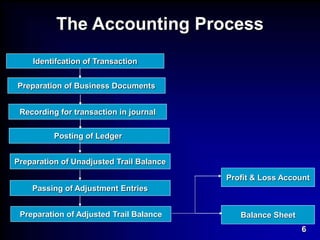

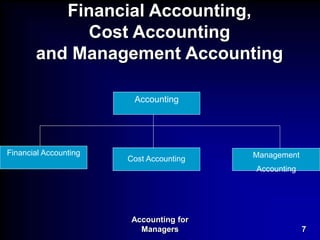

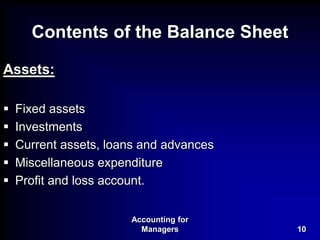

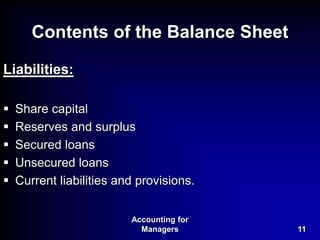

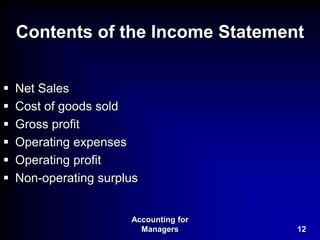

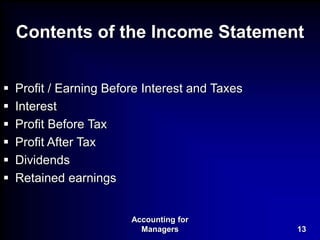

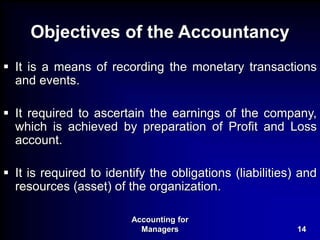

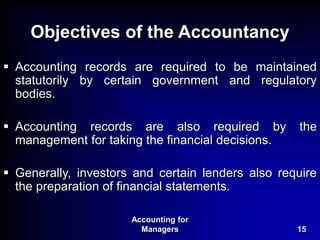

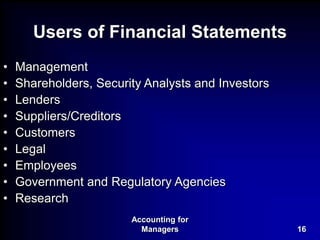

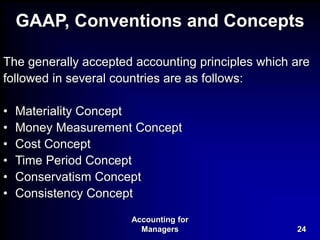

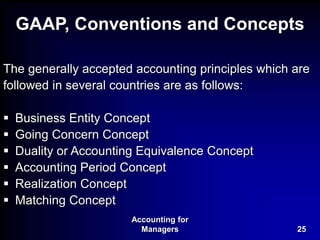

This document provides an introduction to financial accounting. It defines accounting and discusses the objectives and key concepts in financial accounting, including the different types of accounting, the financial statements and their components, accounting principles, and the goals of financial reporting. The major topics covered are the meaning of accounting, the accounting process, financial statements, accounting principles such as double-entry bookkeeping and GAAP, and the objectives of generating financial information.