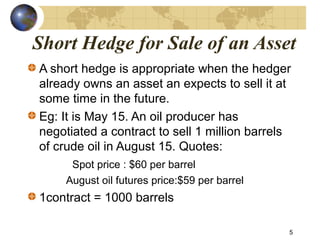

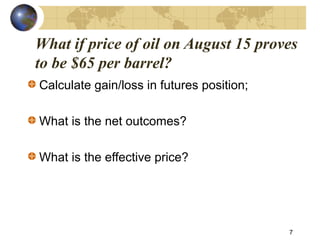

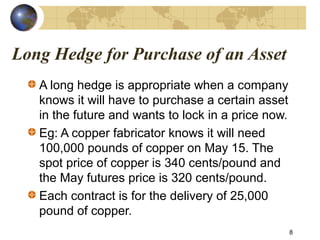

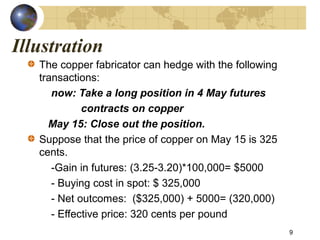

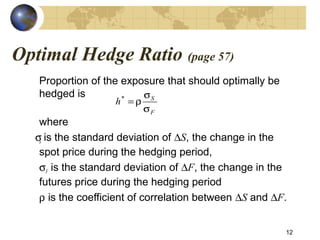

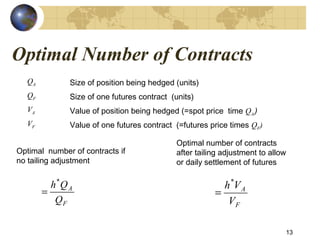

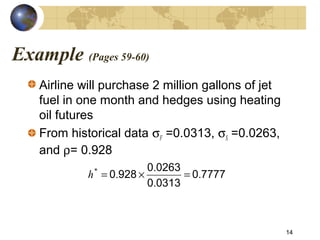

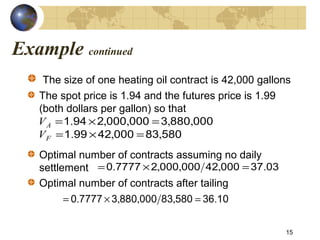

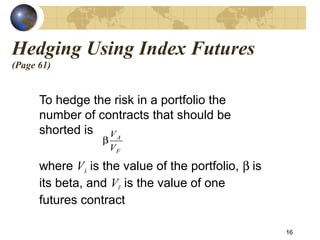

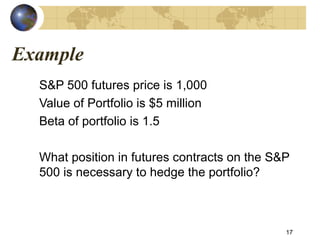

This document discusses various hedging strategies using futures contracts. It describes long and short hedges to lock in future purchase or sale prices of assets. Arguments in favor of hedging include reducing risks from market variables, while arguments against include shareholders already being diversified and increased risk if competitors do not hedge. Examples illustrate how futures hedging works for both long and short hedges. The document also discusses cross hedging using different but correlated assets, calculating optimal hedge ratios, and hedging equity portfolios using stock index futures.