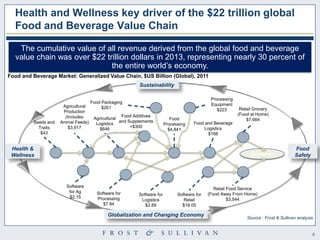

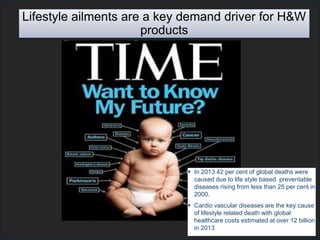

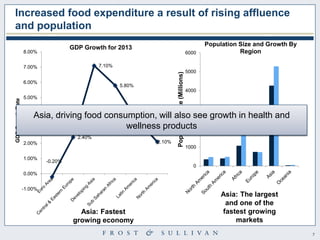

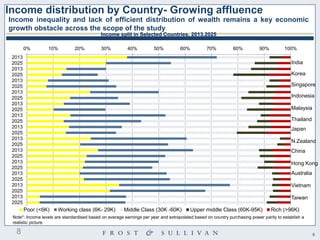

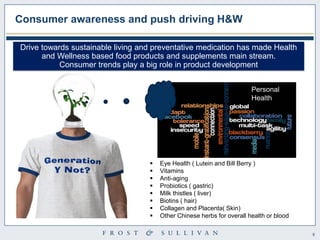

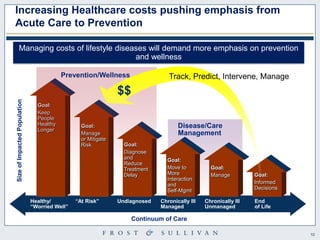

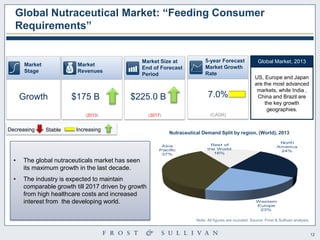

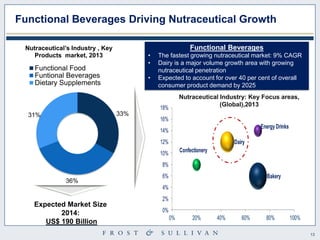

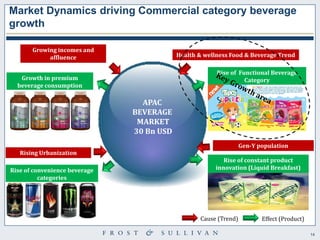

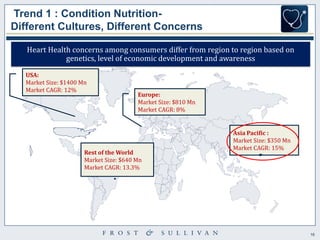

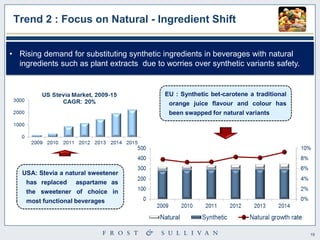

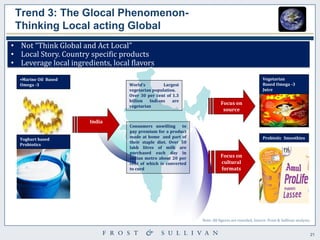

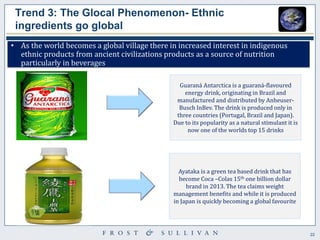

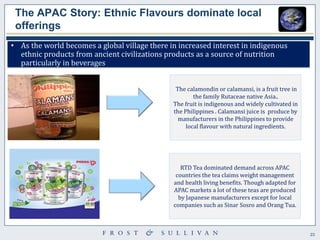

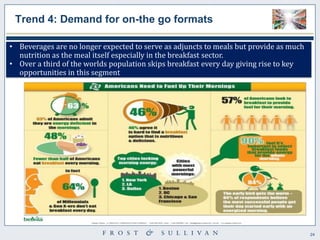

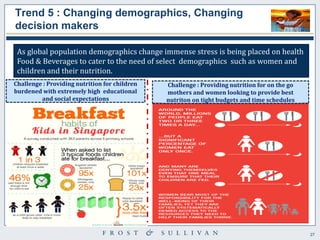

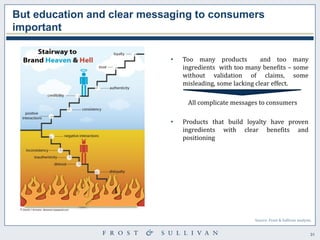

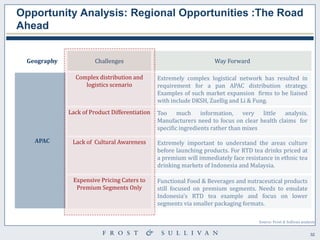

The document analyzes trends and developments in the APAC functional beverage industry, highlighting the growth of health and wellness products driven by rising lifestyle diseases and increased consumer awareness. It notes that the functional beverages sector is expected to continue expanding, particularly with innovations in nutrition-focused products designed for on-the-go consumption. The report emphasizes the significance of local ingredients and flavors in product development to meet the diverse needs of the region's population.