The document outlines the initiatives and developments related to the Goods and Services Tax (GST) by the Indirect Taxes Committee of the Institute of Chartered Accountants of India. It highlights efforts made in program organization, e-learning courses, and research publications while proposing a restructured indirect tax framework aimed at simplifying tax compliance, enhancing efficiency, and addressing industry expectations. The challenges associated with GST implementation and the features of the proposed GST model are also discussed.

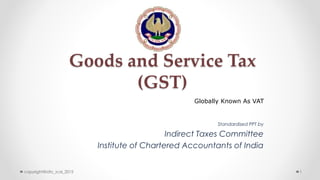

![Present Indirect Tax Structure of India

Present Tax

Structure

[4 Important

Constituents]

Excise Duty

Entry No. 84,

List I, Schedule

VII

Taxable Event is

Manufacture

Service Tax

Residuary Entry

No. 97, List I,

Schedule VII

Taxable Event is

Provision of

Service

Sales Tax /

VAT/ CST

Entry No. 54 of

List II (VAT) and

92A of List I

(CST)

Taxable Event is

Sale

Customs

Duty

Entry No. 83,

List I, Schedule

VII

Taxable Event is

Import & Export

Entry Tax/

Entertainme

nt Tax

Entry No. 52

&62 List II,

Schedule VII

Taxable Event is

Entertainment

& Entry of

Goods

copyright@idtc_icai_2015 4](https://image.slidesharecdn.com/28082015gst-icai-150831235554-lva1-app6892/85/Presentation-on-GST-4-320.jpg)