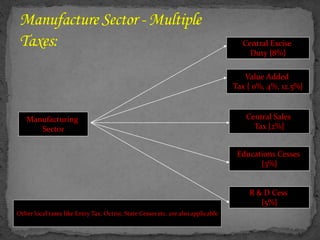

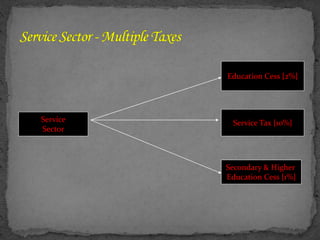

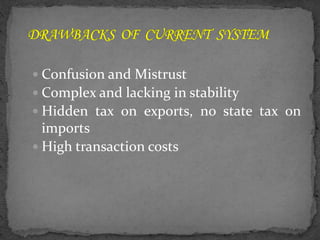

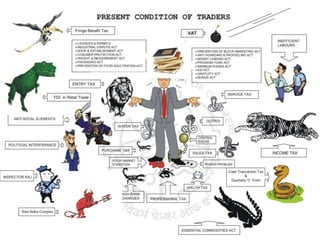

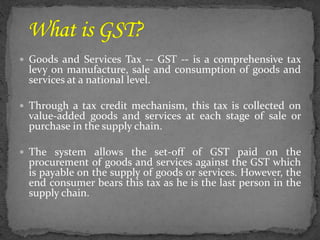

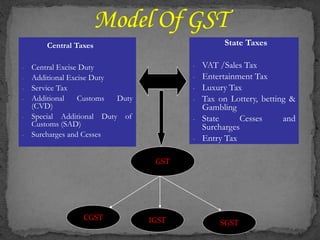

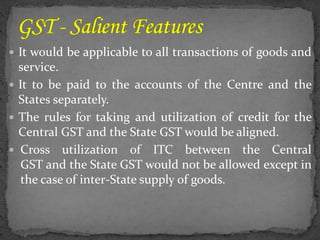

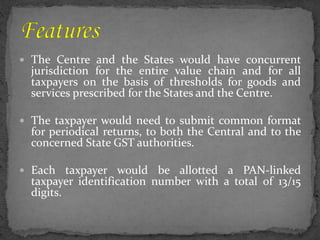

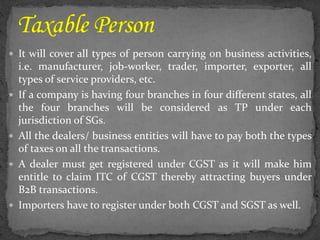

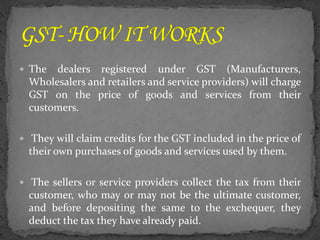

The Goods and Services Tax (GST) is a major tax reform in India aimed at creating a unified market by integrating various state economies and eliminating multiple layers of taxation. Scheduled for implementation from April 2016, GST replaces numerous existing taxes with a single comprehensive tax on goods and services, benefiting both consumers and businesses by reducing complexities and hidden costs. While it is expected to enhance revenue for many states, concerns remain among some regions regarding potential revenue losses and the readiness for a nationwide roll-out.