Embed presentation

Downloaded 12 times

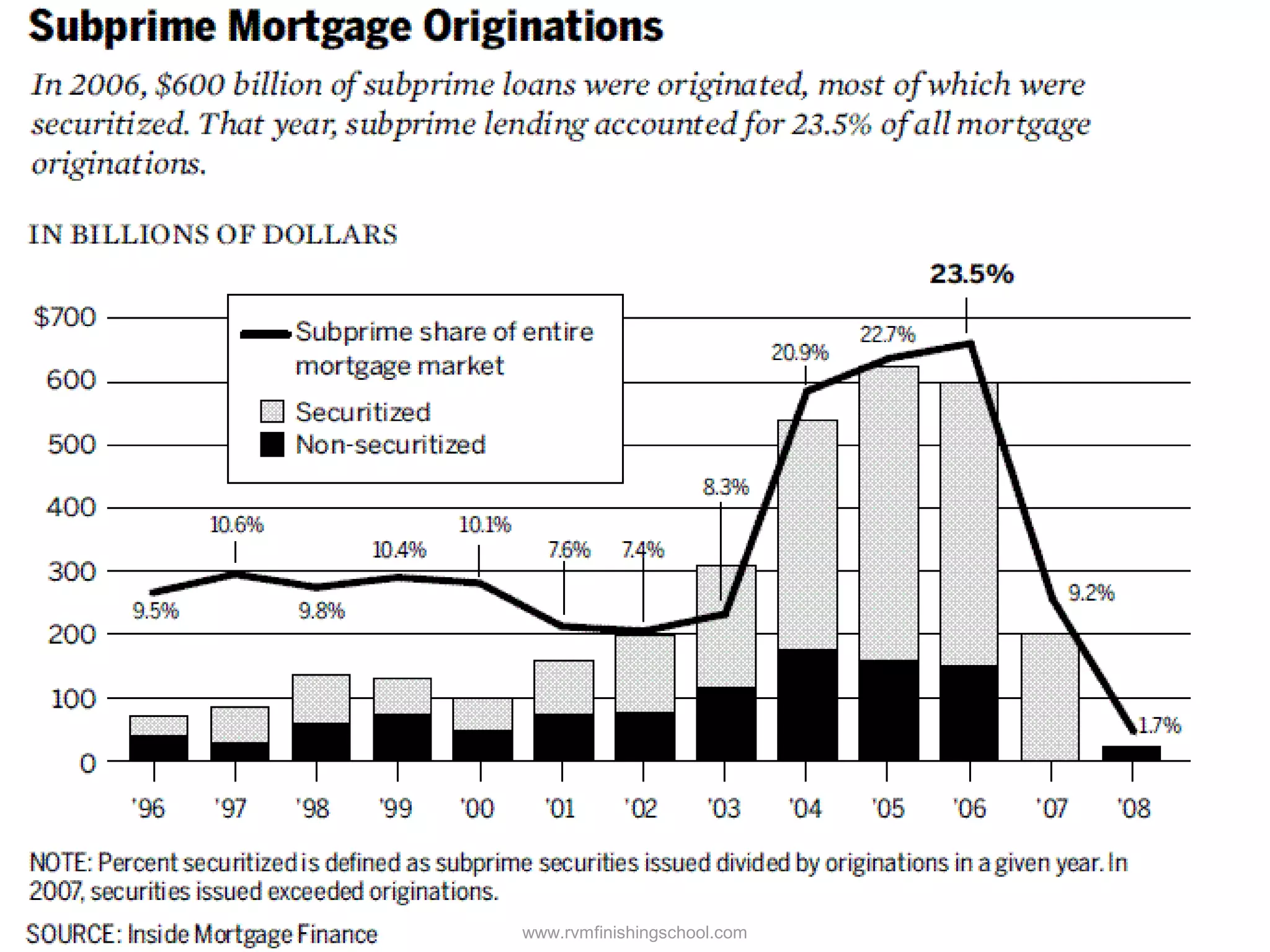

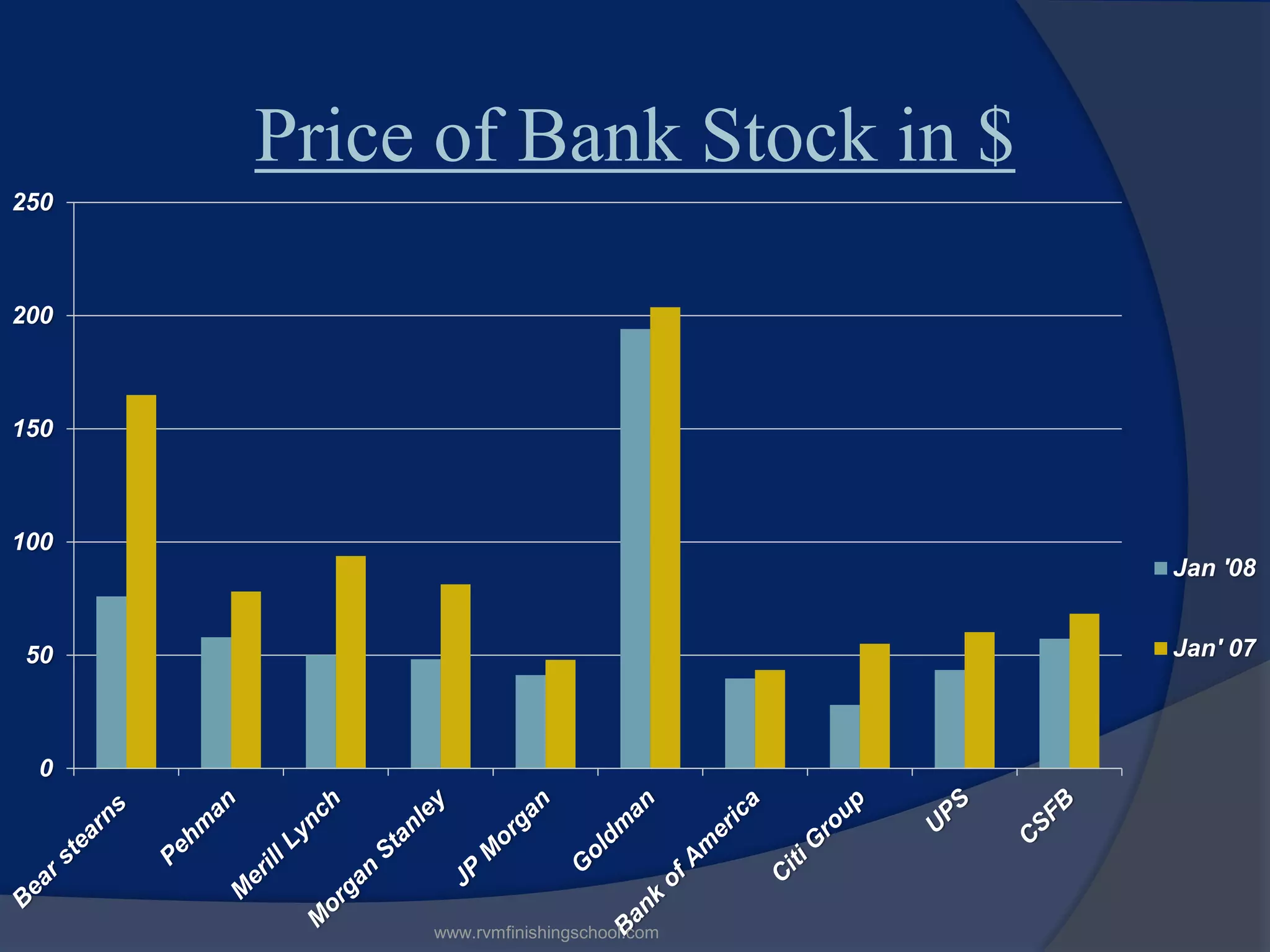

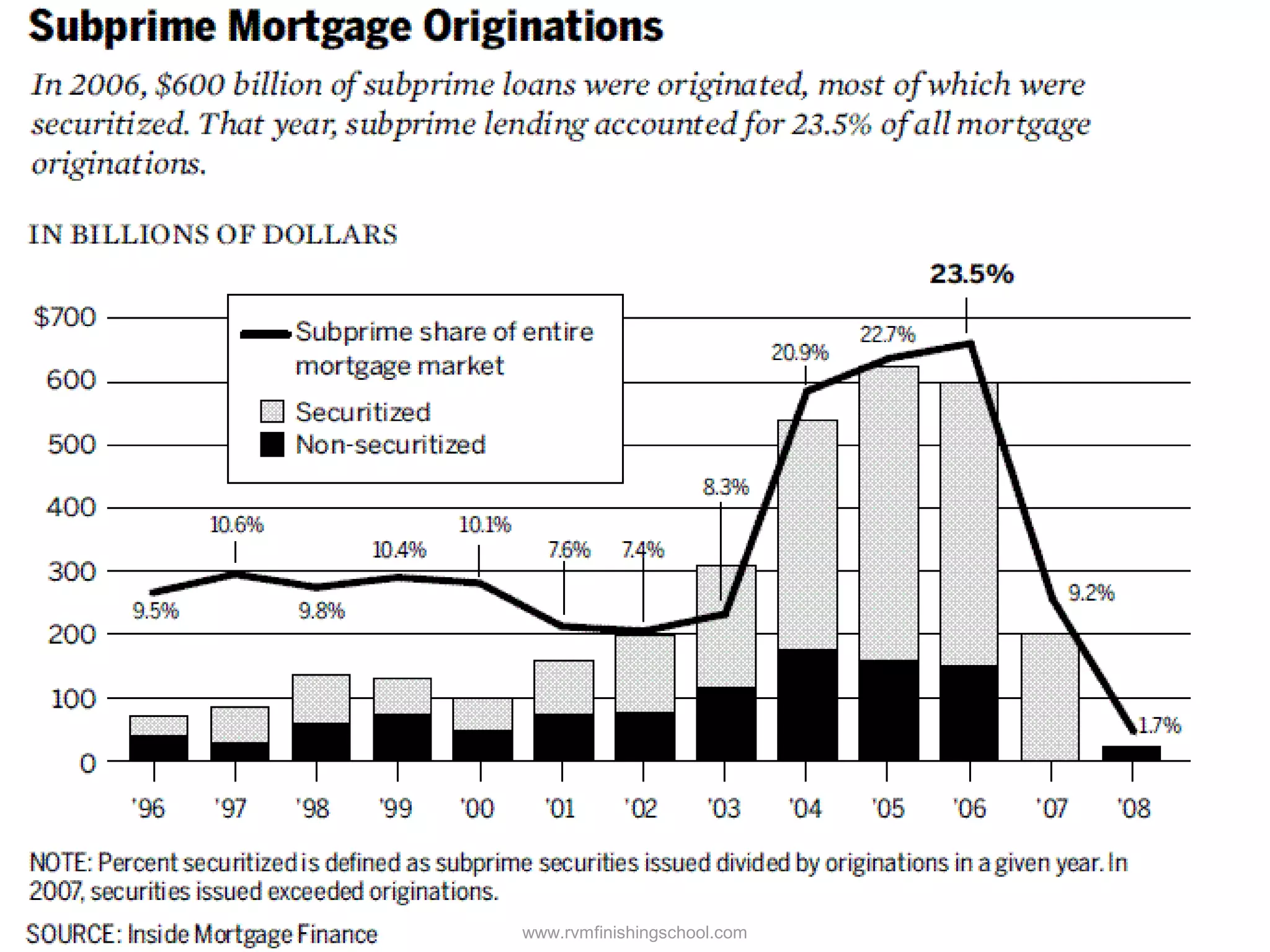

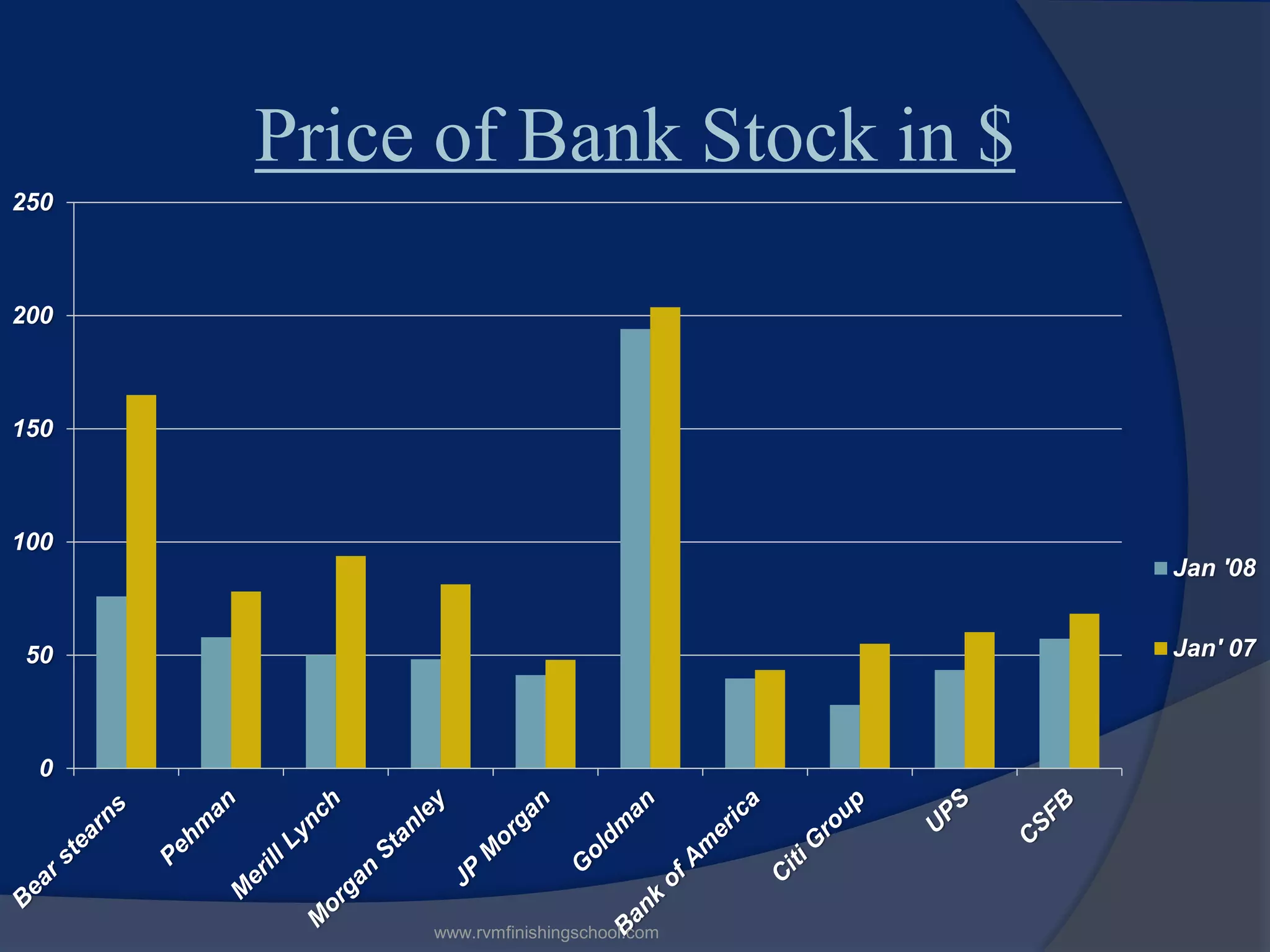

This document discusses the subprime mortgage crisis in the United States. It defines subprime mortgages as loans given to borrowers with poor credit ratings. The crisis coincided with the 2007-2009 recession as home prices declined sharply, many subprime borrowers defaulted on their loans, and financial institutions incurred major losses. This led to effects like a decline in GDP, rising unemployment, a drop in real estate prices, and the bankruptcy of large banks. Government remedies included quantitative easing, credit easing, expanded deposit insurance, capital injections for banks, and programs to avoid home foreclosures.