Currency arbitrage

•Download as PPT, PDF•

4 likes•10,509 views

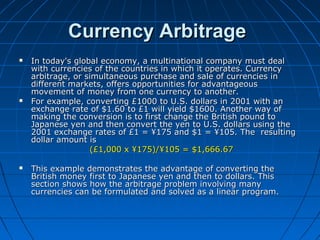

The document describes a mathematical model for currency arbitrage. Currency arbitrage involves simultaneously buying and selling currencies in different markets to profit from temporary price differences. The model seeks to maximize final dollar holdings by determining the optimal amounts to convert between US dollars, euros, British pounds, Japanese yen, and Kuwaiti dinars, given exchange rates and transaction limits. The model is formulated as a linear program to find the currency conversion amounts that maximize profits through arbitrage opportunities across multiple currencies.

Report

Share

Report

Share

Recommended

Covered interest arbitrage (1) (2)

Arbitrage involves purchasing currency where it is cheaper and immediately reselling it where it is more expensive to make a profit. There are different types of arbitrage depending on the number of currencies and locations involved. Covered interest arbitrage moves funds between countries to exploit interest rate differences while hedging exchange rate risk using forward contracts. The international Fisher equation establishes a relationship between exchange rates and interest rates such that any arbitrage profits will be offset over time as markets adjust rates.

Financial Derivatives and Options

This document summarizes information about financial derivatives, with a focus on options. It defines key terms like forwards, futures, swaps, and provides details on call and put options. It explains how options work, including factors that influence pricing and examples of trading options on exchanges. The document also discusses an example where some option traders profited from their positions before an announcement that News Corp was offering to buy Dow Jones & Co. for $60 per share, sending the stock price up 50%. It concludes with some option strategies and examples of financial engineering techniques.

Currency Derivatives

1. The document discusses various currency derivatives including forward contracts, futures contracts, and options contracts. Forward contracts allow corporations to lock in exchange rates for future currency needs, while futures and options are used by corporations for hedging and by speculators.

2. Currency futures contracts are standardized and exchange-traded, whereas forward contracts are customized over-the-counter contracts. Options provide the right but not obligation to buy or sell a currency.

3. The use of currency derivatives allows corporations to hedge currency risk and reduce fluctuations in value, while speculation in these markets allows some traders to profit but does not consistently generate large profits due to market efficiency.

Swaps

A swap is an agreement between two counterparties to exchange cash flow streams, such as interest payments or currencies. The main types of swaps discussed are interest rate swaps, currency swaps, and forex swaps. An interest rate swap involves exchanging interest payments, such as a fixed rate for a floating rate. A currency swap exchanges principal and interest payments in different currencies. A forex swap is an agreement to buy one currency now and sell it back in the future at an agreed upon exchange rate.

Managing transaction exposure and economic exposure

This document discusses foreign exchange exposure and its management. It defines three types of exposure - translation, transaction, and economic - and describes techniques for managing each type. Transaction exposure involves actual cash flows and can be hedged using forwards, futures, options, swaps and cross-hedging. Economic exposure is harder to hedge but diversification and strategic operational changes can help. While derivatives are commonly used, some companies have experienced large losses, so effective risk management is important.

Foreign exchange market

The foreign exchange market is the largest financial market in the world, with over $4 trillion traded daily. It allows currencies to be exchanged between countries, facilitating international trade and investment. The market involves commercial banks, central banks, brokers, and other entities buying and selling currencies constantly. The most heavily traded currencies are the US dollar, euro, Japanese yen, British pound, and Australian dollar. Participants trade in spot markets for immediate exchange or forward markets for future delivery. Factors like economic performance, interest rates, trade balances, and political events influence exchange rates between currencies.

Foreign exchange exposure PPT

Foreign exchange exposure is the risk associated with activities involving currencies other than a firm's home currency. It is the risk that foreign currencies may fluctuate in a way that financially harms the firm. There are three main types of foreign exchange exposure: transaction, economic, and translation. Firms can assess and manage their exposures through hedging strategies like financial contracts and operational techniques. Whether to hedge depends on factors like a firm's currency forecasts and focus on its core business versus currency speculation.

HEDGING

This presentation discusses hedging as a tool for offsetting exchange rate risk. It covers different types of hedging techniques including forward market hedges, money market hedges, and hedging with swaps. Forward market hedges use forward contracts to lock in exchange rates for expected foreign currency cash flows. Money market hedges involve borrowing and lending in different currencies to lock in home currency values. Swaps allow two companies with foreign currency receivables and payables to exchange them, effectively hedging each other's exchange rate risk. Examples are provided to illustrate how each hedging technique works.

Recommended

Covered interest arbitrage (1) (2)

Arbitrage involves purchasing currency where it is cheaper and immediately reselling it where it is more expensive to make a profit. There are different types of arbitrage depending on the number of currencies and locations involved. Covered interest arbitrage moves funds between countries to exploit interest rate differences while hedging exchange rate risk using forward contracts. The international Fisher equation establishes a relationship between exchange rates and interest rates such that any arbitrage profits will be offset over time as markets adjust rates.

Financial Derivatives and Options

This document summarizes information about financial derivatives, with a focus on options. It defines key terms like forwards, futures, swaps, and provides details on call and put options. It explains how options work, including factors that influence pricing and examples of trading options on exchanges. The document also discusses an example where some option traders profited from their positions before an announcement that News Corp was offering to buy Dow Jones & Co. for $60 per share, sending the stock price up 50%. It concludes with some option strategies and examples of financial engineering techniques.

Currency Derivatives

1. The document discusses various currency derivatives including forward contracts, futures contracts, and options contracts. Forward contracts allow corporations to lock in exchange rates for future currency needs, while futures and options are used by corporations for hedging and by speculators.

2. Currency futures contracts are standardized and exchange-traded, whereas forward contracts are customized over-the-counter contracts. Options provide the right but not obligation to buy or sell a currency.

3. The use of currency derivatives allows corporations to hedge currency risk and reduce fluctuations in value, while speculation in these markets allows some traders to profit but does not consistently generate large profits due to market efficiency.

Swaps

A swap is an agreement between two counterparties to exchange cash flow streams, such as interest payments or currencies. The main types of swaps discussed are interest rate swaps, currency swaps, and forex swaps. An interest rate swap involves exchanging interest payments, such as a fixed rate for a floating rate. A currency swap exchanges principal and interest payments in different currencies. A forex swap is an agreement to buy one currency now and sell it back in the future at an agreed upon exchange rate.

Managing transaction exposure and economic exposure

This document discusses foreign exchange exposure and its management. It defines three types of exposure - translation, transaction, and economic - and describes techniques for managing each type. Transaction exposure involves actual cash flows and can be hedged using forwards, futures, options, swaps and cross-hedging. Economic exposure is harder to hedge but diversification and strategic operational changes can help. While derivatives are commonly used, some companies have experienced large losses, so effective risk management is important.

Foreign exchange market

The foreign exchange market is the largest financial market in the world, with over $4 trillion traded daily. It allows currencies to be exchanged between countries, facilitating international trade and investment. The market involves commercial banks, central banks, brokers, and other entities buying and selling currencies constantly. The most heavily traded currencies are the US dollar, euro, Japanese yen, British pound, and Australian dollar. Participants trade in spot markets for immediate exchange or forward markets for future delivery. Factors like economic performance, interest rates, trade balances, and political events influence exchange rates between currencies.

Foreign exchange exposure PPT

Foreign exchange exposure is the risk associated with activities involving currencies other than a firm's home currency. It is the risk that foreign currencies may fluctuate in a way that financially harms the firm. There are three main types of foreign exchange exposure: transaction, economic, and translation. Firms can assess and manage their exposures through hedging strategies like financial contracts and operational techniques. Whether to hedge depends on factors like a firm's currency forecasts and focus on its core business versus currency speculation.

HEDGING

This presentation discusses hedging as a tool for offsetting exchange rate risk. It covers different types of hedging techniques including forward market hedges, money market hedges, and hedging with swaps. Forward market hedges use forward contracts to lock in exchange rates for expected foreign currency cash flows. Money market hedges involve borrowing and lending in different currencies to lock in home currency values. Swaps allow two companies with foreign currency receivables and payables to exchange them, effectively hedging each other's exchange rate risk. Examples are provided to illustrate how each hedging technique works.

FIM - Credit Derivatives PPT

The document discusses credit derivatives and the credit derivatives market in India. It provides information on different types of credit derivatives including credit default swaps (CDS), credit linked notes (CLN), and credit spread options (CSO). It then discusses the growth of the CDS market globally and the composition of the credit derivatives market. It outlines the benefits of credit derivatives for banks and other financial institutions in India. Finally, it discusses the role of the Clearing Corporation of India in facilitating CDS trading and settlement and provides details on the first CDS trades in India in 2011.

Ifm problems

An American investor purchased securities in the Indian market investing $1 million USD. The document calculates the rate of return for the investor under different scenarios where the annual return on the Indian securities is 20%, 25%, and 50%. It also considers a second problem where an American investor wants to invest in Indian securities with a given beta and calculates the expected rate of return and risk. The document then provides exchange rate calculations and examples involving cross rates, spot rates, forward rates, and premiums/discounts. It summarizes international financial management concepts.

International financial market & instruments module 3

This document provides an overview of international financial markets. It discusses how financial markets facilitate the transfer of funds across borders between lenders and borrowers in different countries. The key segments of international financial markets include international bond markets, equity markets, money markets, credit markets, and foreign exchange markets. Different types of international bonds are described such as foreign bonds, eurobonds, and global bonds. The document also outlines various money market instruments like euro notes, commercial paper, and certificates of deposit.

Swap

Swap is an agreement between two parties to exchange cash flows over time. The key types of swaps discussed in the document are interest rate swaps, currency swaps, and credit default swaps. Interest rate swaps involve the exchange of interest payments in the same currency, while currency swaps exchange payments in different currencies and may also exchange principal amounts. Credit default swaps provide credit protection to the buyer in the event of default by a reference entity. Swaps are used for hedging risks and reducing borrowing costs.

Financial derivatives

Derivatives are financial instruments whose value is derived from an underlying asset such as a commodity, currency, bond, or stock. There are several types of derivatives including forwards, futures, and options. A forward is a customized contract where the buyer agrees to purchase an asset at a set price on a future date. Futures are standardized forward contracts that are exchange-traded. Options provide the right but not the obligation to buy or sell the underlying asset at a predetermined price on or before the expiration date.

International bond market ppt

This document provides information about bond markets. It defines key terms like international bonds, domestic bonds, Eurobonds, and foreign bonds. It discusses the different types of international bonds and how they are classified. It also outlines the common process for issuing bonds and describes some of the main instruments and risks associated with international bond markets. Various data on outstanding bond amounts by major instruments, issuers, currencies is presented. The advantages and disadvantages of international bonds for both companies and investors are summarized.

Depository receipts- ADR and GDR covered in this ppt

The document discusses depositary receipts, which allow foreign companies to have their shares traded on domestic exchanges. A depositary receipt is issued by a bank and represents shares of a foreign company that are held in custody overseas. There are two main types: American Depository Receipts (ADRs), which trade on US exchanges, and Global Depository Receipts (GDRs), which trade internationally. The document then provides details on the meaning and features of ADRs and GDRs, where they are listed, and which banks commonly issue them.

Foreign exchange market-final ppt(my)

The foreign exchange market or forex market as it is often called is the market in which currencies are traded.

Currency Trading is the world’s largest market consisting of almost trillion in daily volumes

The market continues to rapidly grow. Not only is the forex market the largest market in the world, but it is also the most liquid, differentiating it from the other markets.

There is no central marketplace for the exchange of currency, but instead the trading is conducted over-the-counter.

This decentralization of the market allows traders to choose from a number of different dealers to make trades with and allows for comparison of prices. Typically, the larger a dealer is the better access they have to pricing at the largest banks in the world, and are able to pass that on to their clients.

The spot currency market is open twenty-four hours a day, five days a week, with currencies being traded around the world in all of the major financial centers.

All trades that take place in the foreign exchange market involve the buying of one currency and the selling of another currency simultaneously. This is because the value of one currency is determined by its comparison to another currency.

The first currency of a currency pair is called the “base currency,” while the second currency is called the counter currency. The currency pair shows how much of the counter currency is needed to purchase one unit of the base currency.

Currency pairs can be thought of as a single unit that can be bought or sold. When purchasing a currency pair, the base currency is being bought, while the counter currency is being sold.

Forex Capital Markets (FXCM) is an online currency trading firm that offers a free demo account to traders who are new and interested in the foreign exchange market.

It allows you to experience every step of currency trading including choosing currency pairs, deciding how much risk to take, tracking the time and dates of placed trades, deciding how long to stay in the trade, and when to exit the trade. It also allows the placing of stop and limit orders on trades.

Information about trading and specifically about how to use the online trading platform can be found on the FXCM webpage. In addition, FXCM offers FREE interactive online seminars that are extremely useful to both new and experienced currency traders.

Characteristics of foreign exchange

Its huge trading volume representing the largest asset class in the world leading to high liquidity;

Its geographical dispersion;

Its continuous operation: 24 hours a day except weekends, i.e., trading from 20:15 GMT on Sunday until 22:00 GMT Friday;

The variety of factors that affect exchange rates;

The low margins of relative profit compared with other markets of fixed income;

The use of leverage to enhance profit and loss margins and with respect to account size.

Primary and Secondary market

the detail about primary and secondary market for BBS final Year students of finance stream. comple detail about unit 2

Call and put Options

This document provides an overview of call and put options, including:

- Call options give the buyer the right to purchase an underlying asset at a specified strike price. Put options give the buyer the right to sell an underlying asset at a specified strike price.

- Options have an expiration date and are used for speculation or hedging. Speculators try to profit from price changes, while hedgers use options to reduce risk.

- The value of an option depends on the value of the underlying asset and volatility. At expiration, call options are worth the maximum of the asset price minus strike price and zero. Put options are worth the maximum of strike price minus asset price and zero.

- Buy

Options

The document provides an introduction to corporate finance options, including:

- A brief history of options and their use in ancient Greece.

- Current options markets and regulators.

- Key terminology related to options contracts.

- The main types of options - calls and puts.

- Common valuation methods and strategies for options positions, including bullish, bearish, and neutral strategies.

Bond immunization

Bond immunization is an investment strategy used to minimize the impact of interest rate changes on bond portfolios. It works by adjusting the portfolio duration to match the investor's time horizon. When a portfolio is immunized, its duration equals the investor's time horizon. Maintaining an immunized portfolio requires rebalancing the average duration whenever interest rates change, to keep it equal to the investor's time horizon. This offsets losses from falling bond prices against gains from reinvesting coupon payments at higher rates.

Foreign Exchange Markets

The ppt gives a description of how different theories define working of forex market. ?

when & where do these theories fail?

What is the impact of macro-economic factors like inflation, unemployment etc on forex exchange.?

A nicely formatted presentation.

What are the different types of forex market?

International Financial Markets

This document provides an overview of international financial markets, including:

- The foreign exchange, Eurocurrency, Eurocredit, Eurobond, and international stock markets. It describes the background and corporate use of each.

- The motives for companies and investors to use international financial markets, such as taking advantage of interest rate differences or currency fluctuations between countries.

- Key concepts related to each market, including how foreign exchange rates are established, the roles of major banks, types of bonds and loans offered, and considerations for companies issuing stock internationally.

- A chart illustrating the typical foreign cash flows of a multinational corporation and how the various international financial markets facilitate trade, investment, and financing activities.

Foreign exchange risk and exposure

Foreign exchange risk and exposure refer to how changes in exchange rates can affect the value of a firm's assets, liabilities, and profits. Exposure is the sensitivity of a firm's value to exchange rate changes, while risk is the variability of a firm's value due to uncertain exchange rate changes. There are three main types of exposures - transaction, translation, and economic. Firms can use hedging strategies like forward contracts and options to manage their foreign exchange risk and exposure by locking in exchange rates for future transactions.

forward and future contract

A forward contract is a customized agreement between two parties to buy or sell an asset at a predetermined future date and price, with no upfront payment required. It is used primarily for hedging and has counterparty risk.

A futures contract is a standardized agreement traded on a futures exchange to buy or sell an underlying asset at a predetermined future date and price, with an initial margin payment required. It is used more for speculation and has low counterparty risk due to clearing house guarantees.

The key differences are that forward contracts are customized over-the-counter agreements while futures contracts are standardized exchange-traded agreements, with futures requiring an initial margin and having a clearing house to reduce counterparty risk.

Factoring and forfaiting

This document provides an overview of factoring and forfaiting. It defines factoring as the sale of book debts by a firm to a financial institution, with the factor paying for the debts as they are collected. Forfaiting is similar but deals specifically with receivables from deferred payment exports. The key parties in each transaction and services provided are described. The document also compares factoring to bills discounting and forfaiting, outlines the various types of factoring, and summarizes the mechanics and stages involved in domestic and export factoring as well as forfaiting transactions.

Derivative - Forward and future contract

This document provides an overview of derivative contracts, specifically forward and future contracts. It defines derivatives and describes how forward contracts are bilateral agreements between two parties to buy or sell an asset at a future date for a predetermined price. Future contracts are similar to forwards but are standardized and exchange-traded. The key differences between forwards and futures highlighted are that futures are traded on exchanges, require margin payments, follow daily settlement marked to market, and can be closed prior to delivery, whereas forwards are customized OTC contracts.

International bond market

This document summarizes the international bond market. It defines international bonds as bonds issued in a currency other than that of the investor or broker, including eurobonds issued in a foreign currency and foreign bonds issued by a foreign government or corporation. International bonds are further classified as euro bonds denominated in a currency but sold internationally, foreign bonds offered by a foreign borrower domestically, and global bonds issued and traded outside the currency's home country. The document also lists some key features and types of international bonds such as corporate bonds, government bonds, zero-coupon bonds, convertible bonds, and floating rate notes.

Derivatives in India

Derivatives emerged to help farmers and traders manage risks and have since become important risk management tools. The derivatives market in India has grown significantly since liberalization in the 1990s. Derivatives allow participants to hedge risks, speculate, and engage in arbitrage. Common derivatives contracts include forwards, futures, options, and swaps. Traders use various strategies like spreads and straddles to limit risks and maximize returns based on their market outlook. While still growing, India's derivatives market is becoming a major global exchange.

International arbitrage

Locational, triangular, and covered interest arbitrage help ensure efficiency in foreign exchange markets. Locational arbitrage exploits price differences between banks. Triangular arbitrage exploits deviations from cross rates. Covered interest arbitrage exploits interest rate differences between countries and hedges against exchange rate risk. These forms of arbitrage eliminate pricing inefficiencies and bring markets to equilibrium.

INTERNATIONAL ARBITRAGE & INTEREST RATE PARITY

1) International arbitrage involves capitalizing on price discrepancies between currencies in different locations without taking on risk. Locational arbitrage occurs when a currency can be bought cheaper in one location and immediately sold at a higher price elsewhere.

2) Triangular arbitrage exploits temporary differences between cross-exchange rates of three currencies. Covered interest arbitrage takes advantage of interest rate differentials between countries while hedging against exchange rate risk.

3) Interest rate parity exists when the forward exchange rate offsets the interest rate advantage of one country over another, eliminating riskless profits from covered interest arbitrage. This equalizes returns between countries.

More Related Content

What's hot

FIM - Credit Derivatives PPT

The document discusses credit derivatives and the credit derivatives market in India. It provides information on different types of credit derivatives including credit default swaps (CDS), credit linked notes (CLN), and credit spread options (CSO). It then discusses the growth of the CDS market globally and the composition of the credit derivatives market. It outlines the benefits of credit derivatives for banks and other financial institutions in India. Finally, it discusses the role of the Clearing Corporation of India in facilitating CDS trading and settlement and provides details on the first CDS trades in India in 2011.

Ifm problems

An American investor purchased securities in the Indian market investing $1 million USD. The document calculates the rate of return for the investor under different scenarios where the annual return on the Indian securities is 20%, 25%, and 50%. It also considers a second problem where an American investor wants to invest in Indian securities with a given beta and calculates the expected rate of return and risk. The document then provides exchange rate calculations and examples involving cross rates, spot rates, forward rates, and premiums/discounts. It summarizes international financial management concepts.

International financial market & instruments module 3

This document provides an overview of international financial markets. It discusses how financial markets facilitate the transfer of funds across borders between lenders and borrowers in different countries. The key segments of international financial markets include international bond markets, equity markets, money markets, credit markets, and foreign exchange markets. Different types of international bonds are described such as foreign bonds, eurobonds, and global bonds. The document also outlines various money market instruments like euro notes, commercial paper, and certificates of deposit.

Swap

Swap is an agreement between two parties to exchange cash flows over time. The key types of swaps discussed in the document are interest rate swaps, currency swaps, and credit default swaps. Interest rate swaps involve the exchange of interest payments in the same currency, while currency swaps exchange payments in different currencies and may also exchange principal amounts. Credit default swaps provide credit protection to the buyer in the event of default by a reference entity. Swaps are used for hedging risks and reducing borrowing costs.

Financial derivatives

Derivatives are financial instruments whose value is derived from an underlying asset such as a commodity, currency, bond, or stock. There are several types of derivatives including forwards, futures, and options. A forward is a customized contract where the buyer agrees to purchase an asset at a set price on a future date. Futures are standardized forward contracts that are exchange-traded. Options provide the right but not the obligation to buy or sell the underlying asset at a predetermined price on or before the expiration date.

International bond market ppt

This document provides information about bond markets. It defines key terms like international bonds, domestic bonds, Eurobonds, and foreign bonds. It discusses the different types of international bonds and how they are classified. It also outlines the common process for issuing bonds and describes some of the main instruments and risks associated with international bond markets. Various data on outstanding bond amounts by major instruments, issuers, currencies is presented. The advantages and disadvantages of international bonds for both companies and investors are summarized.

Depository receipts- ADR and GDR covered in this ppt

The document discusses depositary receipts, which allow foreign companies to have their shares traded on domestic exchanges. A depositary receipt is issued by a bank and represents shares of a foreign company that are held in custody overseas. There are two main types: American Depository Receipts (ADRs), which trade on US exchanges, and Global Depository Receipts (GDRs), which trade internationally. The document then provides details on the meaning and features of ADRs and GDRs, where they are listed, and which banks commonly issue them.

Foreign exchange market-final ppt(my)

The foreign exchange market or forex market as it is often called is the market in which currencies are traded.

Currency Trading is the world’s largest market consisting of almost trillion in daily volumes

The market continues to rapidly grow. Not only is the forex market the largest market in the world, but it is also the most liquid, differentiating it from the other markets.

There is no central marketplace for the exchange of currency, but instead the trading is conducted over-the-counter.

This decentralization of the market allows traders to choose from a number of different dealers to make trades with and allows for comparison of prices. Typically, the larger a dealer is the better access they have to pricing at the largest banks in the world, and are able to pass that on to their clients.

The spot currency market is open twenty-four hours a day, five days a week, with currencies being traded around the world in all of the major financial centers.

All trades that take place in the foreign exchange market involve the buying of one currency and the selling of another currency simultaneously. This is because the value of one currency is determined by its comparison to another currency.

The first currency of a currency pair is called the “base currency,” while the second currency is called the counter currency. The currency pair shows how much of the counter currency is needed to purchase one unit of the base currency.

Currency pairs can be thought of as a single unit that can be bought or sold. When purchasing a currency pair, the base currency is being bought, while the counter currency is being sold.

Forex Capital Markets (FXCM) is an online currency trading firm that offers a free demo account to traders who are new and interested in the foreign exchange market.

It allows you to experience every step of currency trading including choosing currency pairs, deciding how much risk to take, tracking the time and dates of placed trades, deciding how long to stay in the trade, and when to exit the trade. It also allows the placing of stop and limit orders on trades.

Information about trading and specifically about how to use the online trading platform can be found on the FXCM webpage. In addition, FXCM offers FREE interactive online seminars that are extremely useful to both new and experienced currency traders.

Characteristics of foreign exchange

Its huge trading volume representing the largest asset class in the world leading to high liquidity;

Its geographical dispersion;

Its continuous operation: 24 hours a day except weekends, i.e., trading from 20:15 GMT on Sunday until 22:00 GMT Friday;

The variety of factors that affect exchange rates;

The low margins of relative profit compared with other markets of fixed income;

The use of leverage to enhance profit and loss margins and with respect to account size.

Primary and Secondary market

the detail about primary and secondary market for BBS final Year students of finance stream. comple detail about unit 2

Call and put Options

This document provides an overview of call and put options, including:

- Call options give the buyer the right to purchase an underlying asset at a specified strike price. Put options give the buyer the right to sell an underlying asset at a specified strike price.

- Options have an expiration date and are used for speculation or hedging. Speculators try to profit from price changes, while hedgers use options to reduce risk.

- The value of an option depends on the value of the underlying asset and volatility. At expiration, call options are worth the maximum of the asset price minus strike price and zero. Put options are worth the maximum of strike price minus asset price and zero.

- Buy

Options

The document provides an introduction to corporate finance options, including:

- A brief history of options and their use in ancient Greece.

- Current options markets and regulators.

- Key terminology related to options contracts.

- The main types of options - calls and puts.

- Common valuation methods and strategies for options positions, including bullish, bearish, and neutral strategies.

Bond immunization

Bond immunization is an investment strategy used to minimize the impact of interest rate changes on bond portfolios. It works by adjusting the portfolio duration to match the investor's time horizon. When a portfolio is immunized, its duration equals the investor's time horizon. Maintaining an immunized portfolio requires rebalancing the average duration whenever interest rates change, to keep it equal to the investor's time horizon. This offsets losses from falling bond prices against gains from reinvesting coupon payments at higher rates.

Foreign Exchange Markets

The ppt gives a description of how different theories define working of forex market. ?

when & where do these theories fail?

What is the impact of macro-economic factors like inflation, unemployment etc on forex exchange.?

A nicely formatted presentation.

What are the different types of forex market?

International Financial Markets

This document provides an overview of international financial markets, including:

- The foreign exchange, Eurocurrency, Eurocredit, Eurobond, and international stock markets. It describes the background and corporate use of each.

- The motives for companies and investors to use international financial markets, such as taking advantage of interest rate differences or currency fluctuations between countries.

- Key concepts related to each market, including how foreign exchange rates are established, the roles of major banks, types of bonds and loans offered, and considerations for companies issuing stock internationally.

- A chart illustrating the typical foreign cash flows of a multinational corporation and how the various international financial markets facilitate trade, investment, and financing activities.

Foreign exchange risk and exposure

Foreign exchange risk and exposure refer to how changes in exchange rates can affect the value of a firm's assets, liabilities, and profits. Exposure is the sensitivity of a firm's value to exchange rate changes, while risk is the variability of a firm's value due to uncertain exchange rate changes. There are three main types of exposures - transaction, translation, and economic. Firms can use hedging strategies like forward contracts and options to manage their foreign exchange risk and exposure by locking in exchange rates for future transactions.

forward and future contract

A forward contract is a customized agreement between two parties to buy or sell an asset at a predetermined future date and price, with no upfront payment required. It is used primarily for hedging and has counterparty risk.

A futures contract is a standardized agreement traded on a futures exchange to buy or sell an underlying asset at a predetermined future date and price, with an initial margin payment required. It is used more for speculation and has low counterparty risk due to clearing house guarantees.

The key differences are that forward contracts are customized over-the-counter agreements while futures contracts are standardized exchange-traded agreements, with futures requiring an initial margin and having a clearing house to reduce counterparty risk.

Factoring and forfaiting

This document provides an overview of factoring and forfaiting. It defines factoring as the sale of book debts by a firm to a financial institution, with the factor paying for the debts as they are collected. Forfaiting is similar but deals specifically with receivables from deferred payment exports. The key parties in each transaction and services provided are described. The document also compares factoring to bills discounting and forfaiting, outlines the various types of factoring, and summarizes the mechanics and stages involved in domestic and export factoring as well as forfaiting transactions.

Derivative - Forward and future contract

This document provides an overview of derivative contracts, specifically forward and future contracts. It defines derivatives and describes how forward contracts are bilateral agreements between two parties to buy or sell an asset at a future date for a predetermined price. Future contracts are similar to forwards but are standardized and exchange-traded. The key differences between forwards and futures highlighted are that futures are traded on exchanges, require margin payments, follow daily settlement marked to market, and can be closed prior to delivery, whereas forwards are customized OTC contracts.

International bond market

This document summarizes the international bond market. It defines international bonds as bonds issued in a currency other than that of the investor or broker, including eurobonds issued in a foreign currency and foreign bonds issued by a foreign government or corporation. International bonds are further classified as euro bonds denominated in a currency but sold internationally, foreign bonds offered by a foreign borrower domestically, and global bonds issued and traded outside the currency's home country. The document also lists some key features and types of international bonds such as corporate bonds, government bonds, zero-coupon bonds, convertible bonds, and floating rate notes.

Derivatives in India

Derivatives emerged to help farmers and traders manage risks and have since become important risk management tools. The derivatives market in India has grown significantly since liberalization in the 1990s. Derivatives allow participants to hedge risks, speculate, and engage in arbitrage. Common derivatives contracts include forwards, futures, options, and swaps. Traders use various strategies like spreads and straddles to limit risks and maximize returns based on their market outlook. While still growing, India's derivatives market is becoming a major global exchange.

What's hot (20)

International financial market & instruments module 3

International financial market & instruments module 3

Depository receipts- ADR and GDR covered in this ppt

Depository receipts- ADR and GDR covered in this ppt

Viewers also liked

International arbitrage

Locational, triangular, and covered interest arbitrage help ensure efficiency in foreign exchange markets. Locational arbitrage exploits price differences between banks. Triangular arbitrage exploits deviations from cross rates. Covered interest arbitrage exploits interest rate differences between countries and hedges against exchange rate risk. These forms of arbitrage eliminate pricing inefficiencies and bring markets to equilibrium.

INTERNATIONAL ARBITRAGE & INTEREST RATE PARITY

1) International arbitrage involves capitalizing on price discrepancies between currencies in different locations without taking on risk. Locational arbitrage occurs when a currency can be bought cheaper in one location and immediately sold at a higher price elsewhere.

2) Triangular arbitrage exploits temporary differences between cross-exchange rates of three currencies. Covered interest arbitrage takes advantage of interest rate differentials between countries while hedging against exchange rate risk.

3) Interest rate parity exists when the forward exchange rate offsets the interest rate advantage of one country over another, eliminating riskless profits from covered interest arbitrage. This equalizes returns between countries.

Arbitrage

The document summarizes the concept of arbitrage using a story about a "Chaalu Chaiwala". The Chaiwala realized he could buy tea for Rs. 2 from a government canteen and sell it for Rs. 5 at his shop, making a profit of Rs. 3 instead of Rs. 1. This practice of buying low and selling high in different markets is called arbitrage. However, arbitrage opportunities do not last long as information spreads and others copy the strategy, eliminating the price difference. In this case, an assistant revealed the Chaiwala's strategy, it stopped working the next day as prices evened out across markets.

Understanding Arbitrage

The document defines and provides an example of arbitrage.

A tea seller realized he could buy tea for Rs. 2 from a government canteen and sell it for Rs. 5 at his shop, making Rs. 3 profit per cup instead of Rs. 1. This practice of buying low in one market and selling high in another is called arbitrage. However, as word spread of the opportunity, it disappeared as the price difference equalized. The story illustrates that arbitrage opportunities are temporary as information sharing makes prices converge.

Forex Market

The document discusses various concepts related to foreign exchange markets including exchange rates, direct and indirect quotes, bid and ask rates, spot and forward rates, and arbitrage opportunities.

Some key points:

- Exchange rates represent the price of one currency in terms of another currency. Direct quotes show the domestic currency price of one unit of foreign currency, while indirect quotes show the amount of domestic currency per unit of foreign currency.

- Bid and ask rates refer to the rates at which banks are willing to buy and sell currencies. The spread is the difference between these rates.

- Spot rates are for immediate settlement, while forward rates are contracted today for exchange at a future date and may involve a premium or discount.

foreign exchange

Foreign exchange markets allow for the trading of one country's currency for another. This facilitates international trade and investment. The global foreign exchange market consists of major international banks trading various currencies. The major currencies traded are the US dollar, euro, yen, and pound. Arbitrage opportunities can exist when temporary price discrepancies allow traders to profit from buying low and selling high across different currency exchanges.

Arbitrage in Stock Futures

This document is a project report on arbitrage profit in stock futures submitted by students of Jaipuria Institute of Management, Lucknow. It begins with an acknowledgment section thanking the project guide. It then provides an introduction to stock futures and the concept of arbitrage opportunities that can arise from pricing mismatches between the futures and spot markets. The report presents the students' analysis of arbitrage profit opportunities in Bajaj-Auto stock futures over the past 24 months, including regression analysis showing factors like time to maturity that influence arbitrage profit. The conclusion states that while arbitrage funds carry less risk than equities, they are not entirely risk-free as mispricing can still occur.

Interest rate parity (Global Finance)

Interest rate parity is a theory stating that the interest rate differential between two countries should equal the forward exchange rate premium or discount relative to the spot exchange rate. This establishes a break-even condition where returns on domestic and foreign currency investments are equal after accounting for exchange risk. If interest rate parity is violated, an arbitrage opportunity exists where investors can borrow, invest, and exchange currencies to earn risk-free profits. Kim Deal, a European portfolio manager, should choose to invest in 1-year Japanese yen deposits covered by a 1-year forward contract to hedge exchange risk, as this option provides the highest euro return of €352,005 compared to €352,000 from euro deposits.

SPECULATION,TYPES OF SPECULATOR,FUNCTIONS & THEIR ROLE IN STOCK MARKET

The document presents information on speculation, types of speculators, and their role in the stock market. It defines speculation as a financial action that does not provide safety of initial investment or return of principal, and typically involves lending money to purchase assets or debt without thorough analysis or a high risk of losing money. In contrast, investment promises safety of principal and a satisfactory return after analysis. Speculators have a shorter planning horizon, are willing to assume high risk, expect high returns, and may rely on hearsay instead of fundamentals when making decisions. They also tend to use leverage through borrowing funds.

Arbitration & its types

This document discusses arbitration and provides details on various aspects of the arbitration process. It begins with an introduction defining arbitration as an impartial third party making a binding decision to resolve a dispute between two parties. It then covers arbitral and non-arbitral disputes, the duties of an arbitrator, benefits and drawbacks of arbitration, and different types of arbitration including voluntary, compulsory, ad-hoc, institutional, statutory, domestic, international and foreign arbitration. The document also provides an overview of arbitration in India, noting key organizations like the Indian Council of Arbitration and provisions in the Arbitration and Conciliation Act of 1996.

Foreign exchange market and it's structure in india

The document discusses the structure and features of the foreign exchange market. It begins by defining foreign exchange and describing the major participants in the exchange market, including commercial banks, money changers, and the Foreign Exchange Dealers Association of India (FEDAI). It then outlines the roles and regulations of various authorized entities that can participate in the market, such as authorized dealers and restricted authorized dealers. Finally, it discusses key characteristics of the foreign exchange market, including that it is a 24-hour global market connected by communication channels with a daily turnover of $2.75-3 trillion.

The Foreign Exchange Market

The document discusses the foreign exchange market and its evolution from the gold standard to fixed exchange rates to the current floating exchange rate system. It provides details on the Bretton Woods Agreement which established fixed exchange rates between currencies from 1944 to 1971. It then describes how the US dollar became overvalued leading countries to abandon fixed rates and transition to a floating exchange rate system.

Training The Brain 4 Recent Developments Neglect

Part of training the brain series focused on Complex Regional Pain Syndrome (CRPS) but relevant to all types of pain.

Foreign exchange market

The foreign exchange market allows individuals, banks, and firms to buy and sell currencies. It operates globally through telecommunications and includes spot, forward, futures, swap, and options contracts. Major participants include commercial banks, central banks, brokers, importers/exporters, speculators, and hedgers. The market facilitates international trade and investment by enabling currency exchange.

Solubility Products

Discusses the chemical of slightly soluble compounds. Ksp and factors affecting solubility are included as well as solved problems.

**More good stuff available at:

www.wsautter.com

and

http://www.youtube.com/results?search_query=wnsautter&aq=f

Foreign Exchange Market

Axis Ltd, a European company, hedges against adverse currency movements by entering forward exchange contracts after the euro plunges against the dollar, causing lost revenues from prices set in euros. The foreign exchange market allows conversion of one currency to another and helps reduce risk through tools like forward exchange rates, currency swaps, and hedging. Exchange rates are determined by demand and supply of currencies as well as theories including purchasing power parity and interest rate differentials.

Foreign Exchange Market

The document provides an overview of the foreign exchange market and the Reserve Bank of India's (RBI) role in managing it. It discusses the basic concepts and participants in the FX market. It describes the historical evolution from a fixed exchange rate regime to a more liberalized and market-based system. It also outlines the RBI's tools for intervening in the interbank market to influence exchange rates and maintain stability, including through moral suasion, relaxing exposure limits, and direct buying and selling of currencies.

Viewers also liked (20)

SPECULATION,TYPES OF SPECULATOR,FUNCTIONS & THEIR ROLE IN STOCK MARKET

SPECULATION,TYPES OF SPECULATOR,FUNCTIONS & THEIR ROLE IN STOCK MARKET

Foreign exchange market and it's structure in india

Foreign exchange market and it's structure in india

Similar to Currency arbitrage

Chap020.ppt

This document provides an overview of key concepts and topics related to international corporate finance that are covered in Chapter 20, including understanding exchange rates, purchasing power parity, interest rate parity, international capital budgeting, exchange rate risk, and political risk. The chapter outline lists the specific sections and subsections that will be covered. These include foreign exchange markets, spot and forward rates, triangular arbitrage, and equilibrium exchange rate relationships. International capital budgeting techniques like the home currency approach are also introduced.

L Pch17

The document discusses several macroeconomic concepts:

1. Gross Domestic Product (GDP) is the total value of goods and services produced in an economy and has four components: consumption, investment, government spending, and net trade.

2. Economic indicators can be leading, coincident, or lagging in relation to the business cycle.

3. Fiscal policy involves government taxation and spending while monetary policy involves central bank actions to control money supply and interest rates.

4. Stock market indices are leading indicators of business cycles.

A-4-2-Lecture in International Finance (1).ppt

The document provides an overview of an international finance lecture given by Dr. Foued Ayari. It introduces Dr. Ayari's background and qualifications. The lecture outline covers major topics in foreign exchange markets including the FX market structure, spot and forward rates, currency swaps, and FX strategies. Key aspects of the FX market are defined, such as the OTC market structure, major participants like international banks, and 24/7 global trading.

18-Copyright © 2014 by the McGraw-Hill Companies, Inc. .docx

18-*

Copyright © 2014 by the McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

18-*

Key Concepts and Skills

Understand How exchange rates are quoted and what they meanThe difference between spot and forward ratesPurchasing power parity and interest rate parity and the implications for changes in exchange ratesThe types of exchange rate risk and how it can be managedThe impact of political risk on international business investing

*

18-*

Chapter Outline

18.1 Terminology

18.2 Foreign Exchange Markets and Exchange Rates

18.3 Purchasing Power Parity

18.4 Exchange Rates and Interest Rates

18.5 Exchange Rate Risk

18.6 Political Risk

*

18-*

International Finance TerminologyAmerican Depositary Receipt (ADR)Security issued in the U.S. representing shares of a foreign stockCan be traded in the U.S.Cross-rateImplicit exchange rate between two currencies when both are quoted in a third (usually dollars) currency.EurobondBond issued in multiple countries but denominated in the issuer’s home currency

*

18-*

International Finance TerminologyEurocurrency (Eurodollars)Money deposited in a financial center outside the country of the currency involved“Eurodollars” = dollar-denominated deposits in banks outside the U.S. banking systemForeign bondsSold by foreign borrowerDenominated in currency of the country of issueGiltsBritish and Irish government securities

*

18-*

International Finance TerminologyLondon Interbank Offer Rate (LIBOR)Rate international banks charge each other for loans of Eurodollars overnight in the London marketFrequently used as a benchmark rate for money market instrumentsSwapsInterest rate swap = two parties exchange a floating-rate payment for a fixed-rate paymentCurrency swap = agreement to deliver one currency in exchange for another

*

18-*

Global Capital MarketsNumber of exchanges in foreign countries continues to increase, as does the liquidity on those exchangesExchanges facilitate the flow of capital Extremely important to developing countriesDifferences:Market StructureRegulationTrading rulesUnited States = most developed capital markets in the world, but:Foreign markets becoming more competitive Often more willing to innovate

*

18-*

Example: Work the WebThinking about going to Mexico for spring break or Japan for your summer vacation?How many pesos or yen can you get in exchange for $1,000?Click on the Web surfer to find out

*

18-*

FOREX TradingForeign Exchange Largest financial market in the worldTrading = 24/7 over-the-counterMost trading in USD, £, ¥, and €FOREX quotations:Direct = USD per foreign currencyIndirect = Units of foreign currency per USD

*

18-*

Foreign Exchange Quotes

*

18-*

Exchange RatesThe price of one country’s currency in terms of anotherMost currency quoted in terms of dollarsDirect Quotation = price of foreign currency expressed in U.S. dollars. (dollars per currency); Figure 18.1 “in US$”Indirect quotation ...

Chap022

This document discusses international finance concepts including exchange rates, forward rates, purchasing power parity, interest rate parity, and exchange rate risk. It provides examples and explanations of these topics. For instance, it explains that if the yen spot price is 108.173 yen per dollar and the 1-year forward rate is 111.715 yen per dollar, then the dollar is selling at a 3.27% premium relative to the yen. It also works through examples of calculating forward rates and converting cash flows between currencies.

Numericals on IF.pptx

Airbus sold an aircraft to an American company for $30 million payable in six months. To hedge against currency risk, Airbus considered three options: a forward contract, money market hedge, or put options.

If Airbus used a forward contract with a rate of $1.10/Euro, their guaranteed euro proceeds would be $30 million / $1.10 per euro = Euro 27.27 million. Using money market instruments, Airbus would deposit dollars at 3% interest and euros at 2.5% interest to receive Euro 27.27 million. With put options costing $0.02 per euro and a strike of $0.95/euro, Airbus's expected euro proceeds

Forex Terms 101

Ever wondered what "trading forex" means? For starters, forex is the largest financial market in the world. Learn the must-know basics in this slide deck!

ch 26; intl fin mgmt intro

This document provides an overview of key concepts in multinational financial management. It discusses factors that distinguish multinational financial management, international monetary systems, exchange rates, interest rate parity, purchasing power parity, and the impact of relative inflation on interest rates and exchange rates. Multinational corporations operate in multiple countries and seek new markets, resources, and efficiencies through international expansion.

ForexMaster functions and terms

This document provides an overview of key forex trading concepts including currency pairs, buying and selling currencies, account components like profit/loss and cash value, using leverage through margin trading, calculating profit/loss on trades, commission fees, and performance metrics. It explains that currencies are always traded in pairs, buying a currency means you are interacting with the base currency, and selling is the opposite. It also defines important terms and provides examples of calculating P&L on trades.

Lf 2021 rates_viii

The document discusses foreign exchange (FX) market concepts and notations. It introduces a rigorous notation system to index currencies using integers and define spot FX rates between currencies. It defines the usual market convention for quoting currency pairs and relates this to the introduced notation. The document also discusses the FX correlation triangle and how volatility relationships can be derived between currency pairs using properties of geometric Brownian motion processes and Ito's lemma.

FM2 Session 8 & 9 - International Corporate Finance (1).pdf

This document discusses several key concepts in international corporate finance:

1) It outlines key topics like foreign exchange markets, exchange rates, purchasing power parity, interest rate parity, and exchange rate risk.

2) It explains how exchange rates are quoted, the difference between spot and forward rates, and theories like PPP, interest rate parity, and the international Fisher effect that aim to explain exchange rate movements.

3) It illustrates the different types of exchange rate risk multinational firms face and methods they use to manage exchange rate risk, as well as the impact of political risk on international investments.

Risk & return cf presentaion

The document discusses key financial concepts including:

1) The primary goal of financial management is maximizing shareholder wealth through stock price appreciation. This is achieved by forecasting, investment decisions, coordination, and managing risk.

2) Risk is the probability that investment returns differ from expectations. There are various types of risk including market, business, liquidity, exchange rate, country, and interest rate risk.

3) Portfolio risk is determined not just by the risk of individual holdings, but also their covariance—how their returns move together. A portfolio's risk can be lower than its components' risks through diversification.

FX Risk Exposure, Measurement and Management.pdf

This document discusses foreign currency risk management. It provides information on various topics related to foreign exchange including: how to convert currencies and how currencies fluctuate due to factors like supply and demand, speculation, exports/imports, and foreign direct investment. It also discusses purchasing power parity, interest rate parity, and the Fisher effect as they relate to how currencies fluctuate. The document outlines different types of foreign exchange risk like transaction risk and translation risk. It then describes various hedging methods for managing foreign exchange risk both internally, such as invoice matching, and externally using tools like forward contracts, futures contracts, and money market hedging.

Mgnt 4670 Ch 10 Foreign Exchange Fall 2007)

The document discusses the foreign exchange market and concepts related to currency conversion and hedging foreign exchange risk. It defines key terms like spot exchange rate, forward exchange rate, currency appreciation/depreciation, and discusses how forward contracts can be used to lock in exchange rates and insure against future currency fluctuations. Examples are provided to illustrate currency conversion calculations and how forward contracts can protect companies from losses due to unexpected currency movements.

Arbitrage (Practical Problems).pdf

The definition we used presents the ideal view of (riskless) arbitrage. “Arbitrage,” in the

real world, involves some risk (the lower, the closer to the pure definition of arbitrage). We will

call this arbitrage pseudo arbitrage.

ifrs 3

The document discusses foreign currency concepts and transactions accounting. It introduces key definitions like functional currency, spot rates, and foreign currency transactions. It explains how to account for purchases and sales denominated in foreign currencies, including translating the transactions at the spot rate on the transaction date and adjusting for changes in rates until settlement. It also covers accounting for foreign currency derivatives like forward contracts, including their use for hedging and speculation purposes.

Market Risk Modelling

This document discusses various techniques for modeling market risk and estimating volatility, including calculating volatility, exponentially weighted moving average models, GARCH models, Greeks (delta, gamma, theta, vega, rho), value at risk using variance-covariance and Monte Carlo simulation methods, and historical simulation. Key concepts covered include estimating and updating volatility, incorporating mean reversion in models, hedging positions to achieve gamma and vega neutrality, and calculating value at risk over different time horizons using variance-covariance, Monte Carlo simulation, and historical simulation approaches.

International-Financial-Management.pptx

The document contains sample questions and problems from chapters in a textbook on international financial management.

In the first section, it provides context about the US current account deficit and Japan's surplus. It then presents a cross-currency arbitrage problem and asks about opportunities.

The second section describes an importer's options to hedge currency risk on a shipment from the UK, which is expected to appreciate. It asks about using forwards and calculates the no-arbitrage forward price.

The document continues with additional practice problems covering topics like covered interest rate parity, currency option valuation, and hedging transaction exposure.

First, we need to forecast exchange rates for the next three years..pdf

First, we need to forecast exchange rates for the next three years.

Future rate (€/$) = Current rate (€/$) x (1 + rate (€)) / (1 + rate ($))

For year 1, rate = 0.500 x (1 + 7%) / (1 + 5%) = 0.510 and so on...

Now, convert the dollar cash flows in euro cash flows with the corresponding exchange rate.

Cash Flow ($) = Cash Flow (€) / rate (€/$)

NPV ($) = - CF0 + CF1 / (1 + r) + CF2 / (1 + r)^2 + CF3 / (1 + r)^3

= - 4,000,000 + 1,766,355 / (1 + 10%) + 1,733,339 / (1 + 10%)^2 + 1,700,940 / (1 + 10%)^3

= $316,230.720123€/$0.5000.5100.5190.529Cashflow (€)-€ 2,000,000€ 900,000€

900,000€ 900,000Cashflow ($)-$ 4,000,000$ 1,766,355$ 1,733,339$

1,700,940NPV$316,230.72

Solution

First, we need to forecast exchange rates for the next three years.

Future rate (€/$) = Current rate (€/$) x (1 + rate (€)) / (1 + rate ($))

For year 1, rate = 0.500 x (1 + 7%) / (1 + 5%) = 0.510 and so on...

Now, convert the dollar cash flows in euro cash flows with the corresponding exchange rate.

Cash Flow ($) = Cash Flow (€) / rate (€/$)

NPV ($) = - CF0 + CF1 / (1 + r) + CF2 / (1 + r)^2 + CF3 / (1 + r)^3

= - 4,000,000 + 1,766,355 / (1 + 10%) + 1,733,339 / (1 + 10%)^2 + 1,700,940 / (1 + 10%)^3

= $316,230.720123€/$0.5000.5100.5190.529Cashflow (€)-€ 2,000,000€ 900,000€

900,000€ 900,000Cashflow ($)-$ 4,000,000$ 1,766,355$ 1,733,339$

1,700,940NPV$316,230.72.

Similar to Currency arbitrage (20)

18-Copyright © 2014 by the McGraw-Hill Companies, Inc. .docx

18-Copyright © 2014 by the McGraw-Hill Companies, Inc. .docx

FM2 Session 8 & 9 - International Corporate Finance (1).pdf

FM2 Session 8 & 9 - International Corporate Finance (1).pdf

First, we need to forecast exchange rates for the next three years..pdf

First, we need to forecast exchange rates for the next three years..pdf

Recently uploaded

5th LF Energy Power Grid Model Meet-up Slides

5th Power Grid Model Meet-up

It is with great pleasure that we extend to you an invitation to the 5th Power Grid Model Meet-up, scheduled for 6th June 2024. This event will adopt a hybrid format, allowing participants to join us either through an online Mircosoft Teams session or in person at TU/e located at Den Dolech 2, Eindhoven, Netherlands. The meet-up will be hosted by Eindhoven University of Technology (TU/e), a research university specializing in engineering science & technology.

Power Grid Model

The global energy transition is placing new and unprecedented demands on Distribution System Operators (DSOs). Alongside upgrades to grid capacity, processes such as digitization, capacity optimization, and congestion management are becoming vital for delivering reliable services.

Power Grid Model is an open source project from Linux Foundation Energy and provides a calculation engine that is increasingly essential for DSOs. It offers a standards-based foundation enabling real-time power systems analysis, simulations of electrical power grids, and sophisticated what-if analysis. In addition, it enables in-depth studies and analysis of the electrical power grid’s behavior and performance. This comprehensive model incorporates essential factors such as power generation capacity, electrical losses, voltage levels, power flows, and system stability.

Power Grid Model is currently being applied in a wide variety of use cases, including grid planning, expansion, reliability, and congestion studies. It can also help in analyzing the impact of renewable energy integration, assessing the effects of disturbances or faults, and developing strategies for grid control and optimization.

What to expect

For the upcoming meetup we are organizing, we have an exciting lineup of activities planned:

-Insightful presentations covering two practical applications of the Power Grid Model.

-An update on the latest advancements in Power Grid -Model technology during the first and second quarters of 2024.

-An interactive brainstorming session to discuss and propose new feature requests.

-An opportunity to connect with fellow Power Grid Model enthusiasts and users.

AI 101: An Introduction to the Basics and Impact of Artificial Intelligence

Imagine a world where machines not only perform tasks but also learn, adapt, and make decisions. This is the promise of Artificial Intelligence (AI), a technology that's not just enhancing our lives but revolutionizing entire industries.

Cosa hanno in comune un mattoncino Lego e la backdoor XZ?

ABSTRACT: A prima vista, un mattoncino Lego e la backdoor XZ potrebbero avere in comune il fatto di essere entrambi blocchi di costruzione, o dipendenze di progetti creativi e software. La realtà è che un mattoncino Lego e il caso della backdoor XZ hanno molto di più di tutto ciò in comune.

Partecipate alla presentazione per immergervi in una storia di interoperabilità, standard e formati aperti, per poi discutere del ruolo importante che i contributori hanno in una comunità open source sostenibile.

BIO: Sostenitrice del software libero e dei formati standard e aperti. È stata un membro attivo dei progetti Fedora e openSUSE e ha co-fondato l'Associazione LibreItalia dove è stata coinvolta in diversi eventi, migrazioni e formazione relativi a LibreOffice. In precedenza ha lavorato a migrazioni e corsi di formazione su LibreOffice per diverse amministrazioni pubbliche e privati. Da gennaio 2020 lavora in SUSE come Software Release Engineer per Uyuni e SUSE Manager e quando non segue la sua passione per i computer e per Geeko coltiva la sua curiosità per l'astronomia (da cui deriva il suo nickname deneb_alpha).

Project Management Semester Long Project - Acuity

Acuity is an innovative learning app designed to transform the way you engage with knowledge. Powered by AI technology, Acuity takes complex topics and distills them into concise, interactive summaries that are easy to read & understand. Whether you're exploring the depths of quantum mechanics or seeking insight into historical events, Acuity provides the key information you need without the burden of lengthy texts.

Your One-Stop Shop for Python Success: Top 10 US Python Development Providers

Simplify your search for a reliable Python development partner! This list presents the top 10 trusted US providers offering comprehensive Python development services, ensuring your project's success from conception to completion.

June Patch Tuesday

Ivanti’s Patch Tuesday breakdown goes beyond patching your applications and brings you the intelligence and guidance needed to prioritize where to focus your attention first. Catch early analysis on our Ivanti blog, then join industry expert Chris Goettl for the Patch Tuesday Webinar Event. There we’ll do a deep dive into each of the bulletins and give guidance on the risks associated with the newly-identified vulnerabilities.

Taking AI to the Next Level in Manufacturing.pdf

Read Taking AI to the Next Level in Manufacturing to gain insights on AI adoption in the manufacturing industry, such as:

1. How quickly AI is being implemented in manufacturing.

2. Which barriers stand in the way of AI adoption.

3. How data quality and governance form the backbone of AI.

4. Organizational processes and structures that may inhibit effective AI adoption.

6. Ideas and approaches to help build your organization's AI strategy.

How to Get CNIC Information System with Paksim Ga.pptx

Pakdata Cf is a groundbreaking system designed to streamline and facilitate access to CNIC information. This innovative platform leverages advanced technology to provide users with efficient and secure access to their CNIC details.

HCL Notes und Domino Lizenzkostenreduzierung in der Welt von DLAU

Webinar Recording: https://www.panagenda.com/webinars/hcl-notes-und-domino-lizenzkostenreduzierung-in-der-welt-von-dlau/

DLAU und die Lizenzen nach dem CCB- und CCX-Modell sind für viele in der HCL-Community seit letztem Jahr ein heißes Thema. Als Notes- oder Domino-Kunde haben Sie vielleicht mit unerwartet hohen Benutzerzahlen und Lizenzgebühren zu kämpfen. Sie fragen sich vielleicht, wie diese neue Art der Lizenzierung funktioniert und welchen Nutzen sie Ihnen bringt. Vor allem wollen Sie sicherlich Ihr Budget einhalten und Kosten sparen, wo immer möglich. Das verstehen wir und wir möchten Ihnen dabei helfen!

Wir erklären Ihnen, wie Sie häufige Konfigurationsprobleme lösen können, die dazu führen können, dass mehr Benutzer gezählt werden als nötig, und wie Sie überflüssige oder ungenutzte Konten identifizieren und entfernen können, um Geld zu sparen. Es gibt auch einige Ansätze, die zu unnötigen Ausgaben führen können, z. B. wenn ein Personendokument anstelle eines Mail-Ins für geteilte Mailboxen verwendet wird. Wir zeigen Ihnen solche Fälle und deren Lösungen. Und natürlich erklären wir Ihnen das neue Lizenzmodell.

Nehmen Sie an diesem Webinar teil, bei dem HCL-Ambassador Marc Thomas und Gastredner Franz Walder Ihnen diese neue Welt näherbringen. Es vermittelt Ihnen die Tools und das Know-how, um den Überblick zu bewahren. Sie werden in der Lage sein, Ihre Kosten durch eine optimierte Domino-Konfiguration zu reduzieren und auch in Zukunft gering zu halten.

Diese Themen werden behandelt

- Reduzierung der Lizenzkosten durch Auffinden und Beheben von Fehlkonfigurationen und überflüssigen Konten

- Wie funktionieren CCB- und CCX-Lizenzen wirklich?

- Verstehen des DLAU-Tools und wie man es am besten nutzt

- Tipps für häufige Problembereiche, wie z. B. Team-Postfächer, Funktions-/Testbenutzer usw.

- Praxisbeispiele und Best Practices zum sofortigen Umsetzen

“Building and Scaling AI Applications with the Nx AI Manager,” a Presentation...

“Building and Scaling AI Applications with the Nx AI Manager,” a Presentation...Edge AI and Vision Alliance

For the full video of this presentation, please visit: https://www.edge-ai-vision.com/2024/06/building-and-scaling-ai-applications-with-the-nx-ai-manager-a-presentation-from-network-optix/

Robin van Emden, Senior Director of Data Science at Network Optix, presents the “Building and Scaling AI Applications with the Nx AI Manager,” tutorial at the May 2024 Embedded Vision Summit.

In this presentation, van Emden covers the basics of scaling edge AI solutions using the Nx tool kit. He emphasizes the process of developing AI models and deploying them globally. He also showcases the conversion of AI models and the creation of effective edge AI pipelines, with a focus on pre-processing, model conversion, selecting the appropriate inference engine for the target hardware and post-processing.

van Emden shows how Nx can simplify the developer’s life and facilitate a rapid transition from concept to production-ready applications.He provides valuable insights into developing scalable and efficient edge AI solutions, with a strong focus on practical implementation.Choosing The Best AWS Service For Your Website + API.pptx

Have you ever been confused by the myriad of choices offered by AWS for hosting a website or an API?

Lambda, Elastic Beanstalk, Lightsail, Amplify, S3 (and more!) can each host websites + APIs. But which one should we choose?

Which one is cheapest? Which one is fastest? Which one will scale to meet our needs?

Join me in this session as we dive into each AWS hosting service to determine which one is best for your scenario and explain why!

Ocean lotus Threat actors project by John Sitima 2024 (1).pptx

Ocean Lotus cyber threat actors represent a sophisticated, persistent, and politically motivated group that poses a significant risk to organizations and individuals in the Southeast Asian region. Their continuous evolution and adaptability underscore the need for robust cybersecurity measures and international cooperation to identify and mitigate the threats posed by such advanced persistent threat groups.

UiPath Test Automation using UiPath Test Suite series, part 6

Welcome to UiPath Test Automation using UiPath Test Suite series part 6. In this session, we will cover Test Automation with generative AI and Open AI.

UiPath Test Automation with generative AI and Open AI webinar offers an in-depth exploration of leveraging cutting-edge technologies for test automation within the UiPath platform. Attendees will delve into the integration of generative AI, a test automation solution, with Open AI advanced natural language processing capabilities.

Throughout the session, participants will discover how this synergy empowers testers to automate repetitive tasks, enhance testing accuracy, and expedite the software testing life cycle. Topics covered include the seamless integration process, practical use cases, and the benefits of harnessing AI-driven automation for UiPath testing initiatives. By attending this webinar, testers, and automation professionals can gain valuable insights into harnessing the power of AI to optimize their test automation workflows within the UiPath ecosystem, ultimately driving efficiency and quality in software development processes.

What will you get from this session?

1. Insights into integrating generative AI.

2. Understanding how this integration enhances test automation within the UiPath platform

3. Practical demonstrations

4. Exploration of real-world use cases illustrating the benefits of AI-driven test automation for UiPath

Topics covered:

What is generative AI

Test Automation with generative AI and Open AI.

UiPath integration with generative AI

Speaker:

Deepak Rai, Automation Practice Lead, Boundaryless Group and UiPath MVP

Fueling AI with Great Data with Airbyte Webinar

This talk will focus on how to collect data from a variety of sources, leveraging this data for RAG and other GenAI use cases, and finally charting your course to productionalization.

Presentation of the OECD Artificial Intelligence Review of Germany