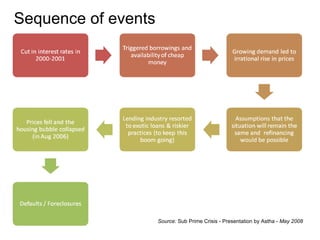

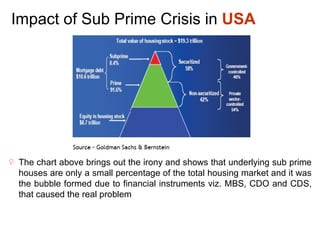

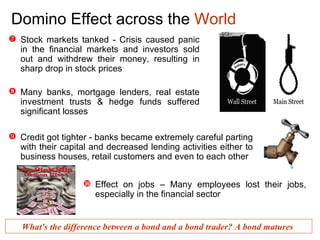

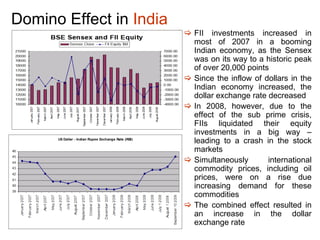

The document summarizes the subprime mortgage crisis and its global impacts. It began with loose lending practices in the US that led to a housing bubble. When housing prices declined and borrowers defaulted, it sparked a financial crisis as risky loans were bundled into securities that spread the risks throughout the global financial system. Major banks and financial institutions collapsed. Credit tightened globally and stock markets plunged significantly. The crisis also impacted economies worldwide through tightening credit, falling markets, and reduced trade and business activity. While government interventions helped stabilize markets, full recovery will take time as the financial systems remain fragile.

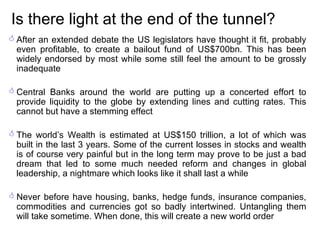

![Some quotes on the crisis “ We were at the brink of something that would have made anything that's happened in financial history look pale. We were very, very close to a system that was totally dysfunctional and would have not only gummed up the financial markets but gummed up the economy in a way that would take us years and years to repair” – Warren Buffet “ There could be a lot more bank closures in the coming months which could create significant investment opportunities. As many as thousand banks could go belly up” – Wilbur Ross “ It is quite likely that the current synchronized global economic boom and the universal, all encompassing asset bubble will lead to a colossal bust” – Dr. Marc Faber “ The money markets have completely broken down, with no trading taking place at all. There is no market any more. Central banks are the only providers of cash to the market, no one else is lending” – Christopher Reiger (Dresdner Kleinwort) [email_address]](https://image.slidesharecdn.com/subprime-1227586567862530-9/85/SubPrime-Crisis-17-320.jpg)