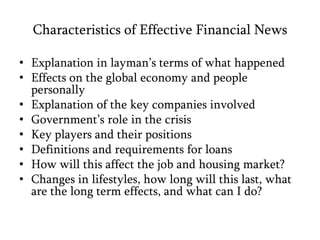

The Post provides comprehensive coverage of the financial crisis through its location in Washington D.C. and partnerships with other major news organizations. It analyzes the crisis from its early signs in 2004 through the present day recovery. During the crisis, it covered the effects on markets, housing, jobs and Main Street. It also closely tracked government policies and debates around regulating Wall Street and aiding struggling industries. In the post-crisis period, it has reported on the challenges of economic recovery and how growth has not benefitted all workers.

![‘Waiting for a Soft Landing’January 4, 2006Explores potential economic issues that could arise, takes a critical, oppositional look at the positive outlookHousing bubble bursts, US dollar crashes, GM files for bankruptcy (due to strikes)‘With Rosy Predictions, Pundits Missing 2006’s Warning Signs’January 4, 2006“Let’s not fall into the trap of confusing that [positive outlook] with long term economic health”Warning signs – housing boom, hedge funds over lending into real estate, auto industry restructuring, bond-markets making it easy to borrow money at fixed ratesMore realistic than the “rosy scenario embraced by Washington and Wall Street.”](https://image.slidesharecdn.com/financialcrisispptfinal-110316211734-phpapp02/85/Financial-crisis-ppt-final-7-320.jpg)