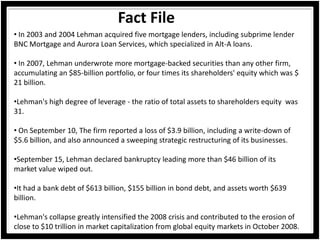

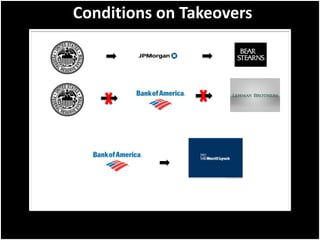

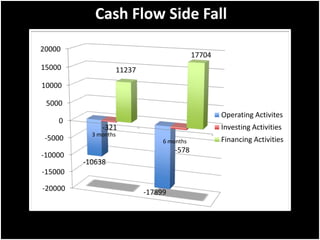

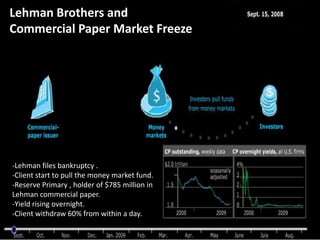

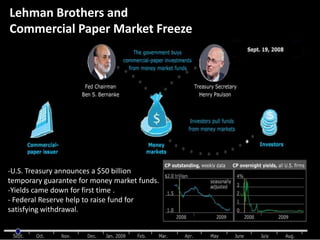

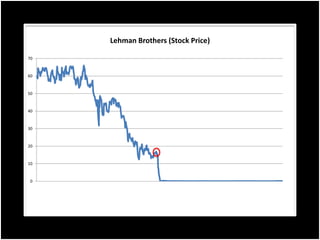

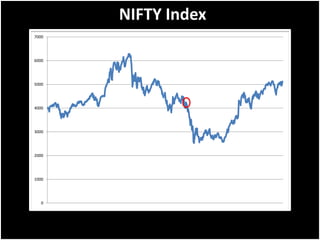

Lehman Brothers accumulated a large portfolio of risky mortgage-backed securities and high levels of debt through acquisitions in the mid-2000s. By 2007, Lehman underwrote more mortgage securities than any other firm and had a leverage ratio of 31 to 1. In September 2008, Lehman declared bankruptcy after reporting large losses, wiping out over $46 billion in market value. Lehman's collapse intensified the 2008 financial crisis and contributed to a loss of nearly $10 trillion in global equity markets. The bankruptcy froze the commercial paper market, and the federal government had to implement guarantees and programs to stabilize money market funds and restart lending.