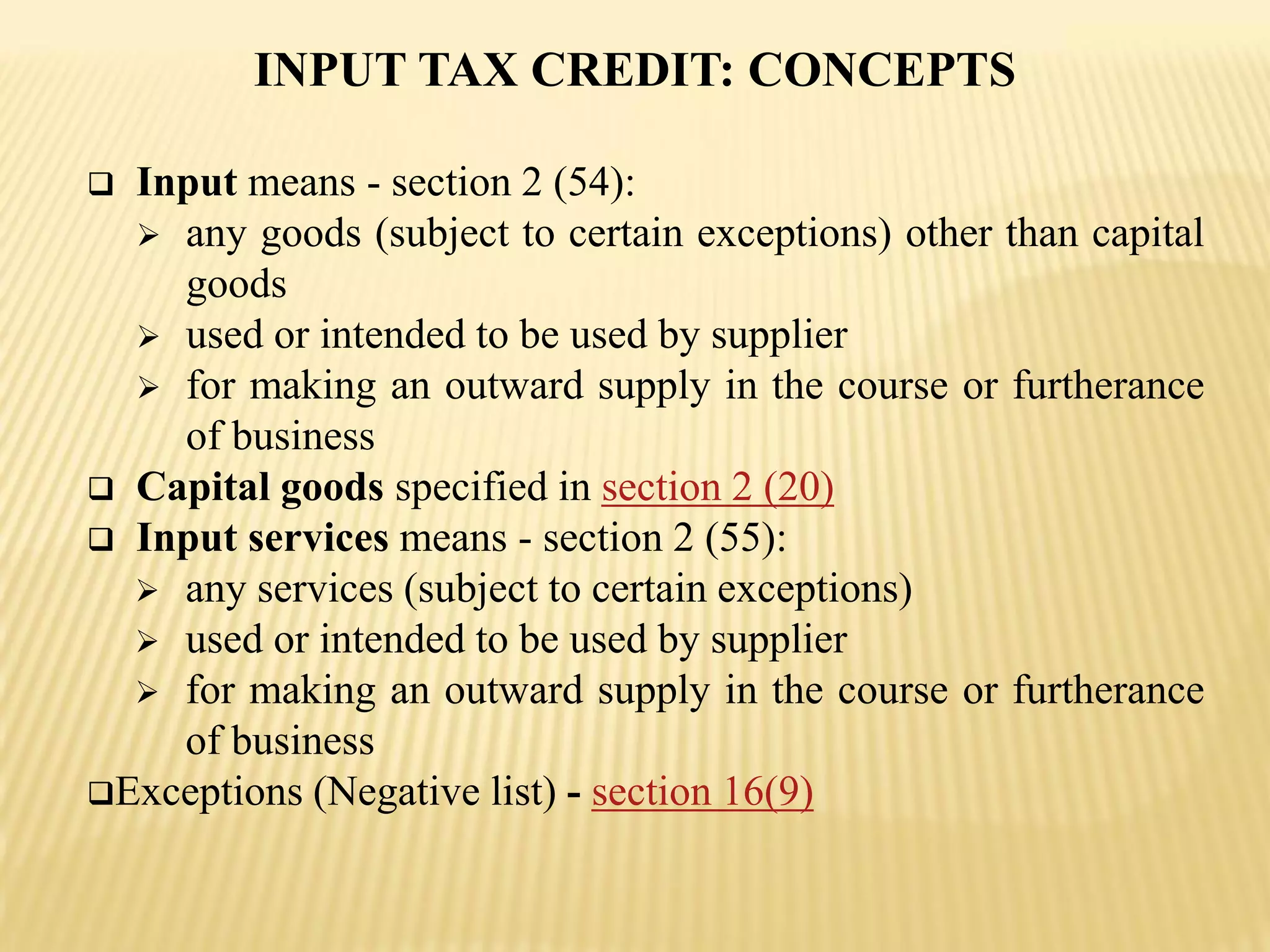

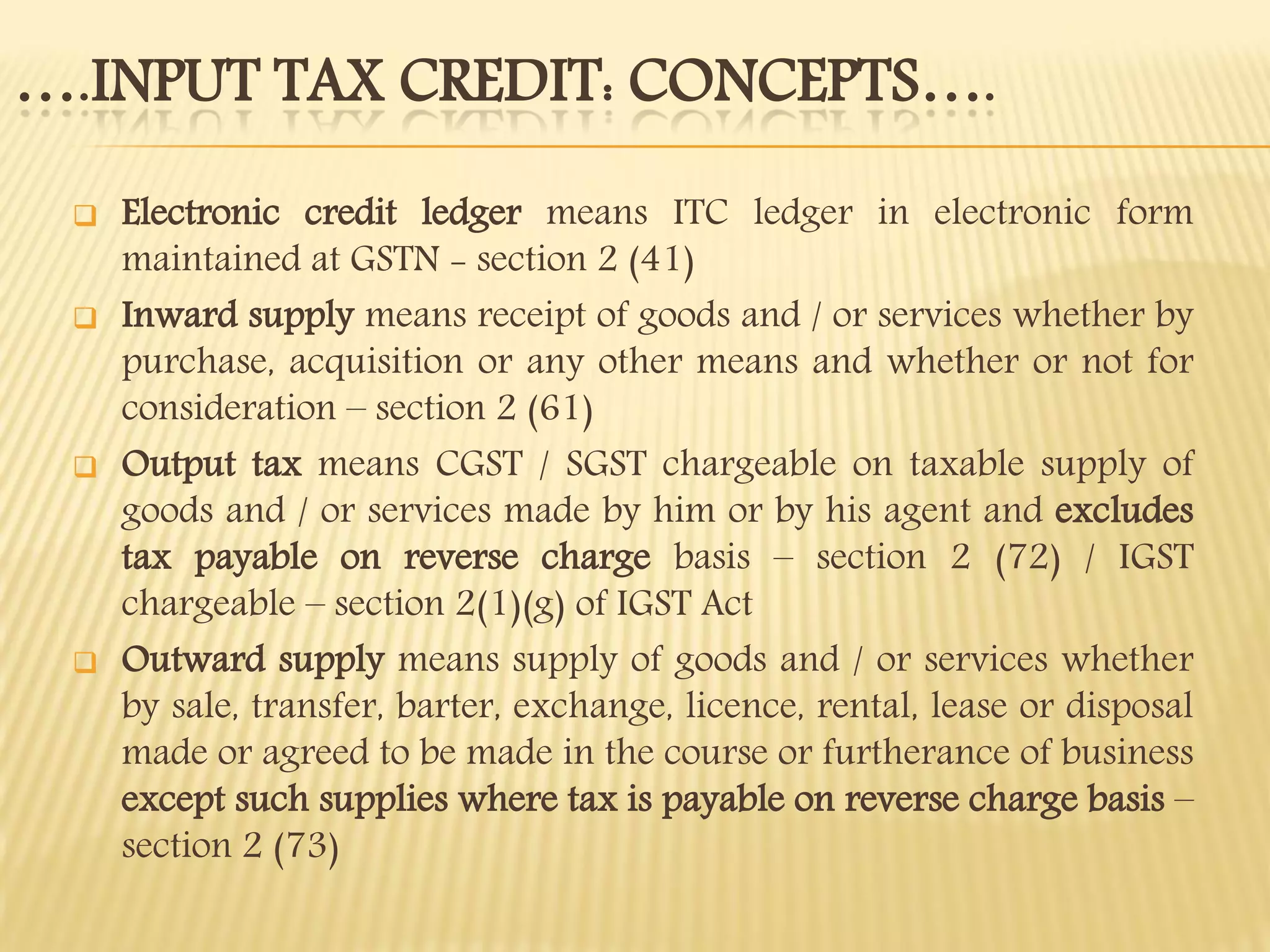

The document discusses concepts related to input tax credit under GST, including definitions of key terms like input, capital goods, input services, and exceptions. It outlines eligibility and features of input tax credit provisions, such as conditions for claiming ITC, time limits, and utilization of credits. Examples are provided comparing tax implications of intra-state and inter-state supplies under the current system versus GST.