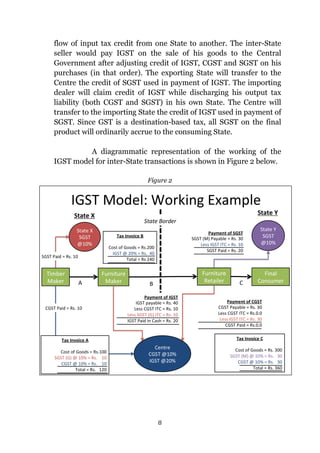

The Goods and Services Tax (GST) is an indirect tax aimed at creating a unified market in India by applying one tax on the supply of goods and services nationwide. It simplifies compliance for businesses with online systems, reduces hidden costs through seamless tax credits, and aims to lower overall tax burdens for consumers. The GST framework involves both central and state components, allows for inter-state transaction taxation through an integrated GST, and replaces multiple earlier taxes at both levels.