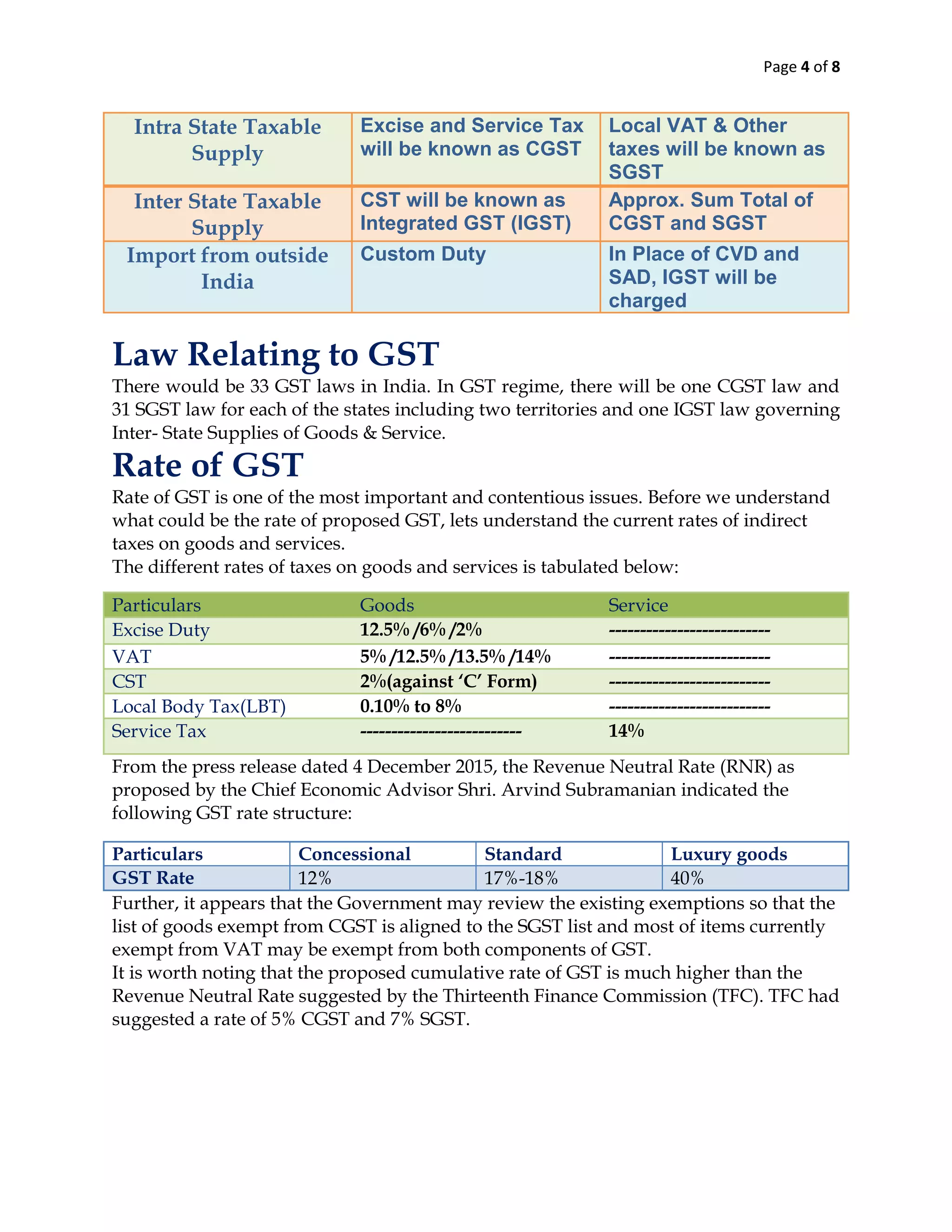

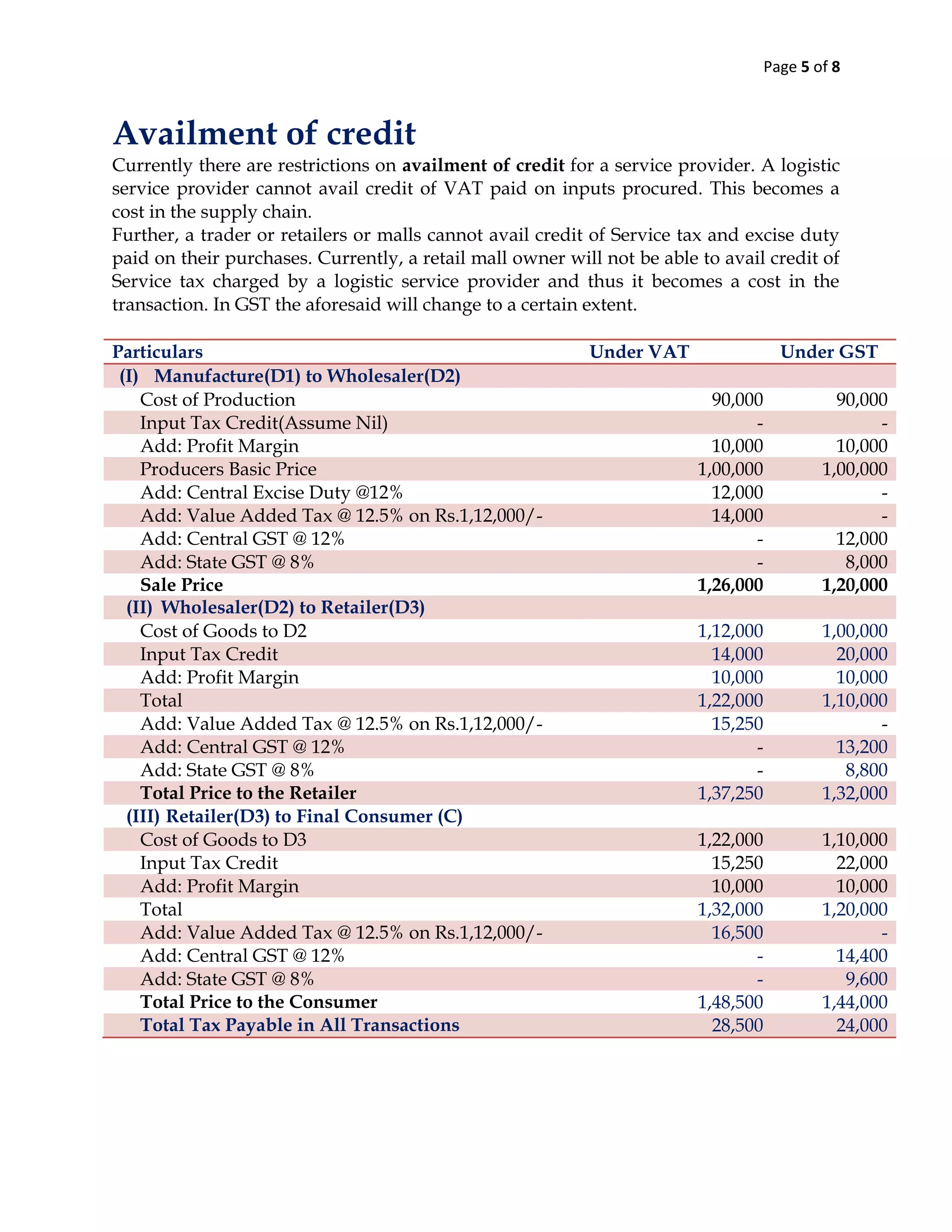

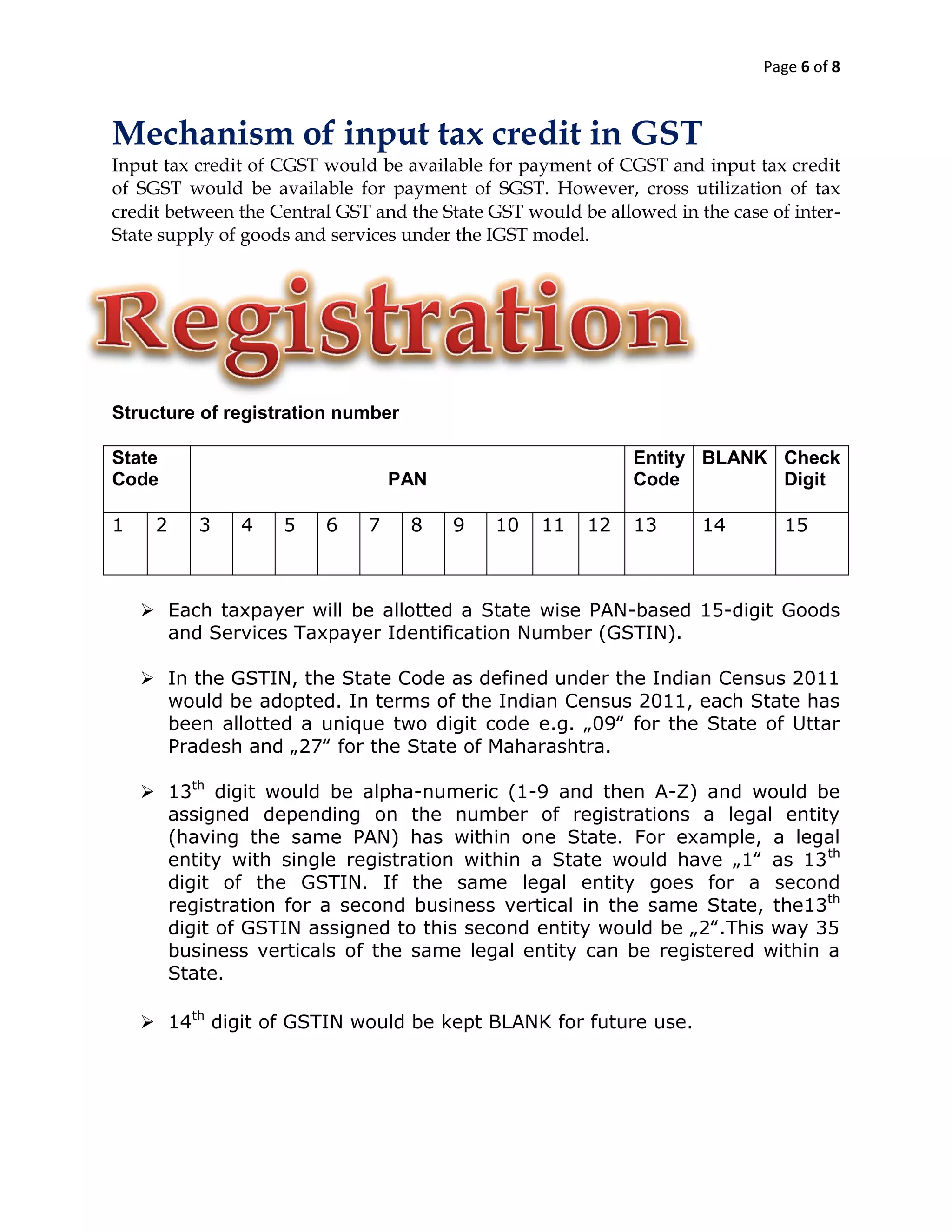

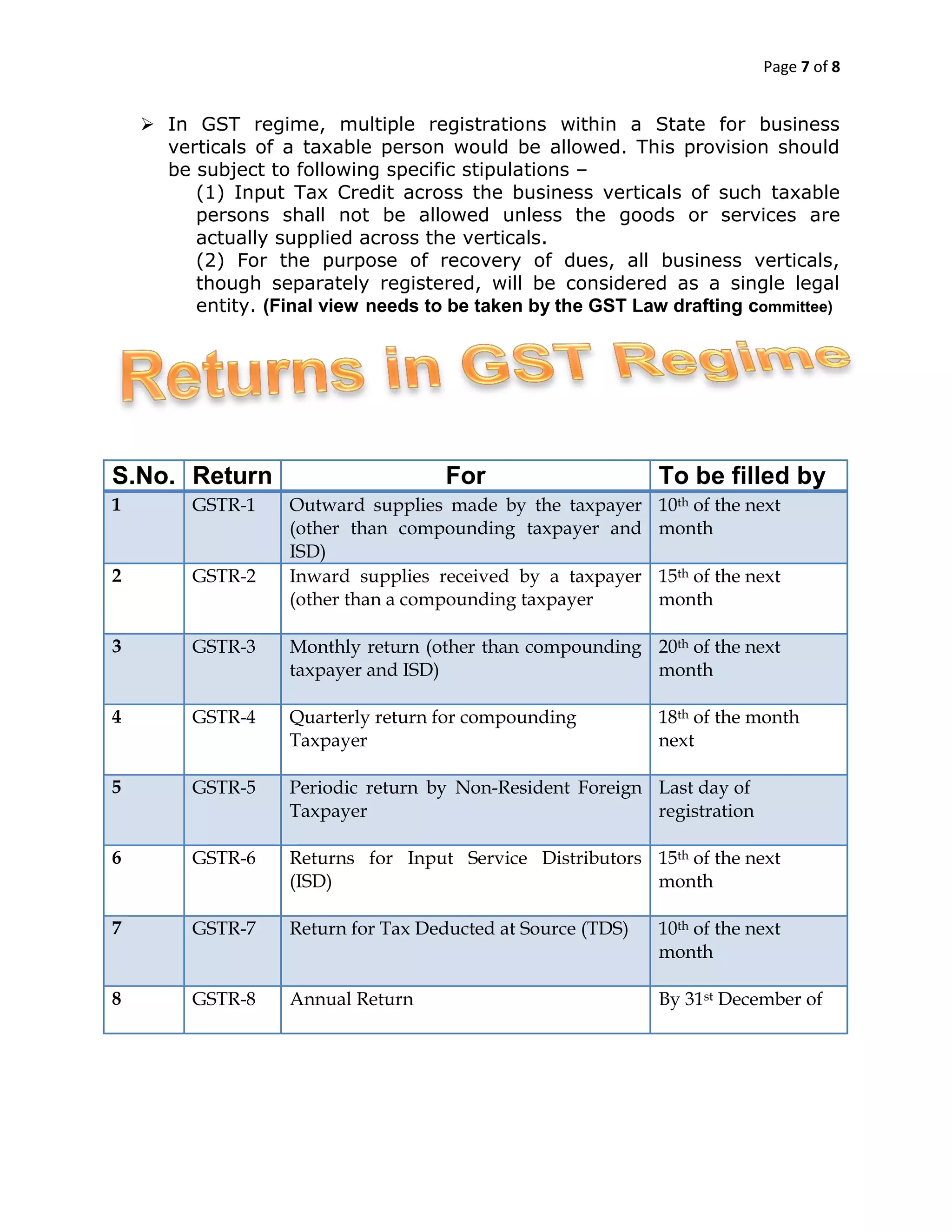

The document provides an overview of the Goods and Services Tax (GST) that is proposed to be implemented in India. It discusses that GST aims to create a single, unified indirect tax by subsuming multiple taxes into one. It will be levied as Central GST (CGST) and State GST (SGST) on intra-state supplies, and as Integrated GST (IGST) on inter-state supplies. The document outlines the proposed GST rate structure and registration process, and explains how input tax credit will work under GST.