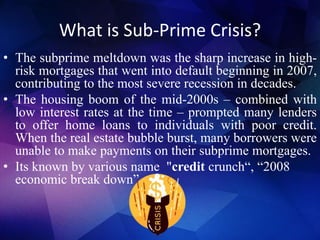

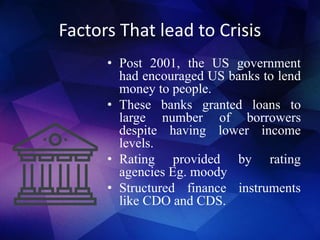

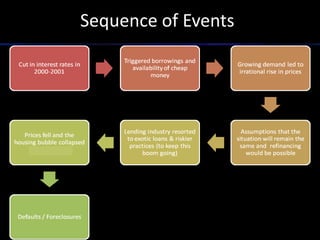

The subprime crisis was caused by a rise in risky mortgages given to borrowers with poor credit starting in 2007, contributing to a recession. Lenders offered many subprime loans during the mid-2000s housing boom when interest rates were low. When housing prices fell, many subprime borrowers defaulted on their loans. This caused losses for banks and mortgage companies and a freeze in the credit markets. The crisis had ripple effects across the global economy and required government intervention to stabilize markets. While the U.S. economy recovered by 2011, there were lasting impacts on household wealth and debt levels.