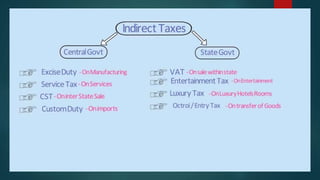

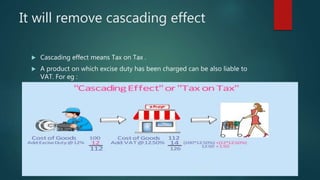

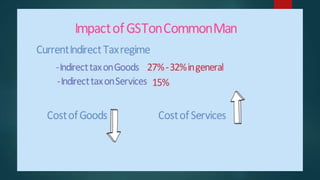

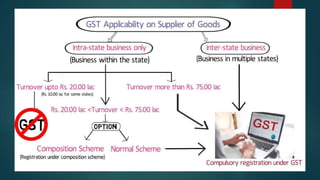

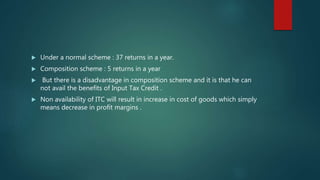

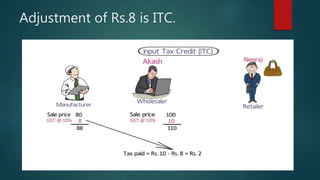

The document provides an overview of the Goods and Services Tax (GST) that is being implemented in India. It discusses that GST is an indirect tax that will replace existing indirect taxes imposed by the central and state governments. It will have two components - CGST imposed by the central government and SGST imposed by state governments. GST is expected to simplify taxation, reduce the cascading effect of taxes, and make India a unified common market by facilitating seamless transportation of goods across states.