- The document discusses transaction exposure (TE), which is the risk from changes in exchange rates for contracts that have been agreed to but not yet settled.

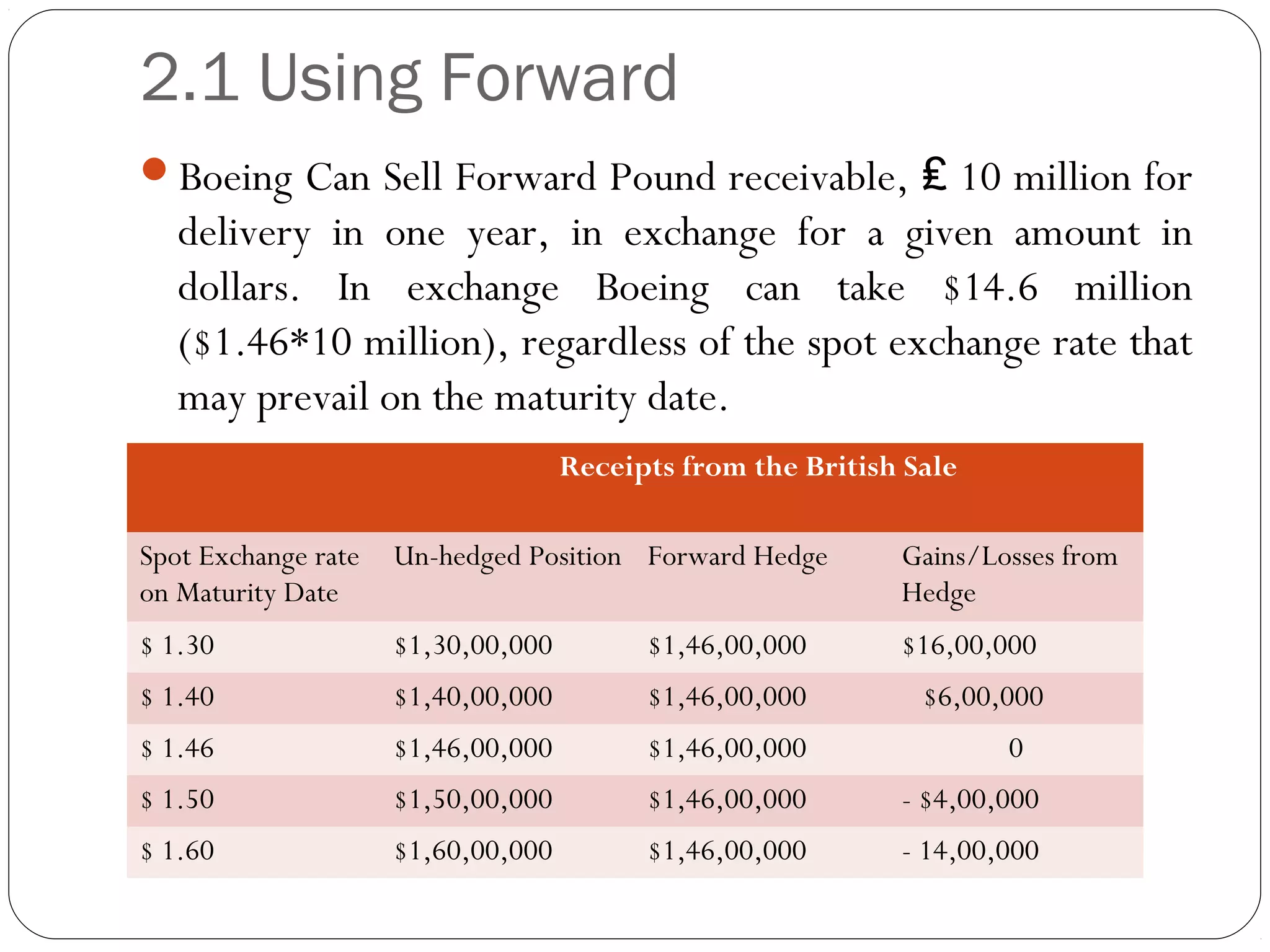

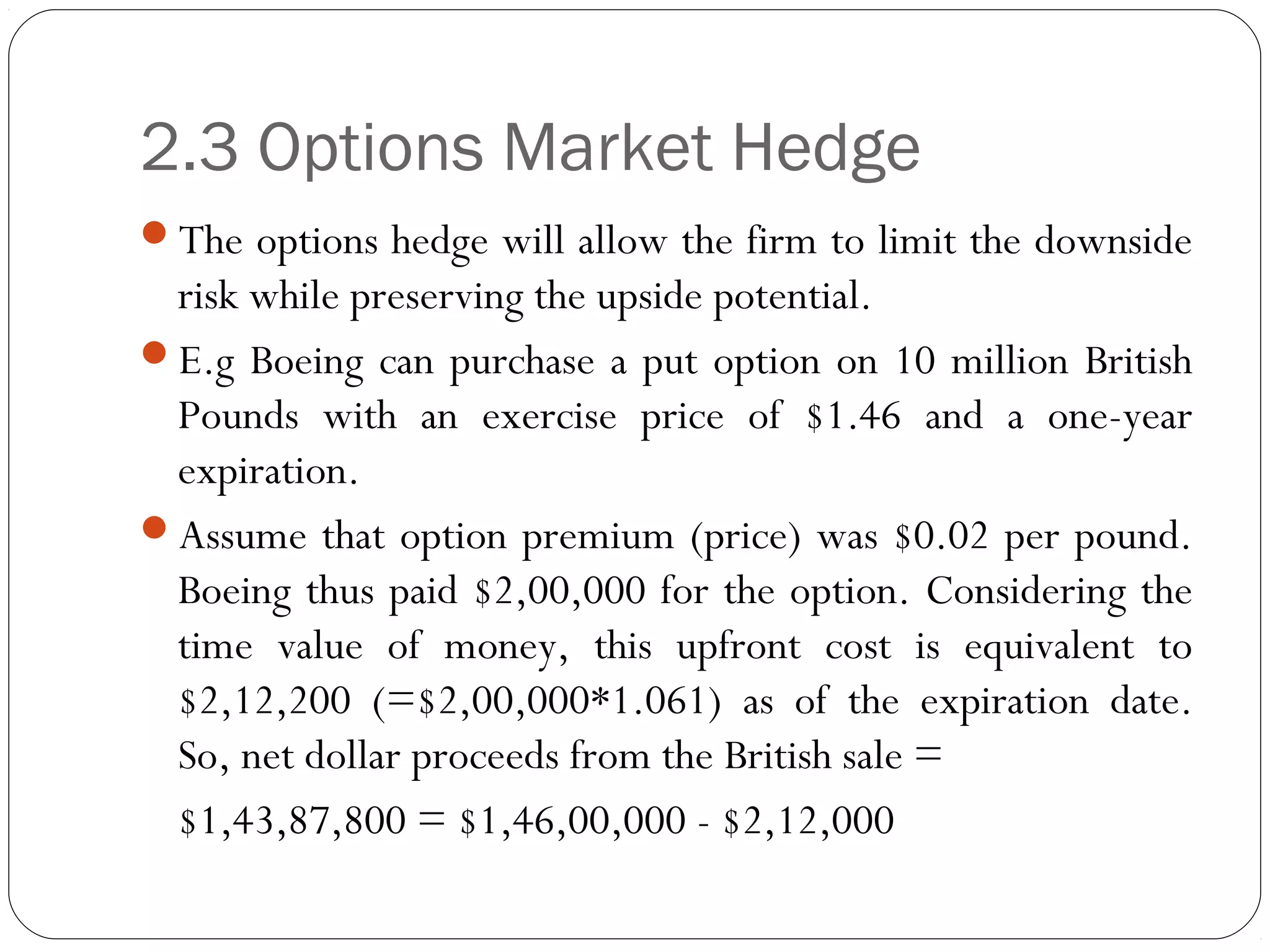

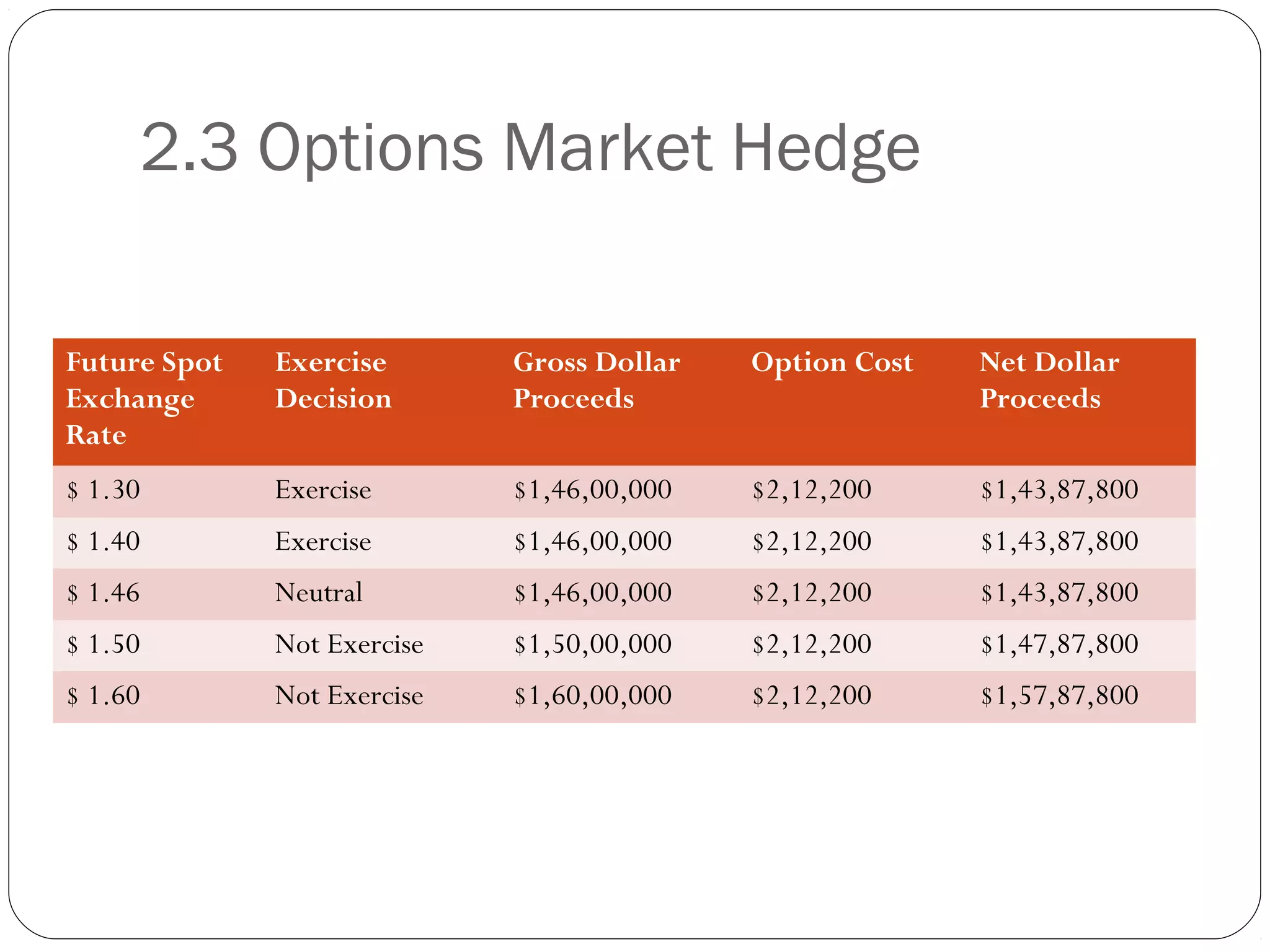

- It describes various ways to manage TE, including through forward contracts, money market hedges, options, and swaps. It also discusses operational techniques like invoice currency choice and exposure netting.

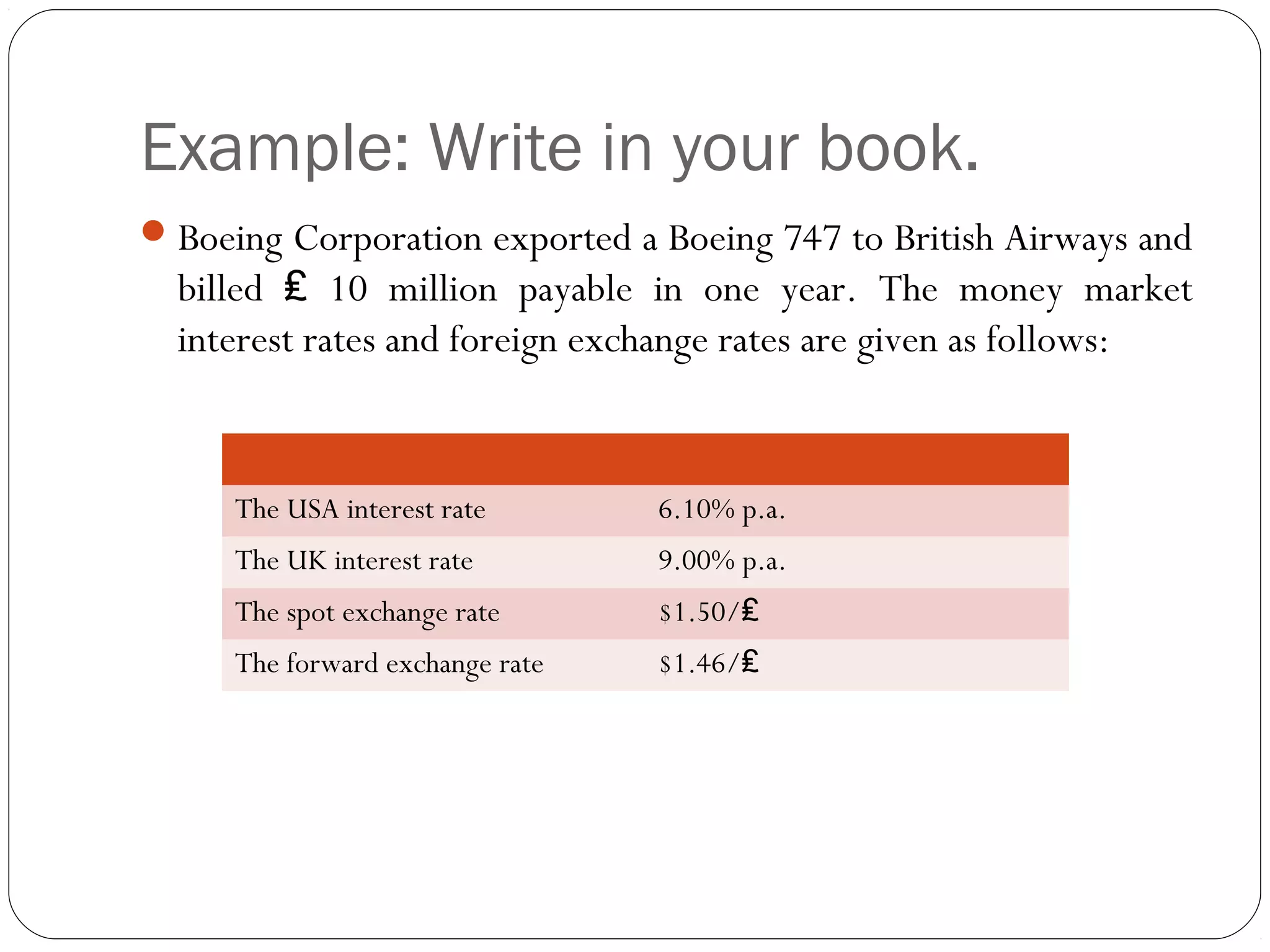

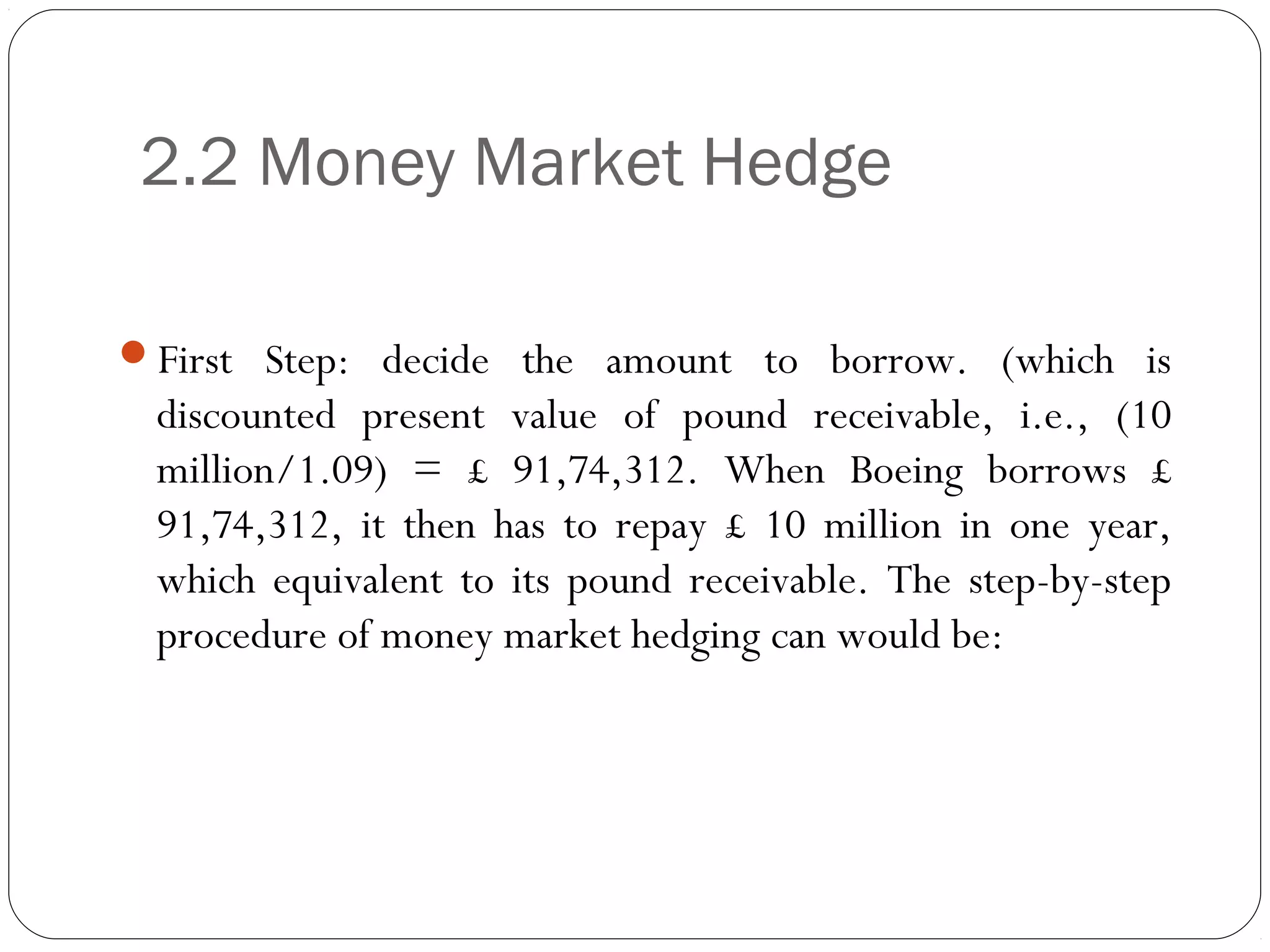

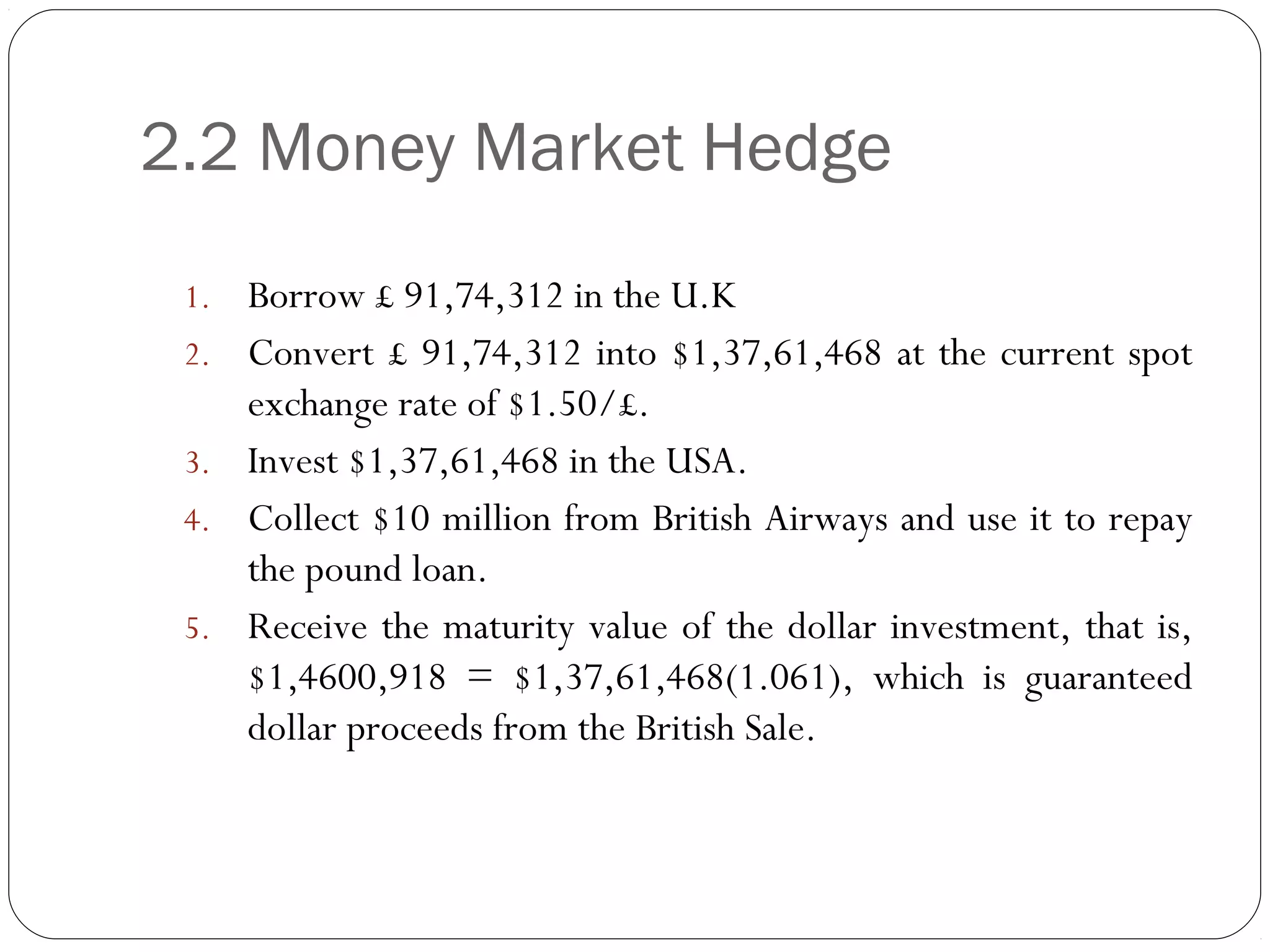

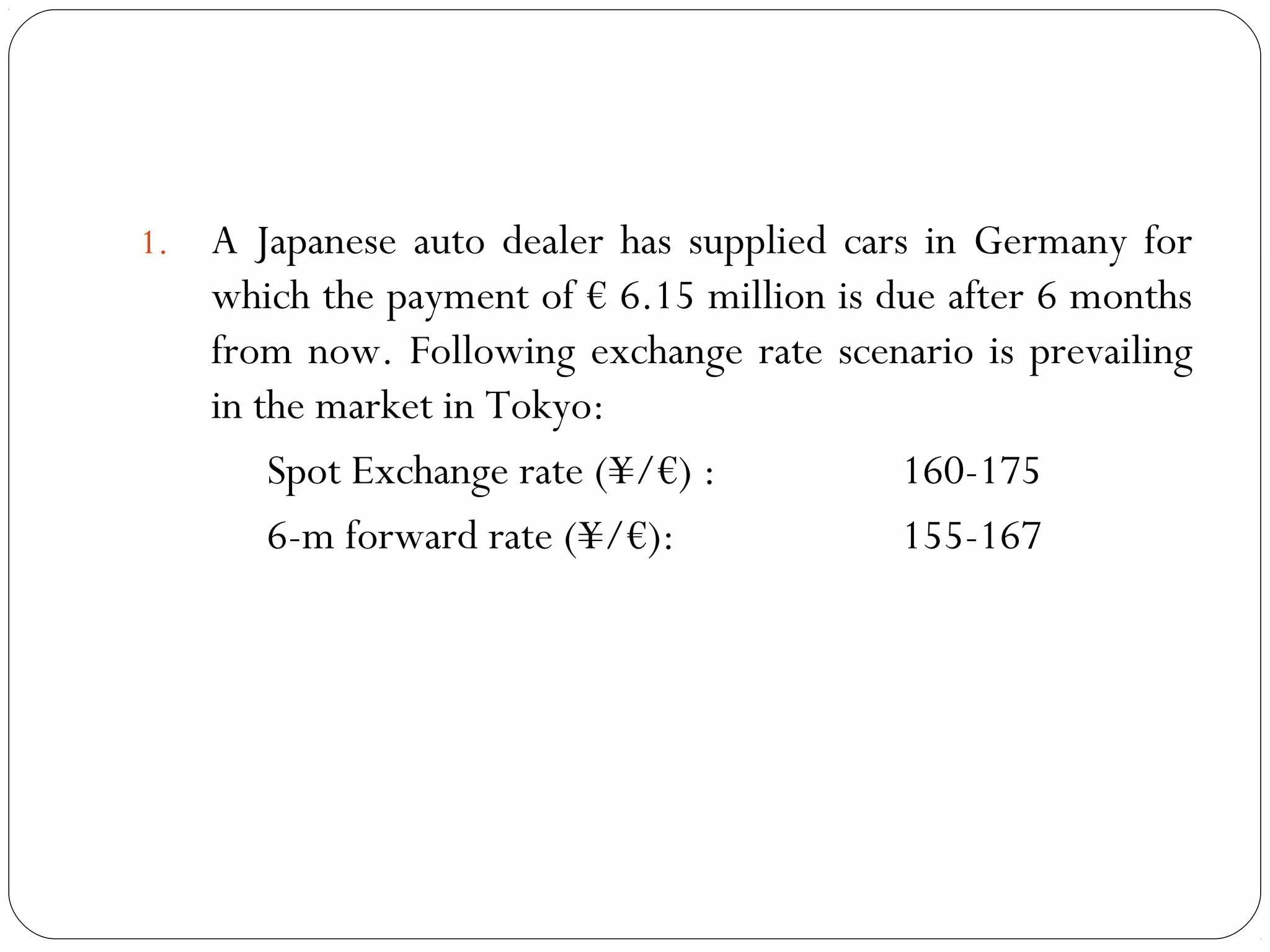

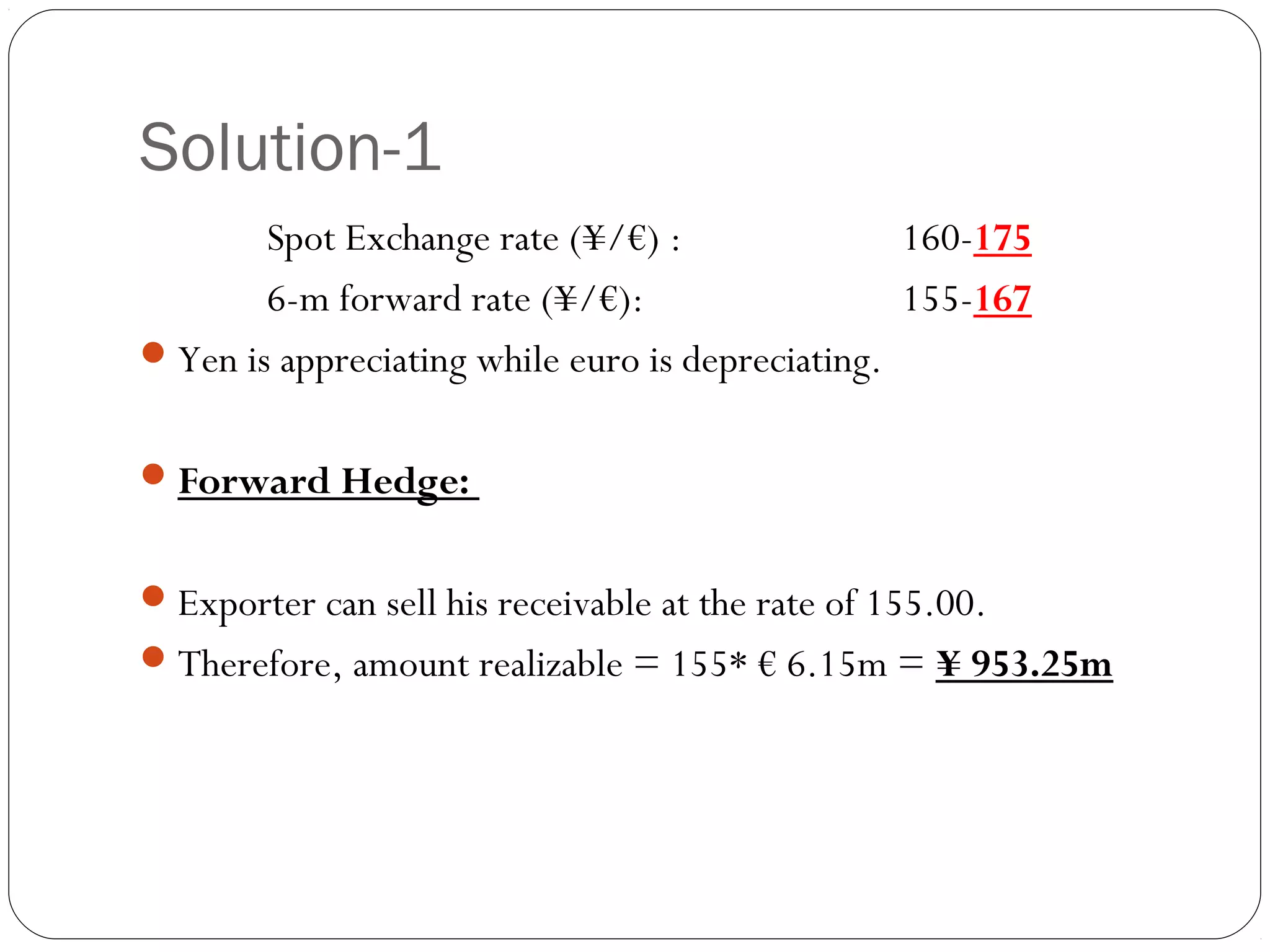

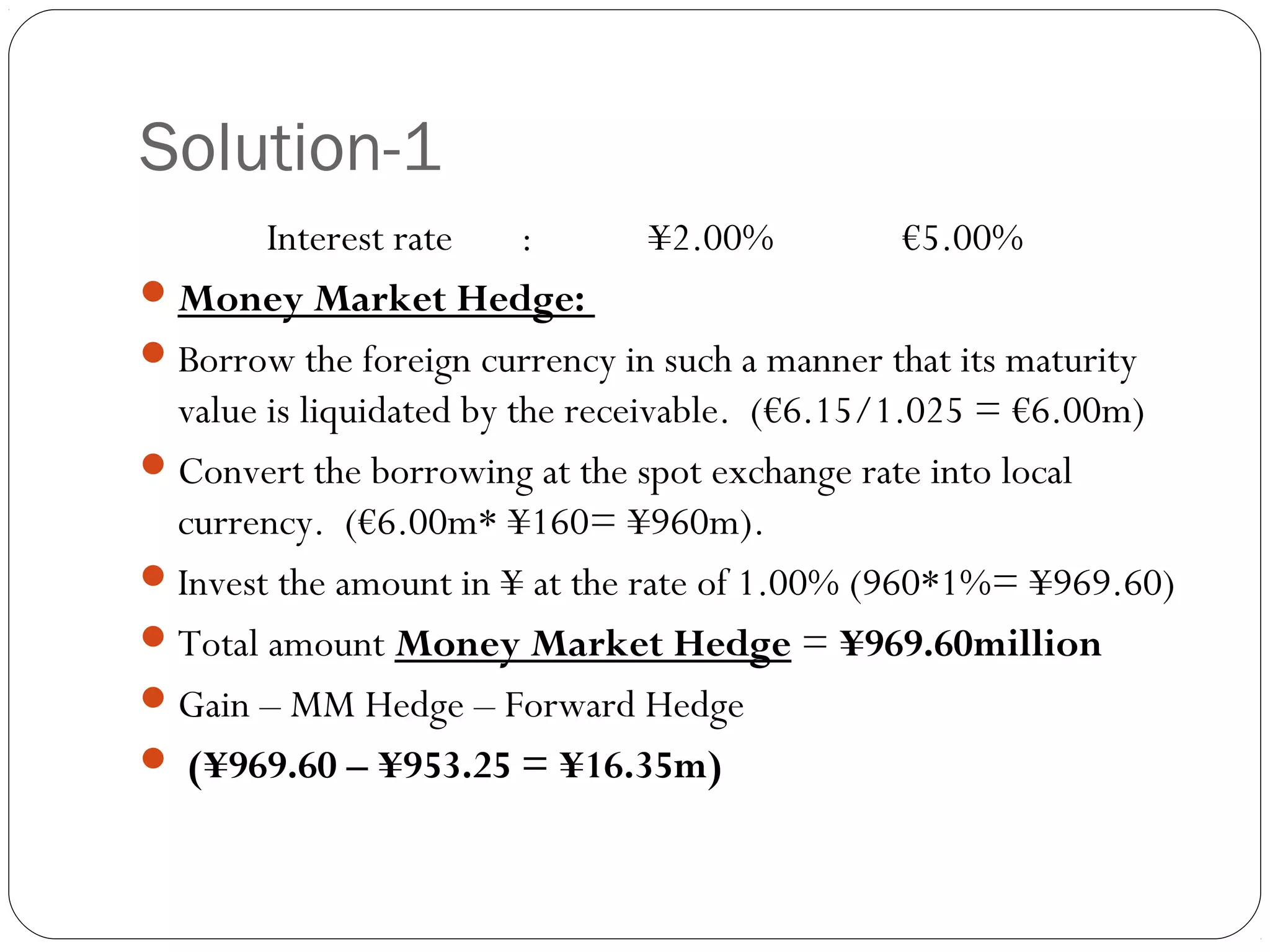

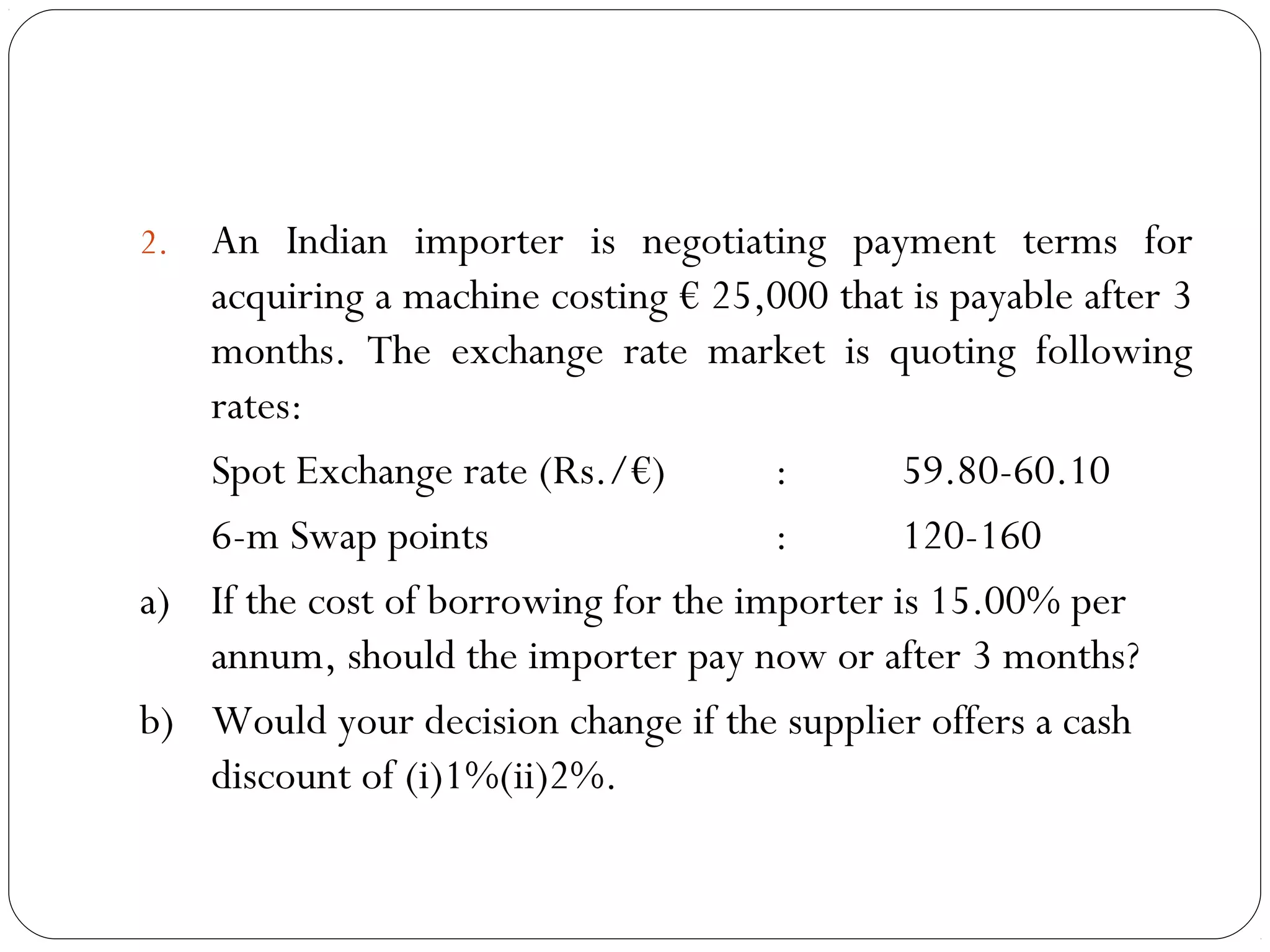

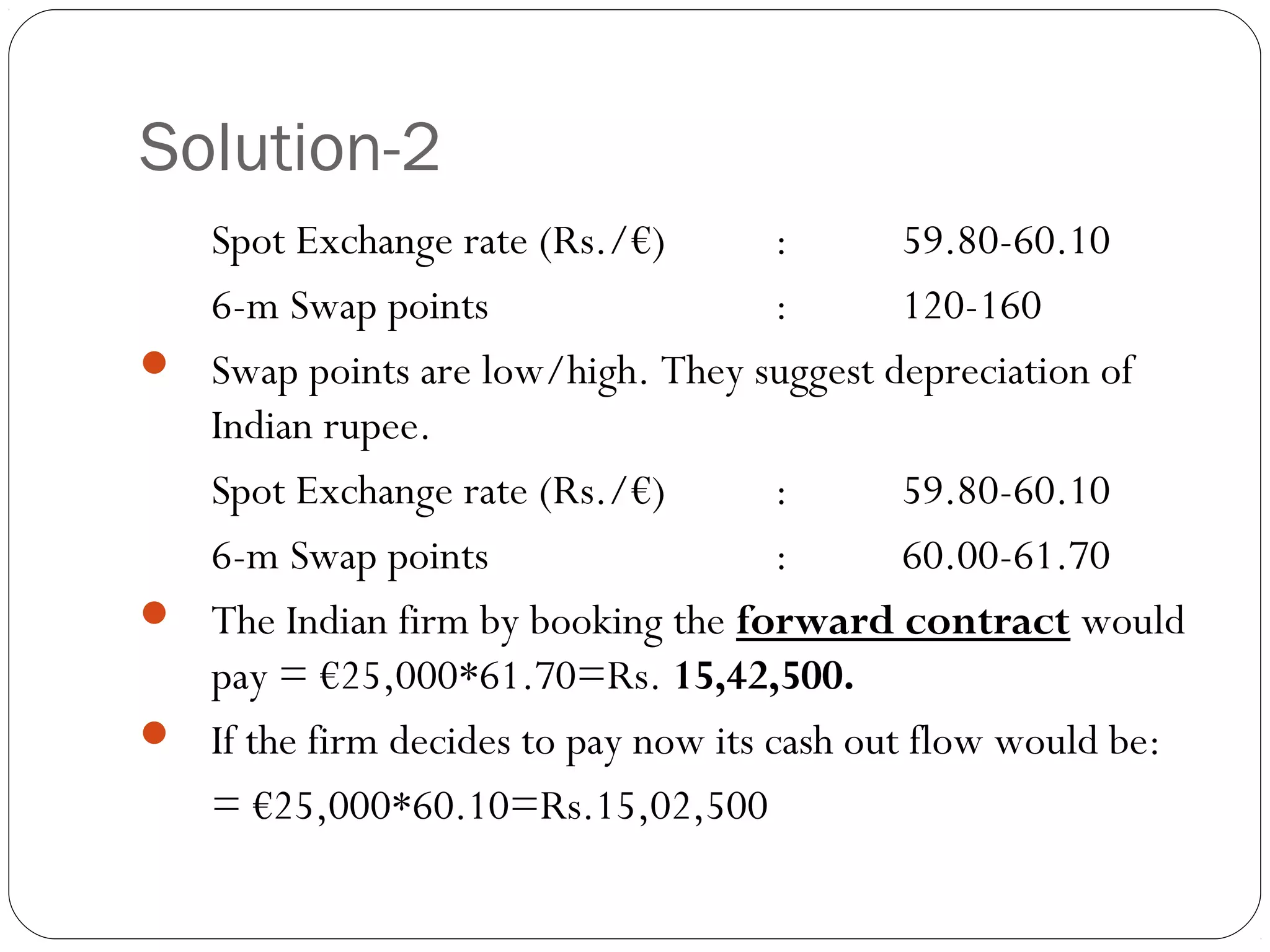

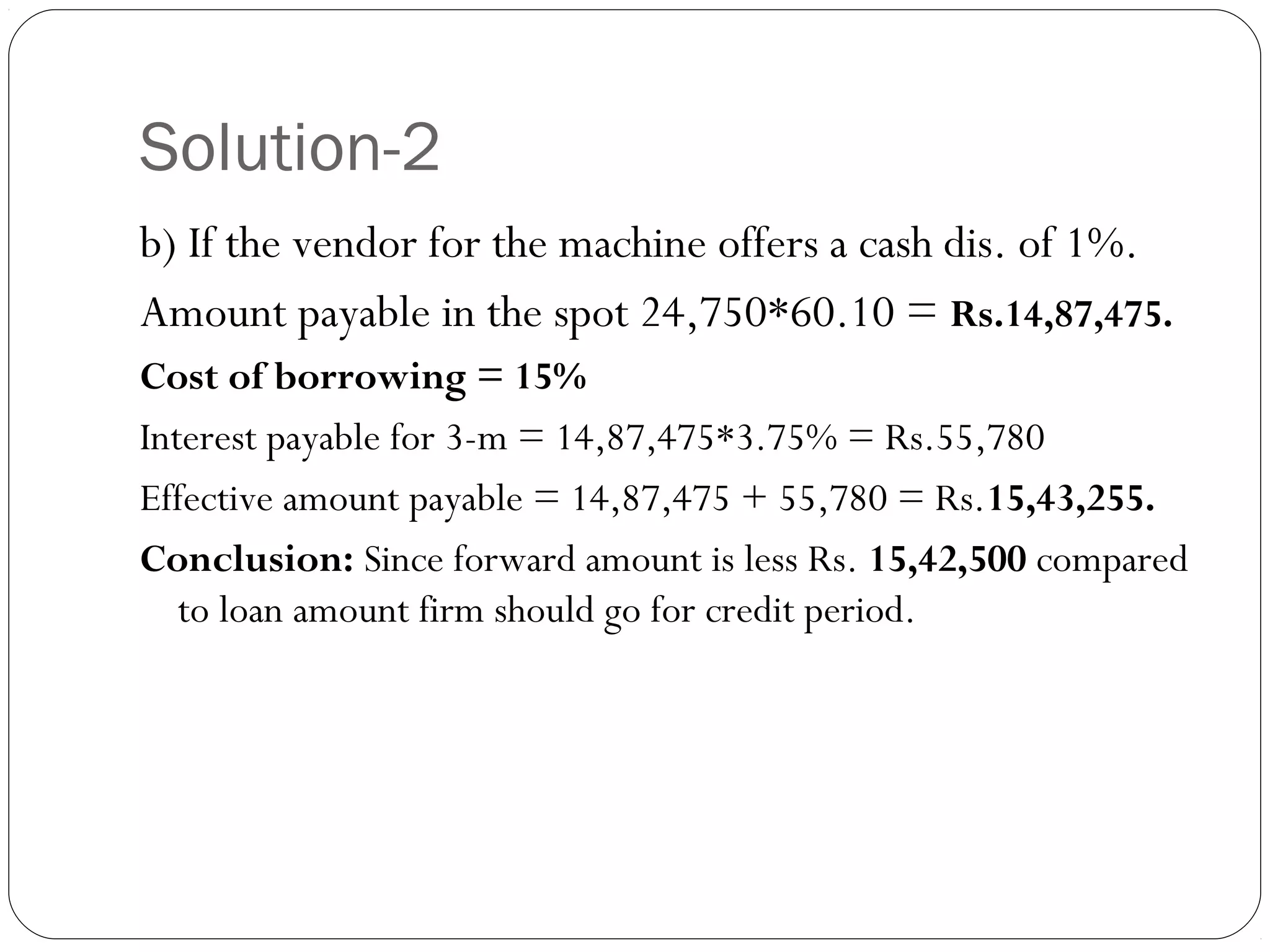

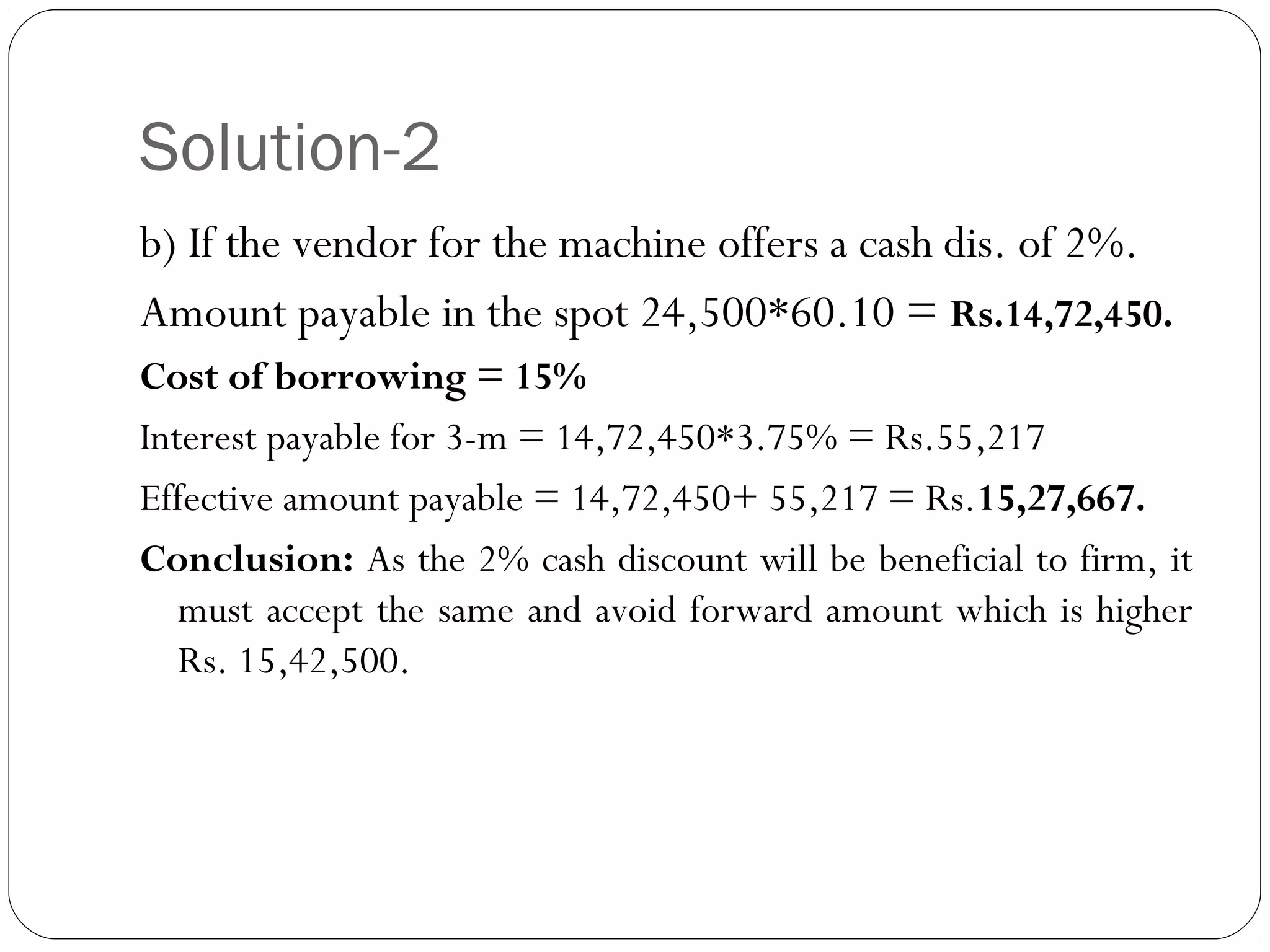

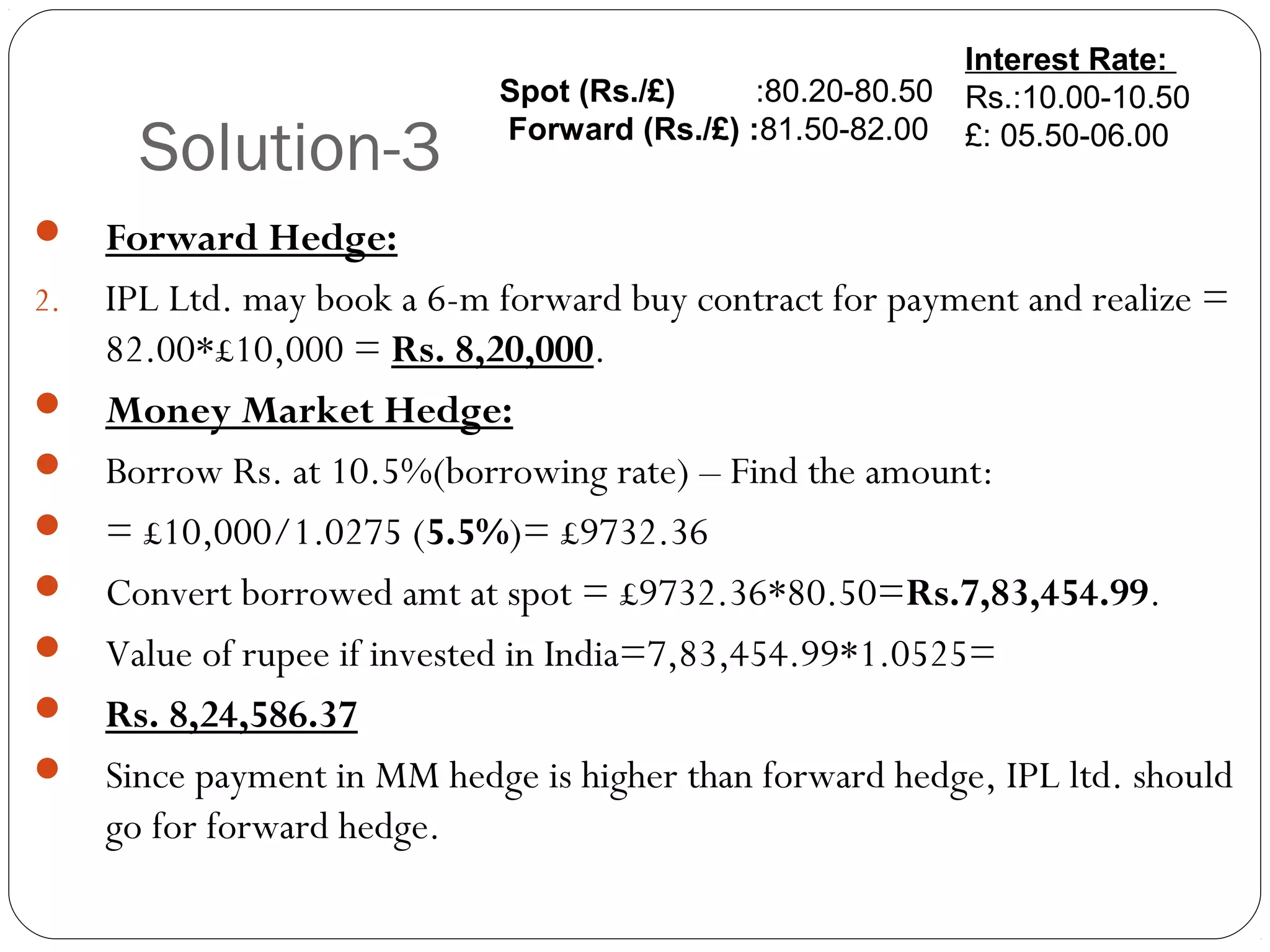

- Examples are provided to illustrate comparing forward contracts to money market hedges for an exporter receiving foreign currency and an importer paying foreign currency. The more advantageous hedge depends on interest rate differences.