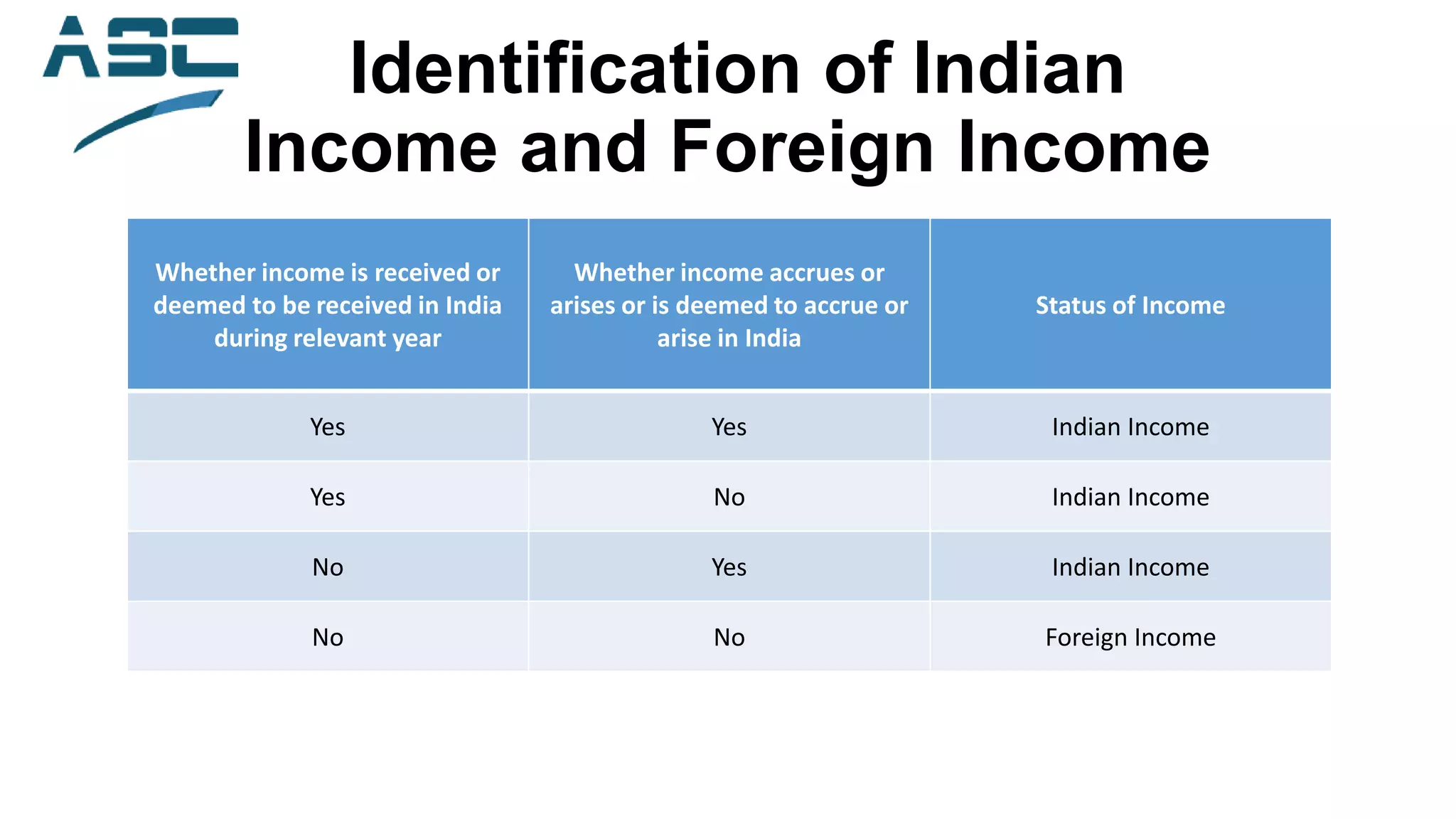

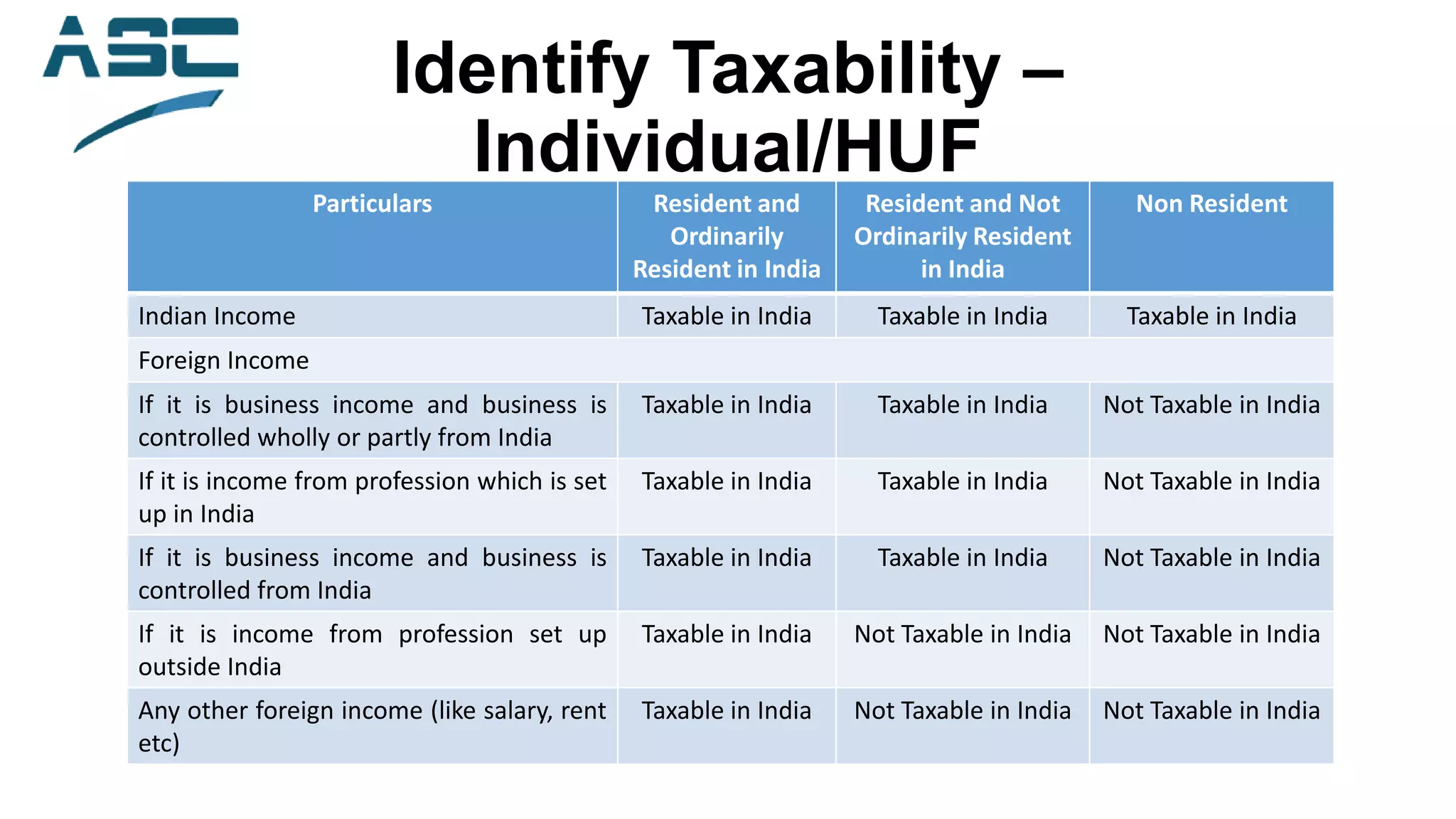

This document discusses the fundamentals of international taxation, covering key sections of the Indian Income Tax Act, types of model conventions, and the concept of double taxation avoidance agreements (DTAA). It outlines procedures for determining taxability of income for individuals and businesses, highlights the differences between business connections and permanent establishments, and explains various clauses in international treaties. Additionally, it addresses the relevance of the 'make available' clause and limitation of benefits in DTAA agreements.

![Fees for Technical

Services/Royalty

Relevance of “Make Available Clause” explained in the case of Raymond

Ltd. vs. DCIT [86 ITD 791] (Mum)

• Does not mean mere rendering of services

• Person utilising the service is able to make use of technical

knowledge independently, without recourse to the performer of

services in future

• Transmission of technical knowledge, skill, etc. from person

rendering the services to the person utilising the services

• Technical knowledge, skill, must remain with the person utilising the

service even after rendering of services has come to an end](https://image.slidesharecdn.com/pptonbasicsofintl-140510015449-phpapp02/75/BASICS-OF-INTERNATIONAL-TAXATION-24-2048.jpg)