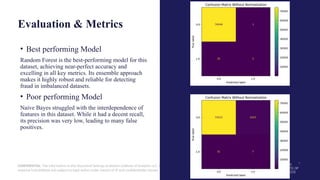

This document outlines a machine learning project focused on detecting fraudulent credit card transactions. It details the dataset, exploratory data analysis, data cleaning and preprocessing, feature engineering, and the evaluation of several models, ultimately identifying random forest as the best-performing model due to its accuracy and effectiveness in handling imbalanced data. The project aims to enhance fraud detection systems in banking and financial sectors to safeguard user transactions and maintain trust.

![CONFIDENTIAL: The information in this document belongs to Boston Institute of Analytics LLC. Any unauthorized sharing of this

material is prohibited and subject to legal action under breach of IP and confidentiality clauses.

Exploratory Data

Analysis

EDA of the “type” Feature

df['type'].unique() –

Displays all unique transation types in the type

column.

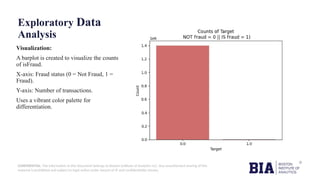

Visualization:

A countplot is created to show the number of

transactions for each type.

•X-axis: Transaction types (CASH_OUT,

PAYMENT, TRANSFER etc.).

•Y-axis: Number of transactions.

•The grid makes the visualization more readable.

•Helps identify which transaction types dominate

the dataset.](https://image.slidesharecdn.com/frauddetectioncapstoneproject-241204135330-da56ac53/85/Fraud-Detection-Harnessing-Data-Science-for-Securing-Transactions-8-320.jpg)

![CONFIDENTIAL: The information in this document belongs to Boston Institute of Analytics LLC. Any unauthorized sharing of this

material is prohibited and subject to legal action under breach of IP and confidentiality clauses.

Exploratory Data

Analysis

• EDA of the "isFraud" Feature

df['isFraud'].unique().astype(int)

Lists the unique values in the isFraud column

(0: Not Fraud, 1: Fraud).

• Dropping unnecessary columns

df.drop(['nameOrig', 'nameDest'], axis=1, inplace=True)

Removes columns nameOrig and nameDest.

These are identifiers and do not contribute to fraud prediction.

Dropping these reduces dimensionality and computational

overhead

• Label Encoding for "type" Feature

df['type'].replace({'CASH_OUT': 0,

'PAYMENT': 1, 'CASH_IN': 2,

'TRANSFER': 3, 'DEBIT': 4},

inplace=True)

df['type'].value_counts()

Converts the categorical values in type into

numerical labels (0–4).

Necessary for feeding data into ML models

that require numerical inputs.

type column now contains integers instead of

strings, simplifying computation](https://image.slidesharecdn.com/frauddetectioncapstoneproject-241204135330-da56ac53/85/Fraud-Detection-Harnessing-Data-Science-for-Securing-Transactions-9-320.jpg)