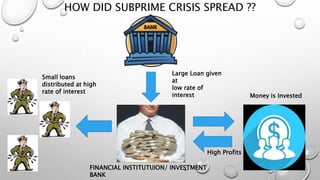

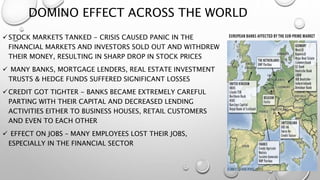

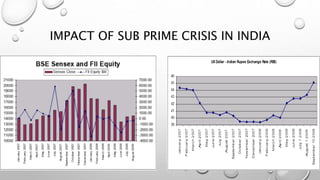

The document discusses the subprime mortgage crisis of 2007-2008. It defines prime and subprime loans, with subprime loans having higher interest rates and being given to borrowers with poorer credit. It describes how US banks gave many subprime loans with little credit checking. When housing prices declined, many borrowers defaulted, spreading crisis through the financial system. The crisis impacted global markets and economies as stock prices dropped and credit tightened. India was impacted through declines in the stock market, IT industry revenues, and exports due to the US recession.