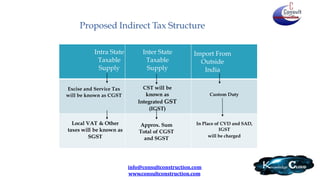

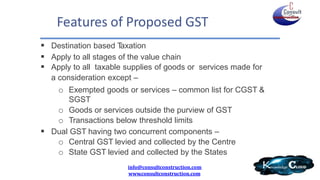

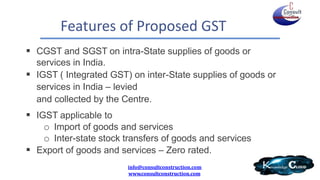

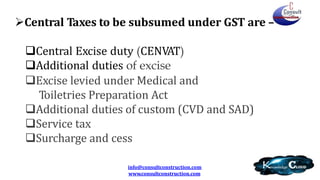

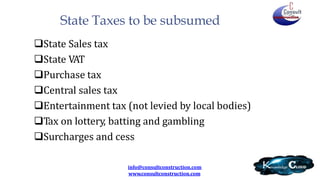

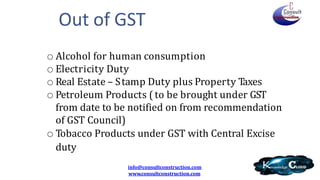

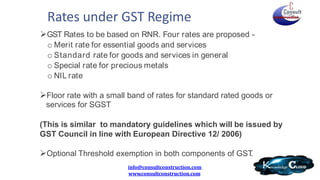

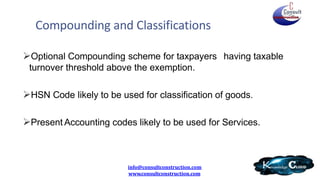

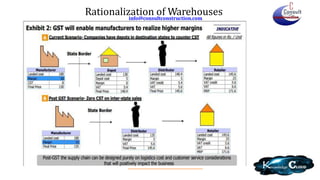

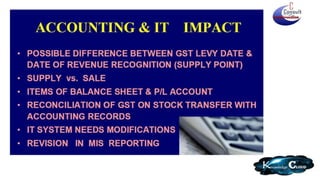

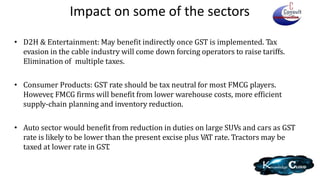

The document outlines a webinar organized by Consult Construction regarding the proposed Goods and Services Tax (GST) structure in India, detailing its features and the types of taxes to be subsumed under it. Key aspects include dual GST components (CGST and SGST) for intra-state transactions and IGST for inter-state transactions, with specific exemptions and classifications for various goods and services. It also discusses potential impacts on different sectors such as consumer products, auto, and transport, while raising concerns about transitional complexities and adjustments needed within the industry.

![Present Indirect Tax Structure of India

Present Tax

Structure

[ 4 Important

Constituents]

Excise Duty

Entry No. 84,

List I, Schedule

VII

Taxable Event is

Manufacture

Service Tax

Residuary Entry

No. 97, List I,

Schedule VII

Taxable Event is

Provision of

Service

Sales Tax

/ VAT/

CST

Entry No. 54 of

List II ( VAT) and

92A of List I

( CST)

Taxable Event is

Sale

Customs

Duty

Entry No. 83,

List I, Schedule

VII

Taxable Event is

Import & Export

Entry Tax/

Entertainment

Tax

Entry No. 52

&62 List II,

Schedule VII

Taxable Event is

Entertainment

& Entry of

Goods

info@consultconstruction.com

www.consultconstruction.com](https://image.slidesharecdn.com/gst-understandingtheimpact-150828083445-lva1-app6891/85/GST-Changes-and-its-impact-3-320.jpg)