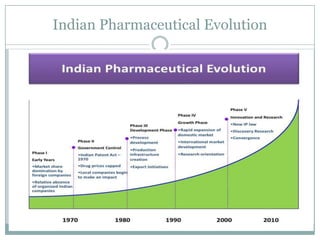

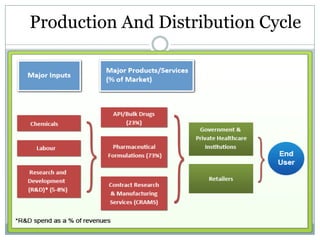

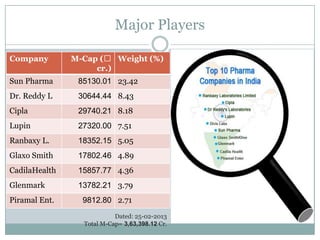

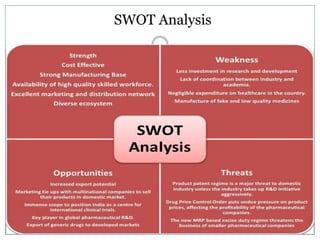

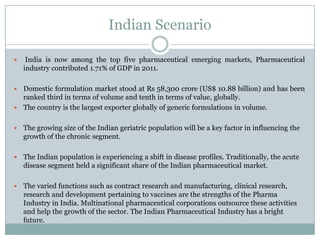

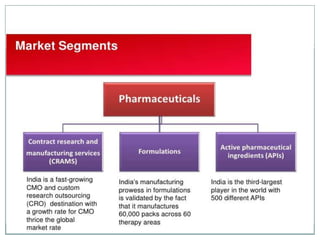

The document discusses the Indian pharmaceutical industry. It provides an overview of major players, the Indian and global scenarios, future outlook, and areas for boosting competitiveness. The industry has grown significantly over time and India is now a top producer and exporter of generic drugs globally. The outlook remains positive with the market expected to reach $74 billion by 2020 and become one of the top ten markets worldwide. However, further investment in R&D and addressing regulatory issues can help strengthen the industry.