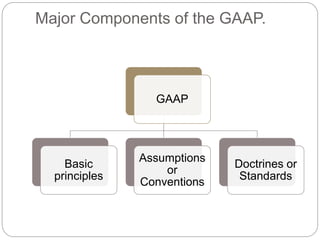

Generally Accepted Accounting Principles (GAAP) are the standards and procedures companies use to compile their financial statements. GAAP include authoritative standards set by policy boards as well as commonly accepted practices. Companies must follow GAAP when reporting financial data to provide consistency for investors. Major components of GAAP include basic principles like the entity principle and matching principle, assumptions like going concern and stable dollar, and standards like objectivity, consistency, and conservatism.