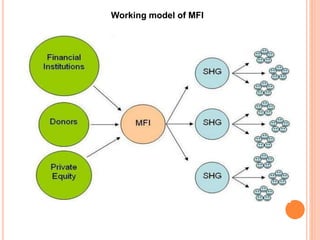

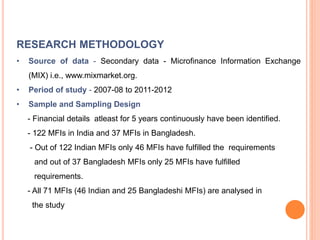

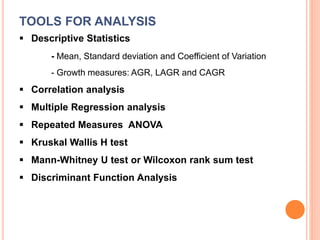

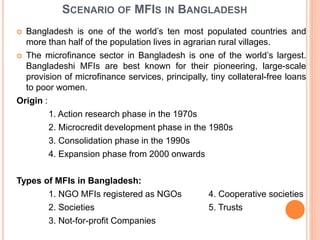

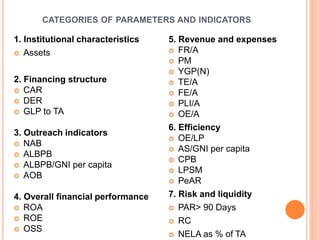

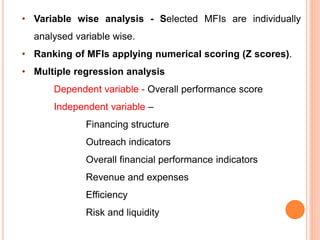

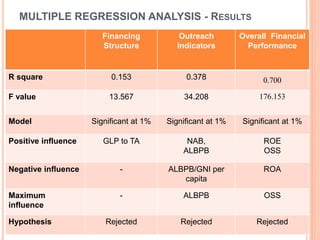

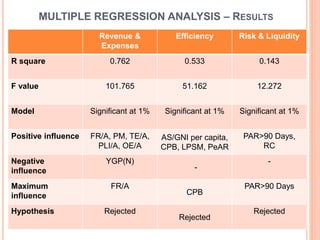

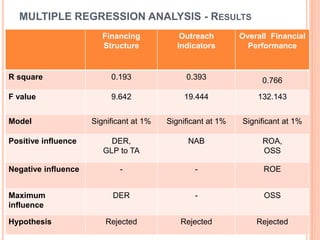

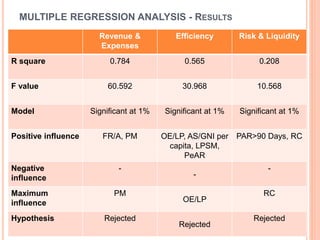

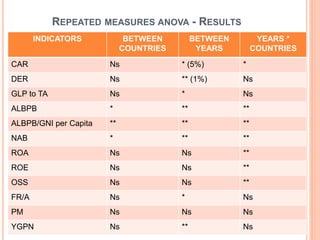

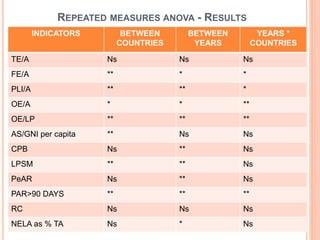

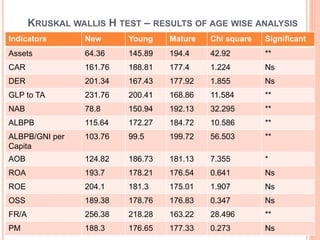

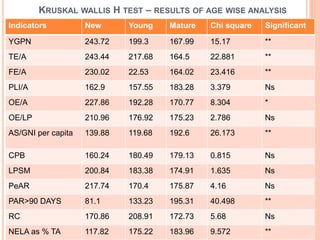

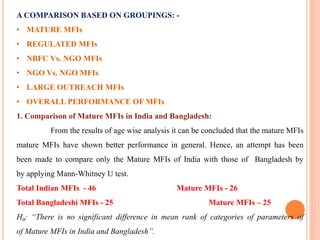

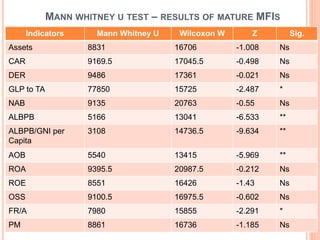

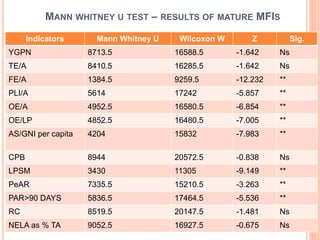

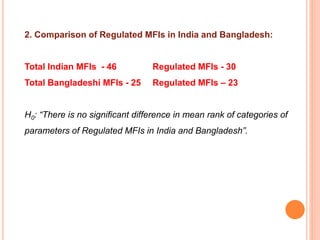

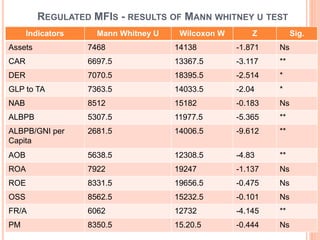

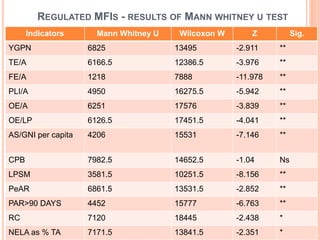

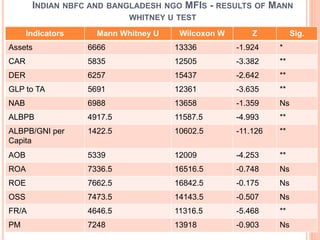

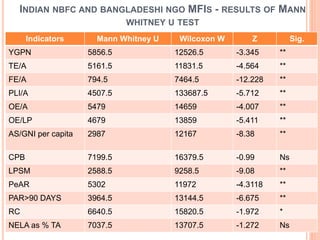

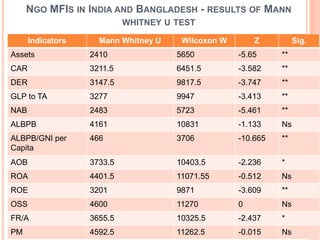

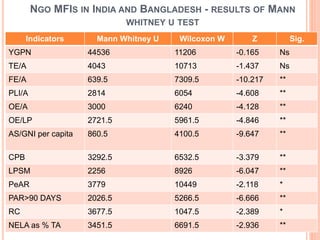

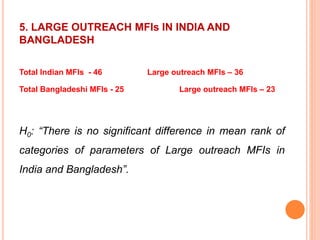

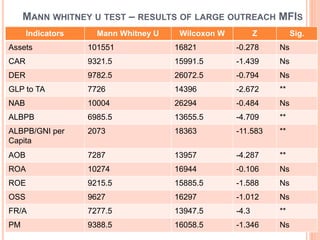

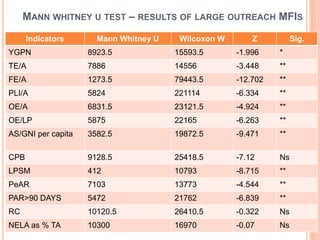

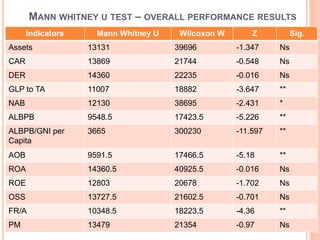

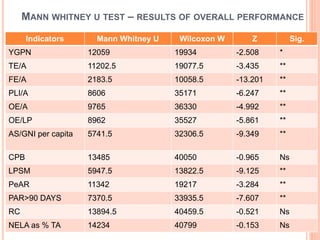

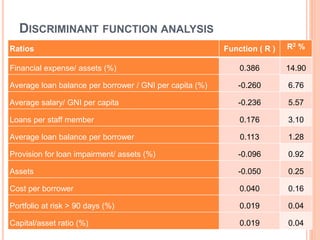

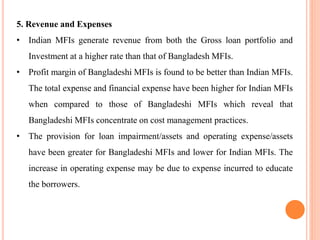

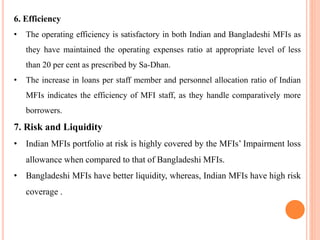

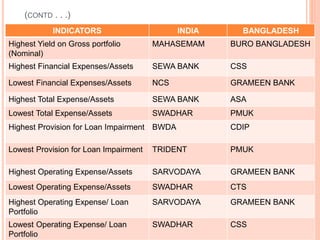

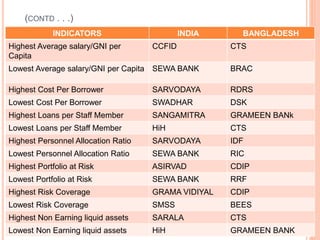

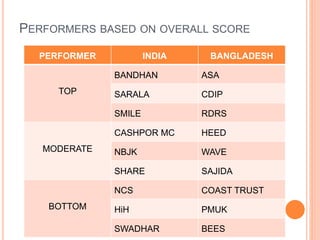

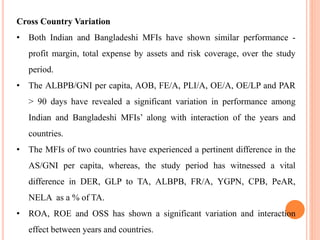

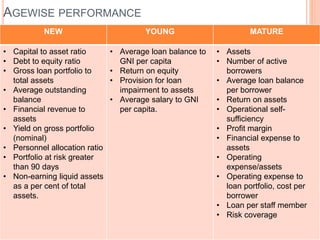

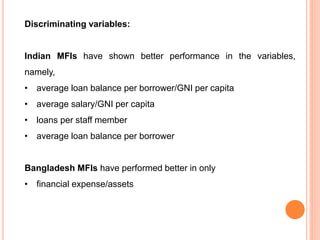

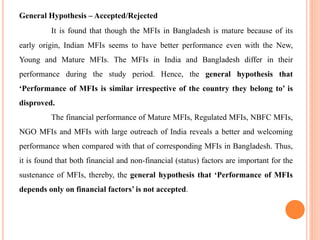

The document provides an introduction and background to a study comparing the financial performance of microfinance institutions (MFIs) in India and Bangladesh. It outlines the research methodology, which involves analyzing seven categories of financial performance indicators for 46 Indian MFIs and 25 Bangladeshi MFIs over 2007-2012 using statistical tools. Hypotheses that performance is similar across countries and does not depend on age or only financial factors will be tested. Multiple regression analysis will examine the influence of institutional characteristics, outreach, financial performance, revenues/expenses, efficiency, and risk on overall performance.