The document summarizes key aspects of the subprime crisis including:

- Causes such as the real estate boom and speculative investing.

- How it spread from the US housing market to global financial markets.

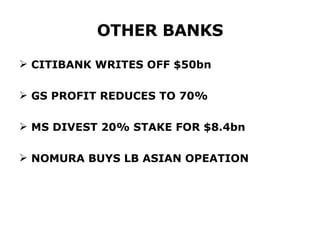

- Major companies that were affected like AIG, Fannie Mae, and Lehman Brothers.

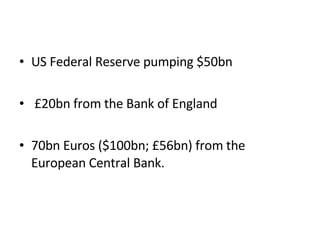

- Responses by governments and central banks to mitigate the crisis.

- Impacts on the world economy like stock market declines and rising unemployment.