The document discusses various currency futures and options concepts:

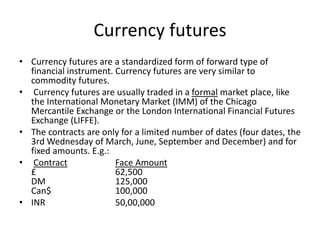

- Currency futures allow standardized hedging of currency exposure at fixed maturity dates and amounts. They require daily margin adjustments while forward contracts only require settlement at maturity.

- Currency options provide the right but not obligation to buy (call) or sell (put) a currency at a fixed strike price by a future date. They allow setting price floors and ceilings on currency receivables and payables.

- A company can hedge currency risk from foreign cash flows by writing covered calls on the currency. This provides premium income while capping upside, reducing downside exposure from currency depreciation. The tradeoff is lower premium but also lower risk of the

![Unhedged position

• First, let us calculate the interest on this loan:

• DM interest on the loan is DM 2m [(1.06)1/4 -

1] = DM 0.029348m

• Since we do not hedge this, the $ value of this

(at St+1) is

• = DM 0.029348 ($ 0.48/DM) = $0.014087m](https://image.slidesharecdn.com/6futuresandoptionsmarket-170319121919/85/futures-and-options-market-11-320.jpg)

![$0.51/DM

Sign a long futures to buy 2m DM

You sell the futures contract @0.48

With a loss of $0.03/DM. Total loss

= $0.06 m

$0.48/DM

$0.50/DM

You want to buy 2DM in Spot market

$0.48/DM

Gain of $0.02/DM. Total gain = $0.04 m

Total position = 0.04-0.06 = loss of $0.02m

2 m DM loan taken

$0.50/DM

Interest @ 6% pa

=1.06^1/4 – 1 =

0.14674

Loan to be repaid

=2.029348 m

$0.48/DM

Margin amount borrowed

= 3000*16=$48,000

Interest on margin amount

to be paid = $48,000 [(1.14^1/4) -1]

=$0.001598 m

It is given in the problem that only principal $1 m will be hedged. i.e.

Interest of DM 0.029348 or equivalent of $ 0.014087 m will not be hedged.

Total amount to be paid =$1.035587 which is equivalent to 15.05%](https://image.slidesharecdn.com/6futuresandoptionsmarket-170319121919/85/futures-and-options-market-16-320.jpg)