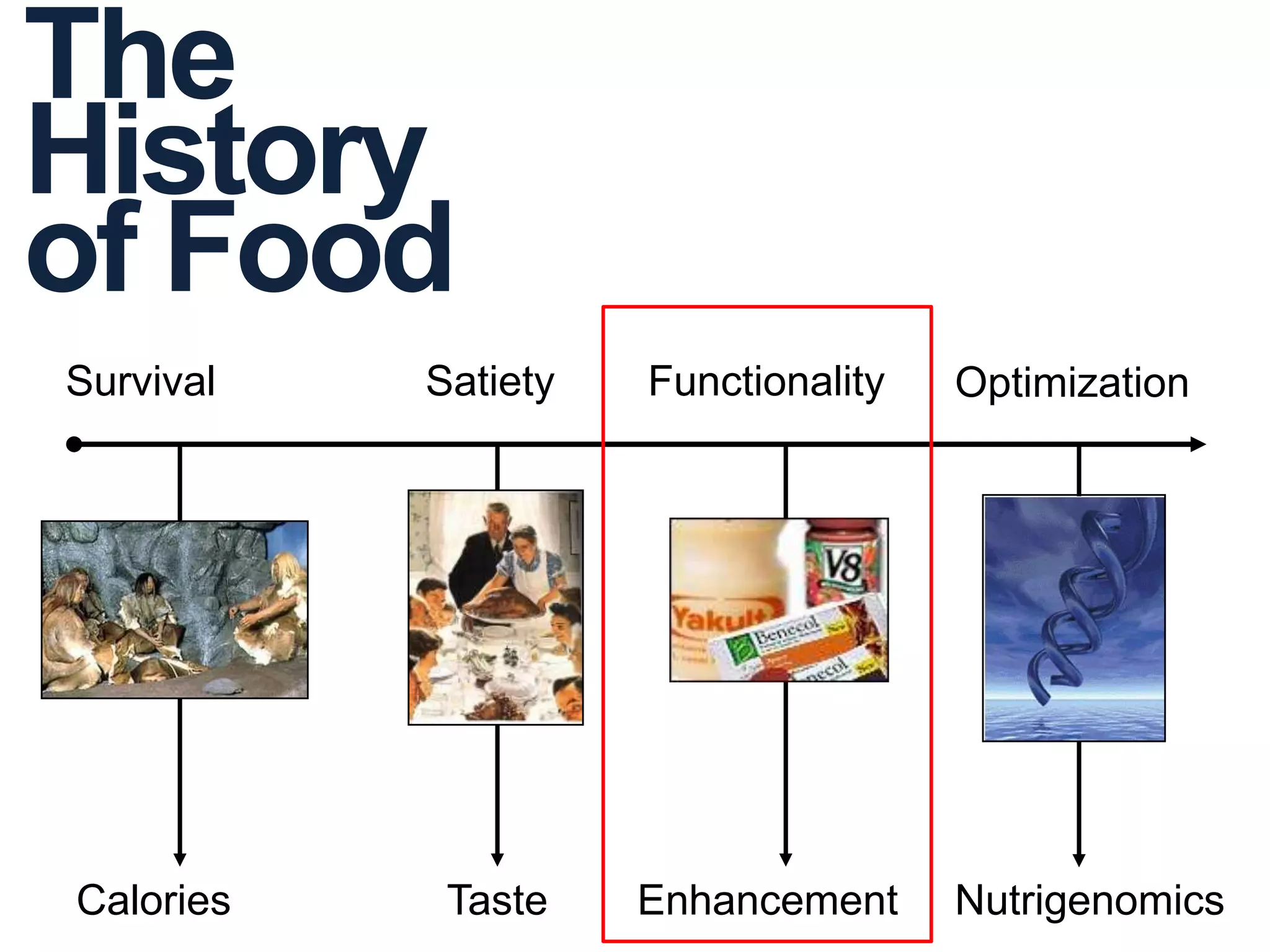

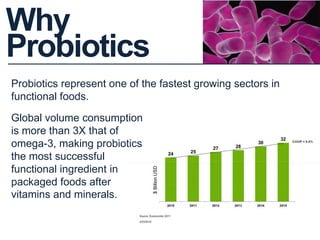

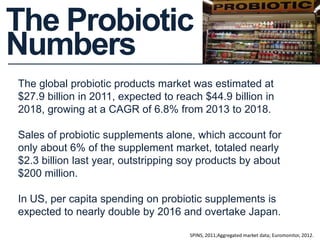

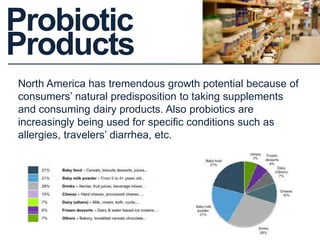

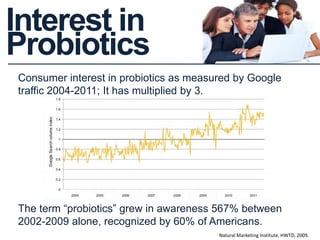

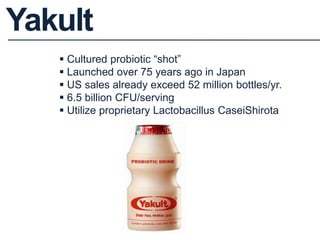

The document discusses the decline in nutritional quality of diets from pre-industrial to post-industrial times, highlighting the shift towards processed foods that are calorie-rich but nutrient-poor. It emphasizes the growing consumer interest in functional foods, particularly probiotics, as a response to dietary deficiencies and health issues. The market for probiotics is rapidly expanding, with increasing awareness among consumers and significant sales growth in probiotic foods and supplements.