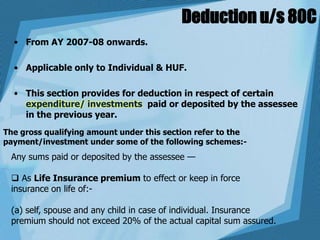

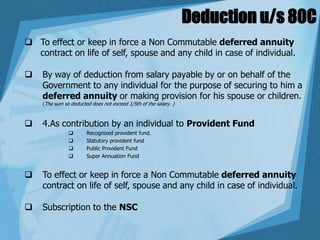

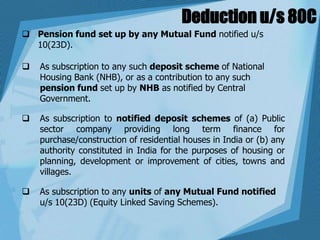

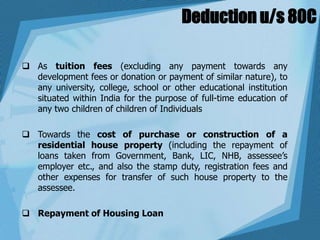

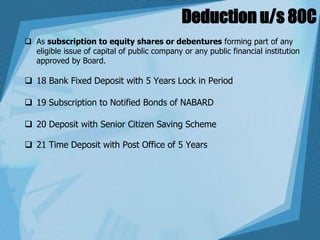

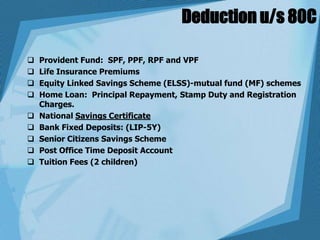

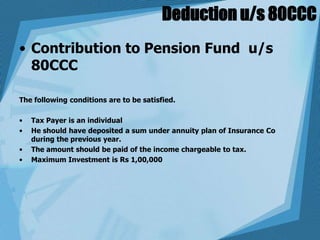

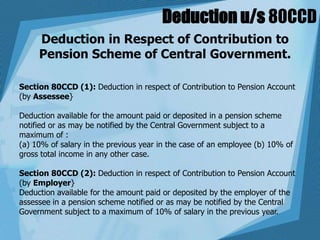

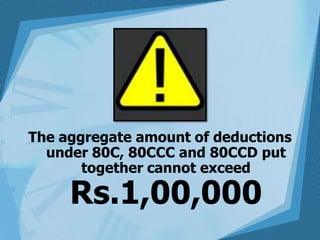

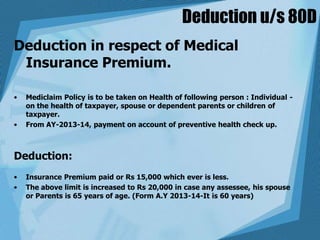

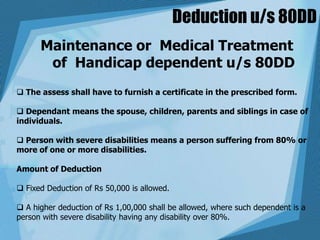

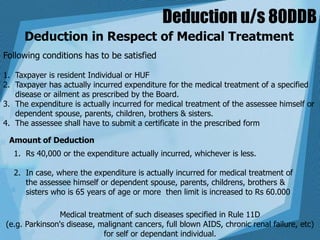

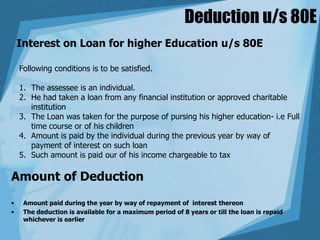

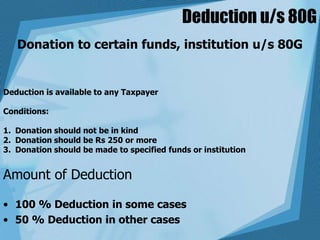

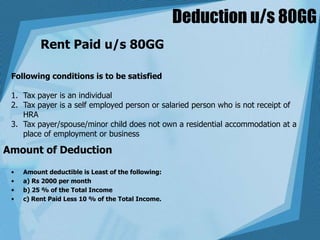

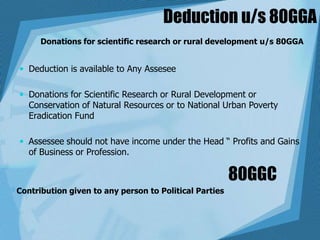

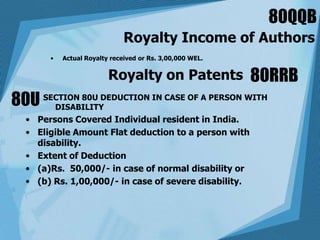

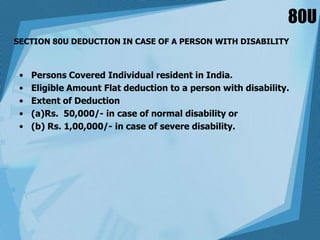

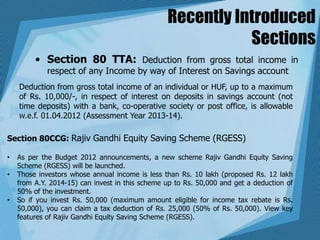

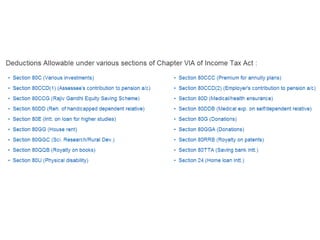

This document summarizes various tax deductions available under the Indian Income Tax Act. It discusses deductions available under sections 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80G, 80GG, 80GGA, 80U, and recently introduced sections 80TTA and 80CCG. Key deductions include those for life insurance premiums, PF contributions, home loan repayment, medical expenses, donations, tuition fees, and investments in specified savings instruments to encourage personal savings. The aggregate deduction under sections 80C, 80CCC and 80CCD cannot exceed Rs. 100,000.