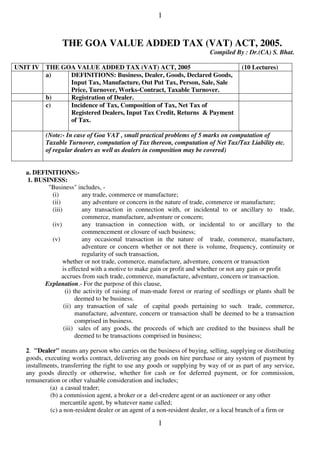

The Goa Value Added Tax (VAT) Act, 2005 outlines definitions essential for understanding VAT, including concepts such as business, dealer, goods, and taxable turnover, along with regulations on dealer registration and tax liability. It details the circumstances under which a dealer must register for VAT and stipulates registration fees based on turnover limits, valid for three years, with penalties for late renewal. The document also elaborates on the calculation of input tax credit, output tax, and conditions for taxation on declared goods and works contracts.

![4

4

the time of or before delivery thereof, excise duty, special excise duty or any other duty or taxes except

the tax imposed under this Act;

Provided that in case of transfer of property in goods (whether as goods or in some other form)

involved in execution of works contract, the sale price of such goods shall be determined in the

prescribed manner by making such deductions from the total consideration for the works contract as

may be prescribed and such price shall be deemed to be the sale price for the purpose of this clause.

11. Turnover means the aggregate amount of sale price for which goods are sold or supplied or

distributed by a dealer, either directly or through another, whether on own account or on account of

others, whether for cash or for deferred payment, or other valuable consideration;

12. Works contract shall include any agreement for carrying out for cash, deferred payment or other

valuable consideration, the building, construction, manufacturing, processing, fabrication, erection,

installation, fitting out improvement, modification, repair or commissioning of any movable or

immovable property;

13. Taxable turnover means the turnover on which a dealer shall be liable to pay tax as determined

after making such deductions from his total turnover and in such manner as may be prescribed, but

shall not include the turnover of sale in the course of interstate trade or commerce or in the course of

export of the goods out of the territory of India or in the course of import of the goods into the territory

of India and the value of goods transferred or dispatched outside the State otherwise than by way of

sale;

b) REGISTRATION OF DEALER.

Who are liable for registration under VAT?

(i) A dealer is required to register in the following circumstances:

(a) When turnover exceed following limits: [i.e. Limit of turnover for Registration (Basic Exemption)]:

Rs 10,000/- in case of non-resident dealer and casual trader.

Rs 1,00,000/- incase of importer/manufacturers

Rs 5,00,000/- in any other case.

• *For this purpose turnover includes, both the taxable and non-taxable turnover.

• The dealers whose turnover does not exceed the above limits (i.e. Basic Exemption) need not

register under VAT Act,2005. They therefore, should not charge any VAT nor are eligible for

any input credit.

• Every dealer exporting any goods outside India or effecting stock transfers to any State and

Union Territories within India, shall be liable to pay tax on all taxable sales effected within the

State.

(b) when he is registered or liable for the registration under CST Act, 1956.

(c) when a person succeeds business of a dealer due to death or transfer.

(ii) Application for registration in Form VAT-I should be filed within 30 days from date of

commencement of liability and in case of succession within 60 days along with receipted challan for

registration fees. Registration is valid for three financial years.

(iii) A dealer can also apply for voluntarily registration along with registration fees and same is valid

for one financial year.

(iv) An employer who is liable to deduct tax at source from contract payments should apply for

registration in form VAT-XXIV.

RENEWAL](https://image.slidesharecdn.com/goavalueaddedtax-180408075316/85/Goa-Value-Added-Tax-4-320.jpg)

![7

7

(i) Rs 10,000/- Non-resident dealer and casual trader

(ii) Rs1,00,000/- Importer/manufacturer.

(iii) Rs 5,00,000/- Others.

(5) For the purpose of calculating the limit of turnover for liability to tax,-

(a) except as otherwise expressly provided, the turnover of all sales shall be taken, whether

such sales are taxable or not or of taxable goods or not;

(b) the turnover shall include all sales made by the dealer on his own account, and also on

behalf of his principals whether disclosed or not;

(c) in the case of an auctioneer, in addition to the turnover, if any, referred to in clauses (a)

and (b), the turnover shall also include the price of the goods auctioned by him for his

principal, whether the offer of the intending purchaser is accepted by him or by the principal

or a nominee of the principal, if the price of such goods is received by him on behalf of his

principal;

(d) in the case of a manager or agent of a non-resident dealer, in addition to the turnover, if

any, referred to in clauses (a), (b) or (c), the turnover shall also include the sales of the

non-resident dealer effected in the State.

COMPOSITION OF TAX.

(1) if any registered dealer, of the class specified in Schedule E, whose total turnover in the previous

year does not exceed the limit specified in the said Schedule and who is liable to pay tax under

section 3, so elects, the Commissioner may accept towards composition of tax, in lieu of the net

amount of tax payable by him under this Act, during the year, an amount at the rate shown against

respective class of dealers in the said Schedule calculated on total turnover, either in full or in

installments, as may be prescribed.

• Total turnover for the purposes of this section will include aggregate sales of taxable and

non-taxable goods].

• The dealer has to apply to the Appropriate Assessing Authority in Form VAT-XIII within 30

days from the date of commencement of the financial year.

(2) Any dealer eligible for composition of tax under sub-section (1) shall not :-

(a) be permitted to claim any input tax credit on purchases and on stock held. Similarly input tax

credit cannot be taken by any dealers who make purchases from dealer in composition ;

(b) charge any tax under this Act in his sales bill or sales invoice in respect of sales made by him;

(c) issue tax invoice to any dealer who has purchased goods from him (can issue his usual invoice).

Dealers eligible for composition of tax;

Only the foll. types of dealers are permitted to go in for composition rate.

( The following rates are from 01-04-2012)

Sr. No.

Section 1.01 [Class of dealer]

Limit of

turnover

Rate of

composition

(1) Dealer other than the dealer of liquor in packed bottles,

dealer effecting sale by transfer of right to use any goods

and importer

Rs 100 lakhs 0.5%

(2) Reseller of liquor in packed bottles Rs 100 lakhs 1%

(3) Hotel, restaurant, eating house, refreshment room,

boarding establishment serving food and non alcoholic

Rs 100 lakhs 7%](https://image.slidesharecdn.com/goavalueaddedtax-180408075316/85/Goa-Value-Added-Tax-7-320.jpg)