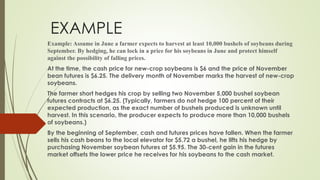

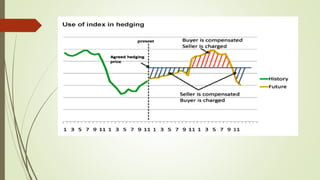

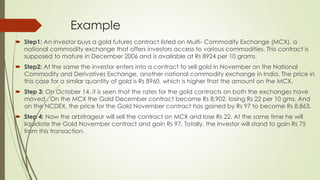

The document discusses hedging and arbitrage as financial strategies to mitigate risks and capitalize on price discrepancies. It outlines how hedging can protect producers, like farmers, from price fluctuations and explains the concept of arbitrage where investors exploit price differences across markets for profit. Additionally, it emphasizes the importance of understanding various risks and transaction costs involved in these strategies.