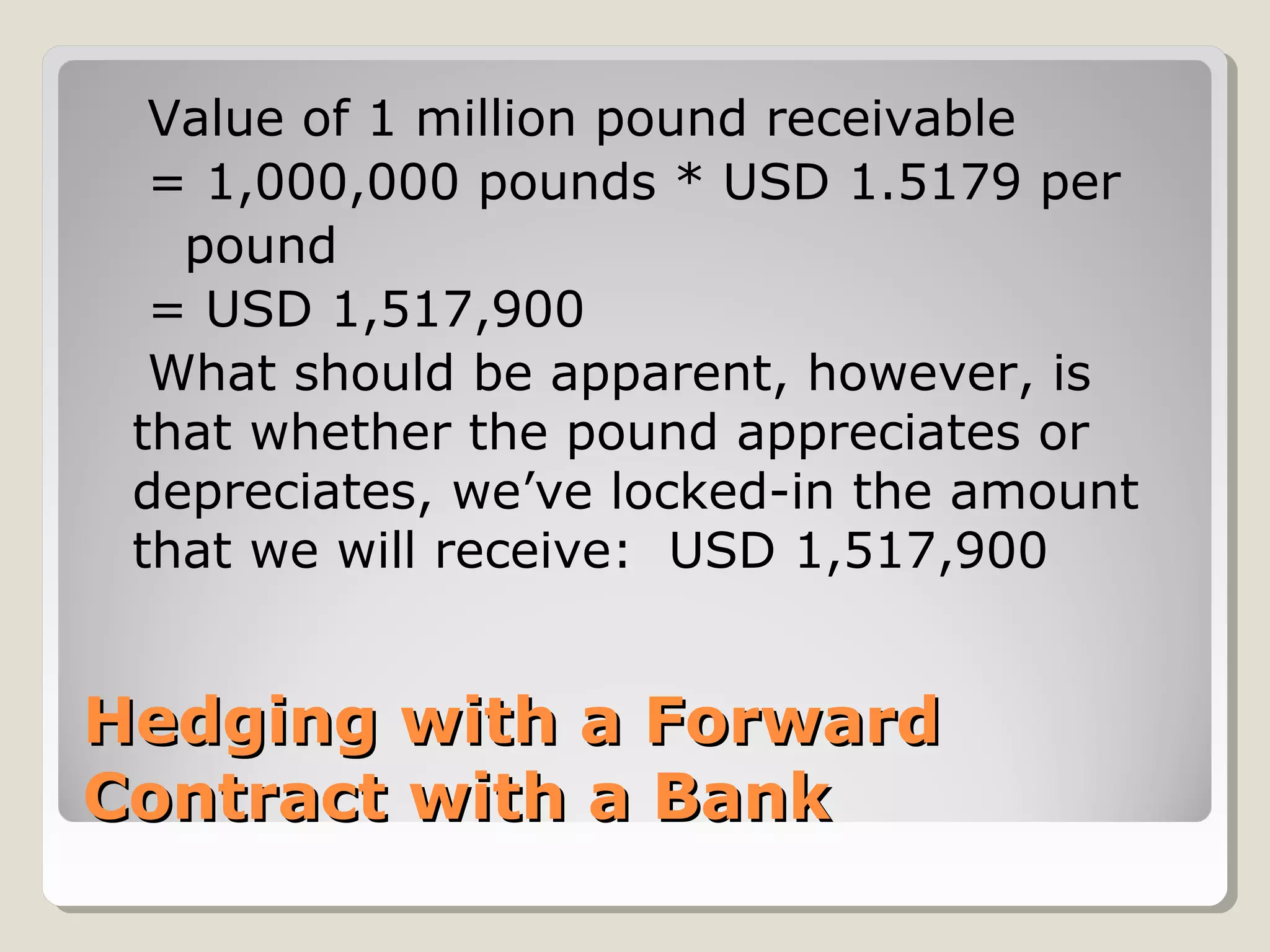

1) Using a forward contract with a bank to lock in receiving $1,517,900

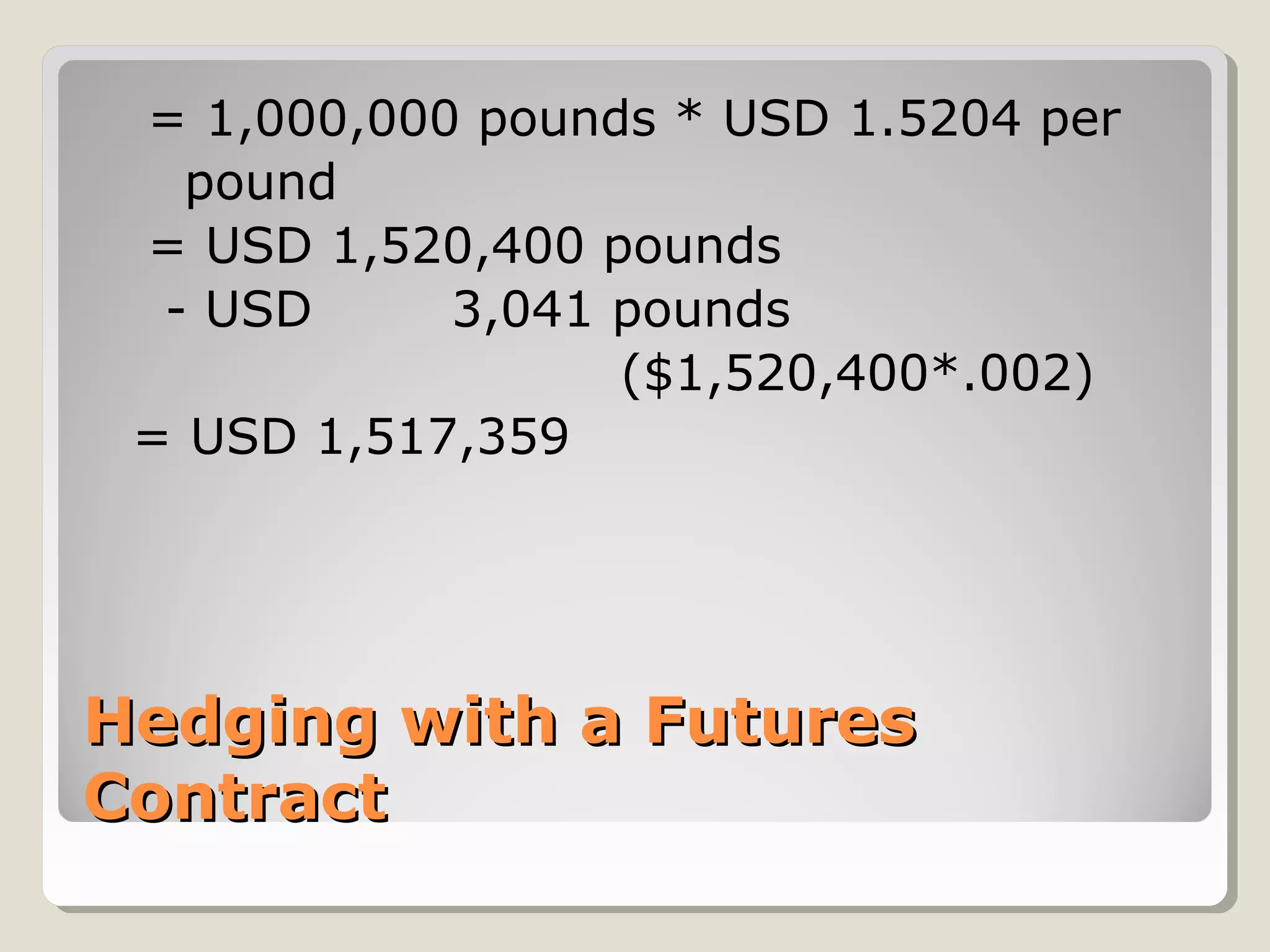

2) Using futures contracts which would net $1,517,359 after commissions

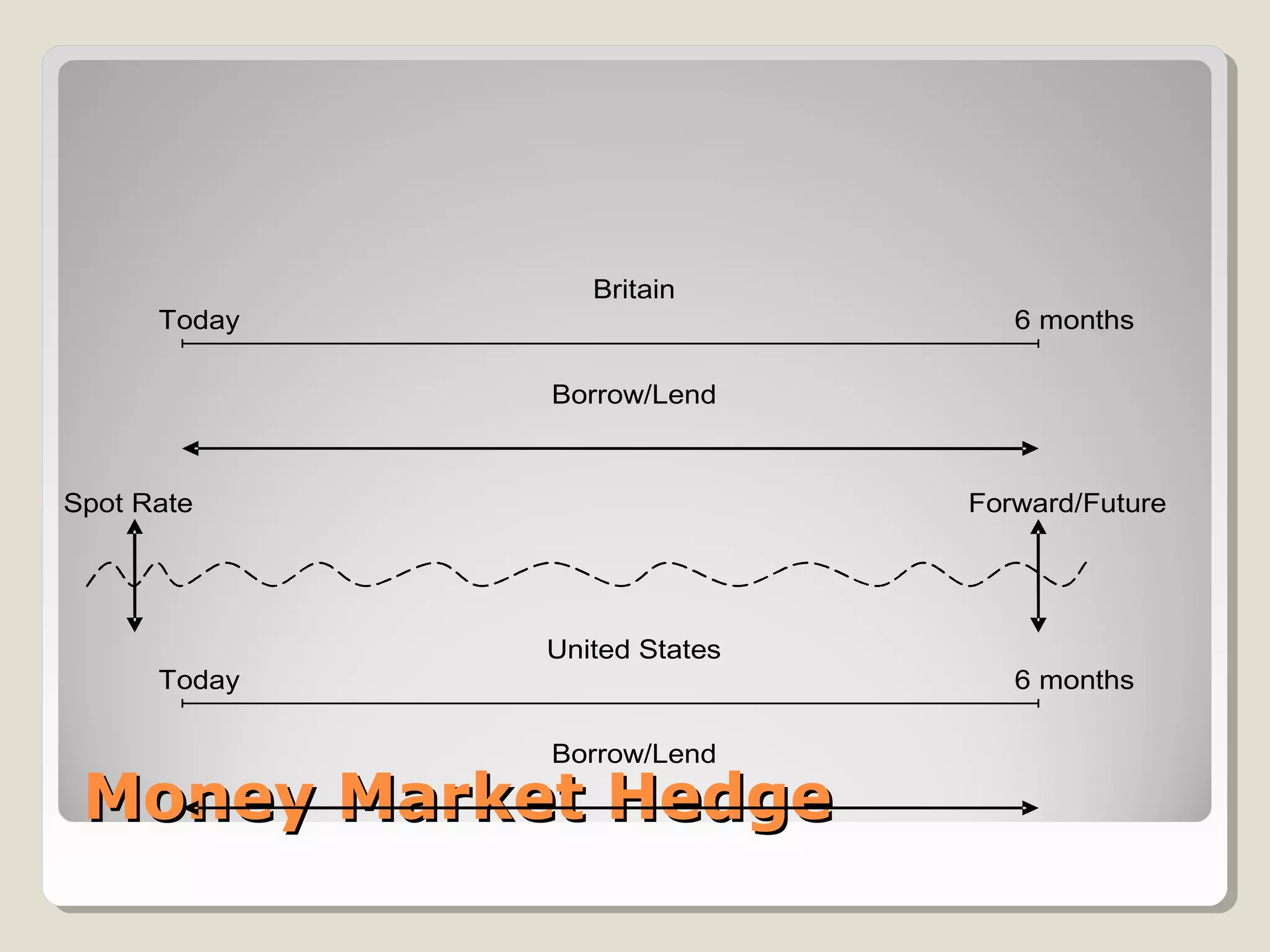

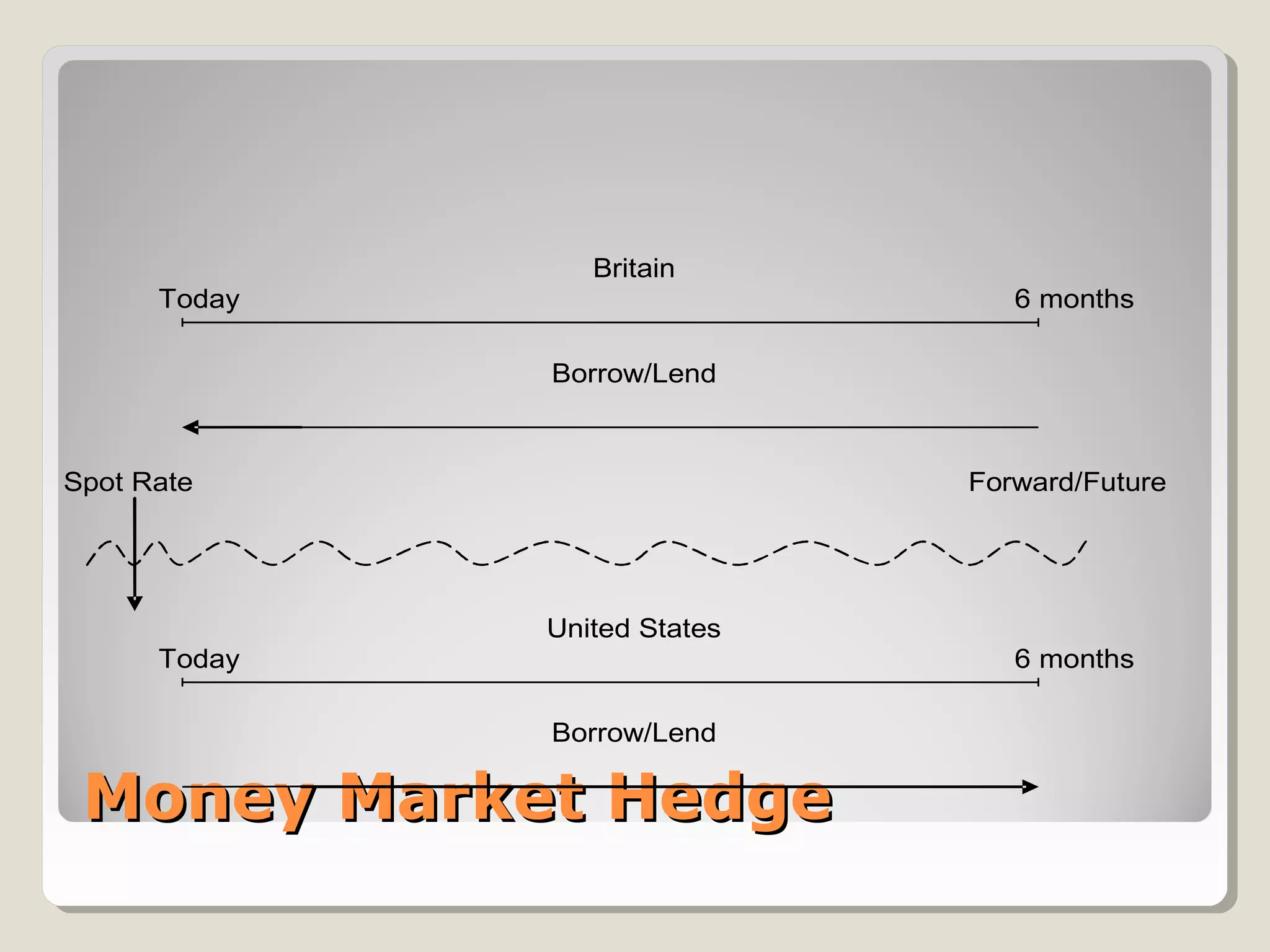

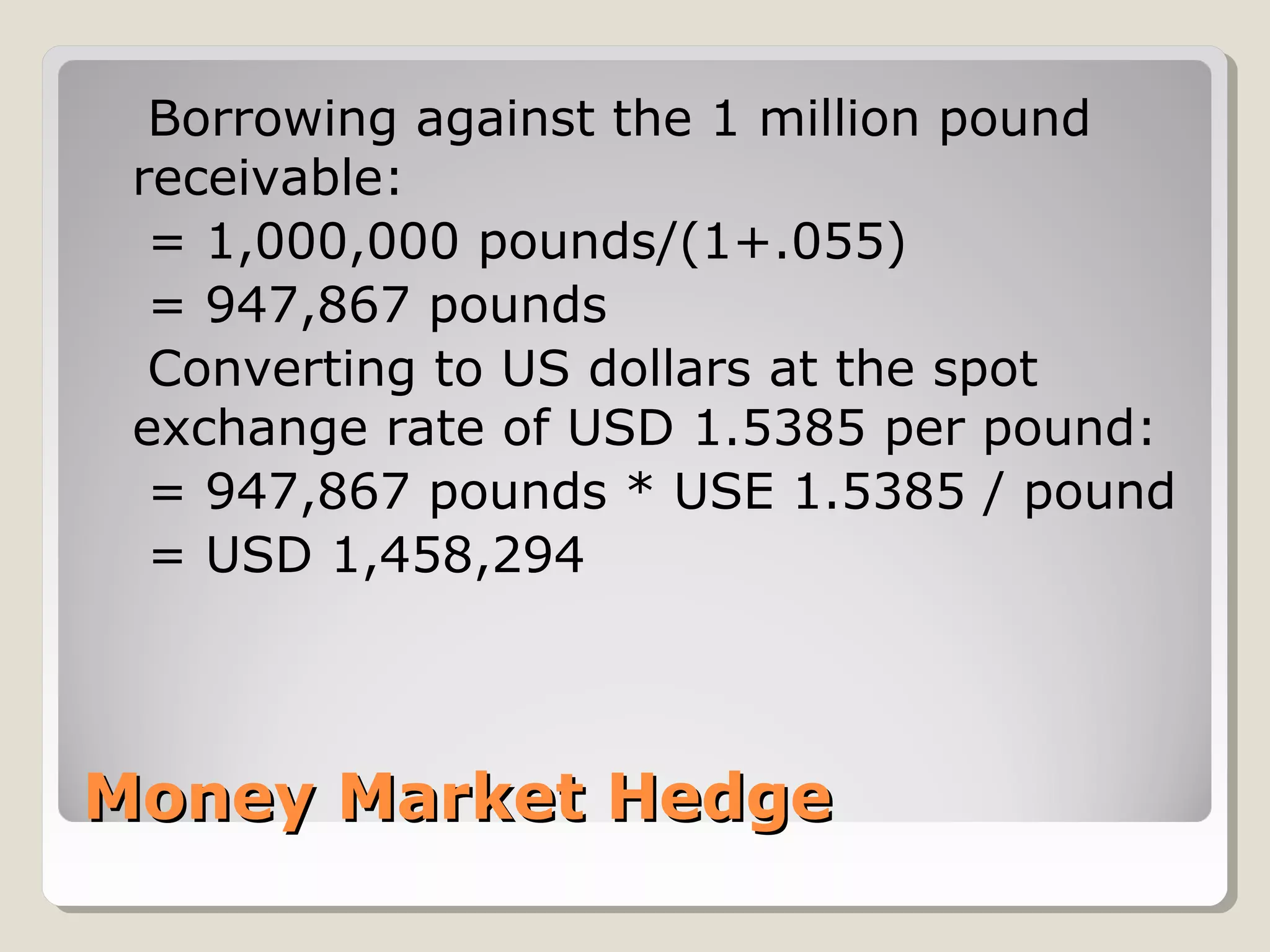

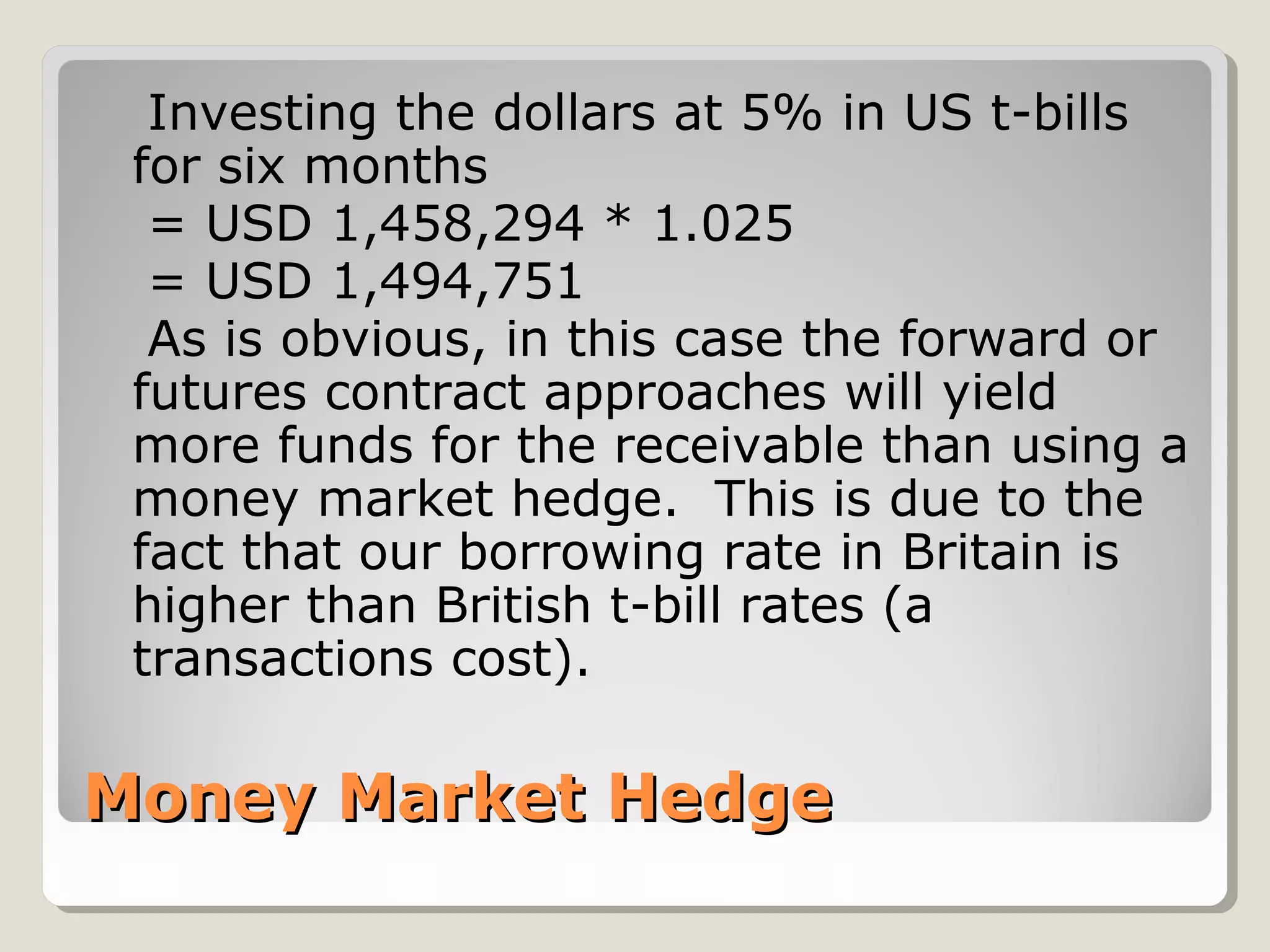

3) A money market hedge which would yield less at $1,494,751 due to higher British borrowing rates

4) Buying a put option for downside protection while allowing upside potential if the pound appreciates above the $1.53 strike price.